Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 14.

There are no changes recommended for any of our Portfolios.

Last week, I described traders’ response to the weak unemployment report and the Japanese central bank raising interest rates as “a bit of an overreaction.” Since stocks have rebounded over the past six trading days, an overreaction was the correct description (at least in the short run).

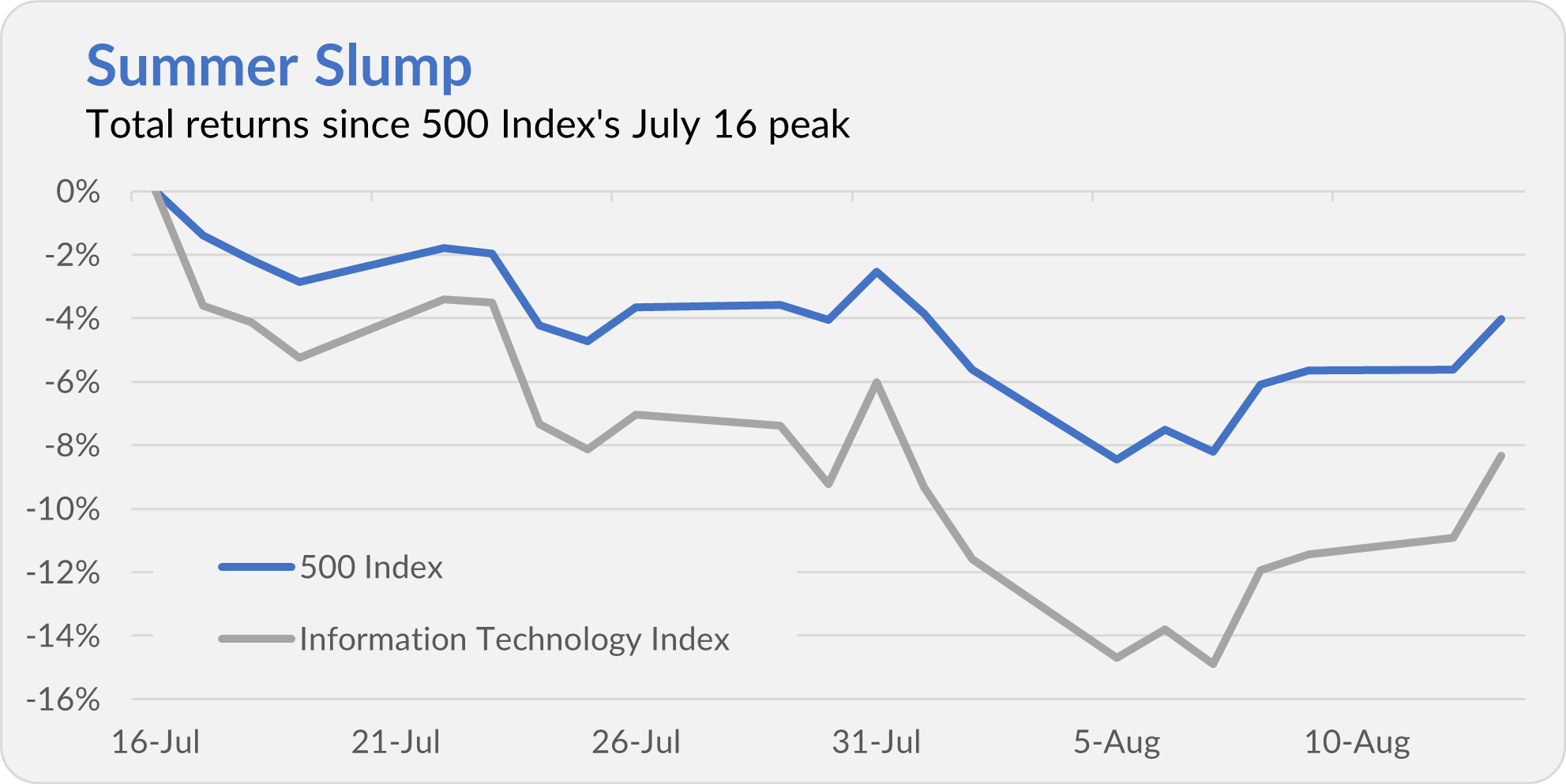

The chart below plots the returns of 500 Index (VFIAX) and Information Technology Index (VITAX) since the flagship index fund’s July 16 peak.

Both funds are still underwater but have been moving in the right direction. From Monday’s (August 5) close through Tuesday (August 13), 500 Index has gained 4.8%. Information Technology Index, which was down nearly 15% at its worst, has rebounded 7.4% over the last six trading days.

