Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 31.

There are no changes recommended for any of our Portfolios.

Growth Without Inflation

Is the U.S. economy’s soft landing upon us? The first estimate from the Bureau of Economic Analysis is that GDP (gross domestic product) grew 0.7% (after adjusting for inflation) in the second quarter. (The 2.8% headline figure quoted in the press is an annualized number.) In dollars and cents, the economy grew by $160 billion in the second quarter to nearly $23 trillion.

Why should we care about a growing economy? Think profits. According to Factset, companies in the S&P 500 are on track to have earned nearly 10% more in the second quarter compared to a year ago. Lipper estimates that earnings grew 12%. Either way, more profits (or earnings) can lead to higher stock prices.

With the economy growing and earnings rising, there’s nothing to worry about on the economic front, right?

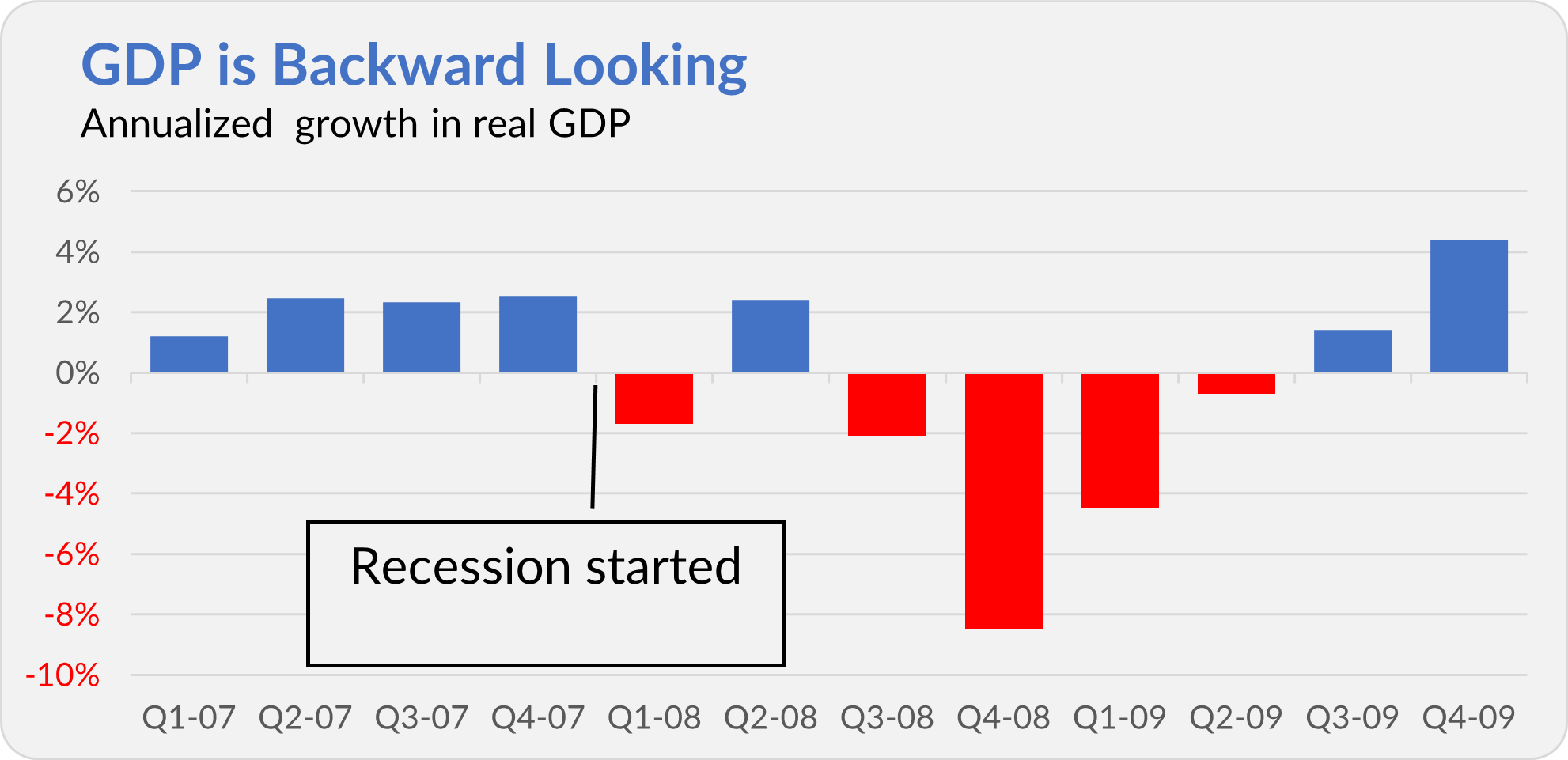

Unfortunately, we can’t answer that question using GDP and earnings growth only. As backward-looking figures, they only confirm what we already knew: The economy didn’t slip into a recession in the second quarter. They don’t tell us anything about the road ahead.

