The Bureau of Economic Analysis’s first estimate, released at April’s end, is that our economy—measured by gross domestic product (GDP) adjusting for inflation—grew 0.3% during the first quarter. (The headline 1.1% figure you see bandied about in the press is an annualized number.)

Over the past 12 months, the economy has expanded 1.6% after inflation. Add inflation into the equation and the U.S. economy was 7.3% larger at the end of March than it was one year ago.

I told you in my 2023 outlook, Just Keep Going, that I expected the U.S. economy would enter a recession this year. That’s still my base case scenario because none of the factors I was watching in December have changed.

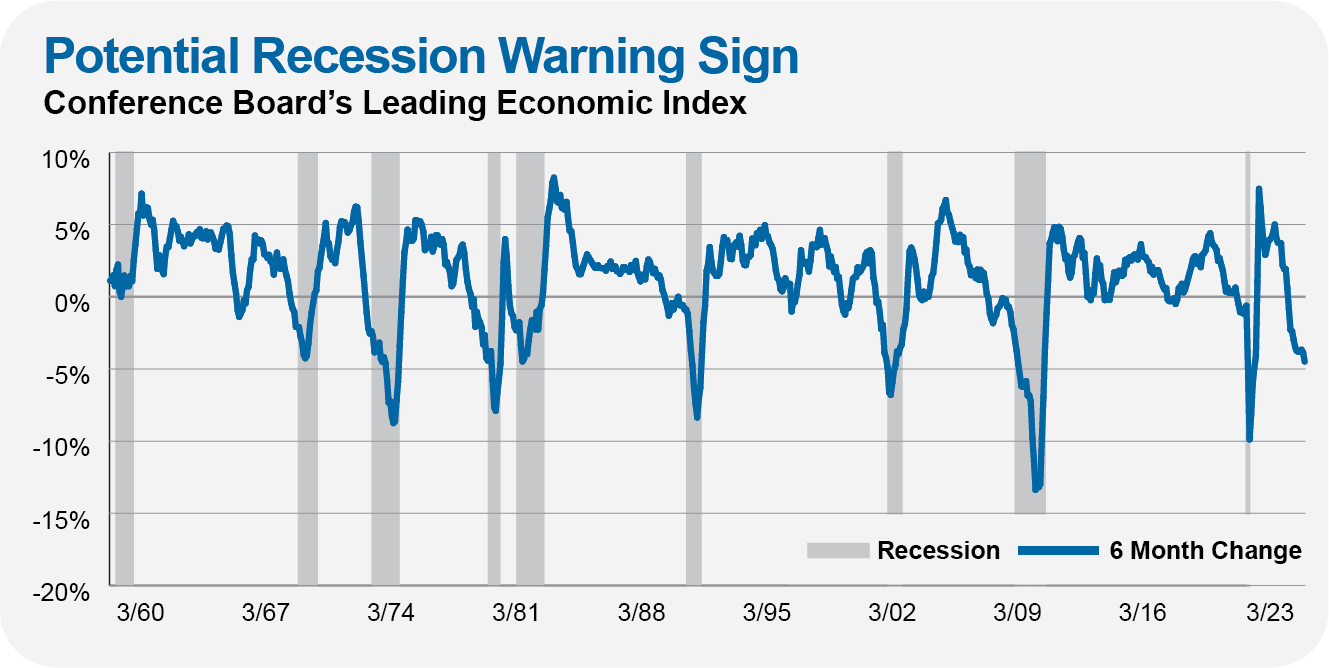

To give just one example, the Conference Board’s Leading Economic Index, which is designed to combine several “forward-looking” factors into one number, continues to flash yellow, as you can see in the chart, dropping to levels that have often been associated with recessions.

I didn’t expect we’d slip immediately into a recession with the turn of the calendar, so seeing GDP clock in with a gain in the first quarter doesn’t come as a surprise. Nonetheless, that’s one quarter down and a potential recession in the cards. Frankly, this is one forecast I’d be happy to get wrong!