Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 4th.

There are no changes recommended for any of our Portfolios.

As I said in last week’s Weekly Brief, 2022 was a challenging year for nearly all investors—from the most aggressive speculator to the more risk adverse. Premium members can find my 2022 market review here and my month-by-month recap of the year here, so I won’t spend much more time covering last year’s ground. Instead, let me offer a statistic support for my more optimistic outlook for 2023.

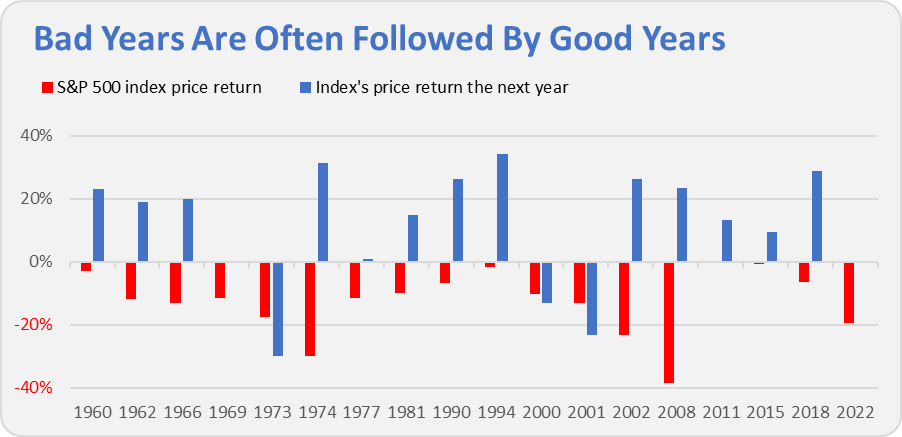

The S&P 500 index fell 19.4% last year—that’s not including dividends. It was the index’s 18th negative calendar year since its inception 65 years ago. The index’s first full calendar year was 1958, and since then it has posted gains in 7 out of ten years.

I went back and looked at how the S&P performed after each of its 17 prior negative calendar years. Not only did the index make gains in all but 3 of the following years but the average return during those years was 12% (or 19% if you look at the median return). And that’s not counting dividends.

In other words, it’s no guarantee, but the odds favor a good market year after a bad one.

With that said, let me jump straight to the 2022 performance of our Portfolios. (For the following commentary I linked up the results of our old publication through September with the returns of our new Portfolios.)

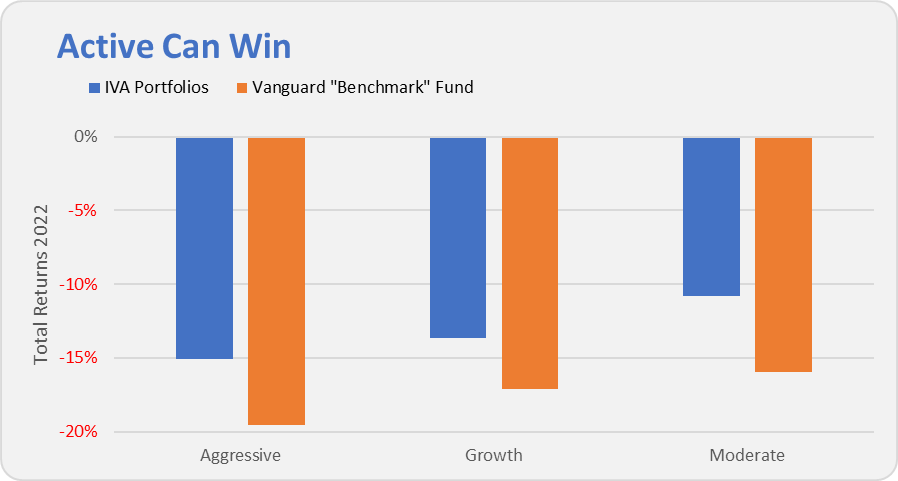

Our Portfolios finished 2022 in the red, but a good sight ahead of the market and their benchmarks. The Aggressive Portfolio declined 15.1%,the Growth ETF Portfolio fell 18.0%, the Growth Portfolio dropped 13.6% and finally the Moderate Portfolio declined 10.8%. This compares to a 19.5% decline for Total Stock Market Index (VTSAX), a 16.0% drop for Total International Stock Index (VTIAX), and a 13.2% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065(VLXVX), fell 17.4% last year and its most conservative, LifeStrategy Income (VASIX), dropped 13.9%. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) did relatively well, falling 9.1% in 2022.