For example, in the fourth quarter of 2007, GDP grew at a 2.5% annual pace (after inflation). That’s not bad and was a slight improvement over the third quarter’s 2.3% growth rate. However, the Great Recession started in December 2007. So, the fact that the economy grew at a decent clip in 2007 didn’t tell you anything about the recession ahead.

I’m not trying to imply that a recession has started. My point is simply that past economic and earnings growth rates cannot be used to predict the future.

This is why, even though the economy and earnings grew in the second quarter, policymakers at the Federal Reserve (Fed) are thinking more about lowering interest rates than raising them in the months ahead, focusing on the fact that inflation is falling and unemployment is rising.

That said, investors are paying too much attention to the Fed. Whether the Fed cuts the fed funds rate once or twice this year, well, that’s just tweaking policy. If you’re a trader, maybe you need to react. But as a long-term investor, that shouldn’t impact your behavior.

From 72 Pages to 1

Well, that was more change than I expected.

In its March 2024 shareholder reports, Vanguard warned investors that its annual (and semi-annual) reports were undergoing a “substantial” redesign. Specifically, Vanguard said...

Important information about shareholder reports

Beginning in July 2024, amendments adopted by the Securities and Exchange Commission will substantially impact the design, content, and transmission of shareholder reports. Shareholder reports will provide key fund information in a clear and concise format and must be mailed to each shareholder that has not elected to receive the reports electronically. Financial statements will no longer be included in the shareholder report but will be available at vanguard.com, can be mailed upon request, or can be accessed on the SEC’s website at www.sec.gov. [Emphasis added]

Vanguard wasn’t kidding; the new shareholder reports are certainly concise.

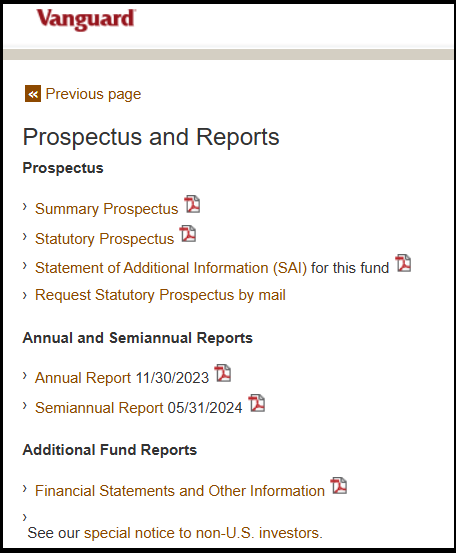

Wellington’s (VWENX) November 2023 annual report was 72 pages long and included commentary on the fund, past returns, holdings, financial statements and many notes and disclosures. I’ve attached a copy of the November 2023 report below.

Wellington’s May 2024 semi-annual report is … wait for it … just one page! Whoa! The commentary, holdings, returns, financials, notes and disclosures have disappeared.

Maybe this one-page report includes all the information that an investor needs. It’s certainly more digestible. But I fear that, in this case, less is not more. I’ve attached it below so you can judge for yourself. (Also, note that I’ve attached the report for the Admiral shares. Wellington’s Investor share class has a separate report.)

