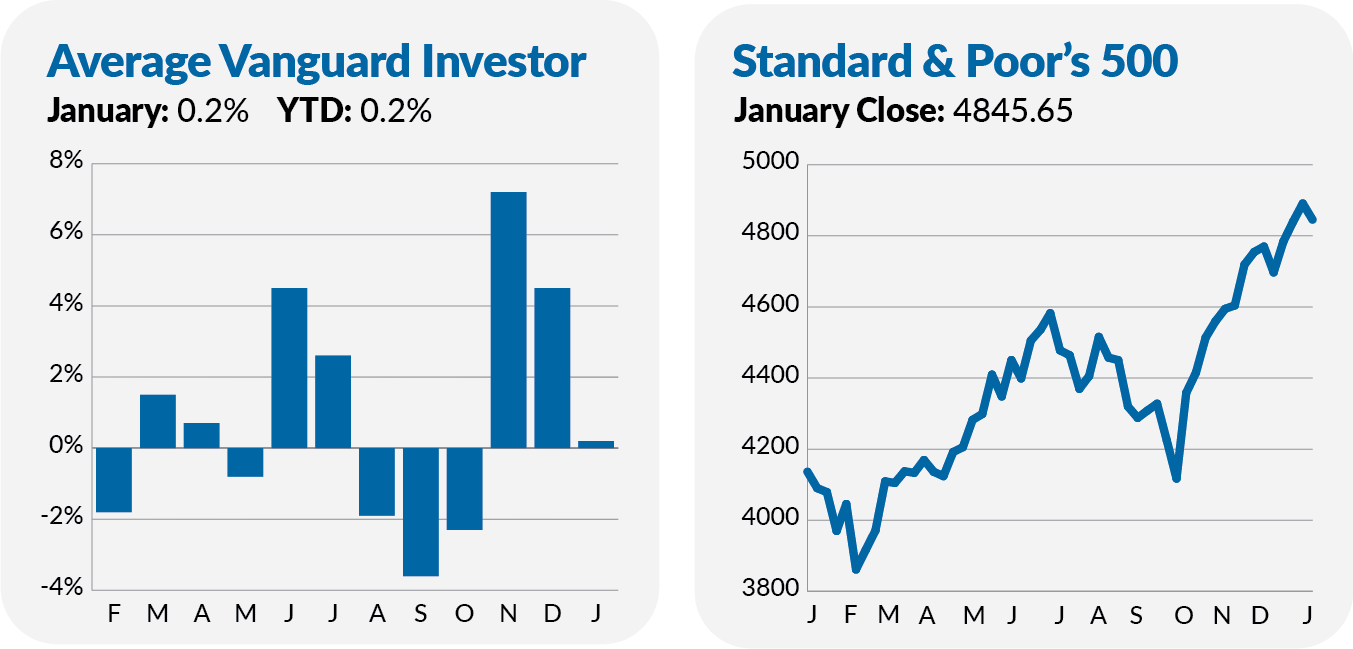

It’s the season of New Year’s resolutions. When many of us promise ourselves that this year will be different in some way—big or small. Well, the markets didn’t get the memo. January’s results were similar to 2023 for investors.

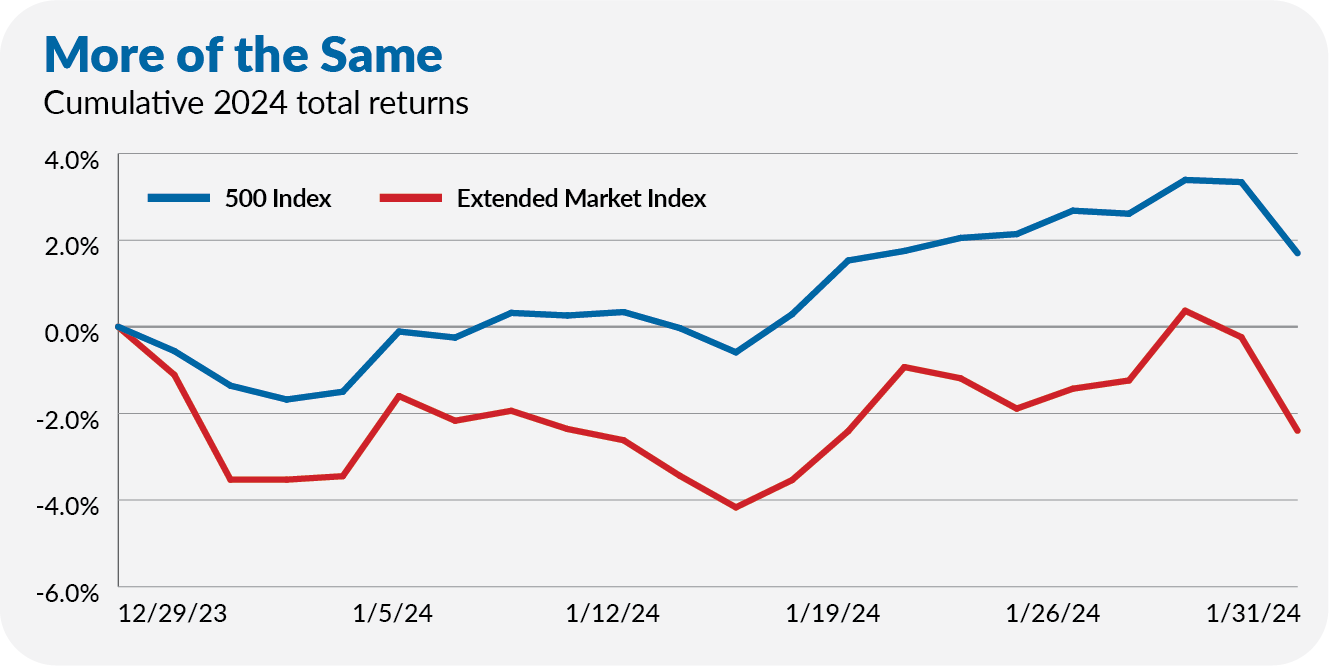

Once again, 500 Index (VFIAX) was the place to be. The fund’s 1.7% return in January was hard to beat. Extended Market Index (VEXAX), which is essentially all the stocks in the U.S. that aren’t included in the S&P 500 index, fell 2.4%. As you can see in the chart below, 500 Index got off to an early lead and never really looked back.