Where we go from here is anyone’s guess—and it would be just that, a guess. Stocks could be off to the races, or we could revisit and surpass last week’s low values. Famed Fidelity manager Peter Lynch once said, “If you’re not ready for the stock market to go down, you should not invest in stocks.” (A tip of my hat to a former colleague for reminding me of this timely quote.) I’m a big believer (and practitioner) in spending time in the market, but that doesn’t mean stocks only go up.

Last week, I told you to be wary of market narratives. But you don’t have to take my word for it; Jason Zweig of The Wall Street Journal also warned readers against latching on to seemingly plausible-sounding explanations. He also offers a few tricks to fight outlandish headlines. I couldn’t agree more with his conclusion:

You don’t have to try to make sense of markets that make no sense. And you certainly shouldn’t listen to anyone trying to make you panic.

On Air

I recently had the pleasure of joining etf.com’s Jeff Benjamin and DJ Shaw on the Advisor Upside podcast. We talked about all things Vanguard—from the new CEO to Vanguard’s new semi-annual reports to cryptocurrencies.

If you’re reading this email, I think you’ll enjoy the episode. You can find it on ETF.com here.

I’ve also provided a few links to other popular podcast sites with the hope that at least one will work for you:

Apple

Spotify

[Note: If the Spotify link does not appear in the email, you can find it by viewing this article on our website.]

YouTube

And if you prefer to read a transcript of the episode, I've attached one below. Please pardon any typos or errors in the transcript. Speech-to-text software is getting better but is still not perfect.

If you enjoy the episode, please spread the word!

Inflation Check In

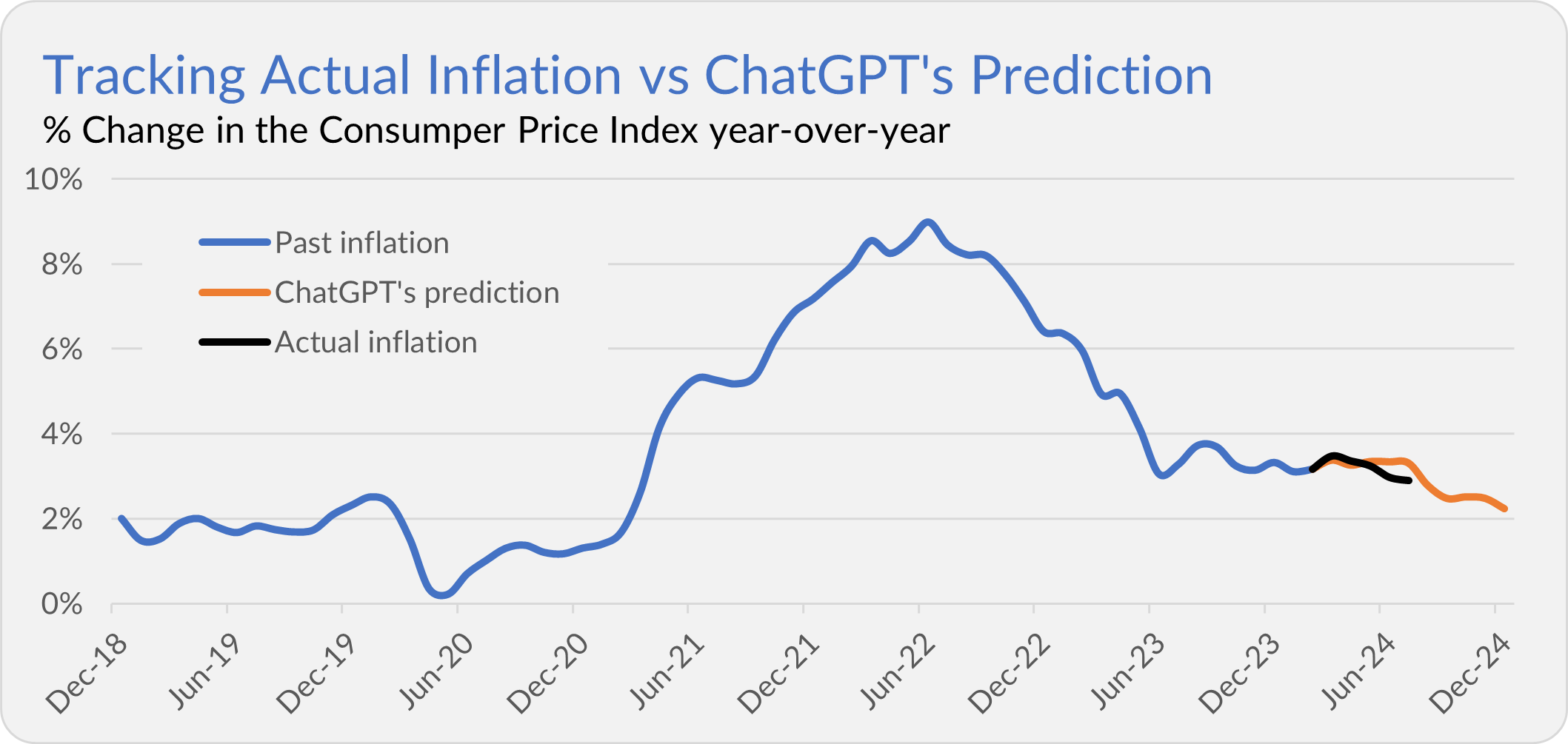

In April, I asked OpenAI's ChatGPT to predict inflation for the rest of the year. Today, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) was up 0.2% in July and is up 2.9% over the past 12 months.