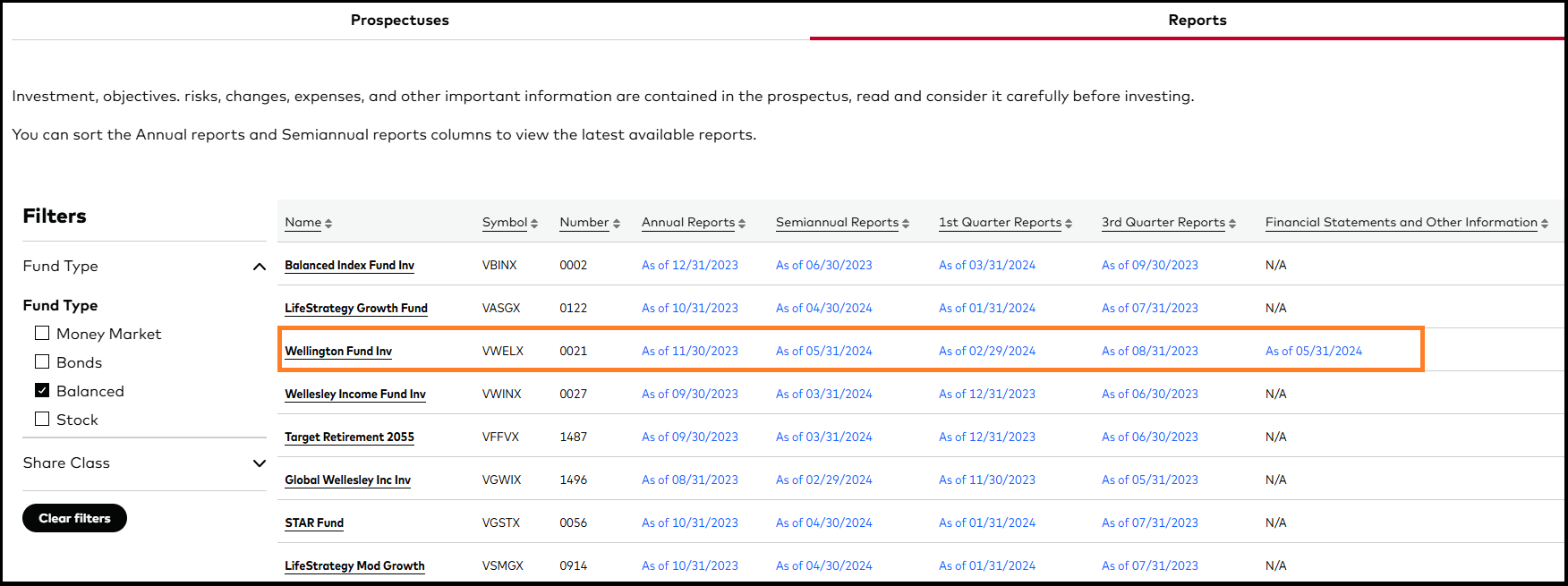

To be fair, the holdings and financial statements aren’t entirely going away. Per regulatory requirements, as Vanguard warned, they have been split into separate reports, which you can find on Vanguard’s website here.

