Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 24.

Are you interested in a Premium Membership? Start your free 30-day trial now.

When I told you a month ago that the noise around the election would get even louder, I didn’t quite have this in mind.

As you know by now, on July 13—just days before the Republican National Convention—former President Trump survived an assassination attempt. A week later (on Sunday), President Biden dropped out of the race and endorsed his Vice President Kamala Harris.

My advice to keep politics out of your portfolios applies just as much today, if not more, than it did a month ago.

It’s been seven trading days since shots were fired at Donald Trump. If you think you know what’s happened in the stock market since then, you may be in for a bit of a surprise.

500 Index (VFIAX) is only down 1.0% despite a computer glitch that snarled worldwide commerce and is still having repercussions, as well as a race for the presidency that’s been turned on its head.

While “the market” is only down a little, there has been a change in the guard within. The market’s darlings—big technology and growth stocks—tripped up. For example, Information Technology ETF (VGT) dropped 2.9%, and MegaCap Growth ETF (MGK) fell 2.6% over the last seven trading days.

Conversely, small-cap and value stocks have gained ground over the past seven trading days. For example, Vanguard's best-performing fund over that stretch, Russell 2000 Value ETF (VTWV), returned 5.9%, and U.S. Value Factor ETF (VFVA) wasn’t far off the top spot, with a 3.4% gain.

Will this rotation last, or will the big tech stocks regain their footing? Time will tell. We’ve seen a few head fakes this year, where small-cap stocks took the lead for a few days, only for growth stocks to retake the leadership role.

Anyone who says they know the rotation is permanent is simply blowing smoke. That’s why diversification is so important.

Inflation Check-In

A cooler-than-expected inflation report was at least partly responsible for sparking the rally in smaller stocks.

