Executive Summary: In the search for Vanguard's best income fund, I analyzed the fund giant’s various solutions, including stock and bond funds, plus mixed-asset funds like Wellesley Income. The ideal choice depends on your timeframe. High-Yield Corporate is a strong option for immediate income, while stocks play a crucial role in long-term income generation. However, a singular focus on income misses the other half of the (total) return equation.

If all I want from my investments is income, what’s the best Vanguard fund for me?

That’s a question I hear regularly. Most times, the investor explains that they can tolerate seeing their portfolio value fluctuate (or even drop meaningfully) because they know that as long as they don’t sell, they’ll have the same number of shares as they did the day before, and their income will keep rolling in.

These investors want to “live off the income” from their portfolio. It’s a worthy goal. It also ties into last week’s article on retirement spending, making now an excellent time to discuss it.

However, first, let’s acknowledge that if you’re going to live off the dividends and interest your investments pay out, you need a large portfolio relative to your income needs. For example, Vanguard’s four LifeStrategy funds have paid between just 2.2% and 3.5% in income over the past 12 months.

If that’s all you need to spend, great. I’m not necessarily trying to encourage more spending per se—defining “enough” is one of the keys to happiness—but for many investors, spending 2% or 3% isn’t going to cut it.

Second, and more importantly, a singular focus on income misses a crucial piece of the total return equation—the combination of income and capital appreciation.

But let’s put those caveats aside for now and try to identify a good and logical candidate for the best Vanguard fund (or funds) for income.

Key Points

- The best income solution depends on when you need it—today or years from now.

- It’s hard to beat High-Yield Corporate if you need income today.

- Stocks have a role to play if you want to generate income for decades.

Methodology

Several contenders for “the best” Vanguard income solution come to mind, so I will start at the highest level and then add funds to the mix in stages. Building in steps might be repetitive, but it makes it easier to digest and follow along.

To evaluate the candidates, I started with a $10,000 investment in each fund at the end of 2006. (I chose this start date because Vanguard launched two dividend-oriented stock index funds in 2006.) I then assumed that an investor withdrew only income distributions (dividends and interest) but reinvested capital gains. I ran the analysis through September 2024.

Why didn’t I send all distributions—interest, dividends and capital gains—to cash?

First, capital gains are unpredictable and irregular and can dry up for years. An investor looking for income is probably also seeking consistency and predictability. It helps to have a reasonably accurate idea of how much you will receive each month or quarter.

Second, counting capital gain distributions as “income” gives actively managed funds (which tend to pay out more capital gains) an unusual advantage over index funds (and ETFs). Said differently, if capital gains count as income, then (all else equal) an income investor would be in the odd position of preferring a fund because it pays out more in capital gains.

I’ve never heard anyone say that before! Let me give you an example:

Fund A’s price per share starts at $100 and advances 10% to $110. The fund then pays out $2 in dividends, dropping its NAV to $108.

Fund B also starts at $100, sees its price rise to $110 and then pays a $2 dividend. However, Fund B also pays out $2 in capital gains, which drops its NAV to $106.

If we’re counting income as all the money paid out by a fund, then Fund B comes out ahead of Fund A—$4 to $2. So, maybe an “income” investor looks at that and says, give me Fund B. But that’s not quite “right.”

With both funds, you started with $100 and now have $110. In the case of Fund A, you have $108 in the fund and $2 in cash (from the dividend). With Fund B, you have $106 in the fund and $4 in cash (from the dividend and the capital gain).

And yes, that’s all before taxes are considered. (Did you think I forgot about taxes? No way.) I’ll return to taxes before the end of this article.

One last caveat. I’m analyzing just one time period, and for most of it, interest rates trended lower. It is possible we’d get a different outcome in an extended rising interest rate environment.

With that said, let’s work our way through Vanguard’s various income funds.

Start at the Beginning

As I said, I’ll start at a high level, evaluating funds in the main asset classes: stocks, real estate, bonds and cash. (Arguably, commodities are another asset class, but they don’t generate income, so I’m just going to leave them out of the picture.) None of these funds will be “the solution,” but starting here sets the stage.

