Executive Summary: PRIMECAP celebrates 40 years of exceptional performance, though recent results have disappointed. This milestone offers a chance to evaluate its history, distinct investment approach and future potential. Despite challenges, PRIMECAP's proven philosophy and seasoned management make a compelling case for patience. Today presents an opportunity to buy an out-of-favor manager.

I also include additional commentary on PRIMECAP Odyssey Aggressive Growth.

It’s not every day that we get to celebrate a mutual fund’s 40th birthday. And make no mistake, PRIMECAP (VPMCX) deserves to be celebrated.

As I’ll show you, the fund has one of the best track records in the industry. It—or one of the other PRIMECAP Management-run funds—has been a significant holding in our Portfolios for the past three decades. (For the record, PRIMECAP Odyssey Aggressive Growth (POAGX) is still my single largest holding.)

However, the fund hasn’t outpaced the market for some time now, and many shareholders are asking themselves if the PRIMECAP Management team has lost its mojo.

So, let’s take this milestone as an opportunity to review PRIMECAP’s history and evaluate its prospects moving forward. I’ll tell you why I’m standing by the PRIMECAP Management team and the recently reopened fund.

A Bit of Housekeeping

This article is focused on PRIMECAP (the fund). However, keep in mind that the same comments and themes apply to all of the funds run by the PRIMECAP Management team.

That said, many of you have followed my lead and own PRIMECAP Odyssey Aggressive Growth, which has trailed the market (and its siblings) by a wider margin over the past few years. At the end, you’ll find additional commentary on the aggressive fund.

Finally, you can find a recent interview Vanguard conducted with PRIMECAP managers Joel Fried and Al Mordecai here.

More Than Just a Pat on the Back

The PRIMECAP Management founders were former portfolio managers at the Capital Group (the firm behind the American funds) who left to create PRIMECAP (the firm) in 1983. Initially, they served a limited number of institutions, but a year later, at Jack Bogle’s behest, they started managing a new fund—PRIMECAP (VPCMX)—for Vanguard.

Simply put, the PRIMECAP team has been among the best in the business over the past four decades.

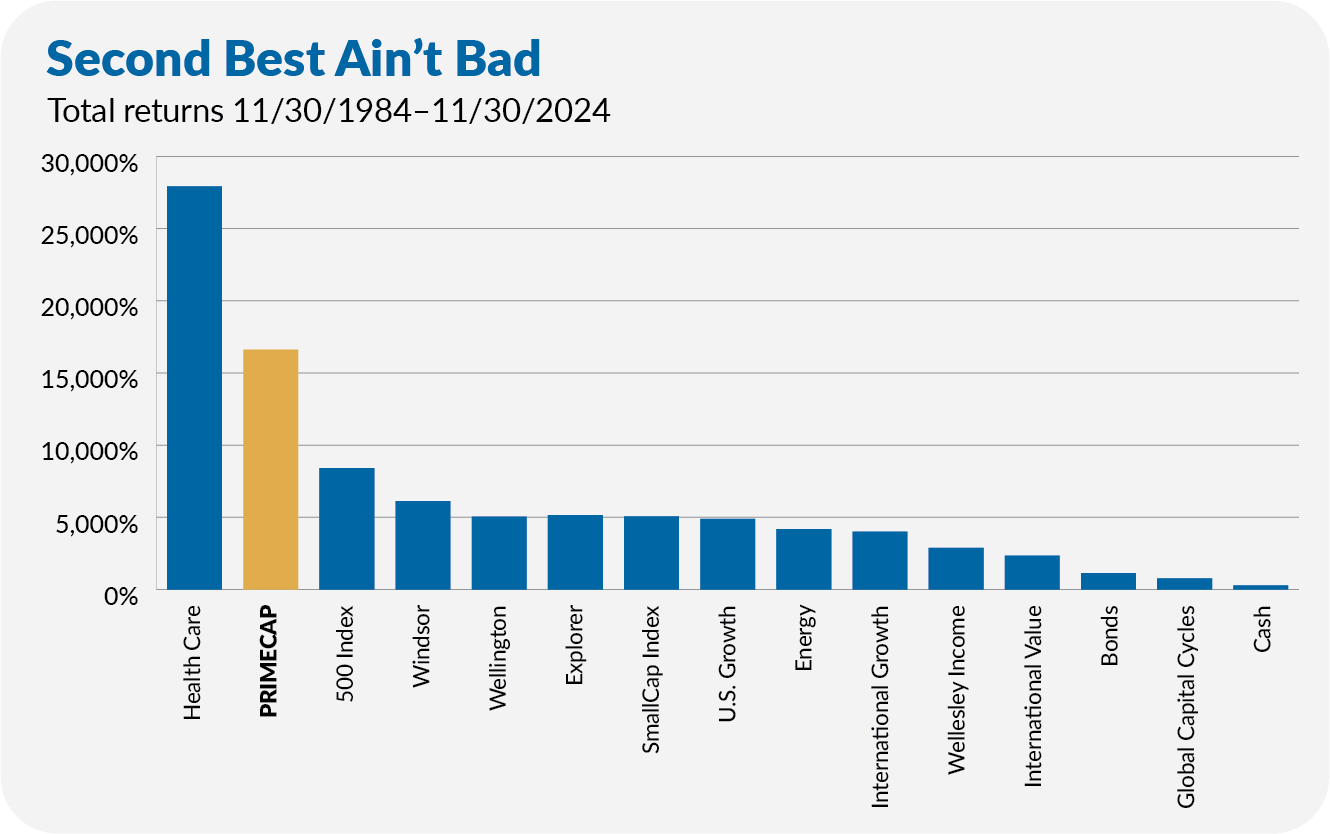

Of the 24 Vanguard funds that have existed for four decades, PRIMECAP’s 16,619% return is second only to Health Care’s (VGHCX) 27,919% return. Third on the list is 500 Index (VFINX), with an 8,402% gain.