Picking up where they left off, Communication Services ETF (VOX) and Information Technology ETF (VGT) were two of the three best-performing sector ETFs in January, with gains of 3.9% and 2.0%, respectively.

And U.S. stocks also continued to outpace foreign stocks. Total International Stock Index (VTIAX) fell 1.8% in January.

That said, January wasn’t a carbon copy of 2023. For example, bucking last year’s trend, Health Care ETF (VHT) outpaced the market with a 2.4% return.

Additionally, we saw some cracks in the armor of the Super Seven—Microsoft, Apple, Amazon, NVIDIA, Alphabet (Google), Meta (Facebook) and Tesla.

For example, Tesla’s stock fell some 25% in January. And, on the last day of the month—really in the last few trading hours of the month—the 2023 trend reversed. All of the Super Seven fell in price on Wednesday as companies' earnings fell short of expectations and Fed Chair Powell poured cold water on the notion of a March interest rate cut.

Of course, one day in the market is just that, one day. While we shouldn’t read too much into a single trading day, it demonstrates my concern with the Super Seven. It’s not that they are bad companies—on the contrary, they are brilliant businesses with dominant market positions and stellar balance sheets—but at today’s prices, investors are expecting a heck of a lot out of these stocks.

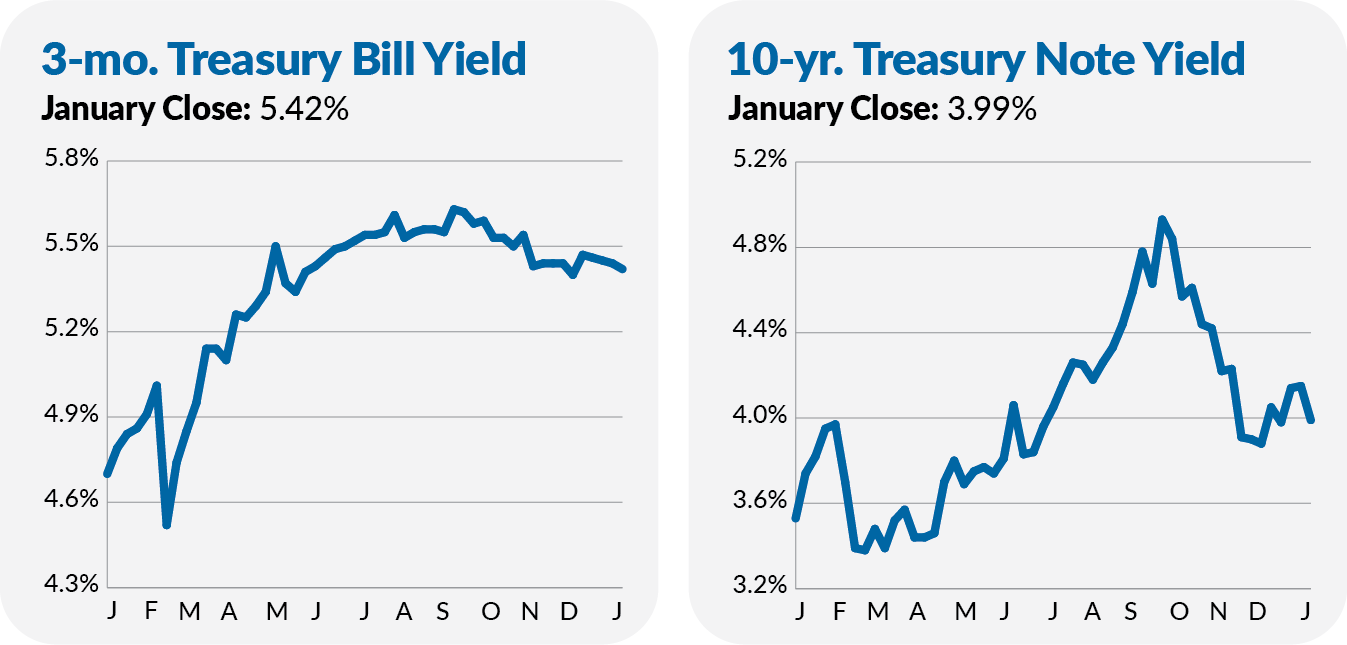

Bonds also stumbled out of the gates, as Total Bond Market Index (VBTLX) fell 0.2% in January—the index fund was down 0.8% on the month as of January 30 before rallying on the final day of the month. Frankly, this shouldn’t be a surprise, as the bond market was coming off a pretty remarkable two-month rally.

Total Bond Market Index’s 4.5% return in November 2023 was its best month since its 1986 inception. And the bond index fund’s 3.7% gain in December 2023 was its third-best month on record. It’s only natural to step back after posting numbers like that.

PRIMECAP on the airways

Yesterday, I told you that Vanguard was exploring the idea of reopening its three PRIMECAP-run funds—PRIMECAP (VPMCX), PRIMECAP Core (VPCCX) and Capital Opportunity (VHCOX).