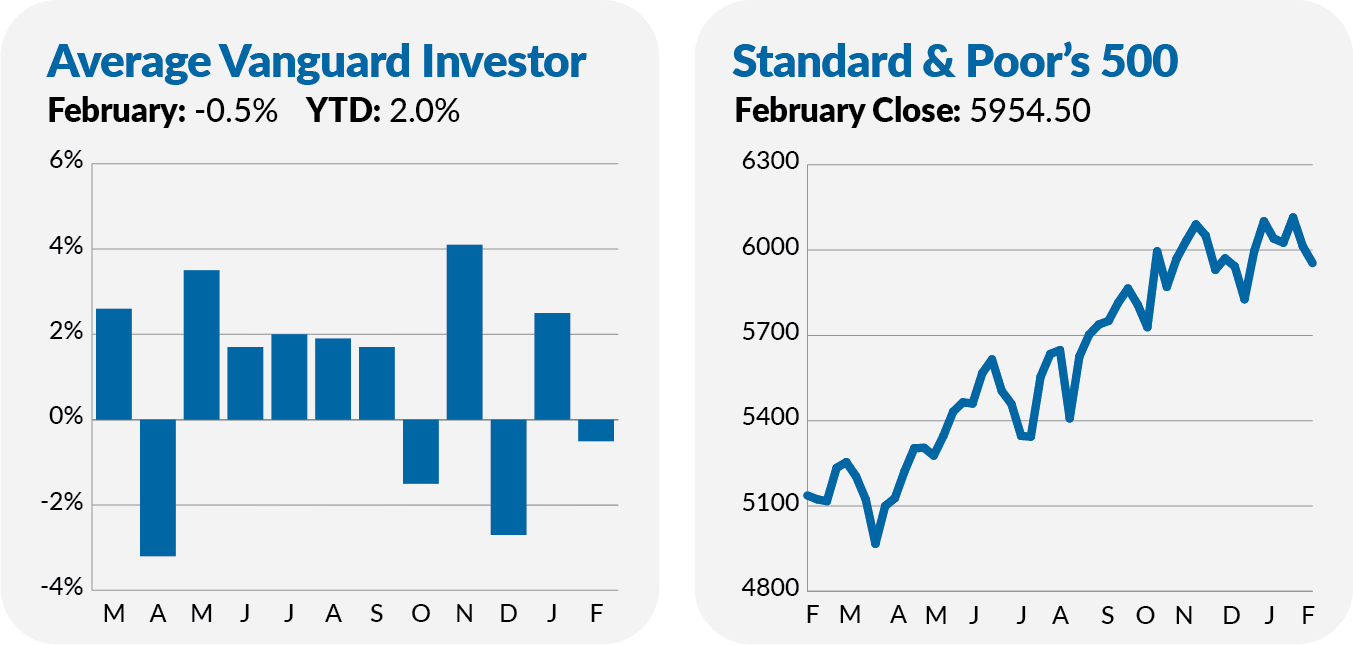

The Magnificent 7 has morphed into the Meh 7. Foreign stock markets are on a roll. And the S&P 500 is 3.1% off its mid-February high.

Was that the top?

Okay. That question is a little hyperbolic. The S&P set a record less than two weeks ago, and its 3% decline from its February 19 high doesn’t come close to meeting the definition of a “correction” (typically defined as a 10% decline from a peak).

So, let’s not get too worked up. Plus, the truth is, no one knows if February 19 was the top of the bull market that started running in October 2022, or not.

What I do know is that diversification has paid off during the first two months of 2025. While 500 Index (VFIAX) fell 1.3% last month, foreign stocks gained ground, with Total International Stock Index (VTIAX) returning 1.8%. European Index (VEUSX) gained 4.2% in February, putting it up 10.5% for the year.

Also, alternatives like Commodity Strategy (VCMDX) and Real Estate Index (VGSLX) were positive on the month, up 1.6% and 3.6%, respectively.

Not all “diversification” worked. Large U.S. stocks continued to outpace smaller stocks, with SmallCap Index (VSMAX) dropping 4.8% in February. I don’t see that as a diversification failing. Instead, it simply shows why you want to cast a wide net when diversifying your portfolio.

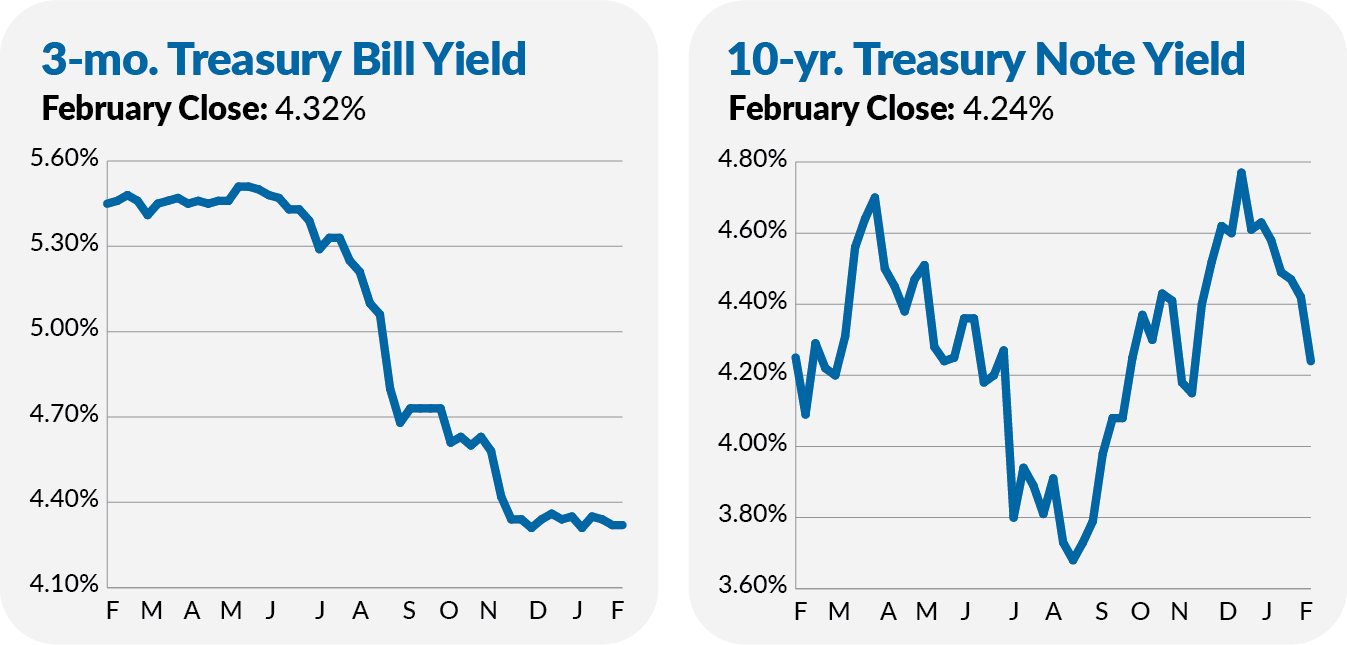

Bonds also delivered shock-absorbing returns for balanced investors in February. Total Bond Market Index (VBTLX) gained 2.1%. As expected, cash delivered a small but reliable return—Federal Money Market (VMFXX) gained 0.3%. The cash fund’s 4-plus percent yield is outpacing inflation. That’s a plus.

As I noted last week, uncertainty is high as President Trump forges a decidedly different path forward. Traders have (largely) taken it in stride. Still, in many ways, it feels like our country is at an inflection point.