Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 22.

There are no changes recommended for any of our Portfolios.

Last week, I talked in depth about the bank runs that took down Silicon Valley Bank and Signature Bank. With UBS agreeing to take over Credit Suisse this past weekend and First Republic Bank teetering, this episode is not over. Yet, even if there are more shoes (or wingtips) to drop, my comments about the safety of your accounts stand. I don’t see any reason for Vanguard investors to worry.

I’ll let you know if my tune changes, but I haven’t changed how I’m managing my own cash since this mini-crisis began, and I don’t think you have to, either.

The past week serves as yet another example of why it is so hard to time the markets. You might have thought that the failure of Credit Suisse—an institution with over 100 years of history—would’ve led to market declines. But no, over the first two trading days of this week, 500 Index (VFIAX) gained 2.2%.

Day trading is hard. That’s why I’ve always said you should be an investor, not a trader. I’m sticking with that.

The banking turmoil is one reason that virtually all eyes were on the Federal Reserve (Fed) today. Policy makers met and hiked the fed funds rate by 0.25%. Prior to the bank runs, the Fed had signaled that inflation was still their primary concern and that a 0.50% increase to the fed funds rate was warranted.

The Fed is trying to walk a tightrope here—they want to bring inflation down, but they don’t want to stress banks further than the current mini-crisis is doing. That mini-crisis has had a similar effect as interest-rate hikes—bankers don’t want to make loans when they are worried about bank runs. So, in that light, the Fed didn’t have to hike interest rates as much this time around to have the same effect. Accordingly, while they did raise interest rates, they stuck to a relatively small 0.25% hike.

While forecasting Fed actions is often a fool’s errand—as I showed in my 2023 Outlook, the Fed often doesn’t even have a clue where interest rates will be 12 months from now—it seems safe to say that we are closer to the end of this interest rate hiking cycle than the start. We may see another interest rate increase or two from the Fed, but I suspect they’ll pause sooner or later and assess the impact of their actions.

Website Redesign

Vanguard recently refreshed the design of its Balances and Holdings pages online. I've heard from one subscriber who is, let's just say, not a fan of the new look. I'm curious to hear what the rest of you think. Below is a quick poll you can take.

Share Split

As a reminder, last week Vanguard executed a 2-for-1 stock split for six of its S&P-based ETFs. Vanguard hopes this will improve liquidity of these ETFs … time will tell if that’s the outcome. If you own shares of those ETFs, don’t be alarmed by the dramatic price drop. While prices were cut in half on the day of the split, the number of shares in your account doubled.

Our Portfolios

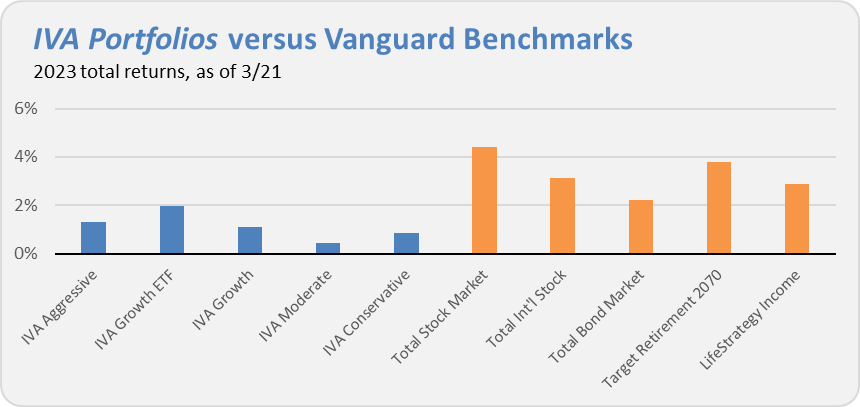

Our Portfolios are all in the green this year, with returns ranging from 0.4% for the Moderate Portfolio to 2.0% for the Growth ETF Portfolio through Tuesday.

This compares to a 4.4% gain for Total Stock Market Index (VTSAX), a 3.1% return for Total International Stock Index (VTIAX), and a 2.2% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 3.8% for the year and its most conservative, LifeStrategy Income (VASIX), is up 2.9% for the year.

While they’ve performed better in March, Dividend Growth (VDIGX) and Health Care ETF (VHT) have held our portfolios back compared to the benchmark index funds in the first quarter of the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.