The bull market is still running.

However, some vulnerabilities were apparent this past week as the artificial intelligence (AI) storyline took a hit. Two weeks ago, U.S. tech giants had an overwhelming lead in the AI race. But DeepSeek’s R1—an AI model out of China as good as anything in the U.S. but (reportedly) built at a fraction of the cost without using the most expensive and hard-to-find chips—proved that lead wasn’t as insurmountable as everyone thought.

Last Monday, January 27, was an ugly day in the market, particularly for technology stocks, as traders reacted to the DeepSeek news. AI darling NVIDIA saw its stock fall 17% on the day—erasing nearly $600 billion from the chip marker’s valuation and pulling Information Technology ETF (VGT) down 5.2%.

But that big one-day sell-off wasn’t the start of a cascading rout for all AI-related stocks. NVIDIA took it on the chin but is still worth over $3 trillion. And Meta (Facebook), which has an open-source AI model called Llama, gained 4.4% in the final week of January.

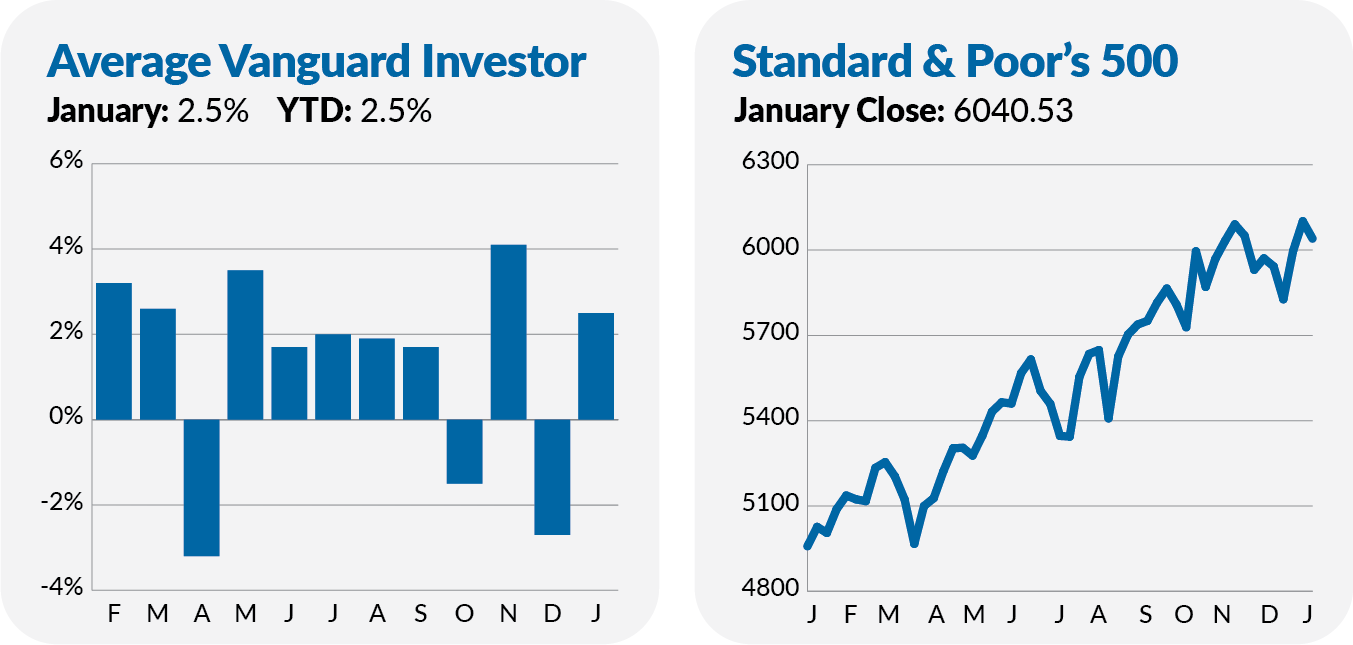

On top of that, the S&P 500 index is just 1.3% below its all-time high, and all but one of Vanguard’s stock funds gained ground in January. The lone exception was Technology ETF, which declined 0.8%.

As I said, the bull market took a hit but still managed to land on its feet. And as I explained in my 2025 Outlook, there are good reasons the bull market could continue running.

For example, the Bureau of Economic Analysis’s first estimate is that the economy (measured by gross domestic product, or GDP) grew 2.5% after inflation in 2024. In dollars and cents, the economy grew by $570 billion, to $23.5 trillion.

Or consider that, according to Factset, the blended earnings growth rate (which includes reported and estimated earnings) for companies in the S&P 500 index is 13.2%. As earnings drive stock prices over time, this is good news.

An expanding economy and rising earnings provide a tailwind for the market as a whole.

However, with tech stocks under fire, it was good to see diversification pay off in January!

While 500 Index (VFIAX) gained a solid 2.8% in the first month of the year, MidCap Index (VIMAX) and SmallCap Index (VSMAX) did better, gaining 4.4% and 3.9%, respectively. Foreign stocks also outperformed the flagship U.S. stock fund, with Total International Stock Index (VTIAX) returning 3.3%.

As I also explained in my Outlook, elevated expectations and valuations alongside top-heavy indexes mean the bull market has a tough road to run.