The answer was in front of us the whole time. Or, at least, that’s how Vanguard’s portfolio review group feels about International Explorer (VINEX).

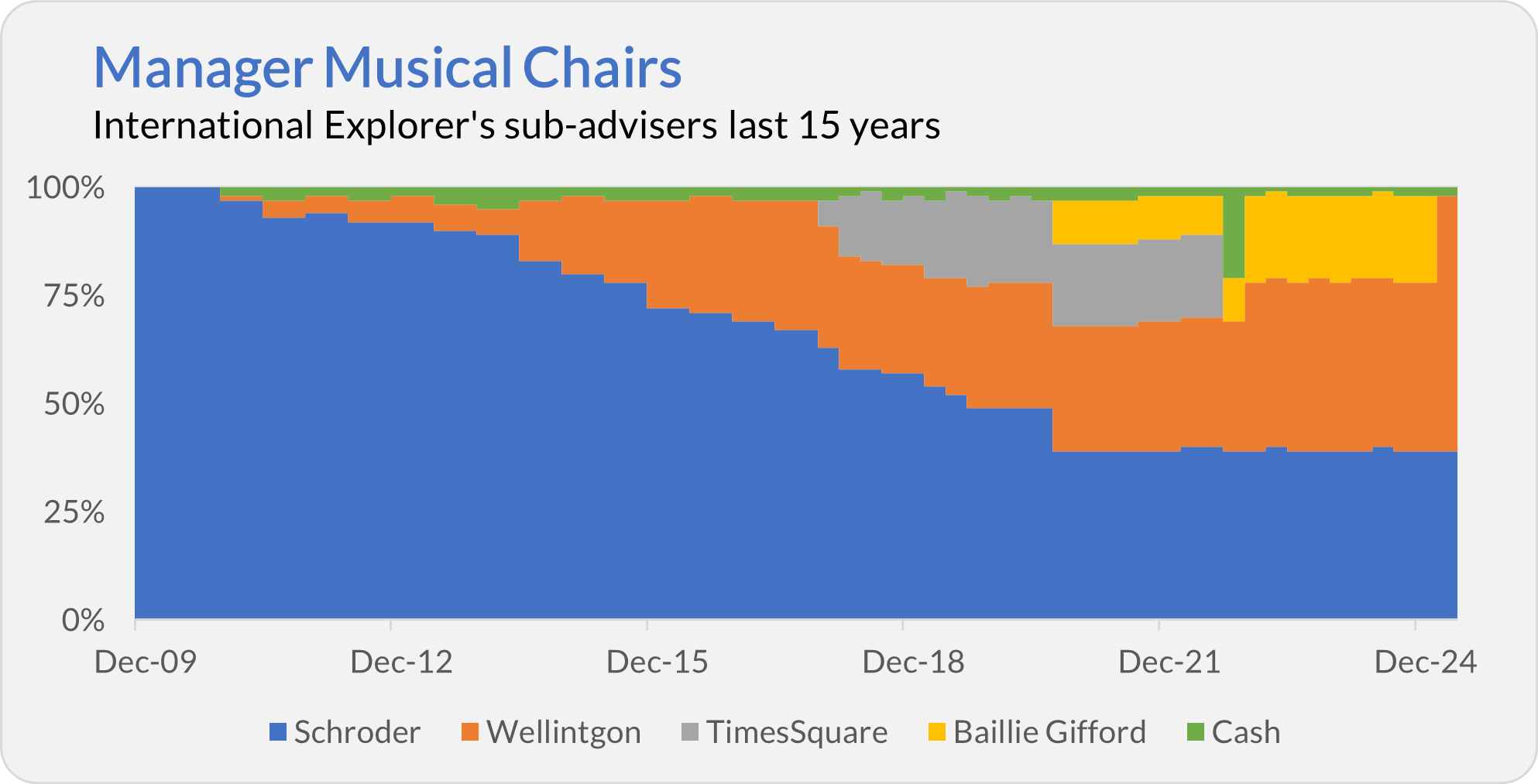

For the past decade or so, Vanguard has been searching for the right mix of managers for the actively managed foreign small stock fund. Today (March 17), Vanguard stopped the music, and Baillie Gifford is the odd manager out.

Vanguard is not replacing Ballie Gifford with another sub-adviser but is redirecting the fund’s assets to Wellington Management. With the change, Wellington will invest 60% of International Explorer’s assets while Schroder Investment Management (the fund’s original manager) will oversee 40% of the portfolio.

For a bit of history, Vanguard acquired this fund in June 2002 when it was tiny, unknown, and run by a single manager, Schroder. Cash flowed so quickly into International Explorer that Vanguard was forced to close it two years later. Outflows and declining markets allowed it to reopen the fund in October 2008.

A few years later, a reclosure of the fund looked likely, but in June 2010, Vanguard added a four-person team from Wellington. For the first several years, the group managed only a sliver of the portfolio, but their stake increased from well under 10% in 2014 to 28% of fund assets at the end of 2017.

In late 2017, as assets exceeded $3.5 billion—just above the fund’s prior asset high—Vanguard added a third sub-adviser, TimesSquare Capital Management, to the mix.

Three years later, Vanguard added Baillie Gifford as the fourth sub-adviser and handed the Edinburgh-based firm 10% of the portfolio at Schroder’s expense—the possible result of longtime manager Matthew Dobbs's retirement at the end of March 2021.

Though Vanguard is usually a patient partner, neither TimesSquare nor Ballie Gifford got much of a runout—both firms were only on the job for five years or so.