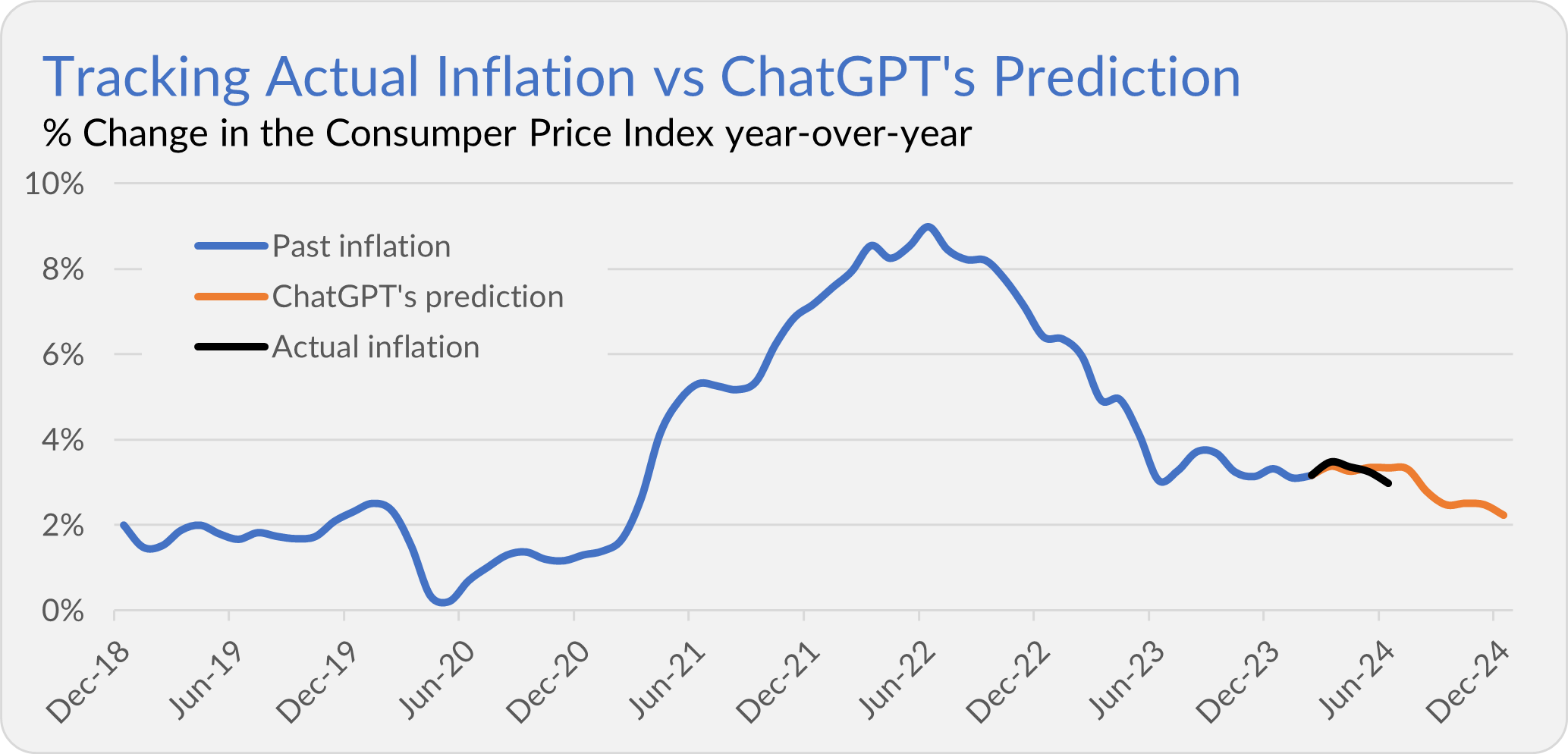

On July 11, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was flat in June and up just 3.0% over the past 12 months. That’s even lower than the number I got when I asked OpenAI’s ChatGPT for a prediction (it said 3.3%) several months ago.

Interestingly, the computer’s prediction of nearly 2% inflation at year-end, which seemed outlandish a few months ago, now looks achievable. But as I’ve said from the get-go, I’m not going to recommend trades based on ChatGPT’s inflation prediction—I’m having a little fun here.

As I’ve been saying for months, central bankers at the Federal Reserve can sit on their hands as long as inflation runs around 3% and unemployment stays near 4%—which is where we are today.

If inflation continues to trend toward 2%, policymakers can focus more on the employment side of their mandate. And, as I told you a couple of weeks ago, at least one unemployment-based metric (the Sahm Rule) is dangerously close to indicating that a recession has started.

This suggests the Fed’s next move will be to cut interest rates, not raise them. That said, I’m expecting policymakers to move slowly. It would take a dramatic turn in the data for the Fed to take, well, dramatic action.

What does this mean for money market yields, which tend to move with the fed funds rate?

According to the options market and CME Group’s calculations, traders expect the fed funds rate will end the year between 4.50% and 5.00%. That’s down from today’s target range of 5.25% to 5.50%. However, if it's accurate, money market funds will still offer an attractive inflation-beating yield as we head into 2025.

Rising Regulatory Risk

Turning to Malvern, PA, Vanguard is acknowledging that it has become a target with a new warning in its funds’ prospectuses.

I’ve discussed how Vanguard’s size has made it a target for regulators (and politicians) a few times this year—here and here, for example—as both the Federal Energy Regulatory Commission (FERC) and the Federal Deposit Insurance Corporation (FDIC) have had the fund giant in their sights.

The short story is that if you are going to be an influential company owner, the regulators want to know about it so they can put you on their radar. Due to the trillions Vanguard manages for shareholders (through its index and active funds), it holds large stakes (say, 5% or more) in almost every U.S. public company.

Regulators have typically given Vanguard the green light to own large holdings in various companies and industries as a “passive owner.” For example, Vanguard doesn’t agitate for new boards or lobby to spin off companies.

But the days of index funds getting a regulatory “free pass” are over. And while no agency has ruled against Vanguard or restricted its purchasing abilities, this risk can’t be ignored.

On Friday (July 19), Vanguard updated all its prospectuses to include a section warning of this risk. As the “Ownership Limitations and Regulatory Relief” section tells us,

The more assets that Vanguard, its affiliates, and its external advisors manage, the more the Vanguard funds are or may be negatively impacted by ownership restrictions and limitations imposed by law, by regulation or regulators, or by issuers.