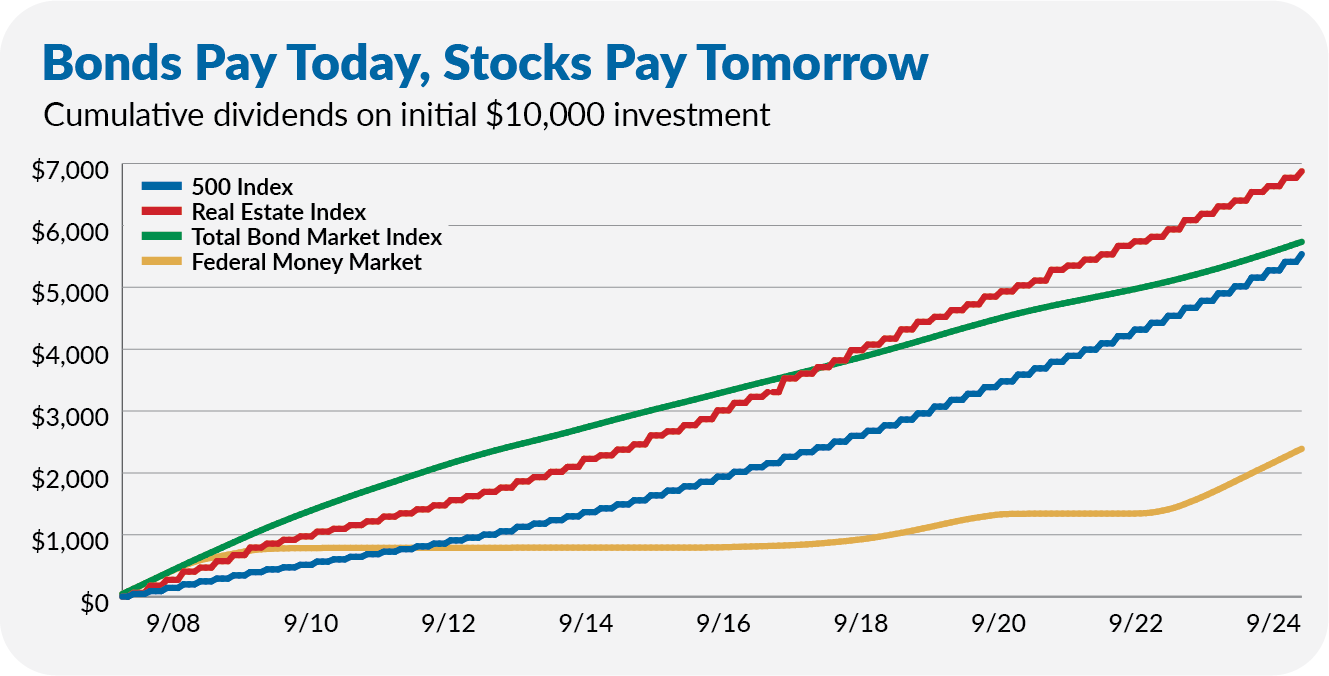

The chart below tracks the cumulative dividends paid out by 500 Index (VFIAX, stocks), Real Estate Index (VGSLX, real estate), Total Bond Market Index (VBTLX, high-quality bonds) and Federal Money Market (VMFXX, cash) since the end of 2006. Again, I’m reinvesting capital gains back into the funds, so I’m not counting those distributions as income.

Initially, Total Bond Market Index and the money market fund generated the most income. However, Real Estate Index paid out the most over the entire period, and 500 Index had almost caught up to the bond fund. As I’ll show you, this is due to declining interest rates and rising dividends (for stocks).

This chart demonstrates the fundamental takeaway of this article: The best income solution depends on when you need the most income. If you’re looking for income “today,” you’ll want to look at bonds. However, stocks should begin to factor into your thinking if you have a long time horizon.