The chart below, showing each fund’s return for the last 40 years, doesn’t include all 24 funds. To make the chart readable, I excluded Vanguard’s tax-exempt bond funds. I also averaged Vanguard’s taxable bond funds and money market funds to show how “bonds” and “cash” fared over the past four decades.

Don’t get distracted by Health Care’s number—Ed Owens, the health care fund’s original manager, was a once-in-a-generation manager. (Also, we owned the sector fund for years in our Portfolios.) But more to the point, PRIMECAP was Vanguard’s best-performing diversified stock fund by a wide margin, roughly doubling 500 Index’s return. And they say you can’t beat the market!

To put some concrete numbers to it, from the end of November 1984, a $10,000 investment in PRIMECAP would be worth $1.67 million today. That same $10,000 invested in 500 Index would have grown to a little over $850,000—or roughly half as much.

That’s what happens when you outperform by 2% per year for 40 years.

Looking beyond Vanguard’s walls, PRIMECAP has been the third-best performer among the 133 diversified U.S. stock funds that have been around since its inception. Its performance only falls behind Fidelity Growth Company and Fidelity Contrafund.

As I said, the PRIMECAP team’s record deserves applause—and we’ve made good money investing here.

A Fair Question

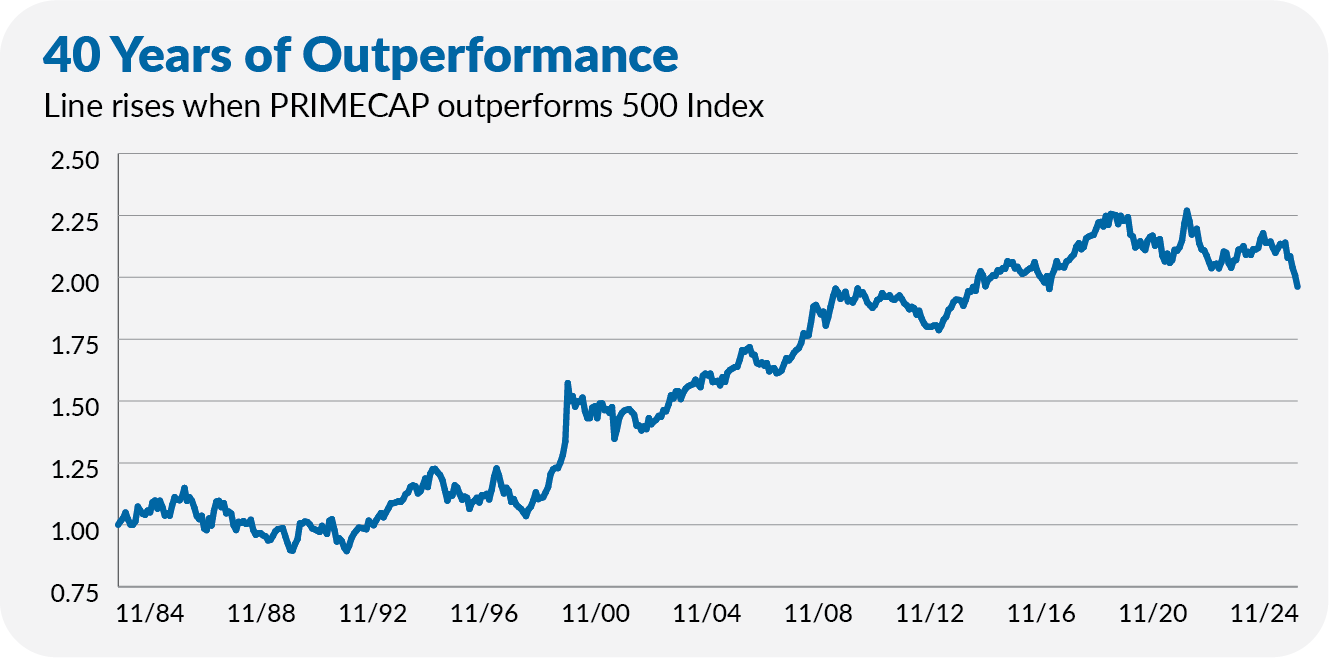

However, even though PRIMECAP smashed the index over the past four decades, it never drove down a one-way street of outperformance.

The relative performance chart below shows that the fund got off to a shaky start. Compared to 500 Index, it was a near-even race for the first half-dozen years or so.

But around 1992, the line started trending up (meaning PRIMECAP is outperforming) more often than not. The 20-year run from September 1998 to September 2018 was particularly rewarding, with PRIMECAP gaining 893% to the index fund’s 410% return.

However, the relative performance line has flattened out in the past several years, meaning performance has been even between the funds. PRIMECAP has trailed the index fund over the last seven years, 130% to 156%.

The recent run of returns is not inspiring. So, let’s give the PRIMECAP Management team our thanks and one last pat on the back for the past four decades … done. But now, I’d like to turn my attention to the pressing question on shareholders’ minds:

Are PRIMECAP's good times over?