For the past month or so, in pursuit of diversification, I have been sharing my analysis of Vanguard’s sector funds (here and here) and foreign stock funds (here). In this article, I’ll examine the intersection of the two—Global ex-U.S. Real Estate Index (VGRLX).

You may recall Revved Up Real Estate. In it, I discussed real estate investing and analyzed Real Estate Index’s (VGSLX) investment merits. If you haven’t read it yet (or need a refresher), I’d suggest you pause here and give that read for the broad basics on real estate. Then come back, because the question I’ll answer today is whether you should take your real estate portfolio global.

Spoiler: The answer is no. This is one place where keeping your portfolio in your home market makes perfect sense.

Key Points

- Real estate has delivered stock-like returns—both in the U.S. and abroad. Not all the time, but over time.

- Owning both Global ex-U.S. Real Estate Index and Real Estate Index has led to lower returns with the same amount of risk compared to holding only the U.S. fund.

One World, Two Funds

Again, if you’re looking for a primer on real estate investing, I suggest you read Revved Up Real Estate first. In a nutshell, real estate investment trusts (or REITs) are securities that give all investors (big and small) exposure to a diversified portfolio of commercial and residential properties.

You can own offices, warehouses, apartment buildings, shopping centers, cell towers, and more through REITs. This level of diversification is hard (if not impossible) for an individual to achieve on their own. But it is very simple and diversified if you buy a mutual fund (or ETF) that owns multiple REITs.

Vanguard offers two dedicated real estate funds—Real Estate Index and Global ex-U.S. Real Estate Index. One focuses on the U.S. market, while the other attempts to cover the rest of the globe. Both come in open-end mutual fund and ETF wrappers.

I typically don’t have a preference between using the mutual fund or the ETF version. However, given the front-end and back-end loads associated with the mutual fund shares of Global ex-U.S. Real Estate Index, if you’re going to buy it, I’d opt for the ETF shares (VNQI), which trade without a fee through Vanguard Brokerage.

Real Estate Index (formerly REIT Index)—the U.S. fund—was launched in 1996. The fund switched to a new benchmark in 2018, but this change was more evolution than revolution, and I doubt shareholders noticed.

By holding around 165 REITs, Real Estate Index owns thousands of properties of all shapes and sizes nationwide. The table below shows the property types in Real Estate Index’s portfolio.

Different Property Types

| Sector | Weight |

| Industrial | 13% |

| Retail | 12% |

| Telecom Tower | 12% |

| Multi-Family Residential | 9% |

| Data Center | 8% |

| Health Care | 8% |

| Real Estate Services | 7% |

| Self-Storage | 6% |

| Other Specialized | 6% |

| Single-Family Residential | 5% |

| Office | 5% |

| Hotel & Resort | 3% |

| Timber | 3% |

| Diversified | 2% |

| Real Estate Operating Companies | 0.4% |

| Real Estate Development | 0.3% |

| Diversified Real Estate Activities | 0.2% |

| As of 7/31/2023. Source: Vanguard and The IVA. | |

Global ex-U.S. Real Estate Index was launched at the end of 2010 as Vanguard’s focused foray into the international real estate market.