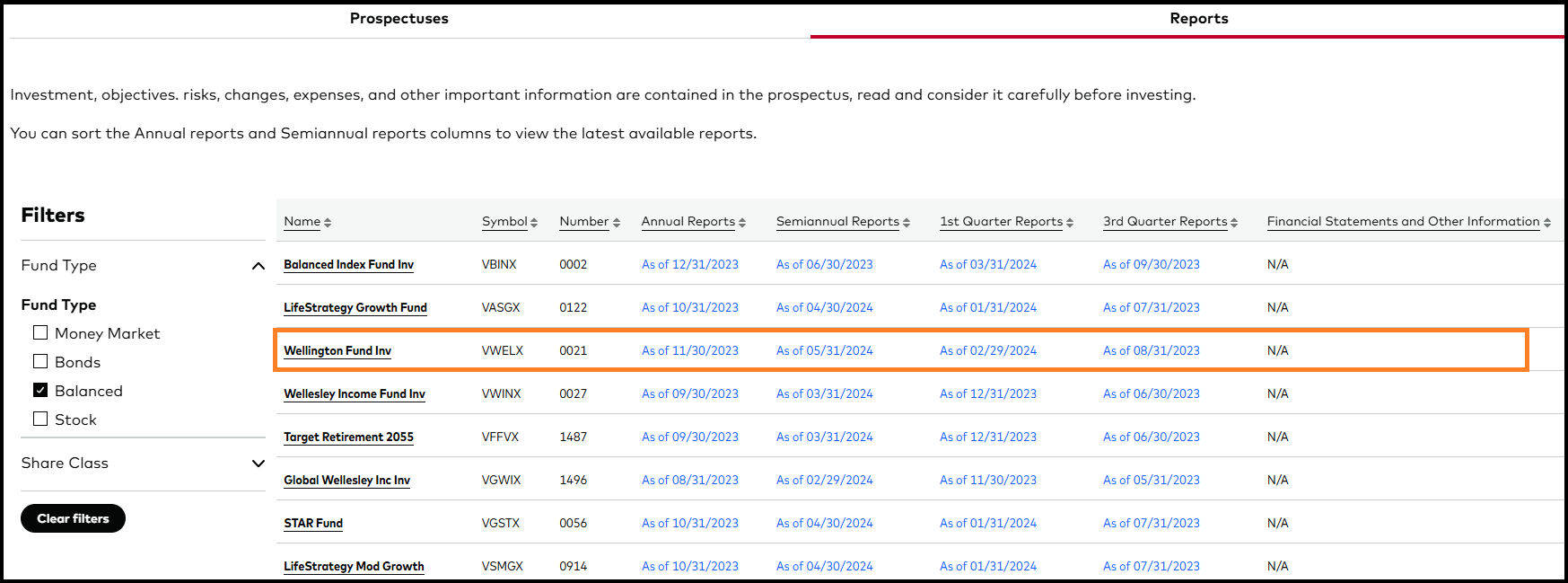

That said, Vanguard isn’t making this easy for investors. And their computer system is playing catch-up.

On Friday, July 26, when I was reading through the shareholder reports and updating my files (What? That isn’t how you spend your summer Friday afternoons?), I wasn’t able to track down Wellington’s financial statements. Where I expected to find the figures, I ran into “N/A” (or not available).

When I asked after the financial statements, Vanguard told me there was a “slight delay between the filing of the slimmed down semi-annual and the Financial Statements report.” Vanguard updated the reports on Tuesday (July 30). Going forward, we can probably expect there to continue to be a delay of a few days between Vanguard filing the annual (or semi-annual) report and updating the financial statements.

Unfortunately, navigating to the page with these “next-gen” forms without the link is not easy unless you are logged into your account. And even then, it’s buried in the “site tree” at the very bottom of Vanguard’s website. Do I really have to be a Vanguard customer (and work this hard) to access these reports?

And the fund literature resource on Vanguard’s institutional site doesn’t include the financial statements. (You and I shouldn’t have to search the institutional site for this information, but I was looking for an easier route.)

You can also access a fund’s reports by visiting its individual page on Vanguard’s website. For example, navigating to the “Fund literature” section of Wellington’s profile page and clicking “View prospectus and reports” will take you to a page with links to the annual reports and financial statements.

Going fund-by-fund this way isn’t practical when I’m gathering reports on many funds at once, but it could work if you’re looking to access the reports for a few funds. (I ran into issues getting this method to work on Tuesday, but Vanguard looks to have fixed them.)

I think you get my point—Vanguard has “slimmed down” its reports without fully updating its systems for the change.

Let me be clear. Vanguard is following regulatory requirements. Separating the holdings and financial statements into their own reports opens the door to more accessible and user-friendly communication, but that isn’t the case so far.

As for the fund commentaries—arguably the most helpful part of the shareholder reports for the investors—those are continuing to get cut down. Originally, Vanguard included commentary in both the semi-annual and annual reports. Several years ago, they dropped that section from the semi-annual reports. Vanguard now tells me that…

There will still be a section for commentary in the annual reports going forward, but consistent with the spirit of the more streamlined Tailored Shareholder Reports required by the SEC, the commentary will be more concise than in the past.

Yikes. That doesn’t sound too promising! The next round of annual (not semi-annual) reports isn’t due until mid-October, so we’ll have to wait and see how “concise” the commentaries are.

I appreciate that I care more about these reports (and the details within them) than most investors. I also suspect that some investors will find the one-pagers a significant improvement over parsing a 72-page report. But, in my opinion, Vanguard is squandering an opportunity to refresh its communication with shareholders on a regular basis.

But it’s not all bad news—let me give credit where it is due.

Vanguard made a substantial improvement to the emails I receive alerting me that reports have been updated for the funds I own. Below is a screen of the email I received from Vanguard on Friday. It now includes a list of the funds with updates and links to those reports.

This is a big improvement! However, all it really means is that if I own a fund, it’s now easier to access less information than before.

Vanguard has work to do. In this case, they’ve taken one step forward but two steps back.

(And for eagle-eyed IVA readers wondering why I own a California municipal bond ETF when I live on the other side of the country or why U.S. Value Factor ETF is listed three times in the email, well, I hold the California fund because I have purchased all of Vanguard’s ETFs to inform my reporting on then. I own the factor ETF in three different accounts.)

