You’ve heard a lot from me the past few days. Today, I shared a month-by-month review of 2024 (here) and a deeper dive into the markets last year (here). And just two days ago, you received my 2025 Outlook, Bull Run or Turning Point?. So, I'll keep this intro short.

At the end of November, I was preparing to write about how nearly every asset class (think stocks, bonds, commodities, etc.) did better in 2024 than in 2023. And then we ran into December.

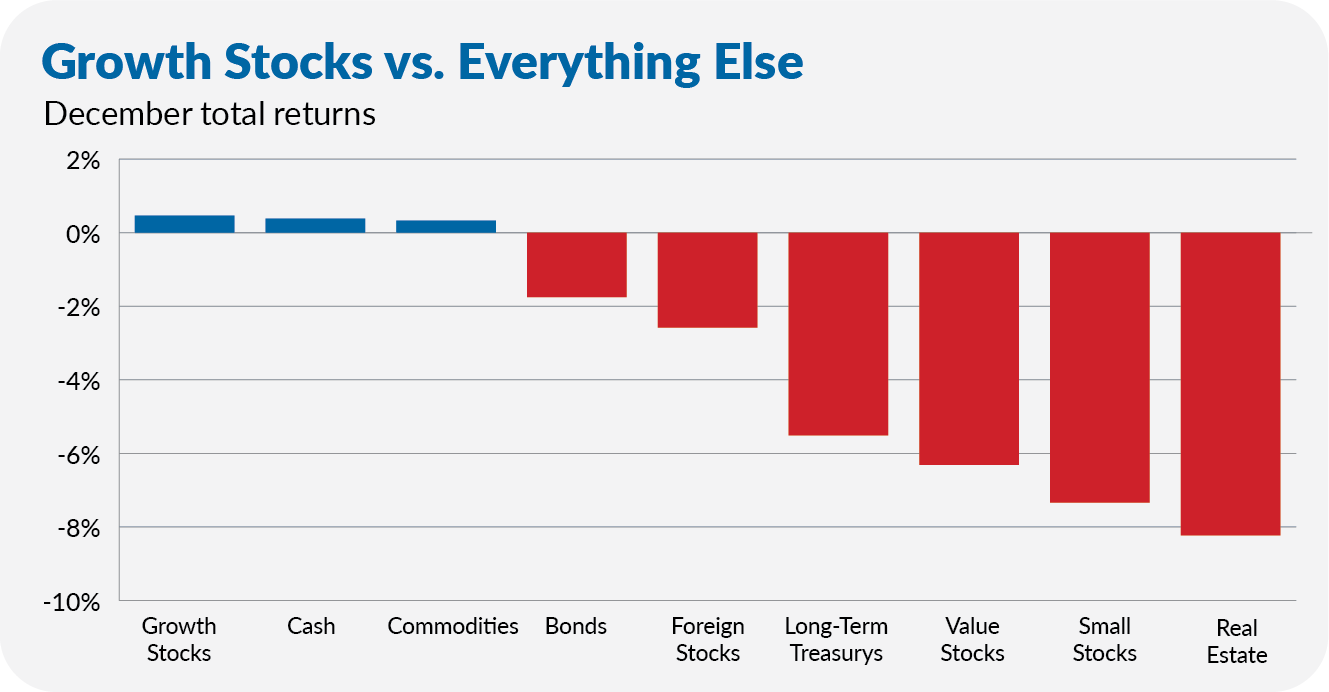

While Growth Index (VIGAX) ended the year on a high(ish) note—gaining 0.5% in December to end the year with a 32.7% return—nearly everything else stumbled in the final month of the year. Value stocks, smaller stocks, foreign stocks, bonds and real estate all were in the red last month. Only cash and commodities were positive.

