Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 28.

There are no changes recommended for any of our Portfolios.

An Expensive Expectations Game

NVIDIA, the second-largest company in the world (by market size) and poster child for the artificial intelligence boom, will report earnings after the market closes today. I am not a stock picker, so I am at risk of getting over my skis here, but I’m reminded of a Scott McNealy quote from a 2002 BusinessWeek interview.

McNealy was the CEO of Sun Microsystems, a high-flyer during the late 1990s tech bubble. When asked if tech stocks were “too good to be true” at the peak of the market, well, here’s what he said:

… [T]wo years ago we were selling at 10 times revenues when we were at $64. At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking? [Emphasis added]

A quick word on jargon: When McNealy says, "We were selling at 10 times revenue,” he refers to the stock’s price-to-sales ratio. Sun Microsystem’s stock was at $64 per share, but the company had only produced sales of (around) $6.4 per share over the prior 12 months. That translates into a price-to-sales (or revenue) ratio of 10. In industry speak the stock is trading at “10 times revenues.”

McNealy is simplifying here, but his point is that buying a company for 10 times its revenues (or sales) is a (very) steep hurdle. Well, NVIDIA currently trades at 40 times revenues!

If you’re paying that price for NVIDIA today, you expect the company’s sales to grow a LOT in the years ahead. Of course, not everyone buying NVIDIA today is making a long-term investment—many are traders chasing momentum or hoping to make a quick buck.

Fine. But does this make NVIDIA’s stock a good or bad buy? I don’t know. Frankly, I could’ve written this back in July 2023 when NVIDIA traded at 45 times sales. The chipmaker’s stock is up 180% or so since then, proving the point that expensive stocks can stay expensive (until they aren’t).

