Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, September 27.

There are no changes recommended for any of our Portfolios.

If there wasn’t a shot clock, this Congress might never shoot.

After taking the debt ceiling debate down to the wire, lawmakers are working in the 11th hour to avoid a government shutdown. As I’ve told you before—here and here—the stock market has not cratered during past government shutdowns. When the government limited operations for over a month between December 2018 and January 2019, the S&P 500 index gained more than 10%.

I’m not saying a government shutdown is “good” for the stock market—my point is that it isn’t a great reason to sell your stocks.

Of course, repeat debt ceiling debates and government shutdowns have a cost—they chip away at investors' confidence in the U.S. government and its ability and willingness to repay its debts.

For example, S&P (in 2011) and Fitch (in 2023) downgraded U.S. Treasurys from AAA to AA when the debt ceiling was used as a political bargaining chip. Moody’s—the last of the big three bond raters to give the U.S. a AAA rating—is considering downgrading U.S. debt due to “less robust” fiscal policymaking.

We’re also seeing the impact in the markets. This month, the rise in bond yields (and fall in bond prices) can be pinned (at least in part) on eroding confidence in the U.S. government and concerns about our ever-growing debt load.

The rule of thumb in the bond market is that the less trustworthy the borrower, the more income (yield) investors demand when lending their money. Well, the yield on the 10-year Treasury has risen from 4.09% at the end of August to 4.56% as of Tuesday night.

While sometimes Treasury yields rise when investors are worried about inflation, that’s not the case today. The break-even inflation rate (the difference between 10-year Treasury yields and 10-year TIPS yields) is 2.33%. It was at 2.24% at the end of August—and the entire move up to 2.33% came in the first week of the month.

If inflation expectations haven’t budged for the past two weeks or so, something else has been pushing 10-year Treasury yields higher. As I said, I suspect it’s related to declining confidence in government.

No, I don’t think the U.S. dollar is about to lose its status as the reserve currency. Nor do I think yields will spike higher from here. We’re talking about the markets’ perception of the U.S. government shifting on the margin. But it does appear that traders and investors are getting worn down by Washington’s dysfunction.

Total Bond Market Index (VBTLX) has now slipped into the red on the year—down 0.7% as of Tuesday’s close. Frankly, I expected bonds to deliver better returns this year. I certainly didn’t predict bonds would decline for a third consecutive calendar year. (Of course, the books aren’t closed on 2023.)

As I’ve repeatedly said this year, I don’t think now is the time to throw the towel on bonds.

With the benefit of hindsight, we know that the time to go to cash was two years ago. But that’s in the past. As investors, we must decide whether to own bonds moving forward.

Short-Term Investment-Grade (VFSTX) and Intermediate-Term Investment-Grade (VFICX) yield 5.40% and 5.49%, respectively. Yields may continue to rise for another two years—or not. I have no particular edge in trading interest rate moves. What I do know is that earning around 5.5% on high-quality bonds is a better deal than bond investors have had in a long time.

Settled

After eight years of back-and-forth, Vanguard and whistleblower David Danon agreed to end their legal battle. Danon, a former Vanguard lawyer, sued the firm, saying he was fired in retaliation for claiming Vanguard had avoided paying $1 billion in federal income taxes and at least $20 million in New York taxes.

In June, the two parties began working with a mediator to resolve the dispute. A settlement has been reached with both parties agreeing to “dismiss the case with prejudice.” That means the case is permanently closed and can’t be retried.

We’ll probably never know the settlement terms because Vanguard is a private company. Though, if Vanguard were a public company, we’d eventually learn how Vanguard and Danon put the matter to bed.

This brings me back to my questions about ownership and transparency at Vanguard. The firm crows about being fund shareholder-owned but enjoys the opacity of being a private company.

Vanguard gets to have its cake and eat it, too.

Our Portfolios

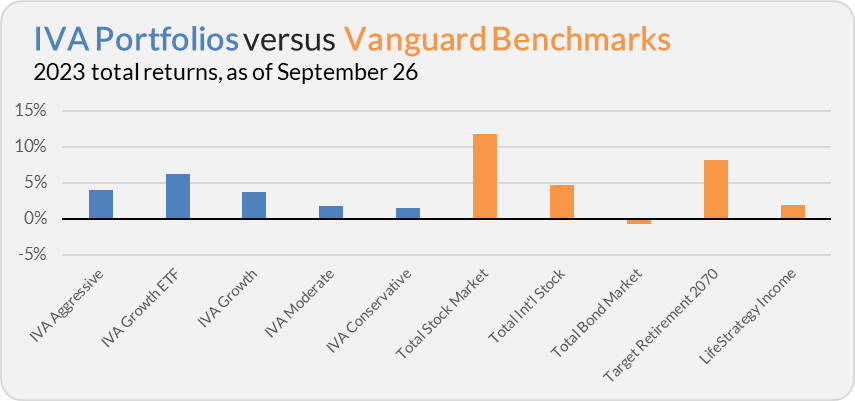

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 4.0%, the Growth ETF Portfolio is up 6.2%, the Growth Portfolio is up 3.7%, the Moderate Portfolio is up 1.8% and the Conservative Portfolio is up 1.6%.

This compares to an 11.8% gain for Total Stock Market Index (VTSAX), a 4.7% return for Total International Stock Index (VTIAX), and a 0.7% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 8.1% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 1.9%.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.