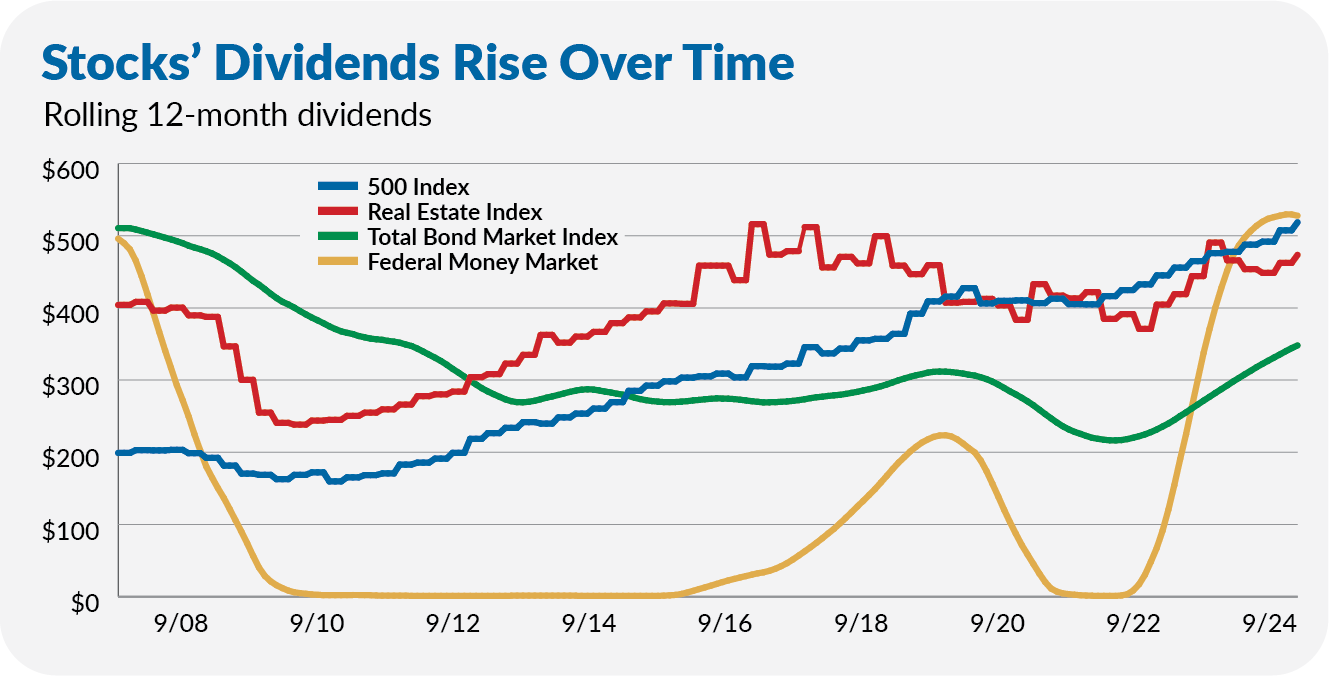

The following chart (below) plots the dividends paid out by each fund over rolling 12-month periods, emphasizing this point further. Bonds paid out a high level of income at the start, but stock investors saw their distributions grow over time. In fact, the stock investor has been taking home more income each year for the past decade!

Yes, part of this reflects that interest rates trended lower for the first 15 years, and that’s not always going to be the case. The chart shows that the bond fund’s distributions have increased for the past few years. Still, after two decades, the bond fund is playing catch-up to the stock fund from an income perspective.

And, of course, the money market fund’s lack of dividends reflects the impact of monetary policymakers’ near-zero interest rate policy during and after the 2008 and COVID recessions.

The rolling distribution chart (above) also highlights the trade-off investors face when choosing between bonds and cash. Bonds offer a more predictable (and stable) stream of income at the cost of less price stability, while cash has a steady price but a variable income stream. (You can read more about this trade-off here.)

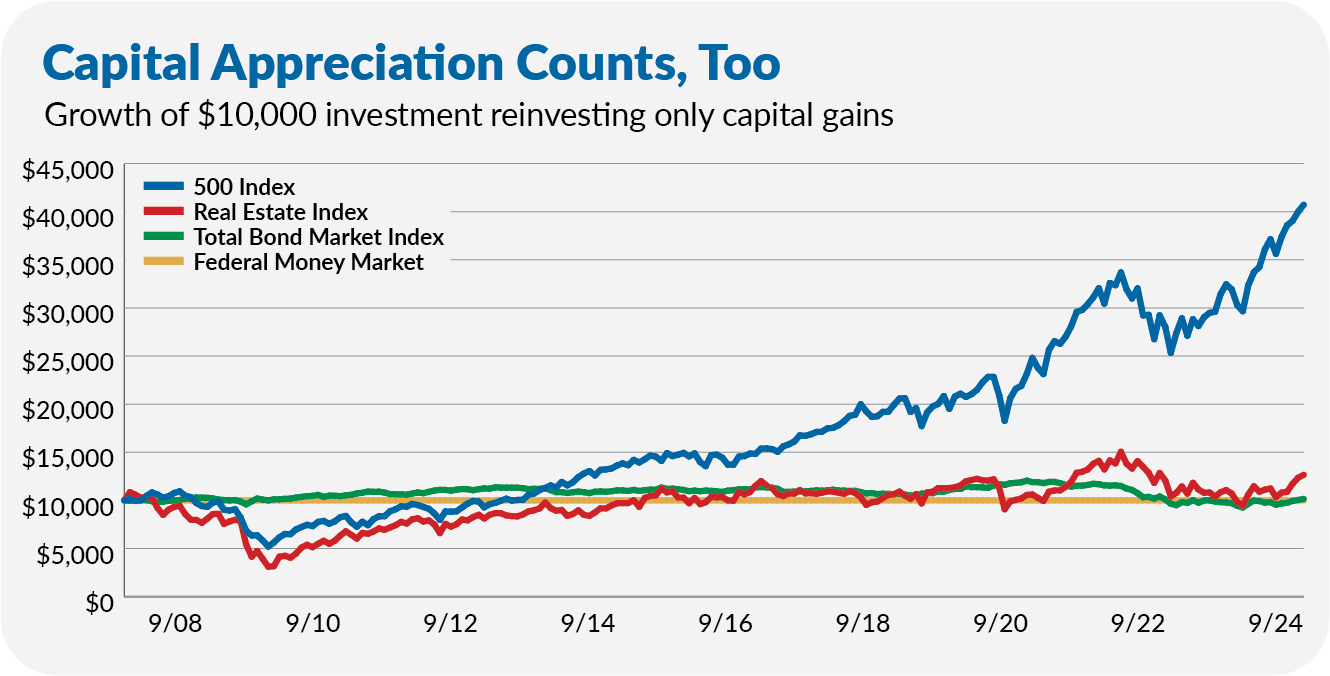

I said I would leave capital gains aside, but let me quickly share the chart showing the value of each fund through time. Over this (nearly) 20-year period, only one of the asset classes (stocks) has offered material capital appreciation.

We’re only talking about “income” here, but that increased portfolio value could be turned into “income.” Take that as something to keep in mind and another argument for stocks, even if you’re an income investor.

Higher Yielding Options?

Okay. Those are the main asset classes, but Vanguard offers more targeted income solutions within the stock and bond markets.