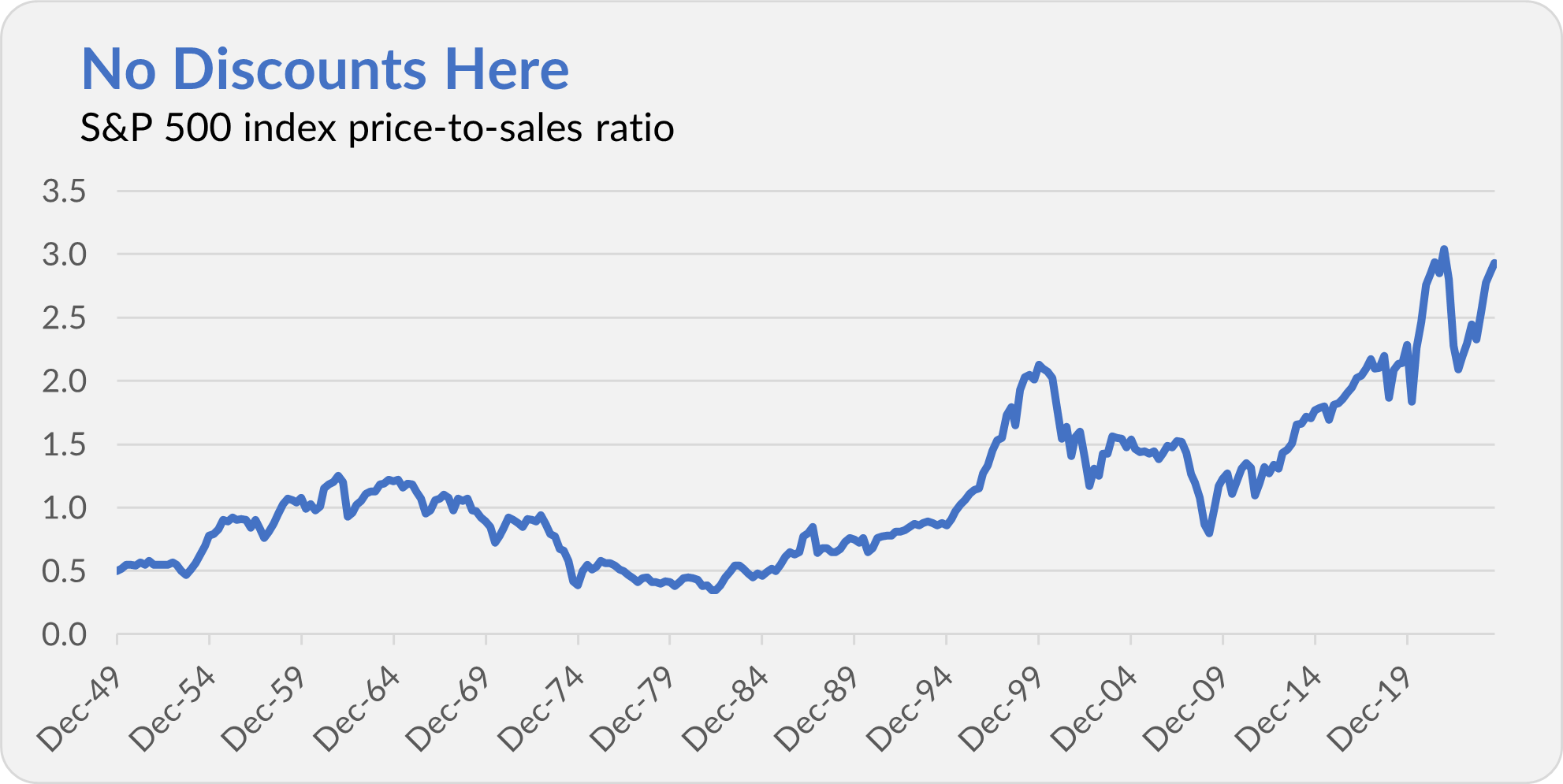

Zooming out from NVIDIA, the chart below shows the price-to-sales ratio of the S&P 500 index over the past 75 years or so. Based on this metric (which is just one of many ways to value equities), stocks are about as expensive as ever—even more so than during the tech bubble.

What’s an investor to do?

Well, as I said, I don’t know when it comes to NVIDIA—I’m not a stock picker. But remember that even great companies are poor investments if purchased at the wrong price.

Importantly, this doesn’t mean I am going to sell my stock funds and sit in cash. I still want to spend time in the market. As I said, stocks can stay expensive. The S&P 500 index has traded at two times revenue (tech bubble levels) or more for roughly eight years now. Had you ditched stocks at the end of 2016, you missed out on some significant gains—500 Index (VFIAX) is up 187% (or nearly 15% per year) since then.

That said, with stocks at record prices, now may be an opportune time to check in on your portfolio. Is your mix between stocks and bonds still aligned with your comfort zone? Are you still properly diversified with exposure to parts of the market (like smaller or foreign stocks) that aren’t as expensive?

If your answer to those questions is “no,” you may need to take action—as I did with the Model Portfolios a month ago.

Private Equity

A few weeks ago, I told you that Vanguard’s new CEO, Salim Ramji, discussed expanding the firm’s presence in private markets.

Vanguard has already dipped its toe into those waters with a series of private equity funds launched in collaboration with HarbourVest. And judging by the emails Vanguard is sending, they’re still trying to drum up assets for new vintages of these private equity portfolios.

A few observations.

First, I’m still puzzled by Vanguard's claim that this is “designed specifically for our most ambitious investors.” I don’t know what it means to be an “ambitious investor” or how to measure one's ambition level. I generally think I’m pretty ambitious … but am I one of Vanguard’s “most ambitious” investors?

Okay, maybe I just need to accept this for what it is: a marketing campaign.

More importantly, we now know the size of Vanguard’s private equity program—over $1.8 billion in “client commitments.”

That doesn’t mean all the money has been invested. When you sign up for a private equity fund, you agree to invest a certain amount (you make a “commitment”); however, you typically don’t give all the money to the private equity firm at once. They issue “calls” for your money over time as investment opportunities present themselves. You may or may not have to invest all the money you agreed to.

That sum, $1.8 billion, sounds like a lot on its own. But it’s only 0.02% of the $9.8 trillion invested in Vanguard’s U.S. mutual funds and exchange-traded funds (ETFs).

Also, those commitments are spread across five funds (if I’ve counted correctly), meaning we’re talking about $350 million (or so) for each fund. This is tiny by private equity standards. Some big players (Blackstone, KKR, Apollo, etc.) can raise $5 billion or more in a single fund.

So, to repeat what I said the other week, private equity hasn’t caught on with the average Vanguard investor. To be fair, to invest here, you must be a qualified purchaser or accredited investor (meaning you meet certain asset requirements), so the “average Vanguard investor” isn’t eligible. Still, investors aren’t banging down the doors to get into Vanguard’s private equity funds.

A third point, and I’ve mentioned this before, is that Vanguard charges an annual fee of 0.10% to 0.30%, depending on how much money you commit to the private equity fund. If you commit $1 million, you’ll pay Vanguard $3,000 per year, even if you don’t end up investing the full million.

That may not be much in the private equity world—but that’s just Vanguard’s cut. It doesn’t include HarbourVest’s fee or the fees charged by the underlying private equity funds that HarbourVest allocates your money to. Fees on top of fees can start to add up quick. To say this is not your “Jack Bogle” type of investment would be a vast understatement.

With $1.8 billion in its private equity program, Vanguard is earning between $1.8 million and $5.4 million per year. So, right there are several million “reasons” why Vanguard may want to expand into private markets.

Finally, I’m always struck by the length of the disclaimers accompanying these marketing emails. Are you familiar with the terms market risk, asset liquidity risk, funding liquidity risk, valuation risk and selection risk?

