Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 17.

There are no changes recommended for any of our Portfolios.

On Air

If you missed my note yesterday, I recently joined Rusty Vanneman and Robyn Murray on Orion's The Weighing Machine podcast. We talked about my background and all things Vanguard. If you’re reading this email, I think you’ll enjoy the episode.

You can find the episode wherever you listen to podcasts, but I've provided a few links below:

Spotify

[Note: If the Spotify link does not appear in the email, you can find it by viewing this article on our website.]

Apple Podcast

Google Podcast

One Last Bitcoin Loophole

As I said last week, this isn’t a cryptocurrency newsletter. But Vanguard and the cryptocurrency world have collided for the past week. Here’s a timeline of recent bitcoin-related events:

On Thursday, January 11, the SEC approved 11 spot bitcoin ETFs—a first. That same day, I told Premium Members how they could still buy bitcoin trackers at Vanguard, even though the firm was blocking purchases of the new ETFs.

After the market closed on Friday, January 12, Vanguard closed the bitcoin loophole I had identified.

Which brings us to today. Vanguard has clearly and loudly said N-O to bitcoin and cryptocurrency products. Vanguard has put a full stop to buying them, and they are adamant that they have no plan to offer their own bitcoin ETF.

This puts Vanguard at odds with its biggest competitors and millions of customers. I’m working on a missive for Premium Members that lays out my thinking on what this means for Vanguard, the company, in the long run. Stay tuned.

In the meantime, if you’re hellbent on buying bitcoin in your Vanguard account, I have one last loophole: MicroStrategy (MSTR) stock.

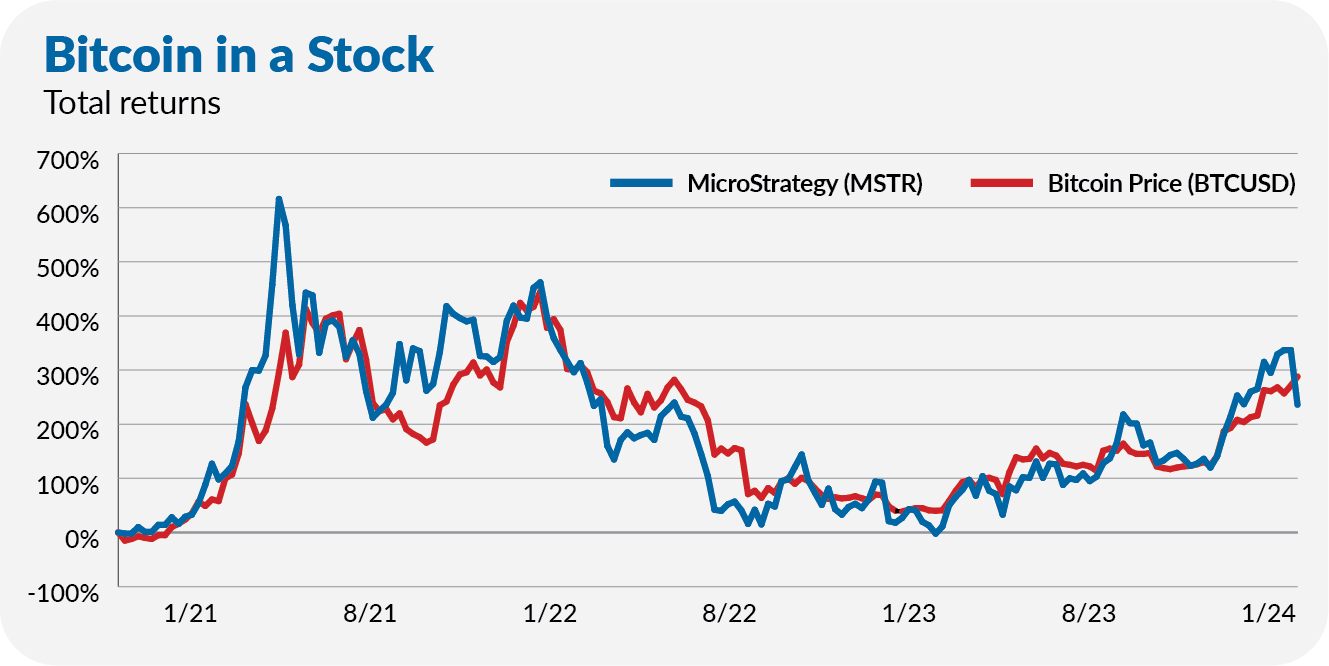

MicroStrategy is a (former?) technology company that started buying bitcoin in a big way in August 2020 and is now almost wholly focused on it. Since then, investors have used the company’s stock as a close but not perfect way to play bitcoin. As you can see in the chart below, the stock has roughly tracked bitcoin’s ups and downs over the past three years.

You can still buy MicroStrategy stock in your Vanguard brokerage account. It’s not the same as purchasing a spot or futures-based bitcoin ETF, but it could do the job for you.

However, let me repeat one more time: You absolutely do not need bitcoin in your portfolio.