The prospectus update also gives us clues to how Vanguard would manage the funds should it encounter this regulatory hurdle. I’ve included a link to the supplement below, but here’s my attempt to translate the steps Vanguard would take into plain English.

First, Vanguard would try to obtain permission to exceed any regulatory limitation. This might involve agreeing to certain conditions, like voting some of its proxies in a specific way.

Second, Vanguard will allocate stocks across its funds in a way that it “deems fair and equitable over time.” (I’m a little surprised they had to spell this out. Isn’t this how they should have been operating all along?)

Third, Vanguard could use derivatives to gain “indirect” exposure to certain stocks or sectors rather than purchasing stocks outright. This would involve entering into a contract with someone like Goldman Sachs, where Vanguard would pay to receive the return of a basket of stocks mimicking some market sector.

What does this mean for Vanguard investors like you and me?

Well, as I said, no one has put restrictions on Vanguard’s ability to buy stocks just yet. So, for now, this is just the lawyers covering Vanguard’s backside. (BlackRock, which runs the iShares family of ETFs, is in the same boat.)

Should Vanguard be handcuffed, it would be a big issue for its bread-and-butter products—its index funds and ETFs. Any restriction would make it harder for the managers to track the indexes. Also, costs could increase, and the funds could become less tax-friendly.

Vanguard’s active funds could also face these limitations, too. Not only might today’s sub-advisers be unable to buy the stocks they want, but Vanguard’s ability to attract top-tier talent could also be damaged.

Before you jump to the conclusion that the regulators are overdoing it, here’s my take.

I absolutely think regulators should be asking the questions that could lead to greater oversight if they deem it necessary. Vanguard managing $10 trillion is a different beast than Vanguard managing $1 trillion. Vanguard’s (and BlackRock’s) growth could have unintended consequences.

But, realistically, Vanguard has grown to its current size because it has delivered a clear (and valuable) “good” to consumers—low-cost, tax-friendly, diversified exposure to the investment markets. For example, in 2016, Eric Balchunas at Bloomberg estimated that Vanguard’s penny-pinching had saved investors $1 trillion.

Regulators should tread carefully before taking action that could damage a clear good to address a perceived cost.

One Step Back

A quick update on the PRIMECAP Management team.

On July 10, Theo Kolokotrones, the last of the firm’s three founders still in an active role, resigned as PRIMECAP Management’s co-CEO.

No, Kolokotrones has not left the firm—he is still engaged and manages significant assets. But after five decades in the business and four decades at PRIMECAP, Kolokotrones has finally handed off the last of his “office duties.” (He’s earned it!)

The firm is in good hands with PRIMECAP Management veterans Joel Fried and Al Mordecai acting as co-CEOs.

As for the PRIMECAP-run funds, like Capital Opportunity (VHCOX) or PRIMECAP (VPMCX) or the PRIMECAP Odyssey funds, while Kolokotrones is still a portfolio manager today, it’s safe to assume he’ll decrease his responsibilities over time—that’s only prudent and practical.

I wouldn’t be surprised if PRIMECAP names another manager to the funds sooner rather than later. If I had to guess, Greg Molinelli, who has been at the firm for 16 years, including a stint as director of research, would be the logical candidate.

Remember that by the time a PRIMECAP analyst becomes a portfolio manager, they’ve already proven their stuff with real money on the line. So, whether it's Molinelli or one of his colleagues who becomes the next PRIMECAP manager, rest assured that they’ve got a track record of investment success.

The bottom line is that manager changes are inevitable. The PRIMECAP team is set up as well as any other firm—and better than most—to handle those transitions successfully.

