Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, April 26.

There are no changes recommended for any of our Portfolios.

At the headline level, stocks are having a decent year, with 500 Index (VFIAX) up 6.6% on the year (as of Tuesday night). That’s a decent a clip—if that pace holds for the next seven months, the index fund will have returned around 11% on the year. (I’d take that.)

However, that headline number masks a change within the stock market over the past six weeks or so—fewer stocks are driving the markets returns than before.

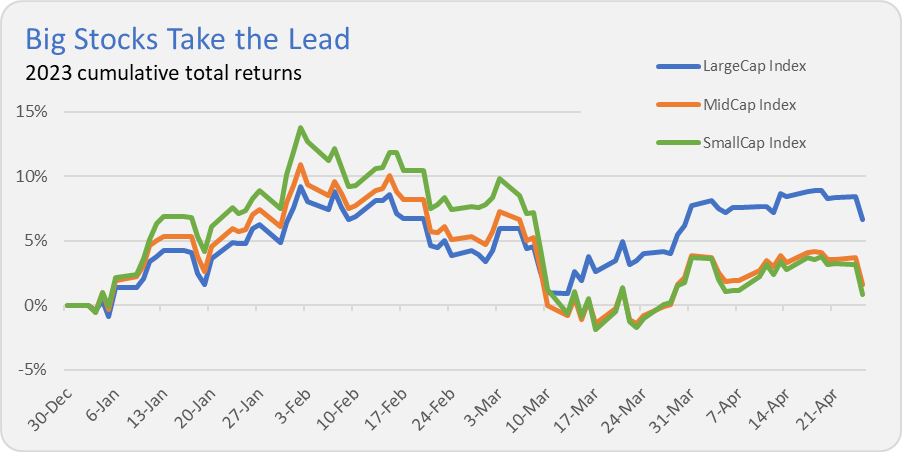

As you can see in the chart below, LargeCap Index (VLCAX), MidCap Index (VIMAX) and SmallCap Index (VSMAX) generally moved together for the first two months or so of the year. The index funds gained between 6% and 10% in January and then fell together in February and the first week of March.

Since then, it’s been a different story. From March 10 through April 25, LargeCap Index’s 5.6% gain has left MidCap Index (up 1.6%) and SmallCap Index (down 0.4%) in the dust.

What this tells us is that early in the year, a lot of stocks were generating gains—the inside-baseball terminology would be that the market had good “breadth.” Since then, breadth has narrowed as fewer and larger stocks have carried returns higher.

This doesn’t automatically mean that the market is due to fall—smaller stocks could play catch-up (and often have). The point is that market leadership is not constant. Smaller stocks led in January but have taken a back seat in March and April. Trying to predict the next handoff is a fool’s errand, which is just another reason that diversification works over time.

Safety

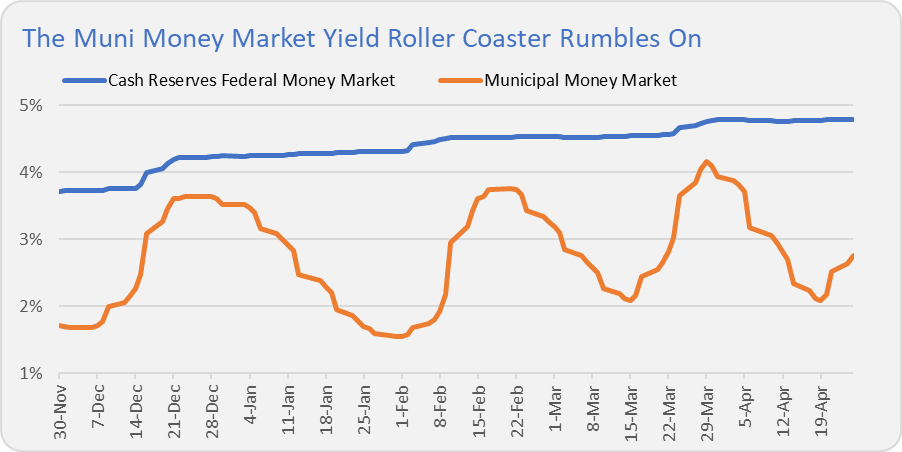

With March bank failures mostly behind us (First Republic is still making headlines) and the debt ceiling looming ahead, I’ve been getting a lot of questions on money markets and Vanguard’s new cash accounts—Cash Deposit andCash Plus Account. I’ll share my take on those next week with Premium Members, but I’ve been sharing regular updates on municipal money market yields in the Weekly Brief. And wow, that yield roller coaster ride is not over.