Our Portfolios

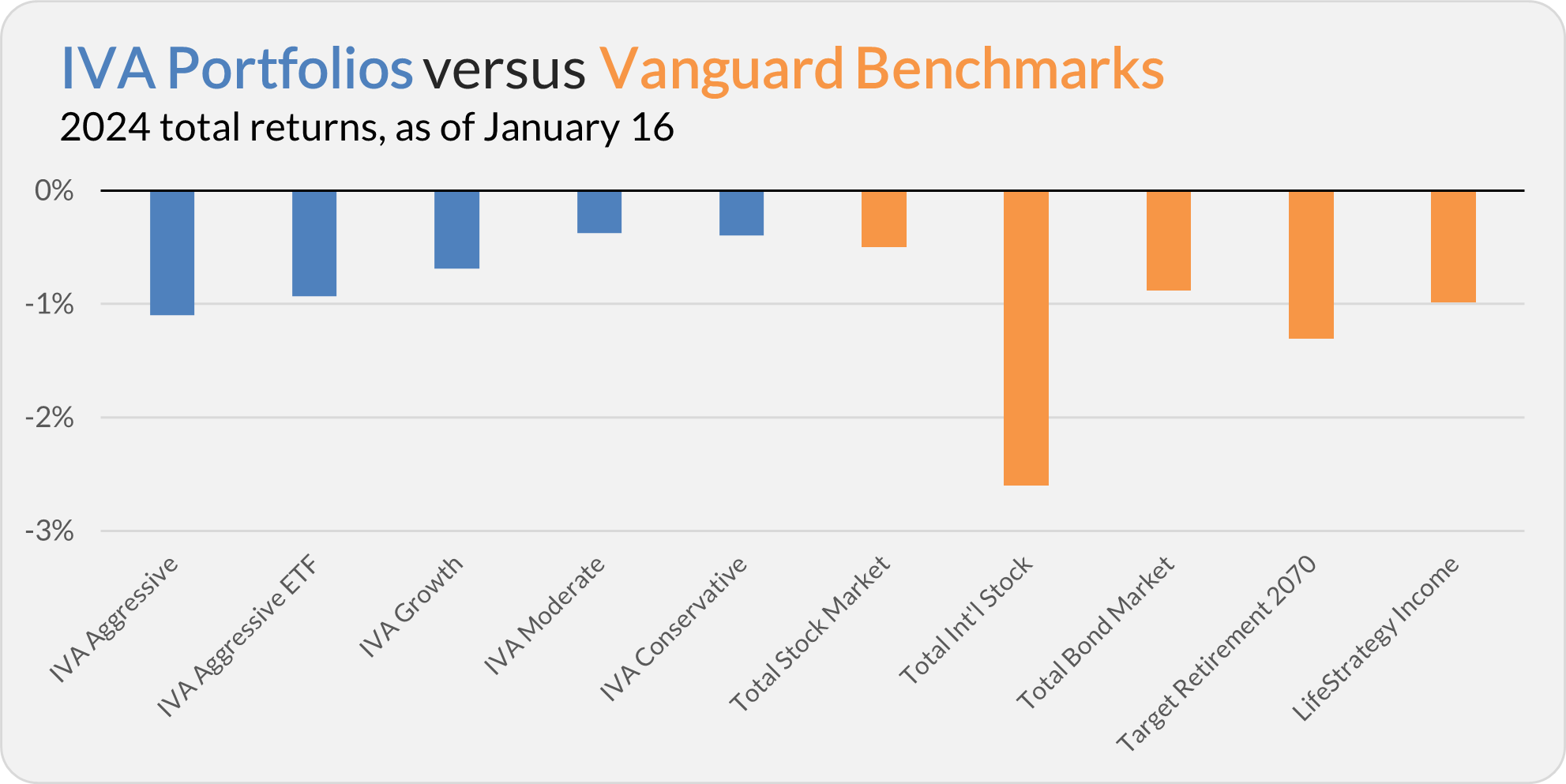

Our Portfolios are slightly in the red for the year through Tuesday. The Aggressive Portfolio is down 1.1%, the Aggressive ETF Portfolio is off 0.9%, the Growth Portfolio is down 0.7% and the Moderate and Conservative Portfolios are down 0.4%.

This compares to a 0.5% decline for Total Stock Market Index (VTSAX), a 2.6% drop for Total International Stock Index (VTIAX), and a 0.9% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is down 1.3% for the year, and its most conservative, LifeStrategy Income (VASIX), is off 1.0%.

IVA Research

Yesterday, I shared an update on 2024’s contribution limits for retirement accounts with Premium Members. I also published an article in support of saving and investing early, which is open to the public. Please feel free to share that article with anyone who might benefit from the message.

Several of you have asked about the other side of retirement accounts—required distributions. I hear you, and an article exploring that topic is in the works. Stay tuned.

Finally, as I noted already, Premium Members also received a couple of Quick Take articles from me about Vanguard blocking purchases of bitcoin ETFs.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start your free 30-day trial now.