That’s lower than ChatGPT’s expectation of 3.3%.

As I’ve said from the get-go, I’m not going to recommend trades based on ChatGPT’s inflation prediction—I’m having a little fun here.

The latest inflation report makes it more likely that the Federal Reserve (Fed) will cut the fed funds rate in September. I don’t expect Fed policymakers to take aggressive action next month. And if the fed funds rate is 0.25% lower (or higher) than it is today, it shouldn’t cause you to change your portfolio.

However, I’m already getting the question, “Should I make a trade if the Fed is going to cut rates?” And you can bet that the noise around the Fed will increase in September.

So, as I like to do in these situations, I will hit the history books and Excel spreadsheets to see how stocks, bonds and cash actually fared during past cycles. I’ll share my findings with Premium Members in the next few weeks.

Sayonara Oaktree

After nearly three decades, Vanguard and Oaktree Capital Management have parted ways.

Oaktree managed Convertible Securities from 1996 until the fund was swept into the dustbin in 2019. It has also managed a portion of Emerging Markets Select Stock (VMMSX) since the fund’s 2011 launch. That run ended on Monday when Vanguard handed Oaktree its final pink slip.

On Monday, I shared my Quick Take on Oaktree’s departure and its impact on the fund with Premium Members.

529 Changes

In March, I shared my analysis of Vanguard’s 529 Plan with Premium Members. I mention it because Vanguard just changed its 529 fund lineup.

Vanguard dropped three funds (called “Portfolios” in 529 lingo)—High-Yield Corporate (VWEHX), Inflation-Protected Securities (VIPSX) and STAR (VGSTX). At the same time, Vanguard added Core Bond (VCOBX), Short-Term Bond Index (VBIRX) and Social Index (VFTAX) to the mix.

Additionally, Vanguard changed the plan's static multi-fund portfolios, which are similar to LifeStrategy funds—they hold a consistent allocation of funds until Vanguard changes that mix. In fact, the changes bring the 529 Portfolios in line with the LifeStrategy funds with the same names (Growth, Moderate Growth, Conservative Growth and Income).

Vanguard's NEW Static Multi-Fund Portfolios

| 529 Aggressive Growth | 529 Growth | 529 Moderate Growth | 529 Conservative Growth | 529 Income | 529 Conservative Income | |

| Total Stock Market | 60 | 48 | 36 | 24 | 12 | — |

| Total Int'l Stock | 40 | 32 | 24 | 16 | 8 | — |

| Total Bond Market | — | 14 | 28 | 42 | 56 | 35 |

| Total Int'l Bond | — | 6 | 12 | 18 | 24 | 22 |

| Short-Term Infl-Prot. Sec. Index | — | — | — | — | — | 18 |

| Cash* | — | — | — | — | — | 25 |

| *529 Conservative Income owns a"short-term reserves" fund, which is similar to Interest Accumulation Portfolio. Source: Vanguard and The IVA | ||||||

Aligning the LifeStrategy and 529 Portfolios is a little more user-friendly for Vanguard investors. It also gives college savers an additional static portfolio to choose from. However, if you owned one of these funds before, you may need to confirm that the new allocation is how you want to be positioned. The table above showing the allocations of the 529 Portfolios can help.

It would be nice if Vanguard provided some rationale for its changes—but then I didn’t actually see an announcement; I only noticed the modifications when an IVA reader asked about STAR. To be fair, my son’s 529 plan is through New York, which is different from the Vanguard 529 Plan. I’m willing to bet Vanguard alerted participants in its plan of the changes. (Or at least, I hope they did.)

The changes are acceptable (to use a technical term) but aren’t one-for-one. High-Yield Corporate was a good fund to hold in a tax-deferred account. And inflation seems like a big concern for college savers, so why drop Inflation-Protected Securities?

While I rate Core Bond a Buy, it’s not all that different from Total Bond Market Index. If you’re dropping the junk bond and inflation bond funds, why not add something that complements the total bond fund, like Multi-Sector Income (VMSIX)?

