You've heard from me a lot this week, but with fresh Vanguard news and a turbulent day in the markets, I wanted to check in one more time. Let’s start with the news out of Malvern (Vanguard HQ):

A New ETF

Today, Vanguard launched its fourth actively managed taxable bond ETF: Short Duration Bond ETF (VSDB).

As I noted when the ETF was announced in January (here), this fund remains a “wait-and-see” for me. Since the managers can invest up to a quarter of the fund’s assets in junk bonds, I want to see how the portfolio shapes up before jumping in.

With plenty of tried-and-tested, competitively-priced, short-duration bond funds to choose from, there’s no reason to rush in here.

Tariffs in Context

Just about everyone was caught off guard by the size of the tariffs President Trump announced yesterday. I’m not going to run through all the details, but here are the key points:

Starting on April 5, the U.S. will impose a 10% baseline tariff on nearly all imports. Four days later, higher duties will hit select countries, including China, Japan, the E.U. and Vietnam. As of today, the 25% tariff on auto imports is in effect.

Traders are not taking this news lightly—the S&P 500 index is down 4% as I write. Several IVA readers have asked why the reaction is so much stronger than during President Trump’s first term. The short answer: These new tariffs are in a different league entirely.

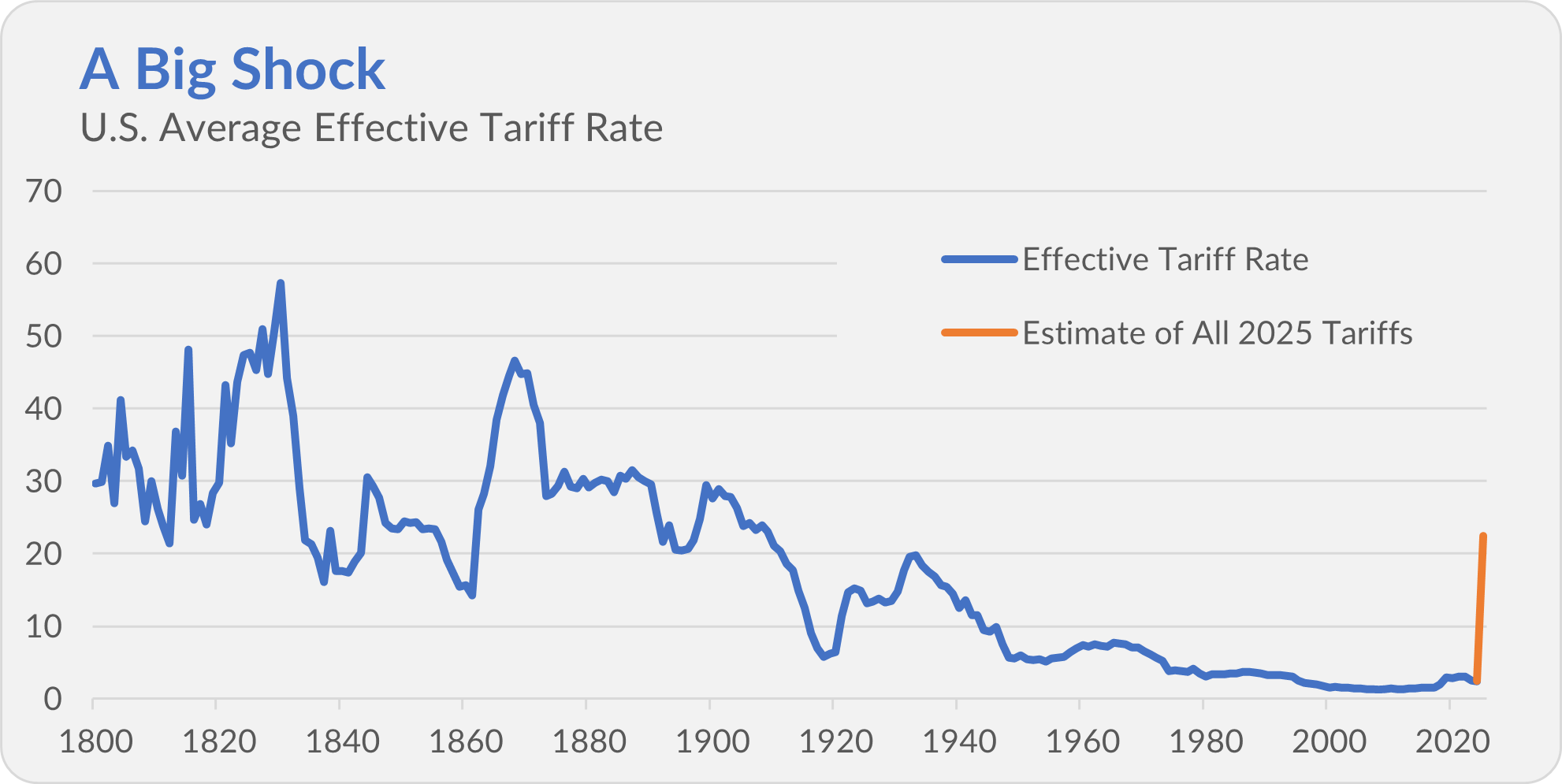

The chart below tracks the effective U.S. tariff rate since 1800. The 2018 increases barely make a blip. But The Budget Lab at Yale projects that this year’s tariff actions will send the rate soaring to 22.5%—up from just 2.4% in 2024, and the highest it’s been in more than 100 years!

No matter how you look at it, this is a major shock to the economic system, which explains the sharp market reaction.

The 3.5% Solution

As mentioned, it’s a rough day in the stock market—the S&P 500 index is currently down 4%, though we’ll see where it ends up.

Not to sound flippant, but sharp declines are part of investing. Over the past four decades, 500 Index has dropped 3.5% or more on 69 trading days. Today looks set to be number 70—unless we see a late-day rally.