Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, December 7th.

There are no changes recommended for any of our Portfolios.

Stocks have stumbled out of the gate this month with 500 Index (VFIAX) down 3.4% through Tuesday. That traditional defensive funds are holding up relatively well, however. For example, Dividend Growth (VDIGX) is only down 2.0% and Health Care ETF (VHT) is off just 1.5%. That’s (relatively) good news for our Portfolios.

And in a piece of good news for all balanced investors, bonds are finally acting like shock-absorbers against stock market declines. Total Bond Market Index (VBTLX) is up 1.0% so far in December. The bond index fund has a big hole to climb out of (it is still down double-digits on the year), but it is reassuring to see bonds gaining ground as stock prices fall—bonds are not broken.

Of course, we’re talking about just four days of market action, so let’s not read too much into things—good, bad or otherwise.

Let’s talk about the most recent mainstream attack on active management. To sum up, this past Sunday’s The New York Times article “Mutual Funds That Consistently Beat the Market? Not One of 2,132” argues that because few active funds beat the indexes year-in-and-year-out, investors should just buy index funds. The article leans heavily on S&P’s U.S. Persistence Scorecard report.

I don’t disagree with the article’s conclusion … most investors should just buy index funds. I just come to that conclusion from a different angle.

S&P’s Persistence Scorecard is on my list of pet peeves. Why? Because there is no manager or strategy that outperforms the market or peers every year. If that’s your expectation, you are pretty much guaranteed to be disappointed (as the S&P report makes clear). But when I buy an active fund—ANY active fund—I know that there will be periods where my choice looks like a bad one because it will inevitably trail the pack or whichever index I’ve chosen to compare it to. But that doesn’t mean it’s a failure.

I’m investing for longer than the next 12 months. I know that even if a manager trails over one short period, that doesn’t mean they can’t go on to outperform over time. I have confidence that by researching thoroughly before buying, I will make more good decisions than bad ones over time and that this will accrue to my benefit. It has for decades. Why shouldn’t it continue to do so?