Our Portfolios

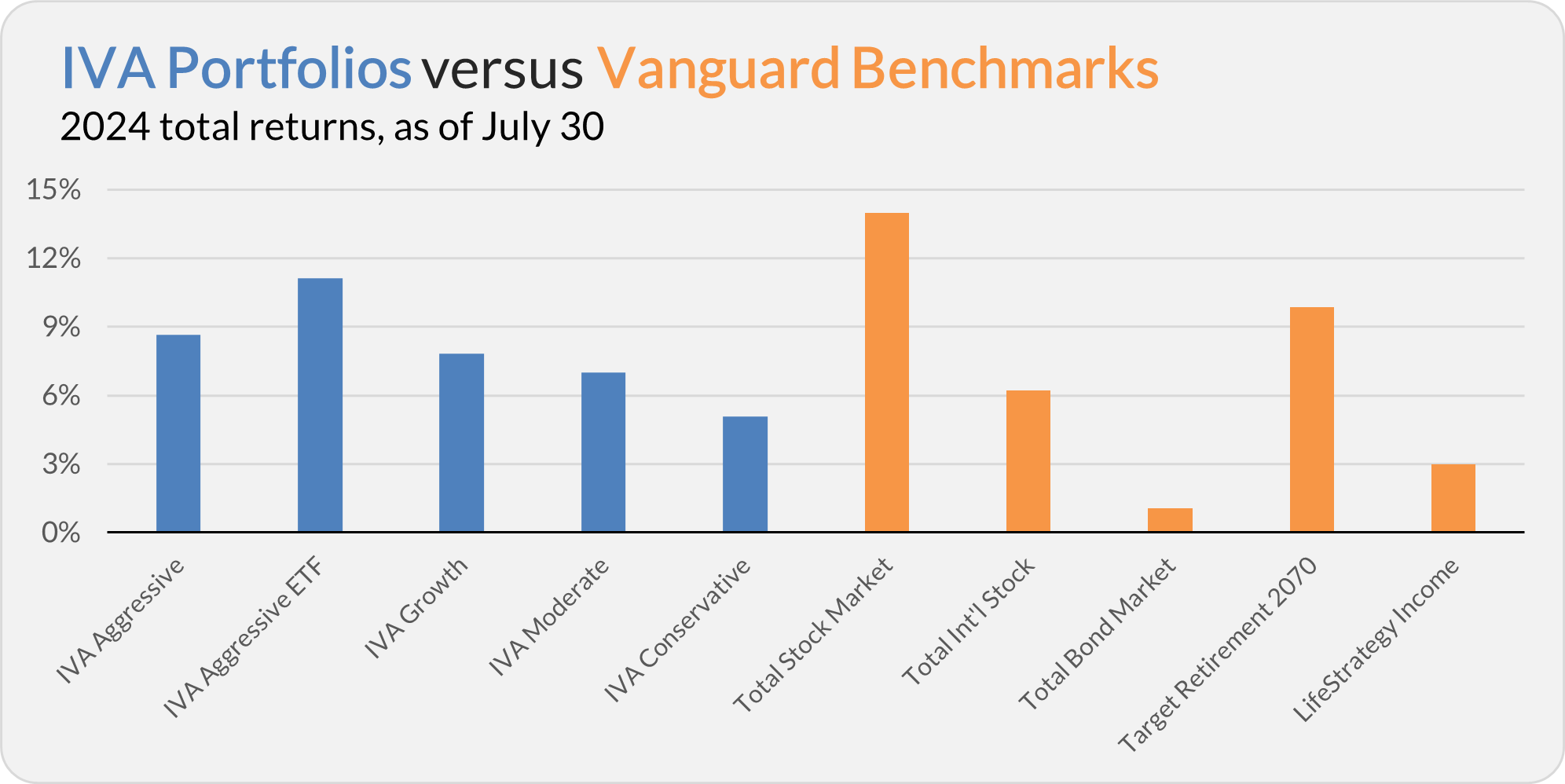

Our Portfolios are showing improved but still lagging returns for the year through Tuesday. The Aggressive Portfolio is up 8.7%, the Aggressive ETF Portfolio is up 11.1%, the Growth Portfolio is up 7.8%, the Moderate Portfolio is up 7.0% and the Conservative Portfolio is up 5.1%.

This compares to a 14.0% gain for Total Stock Market Index (VTSAX), a 6.2% return for Total International Stock Index (VTIAX), and a 1.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.0%.

IVA Research

Yesterday, I told Premium Members why rebalancing is overblown—it’s all about managing the risk in your portfolio, not boosting your returns.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.