Our Portfolios

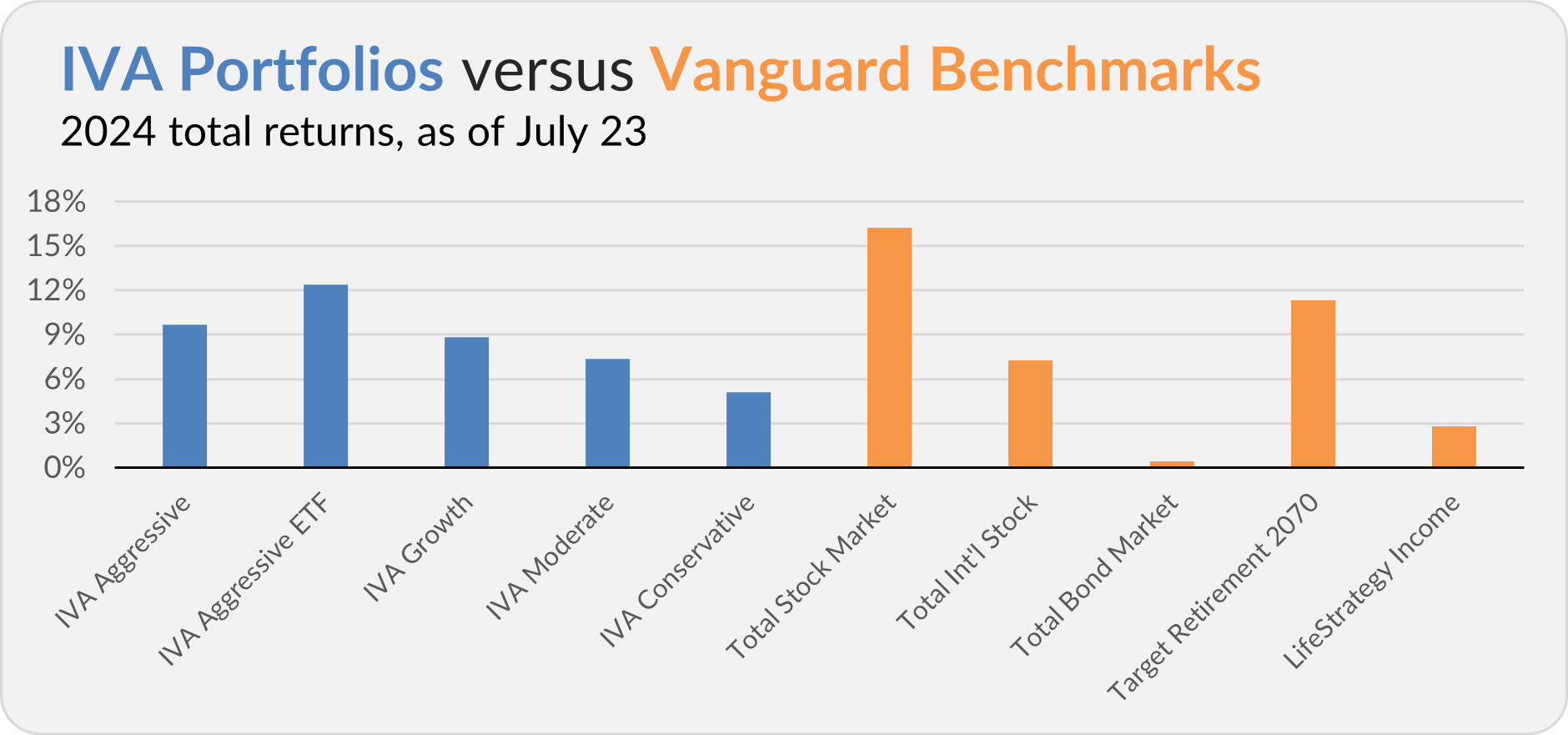

Our Portfolios are showing improved but (still) lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 9.7%, the Aggressive ETF Portfolio is up 12.4%, the Growth Portfolio is up 8.9%, the Moderate Portfolio is up 7.3% and the Conservative Portfolio is up 5.1%.

This compares to a 16.2% gain for Total Stock Market Index (VTSAX), a 7.3% gain for Total International Stock Index (VTIAX), and a 0.4% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 11.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.8%.

IVA Research

Yesterday, in Time to Get Aggressive?, I shared my analysis of Vanguard’s family of aggressive growth funds with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.