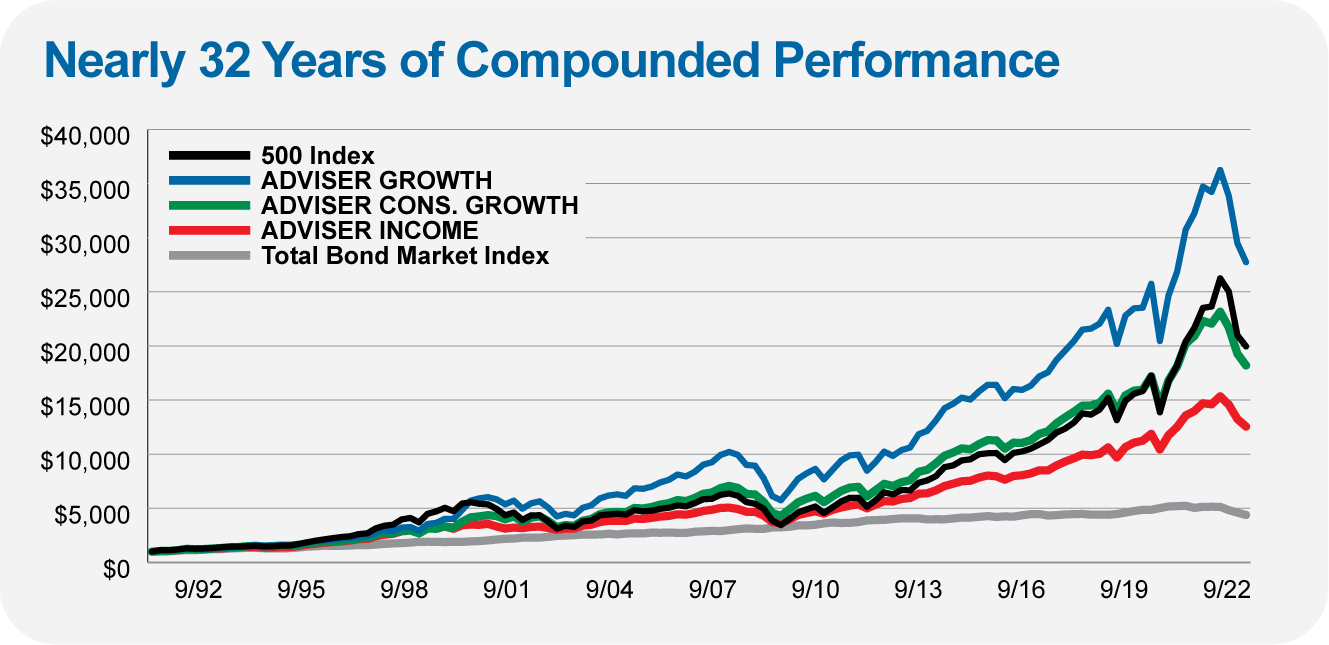

Here’s the proof behind that statement: The chart below tracks the performance of the Model Portfolios from our prior publication from inception (January 1991) through its end (September 2022). Our old Growth Model (now the Aggressive Portfolio) outpaced the market with a similar level of risk while the Conservative Growth Model (renamed the Growth Portfolio) roughly matched the market with less risk. Premium Members can find the Portfolios here.

That said, active management is not easy. If you don’t have the time, energy, expertise, a process, a philosophy, the resources (or a partner who can do all that for you), then you shouldn’t try to outsmart the market. And even then, the data is pretty clear that most active mutual funds don’t beat the indexes after fees—which tells you that having all those elements in place still doesn’t guarantee market-beating returns.

Still, active management can be worth pursuing, but utilizing index funds (or ETFs) is also worthy for some investors—probably most investors. Fortunately, it’s a great time to be an investor—you can buy the market for effectively no cost in a very tax efficient way. So, while the recent NYT article offers sound advice to buy index funds, its swing at active management doesn’t quite land.

Turning to Malvern—but sticking to the topic of investors flocking to index funds—this may sound crazy but Vanguard’s ability to buy utility stocks is being threatened. The backstory is that Vanguard has become such a large investor in U.S. stocks that it has to file a request with the Federal Energy Regulatory Commission (FERC) to own up to 20% of a utility’s voting shares. To get this authorization from the FERC, Vanguard has to pledge to not use its ownership of the stock to manage the utility. In other words, they must remain a “passive” investor in the company.

Now, a coalition of attorney generals are arguing that since Vanguard is involved in emissions-reduction campaigns through its membership in groups like the Net Zero Alliance and Ceres Investor Network, that the firm has “abandoned its status as a passive investor in public utilities and adopted a motive consistent with managing the utility."

I’m not a regulator, so I won’t speculate on whether Vanguard will be allowed to continue purchasing utility stocks, or not. Clearly, if they were barred, this would be a big problem for Vanguard’s index funds and ETFs. Though there may be some work arounds … Would Vanguard be able to buy a utilities ETF from, say, iShares or Fidelity to get their exposure? Could those wunderkinds on Wall Street cook up some options-based strategy specifically for Vanguard? Again, I’m not regulator nor am I Goldman Sachs.

While the impact on Vanguard’s index funds will get a lot of press if this comes to pass, I suspect it would also be an issue for their active funds. If you are a sub-adviser and you want to buy a utility stock, will you be prohibited from doing so? That would sure make working with Vanguard a lot less attractive for sub-advisers.

However, the bigger point is that it gets at the heart of what happens when index funds (and ETFs) get so big that they own and control large stakes in vast numbers of companies. Vanguard and BlackRock, as the two big index players, have targets on their backs. None of the protests or special interest groups have had much of an impact. This legal question, though, is a good one. It remains to be seen how electrifying it will truly be. Keep the lights on and stay tuned.

One last Vanguard item on my radar this week: When Vanguard launched Global Environmental Opportunities Stock (VEOIX) a month or so ago, I said that I expect Vanguard will roll out more ESG funds and ETFs. For example, I think it’s only a matter of time until we see ESG versions of the Target Retirement and LifeStrategy funds.

However, in Europe, Vanguard just launched two ESG ETFs—one for emerging market stocks broadly and the other focused on the Asia region. So, before we see those broad allocation funds get an ESG filter, Vanguard might continue to slice-and-dice the market into finer ESG pieces. Stay tuned.

Finally, our Portfolios are showing improved returns for the year through Tuesday. The Aggressive Portfolio is down 13.4%, the Growth ETF Portfolio is off 16.5%, the Growth Portfolio has declined 12.1% and finally the Moderate Portfolio is down 9.5%. This compares to a 17.5% decline for Total Stock Market Index (VTSAX), a 15.4% drop for Total International Stock Index (VTIAX), and an 11.8% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065(VLXVX), is down 15.9% for the year and its most conservative, LifeStrategy Income (VASIX), is down 12.1% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is off 8.3%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.