To provide a little more context, in the chart below, I’ve matched our Portfolios against an appropriate Vanguard fund as a “benchmark.”

I simply compared the Aggressive Portfolio to Total Stock Market Index. The Growth Portfolio is matched up with LifeStrategy Growth (VASGX) while the Moderate Portfolio competes with LifeStrategy Moderate Growth (VSMGX).

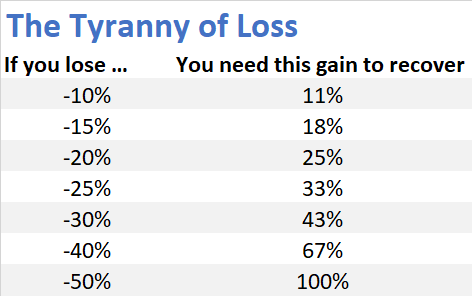

Our Portfolios were down last year—which is never fun. But the math is clear on this, as the table below shows. It is easier to recover from smaller declines. For example, our Aggressive Portfolio needs a return of 17.7% to recover from its 15.1% 2022 drop while Total Stock Market Index needs a 24.3% gain to rebound from its 19.5% loss.

So, I’m not thrilled to see my portfolio decline in value, but I’m pleased to report that our Portfolios outpaced the benchmarks by 3.5%-5.0% in a down year.

Turning to 2023. The first shall be last, and the last shall be first … if only for a day!

Vanguard’s best performing and worst performing funds of 2022, switched places on the first trading day of 2023. Energy ETF (VDE), Vanguard’s best performing fund in 2022, was its worst performing on Tuesday with a 4.0% decline. At the other end of the table, Extended Duration Treasury ETF (EDV) topped Vanguard’s table with a 2.4% gain yesterday.

Of course, I wouldn’t read anything into a single trading day.

Turning to Malvern … Vanguard snuck in a few manager (not sub-adviser) changes at the end of the year.

First, Kristin Ceglar replaced Philip Kearns and Thomas Stevens on D.E. Shaw's sleeve of Growth & Income (VQNPX). Seeing both managers abruptly replaced is worrisome. But then, I don’t rate Growth & Income highly. With three firms-all relying on computers to do the stock picking, stirring the pot and cooking up a portfolio with over 1,500 holdings, there isn’t much appeal here.

Second, Ronald Temple stepped away from Lazard's sleeve of Windsor II (VWNFX). I’m not concerned with this manager departure. Again, the multi-manager approach limits the impact of a single manager departure. But more importantly, Andrew Lacey, who has managed Lazard’s portion of the fund for 16 years, remains in place. I don’t expect any change to the portfolio or approach with Temple’s departure.

Temple’s departure doesn’t change my view of Windsor II: There are too many managers in this value fund’s kitchen. Relative to the broad market, Windsor II had a decent 2022, declining 13.2%. But it trailed Value Index (VVIAX) which fell only 3.4%. With four different sub-advisers contributing to Windsor II’s portfolio, it is no longer a pure value fund, and the most likely outcome is for middle-of-the-road performance.

Vanguard also hired a new role—a global head of investor research and policy. Fiona Greig joins Vanguard from JP Morgan and will be part of their firm’s in-house research team producing reports on investor behavior.

And, on another note, it’s unfortunate but Vanguard still hasn’t got its tech working. They haven’t started 2023 on the right foot. I heard that some subscribers weren’t able to access their accounts online on Tuesday.

Another subscriber shared a Vanguard system malfunction story with me. For years, he has been making online transfers from Federal Money Market to a linked bank account. On Tuesday, the online transfer didn’t work, and Vanguard sent the money by check. There was no way to cancel the paper check and the subscriber is now stuck waiting for his cash to arrive.

That’s not a great start for Vanguard’s customer service, but the year is young. Here’s to hoping they can turn it around.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.