That said, I like the addition of Short-Term Bond Index. While that’s not my preferred short-term bond fund—I would’ve chosen Short-Term Investment-Grade (VFSTX) or Ultra-Short-Term Bond (VUBFX) if it were up to me—the fund fills a hole in the lineup, providing a solution for when your beneficiary nears college.

Swapping Social Index for STAR is a little weird. Social Index is an all-stock portfolio for investors who want to screen out specific industries (like oil and gas or firearms), and STAR is a collection of actively managed stock and bond funds. A more like-for-like swap for STAR would’ve been Wellington (VWELX).

Our Portfolios

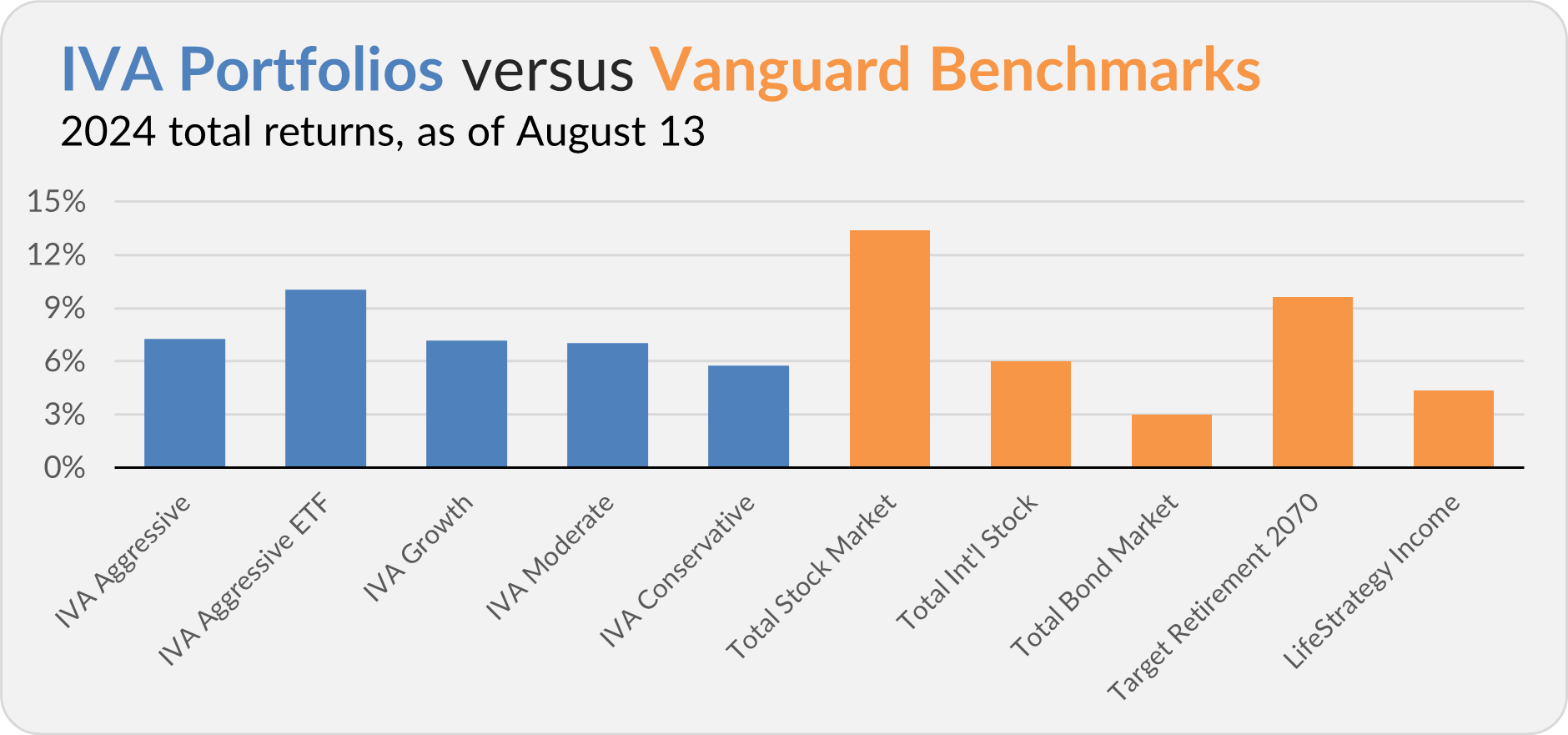

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 7.3%, the Aggressive ETF Portfolio is up 10.0%, the Growth Portfolio is up 7.2%, the Moderate Portfolio is up 7.0% and the Conservative Portfolio is up 5.8%.

This compares to a 13.4% gain for Total Stock Market Index (VTSAX), a 6.0% return for Total International Stock Index (VTIAX), and a 3.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.3%.

IVA Research

Yesterday, in Overlooked Growth Potential, I shared my analysis of Vanguard’s family of mid-cap growth funds with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.