The holiday season is off to a good start, at least for investors.

The S&P 500 index and Dow Jones Industrial Average closed the month at record highs. 500 Index (VFIAX) had its best month of the year, up 5.9% in November. SmallCap Index (VSMAX) did about twice as well, gaining 10.5%. All of Vanguard’s sector ETFs finished in positive territory.

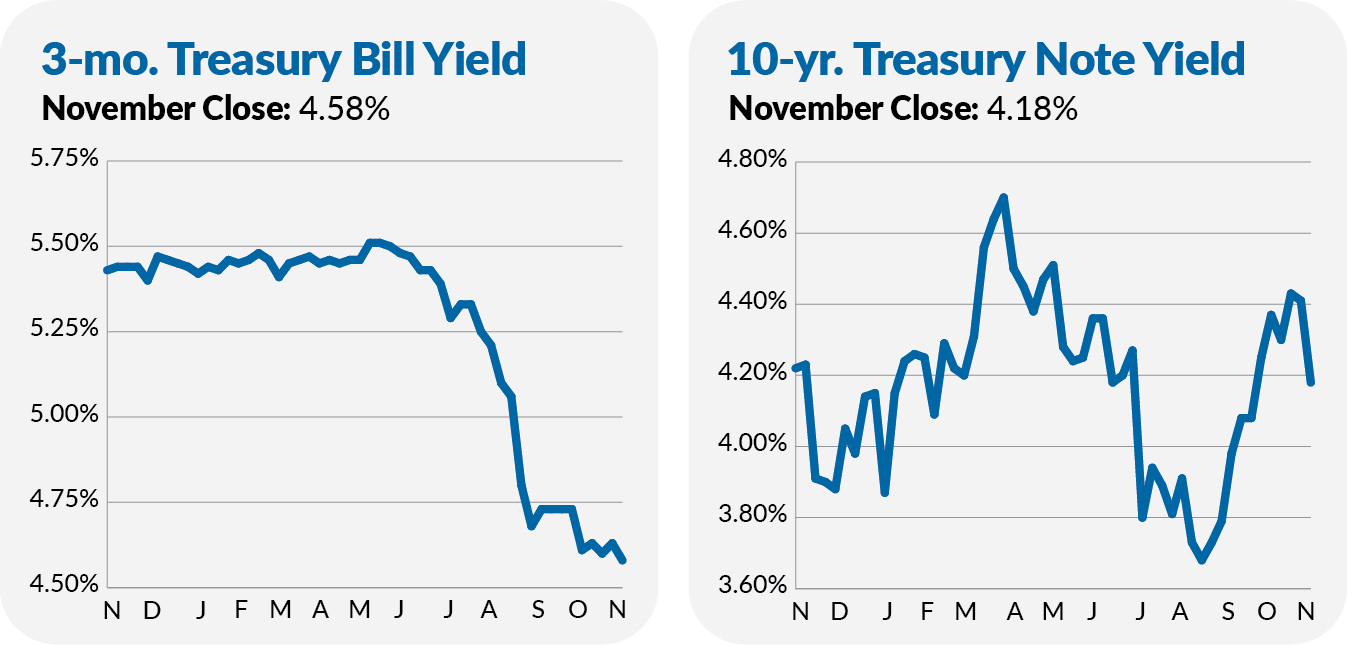

Bond investors also had plenty to cheer about. All of Vanguard’s bond funds gained ground, with Total Bond Market Index (VBTLX) returning 1.1%. Cash held the course, with Federal Money Market (VMFXX) gaining 0.4%.

Foreign stocks were the glaring exception to all the gains. Total International Stock Index (VTIAX) fell 0.2% on the month.

So, the average Vanguard investor gained 4.1% in November. But, well, I don’t mean to play the Grinch here, but let me offer a different take on November’s market.