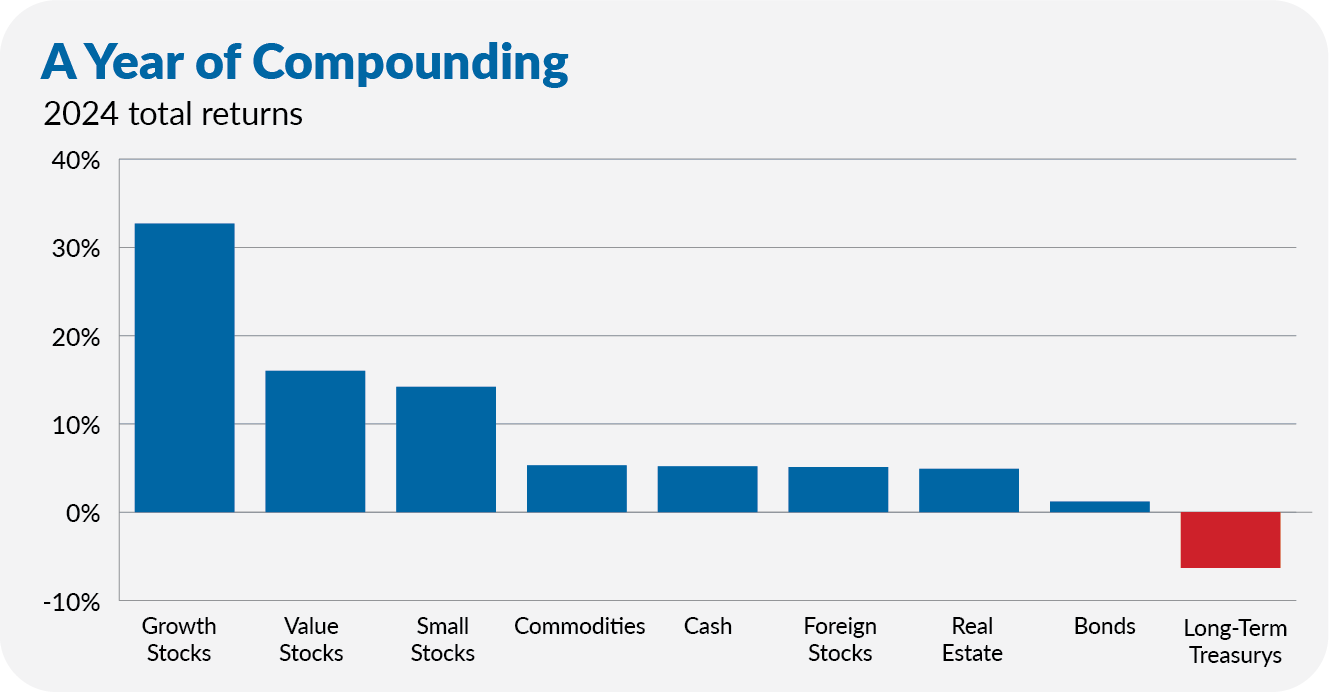

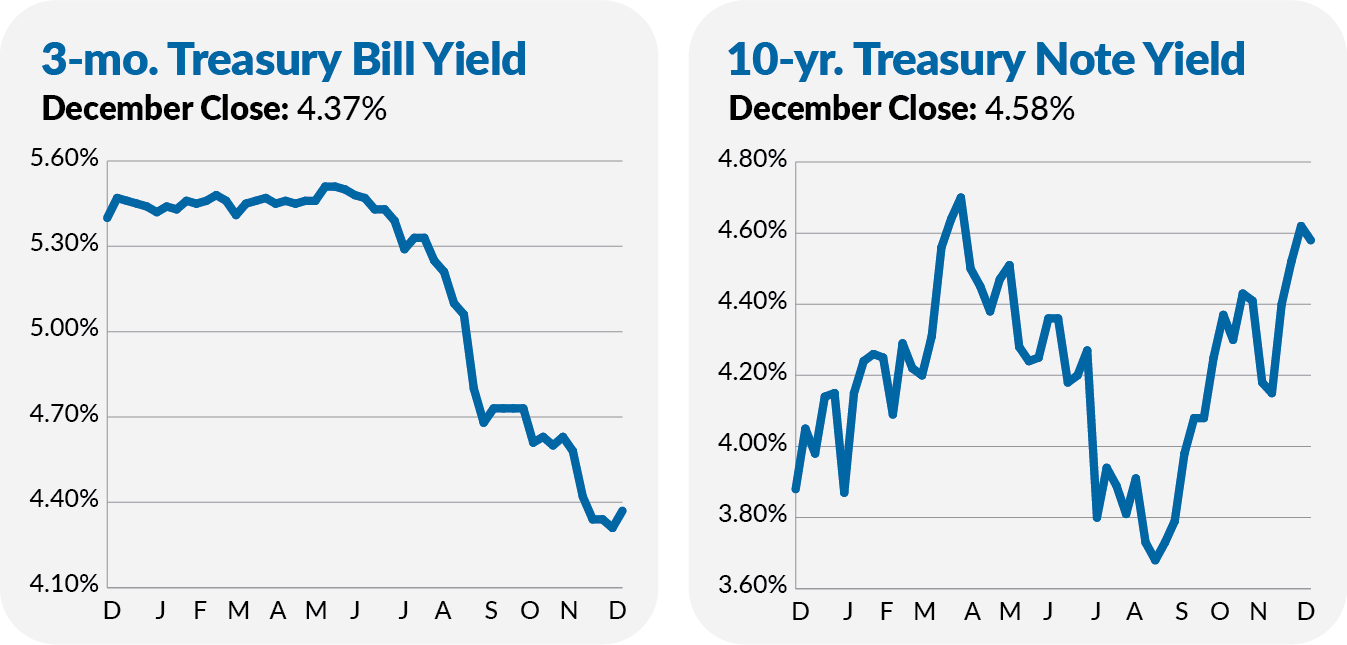

Of course, that’s just one month. Step back, and most Vanguard funds gained ground in 2024. The glaring exceptions were Vanguard’s long-maturity bond funds, which fell between 1.9% and 12.7% in 2024.

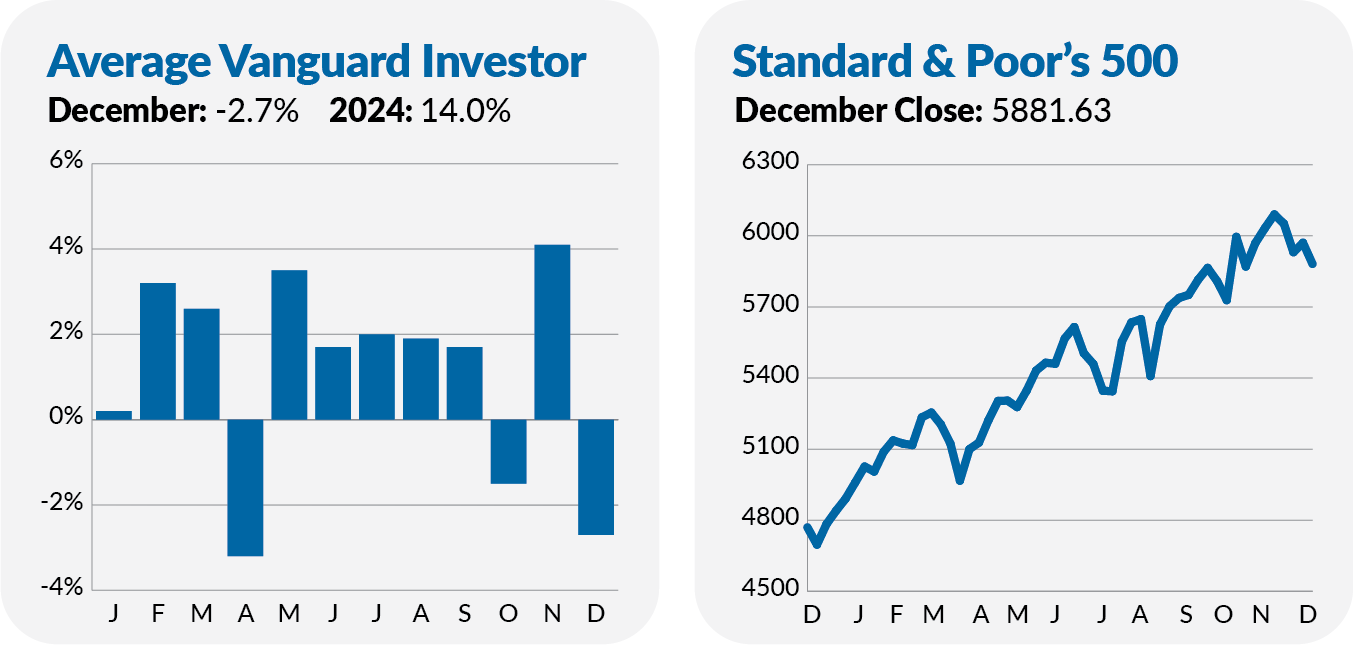

With gains across the board, the average Vanguard investor earned a solid 14.0% return in 2024. No, that doesn’t match 500 Index’s (VFIAX) 25.0% gain, but I suspect that it’s a big step in the right direction for most investors.

Loading up on the largest growth stocks was a winning strategy last year, and it will continue to work until it doesn’t. I urge you to stay the course with a diversified portfolio. You might not fly as high with a diversified portfolio, but you also won’t venture too close to the sun.

Roundup

Here is the latest news out of Malvern: