Investor sentiment is on the rise, and who can blame them?

Total Stock Market Index (VTSAX) broke a three-month losing streak with a 9.4% gain in November. And Total Bond Market Index (VBTLX) ended a six-month losing streak with a 4.5% return.

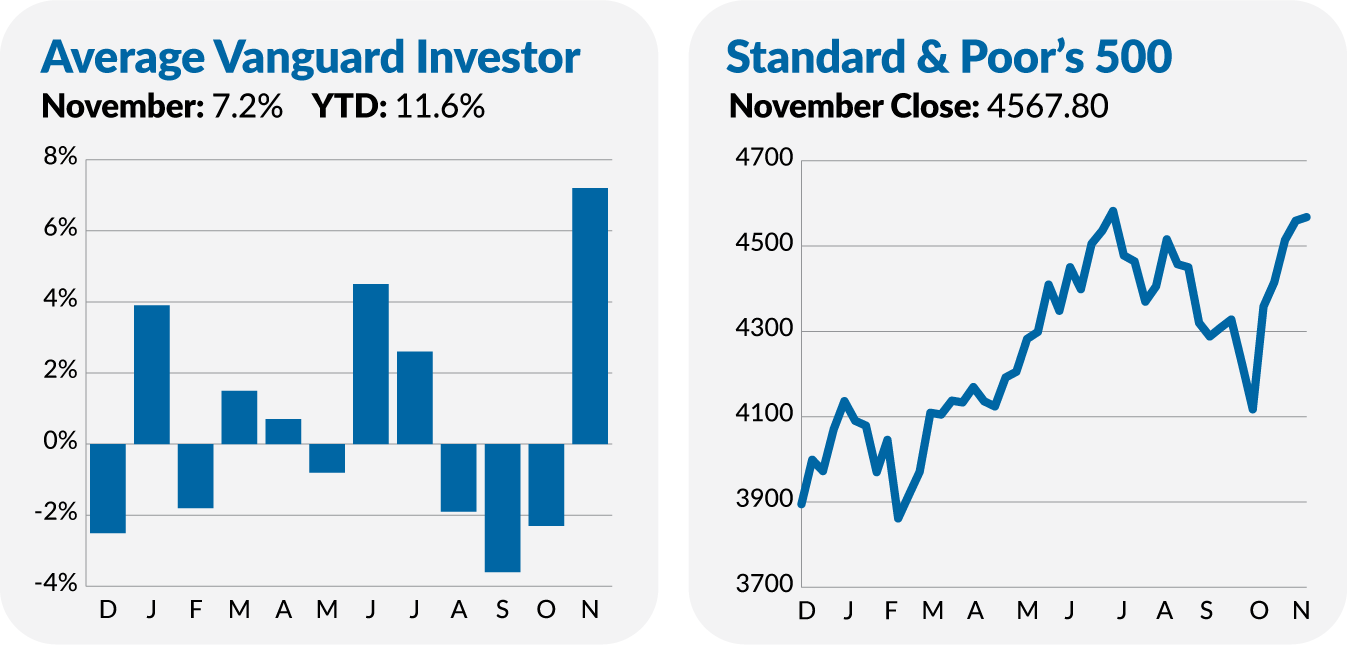

Put those together, and the average Vanguard investor gained 7.2% in November and is now up 11.6% for the year.

But the market’s spoils have not been shared equally this year.

In the past two Weekly Briefs—see here and here—I discussed how growth stocks, and specifically stocks in three sectors—Information Technology ETF (VGT), Consumer Discretionary ETF (VCR) and Communication Services ETF (VOX)—have driven returns this year.

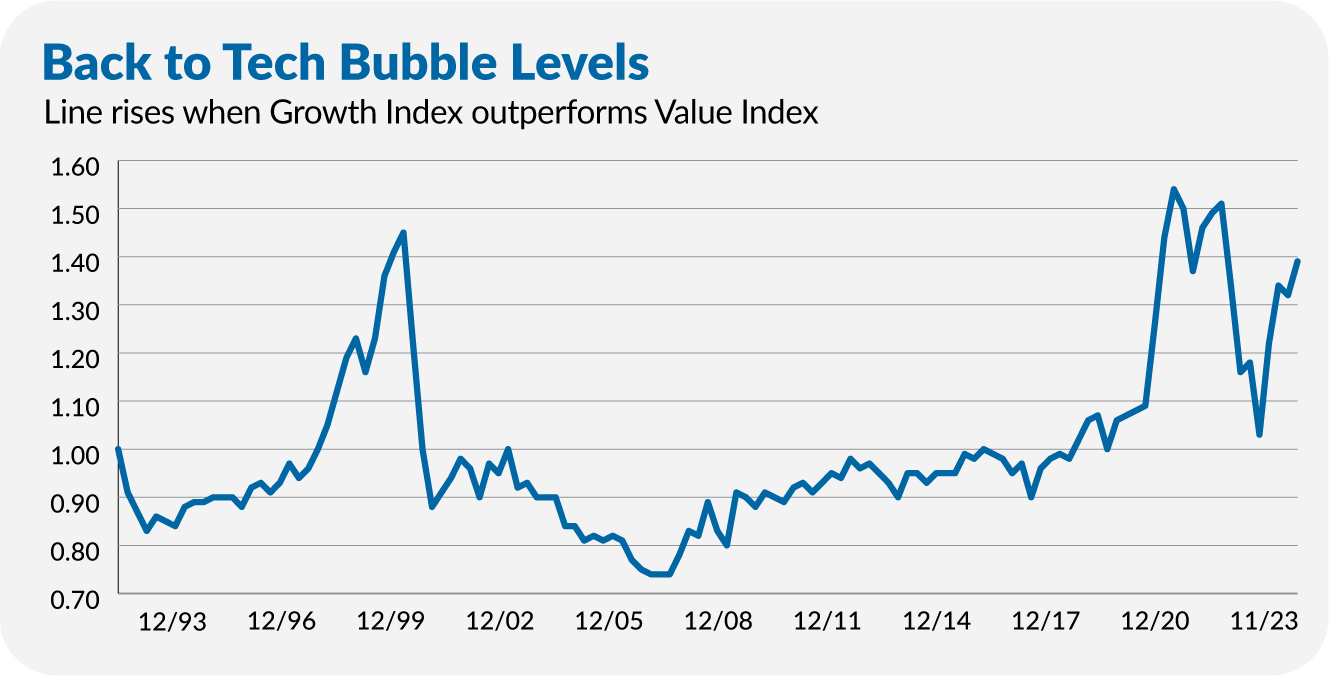

If you were on the “right side” of that trade, you’re probably feeling pretty good right now. Not to burst your bubble, but allow me to offer one more chart that shows just how dramatic the divergence in returns between growth stocks and value stocks has been this year.

In the relative performance chart below, the line rises when Growth Index (VIGAX) outperforms Value Index (VVIAX). As you can see, Growth Index’s outperformance is back at the level we saw during the tech bubble in the late 1990s.

Of course, growth stocks could continue to outperform—they beat value stocks by a wider margin in 2020. But the last two times we reached this extreme, the pendulum swung sharply the other way.