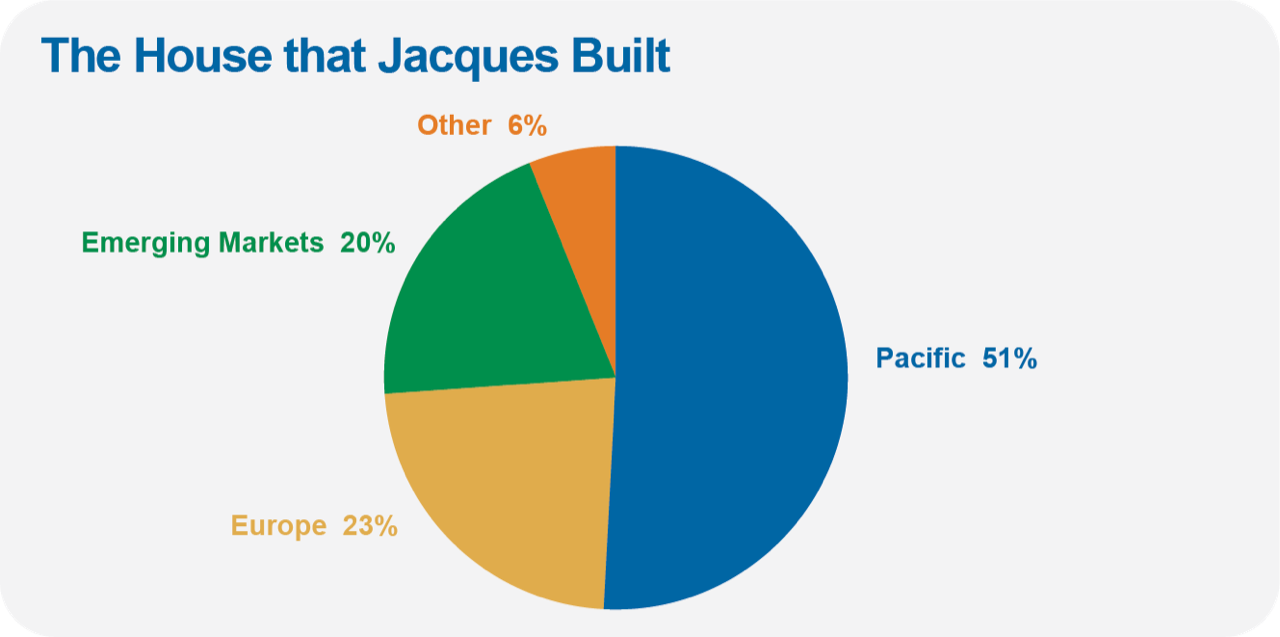

The fund holds over 650 real-estate-related companies from 40 countries. The chart below shows the portfolio’s regional breakdown.

Properties in Japan, the largest individual country allocation in the index, account for nearly a quarter of the portfolio—roughly equal to all of Europe. I can’t say I have a strong view on the Japanese property market. Do you?

Like the U.S. fund, the global fund provides exposure to properties of all types. The big difference? So-called Real Estate Operating Companies, Diversified Real Estate Activities, and Real Estate Development companies make up half of the foreign portfolio but only 1% of the U.S. portfolio, which is dominated by REITs.

Fewer REITs, More Companies

| Sector | Weight |

| Real Estate Operating Companies | 19% |

| Diversified Real Estate Activities | 18% |

| Real Estate Development | 14% |

| Industrial | 12% |

| Retail | 11% |

| Diversified | 11% |

| Office | 7% |

| Multi-Family Residential | 3% |

| Health Care | 2% |

| Hotel & Resort | 1% |

| Self-Storage | 1% |

| Other | 1% |

| Sector breakdown for Global ex-U.S. Real Estate Index as of 7/31/2023. Source: Vanguard and The IVA. | |

A brief bit of background:

REITs were first created in the U.S. in 1960—though the modern era for REITs started with the Tax Reform Act of 1986, which allowed REITs to operate and manage real estate. It’s taken other countries some time to adopt the structure. Canada did it in 1993, Japan in 2001, Hong Kong in 2005 and the U.K. in 2007, for example.

That’s why many property companies outside the U.S. (particularly in Japan and Hong Kong) are not structured as REITs. It simply wasn’t an option when the companies were incorporated.

Stock-Like Results Over Time

I said that real estate fund performance has about matched the stock market. Let me put some meat on those bones.

Real Estate Index has been a strong performer since its 1996 inception. Its 944% total return isn’t far behind 500 Index’s (VFIAX) 1,011% gain. That may sound like a lot, but it’s a difference of just 0.25% per year. Plus, the two were on level footing as recently as May 2023. I’m willing to call that a draw.