Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 3.

There are no changes recommended for any of our Portfolios.

Another One Down

This week kicked off with reports that the so-called “banking crisis” is over. First Republic Bank was taken over by the FDIC over the weekend and then sold to J.P. Morgan in the early hours of Monday morning. This third big bank failure of the year felt different, though. While the Silicon Valley Bank and Signature Bank failures happened all of sudden, First Republic Bank had been more of a slow-motion crash.

Yes, stocks were down on Monday, but only a fraction. The S&P 500 index fell just 0.04%. As I’ve said, it’s the risks that no one is talking about that trip investors and traders up. Since nobody was caught off guard by the troubles at First Republic Bank, it was a non-event in the market … at least on the day.

Market participants were hoping that closing the book on First Republic Bank would bring an end to this mini banking crisis. Even Jamie Dimon (J.P. Morgan’s CEO) proclaimed Monday that “this part of the crisis” is over.

I think this leaves the door open to further failures. Given that regional bank stocks were once again under pressure on Tuesday—this time led by PacWest Bancorp, Western Alliance Bancorp and Metropolitan Bank—it’s too soon to sound the all clear.

Higher interest rates have put pressure on bank balance sheets … but they’ve also given investors plenty of motivation to move their cash out of a checking or savings account and into a money market fund. Even without banks failing, if you can go from earning 0.45% (the yield Schwab is advertising on its checking account) to earning 4.64% with Treasury Money Market (VUSXX), well, it’s kind of a no-brainer.

That said, I don’t think this is a banking crisis à la 2008. The big, national banks (like Bank of America and J.P. Morgan) are just fine, thank you very much. Pressure remains on regional and smaller banks that might have gotten out past the fronts of their skis when interest rates were scraping bottom. But the mega-banks have more controls over the risks they take and the reserves they must hold on their balance sheets.

One More Hike

Speaking of higher interest rates, the Federal Reserve (Fed) completed its two-day meeting today and raised the fed funds rate by 0.25%—the target range is now 5.00% to 5.25%.

I could be wrong, but I’d guess we are at (or very near) the end of this cycle of interest rate hikes. My thinking: Given there is a lag between Fed actions and their impact on the economy (and markets), it’s only reasonable that monetary policymakers will want to pause and measure the impact of their actions.

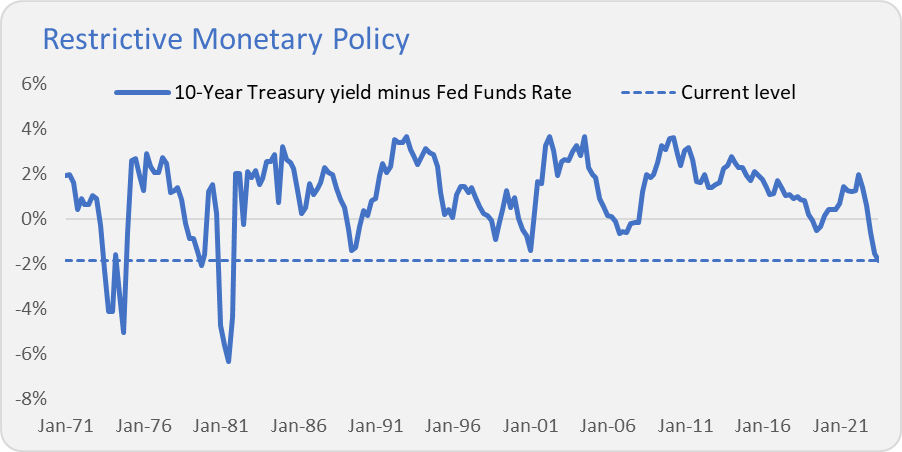

I think we’ve reached that point, as the Fed hasn’t been this aggressive in fighting inflation for the better part of four decades. One way to view how aggressively the Fed is trying to slow the economy is to compare the 10-Year Treasury’s yield to the fed funds rate.

As I write this, the 10-Year Treasury is yielding 3.40% and the fed funds rate (the upper bound) is at 5.25%. As you can see in the chart below, we haven’t seen the fed funds rate top the 10-Year Treasury yield by this much (1.85%) since the 1970s and early 1980s.

Again, the Fed governors have come a long way in their efforts to tame inflation over the past year. With inflation trending lower and parts of the banking system under stress, it’s time to hit pause and see how things play out.

Running Out of Road

Speaking of seeing how events unfold, Treasury Secretary Janet Yellen has warned that the U.S. government will be unable to pay all of its bills—read “default”—as soon as June 1 if Congress doesn’t raise the debt limit. Though that sounds ominous and is just weeks away, my base case assumption is that a deal will be reached, and the U.S. government will not default.

But clearly there is a lot to unpack and discuss when it comes to the debt ceiling, government shutdowns and a potential government default … and I’ll be doing exactly that in my article for Premium Members next week.

If you’re not already a Premium Member, you can start a free 30-day trial by clicking the button below:

If you are already a Premium Member, thank you. Keep an eye out for an article on the debt ceiling next week.

Our Portfolios

Bank failures, Fed interest rate hikes and a potential default … the headlines are noisy this week. That makes it a good time to step back and remember that reacting to headlines may feel good in the short term but is rarely the right thing to do in the long run for our portfolios.

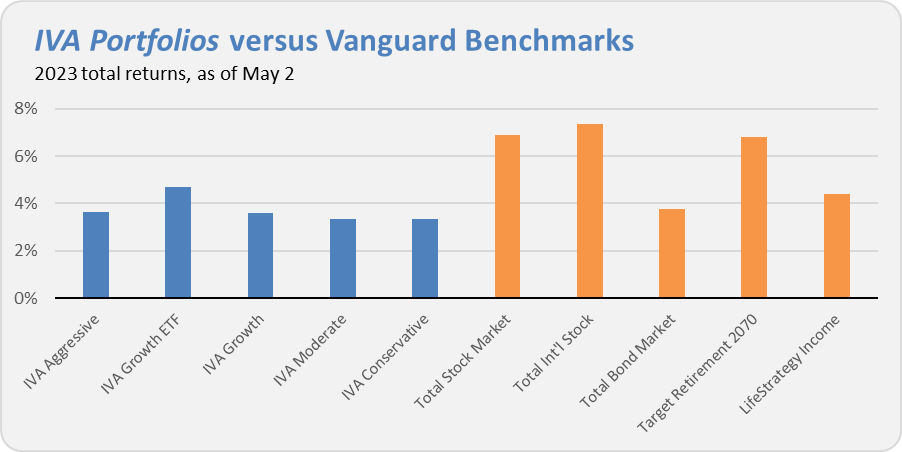

For all the handwringing and headlines, our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.6%, the Growth ETF Portfolio is up 4.7%, the Growth Portfolio has gained 3.6%, the Moderate Portfolio is up 3.4%, and finally the Conservative Portfolio has returned 3.3%.

This compares to a 6.9% gain for Total Stock Market Index (VTSAX), a 7.3% return for Total International Stock Index (VTIAX), and a 3.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 6.8% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.4% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.