If not, you should probably give private equity a pass—and don’t lose a wink of sleep over it.

Our Portfolios

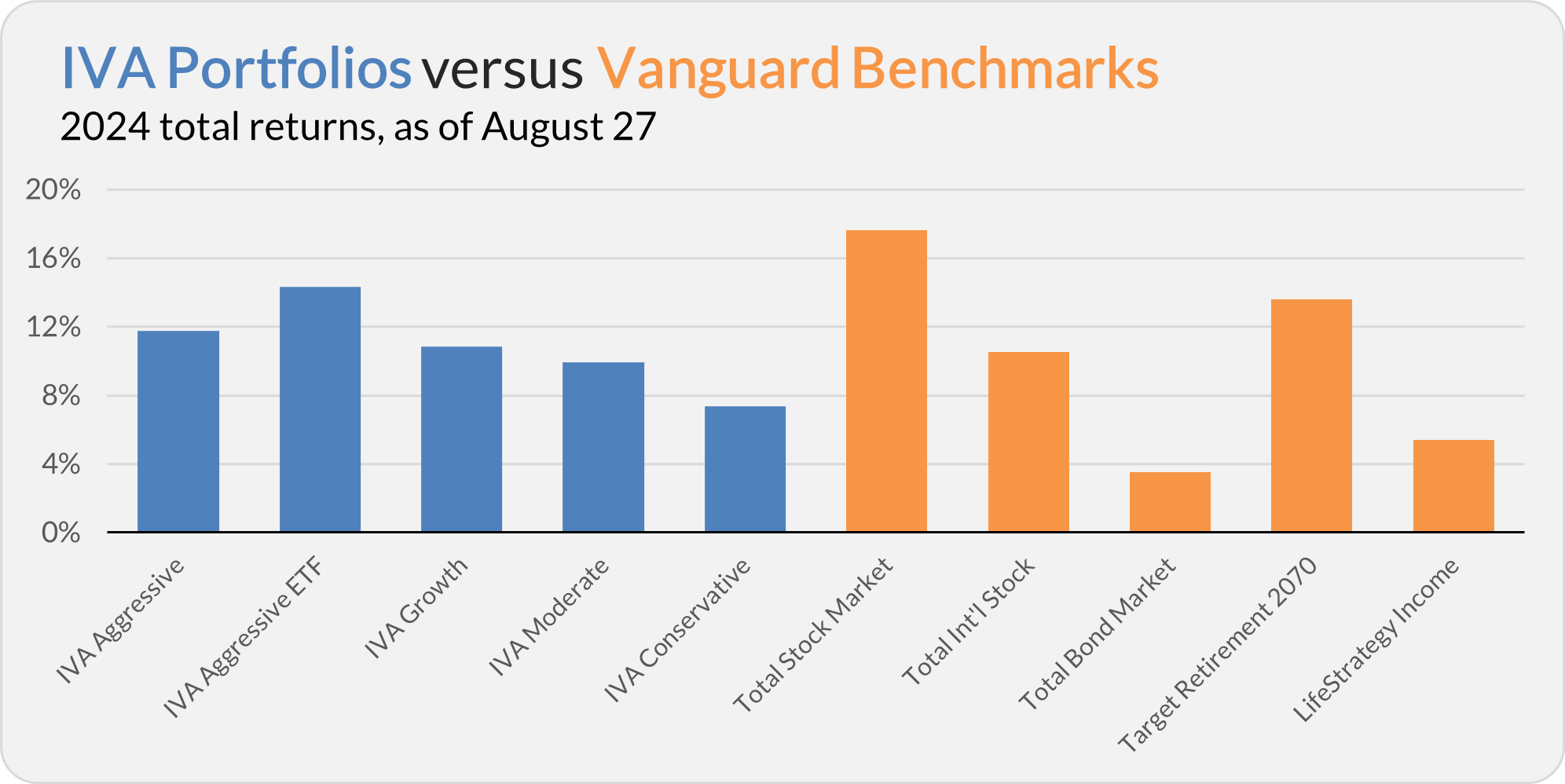

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 11.8%, the Aggressive ETF Portfolio is up 14.3%, the Growth Portfolio is up 10.9%, the Moderate Portfolio is up 9.9% and the Conservative Portfolio is up 7.4%.

This compares to a 17.6% gain for Total Stock Market Index (VTSAX), a 10.6% return for Total International Stock Index (VTIAX), and a 3.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 13.6% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 5.4%.

IVA Research

It’s a foregone conclusion that Federal Reserve policymakers will lower the fed funds rate in September. With Wall Street lore telling us, “Don’t fight the Fed,” what’s an investor to do?

Yesterday, Premium Members received part one of a two-part series aimed at answering that question. I started by approaching the issue from the standpoint of a bond investor. Next week, I’ll bring stocks into the equation.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.