Over the course of ten trading days, while taxable yields remained fairly steady, Municipal Money Market’s (VMSXX) yield went full circle from 2.81% on April 12 down to 2.08% (April 19) and back to 2.76% (April 25). Those are some big moves.

Mark Twain is said to have opined that “If you don't like the weather in New England now, just wait a few minutes.” Well, the same could be true for municipal money market yields these past five months!

Arrests at Vanguard HQ

Last week, 16 people were arrested at Vanguard HQ while staging a protest against Vanguard’s investment in fossil fuel companies. The protest, part of Vanguard S.O.S.’s campaign to urge Vanguard to do more on climate change, blocked several driveways leading into the corporate campus.

As I’ve said before, Vanguard’s success and growth has put a target on its back. BlackRock (and its iShares arm) is also facing pressure from activists on the climate front—see here, for example. The question is, and remains, how should these large index providers, which own big, passive stakes in corporate America, respond when it comes to climate change?

Vanguard’s claim of using its position to push for better disclosure feels a little … well, weak. That said, I don’t think Vanguard should be dictating strategy to individual companies. Vanguard doesn’t specialize in turnarounds or business strategy. Vanguard has a large stake in companies because it offers low-cost index funds that have become the default choice for investors across the board. That’s a different skill set than being an activist investor.

Can we ask more of Vanguard? More engagement? More transparency? Of course. Should we expect Vanguard to solve climate change? Of course not.

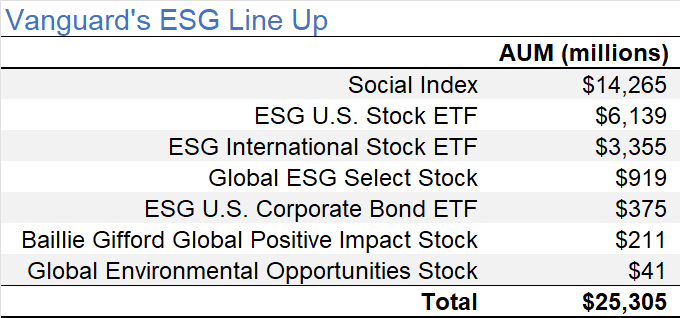

Remarkably, while the protesters are taking Vanguard to task for (in their eyes) not doing enough, they seem to have ignored the fact that Vanguard now offers seven different funds and ETFs to those who’d like to incorporate ESG into their portfolios. Assets in those options have grown to more than $25 billion, a 6-fold increase over the past five years.

That sure sounds good, but the flip side of the coin is that $25 billion is less than 1% of Vanguard’s $7 trillion asset base. So, could Vanguard offer more ESG funds? Yes. For example, Vanguard could launch a Target Retirement series using ESG funds. But it’s not like investors have been piling into the existing funds.

Our Portfolios

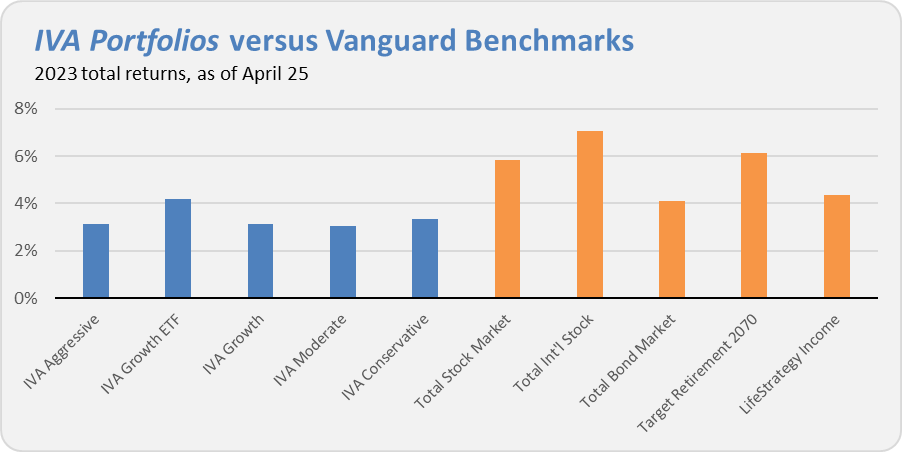

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.1%, the Growth ETF Portfolio is up 4.2%, the Growth and Moderate Portfolios are both up 3.1% and finally the Conservative Portfolio is up 3.35.

This compares to a 5.8% gain for Total Stock Market Index (VTSAX), a 7.1% return for Total International Stock Index (VTIAX), and a 4.1% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 6.1% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.3% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.