With New York’s weather transitioning into spring, the temperatures are swinging daily, and I don’t know if I’ll need a sweater or a T-shirt on any given morning. Traders have been just as fickle.

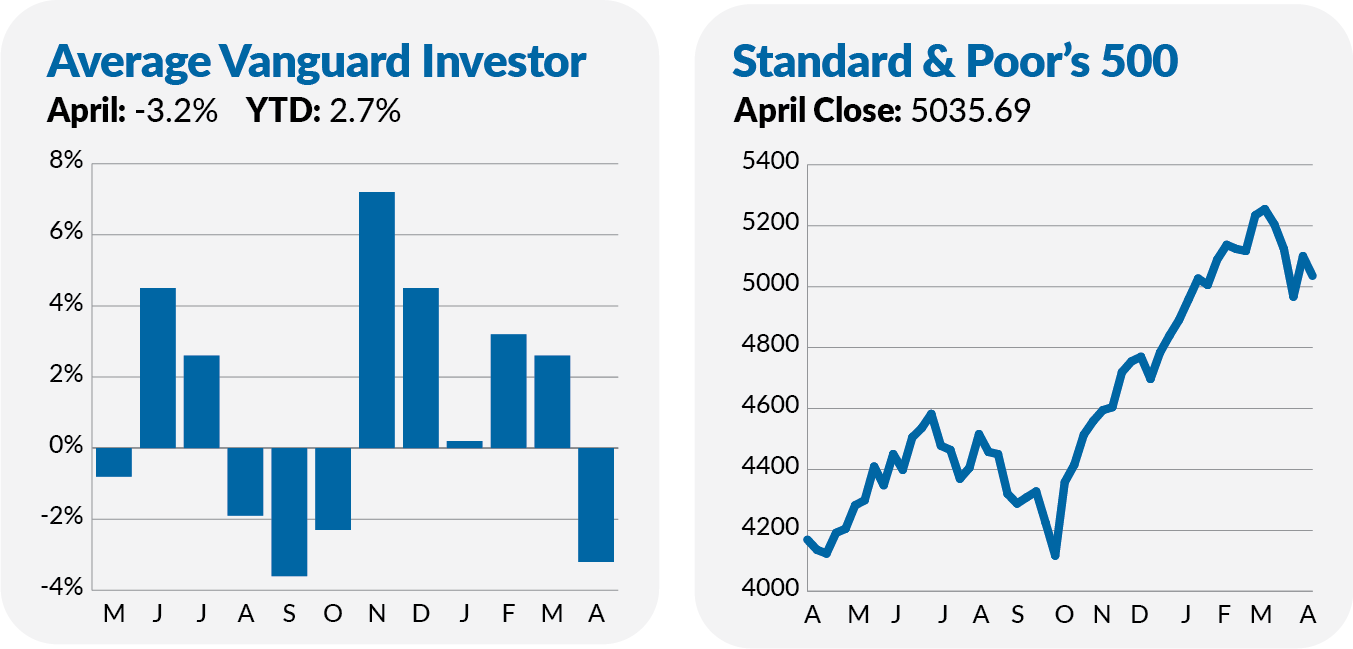

A month ago, I reminded you that stocks make new highs during bull markets. As if on cue, the S&P 500 index peaked on March 28, fell 5% below that peak on April 19 and finished the month down 4.2%. (Thankfully, I’m not a short-term trader!)

April was challenging for Vanguard investors. The stock market dropped, with 500 Index (VFIAX) slipping 4.1% and SmallCap Index (VSMAX) falling 6.5%. Foreign stocks held up relatively better but still took losses—Total International Stock Index (VTIAX) fell 2.3%.

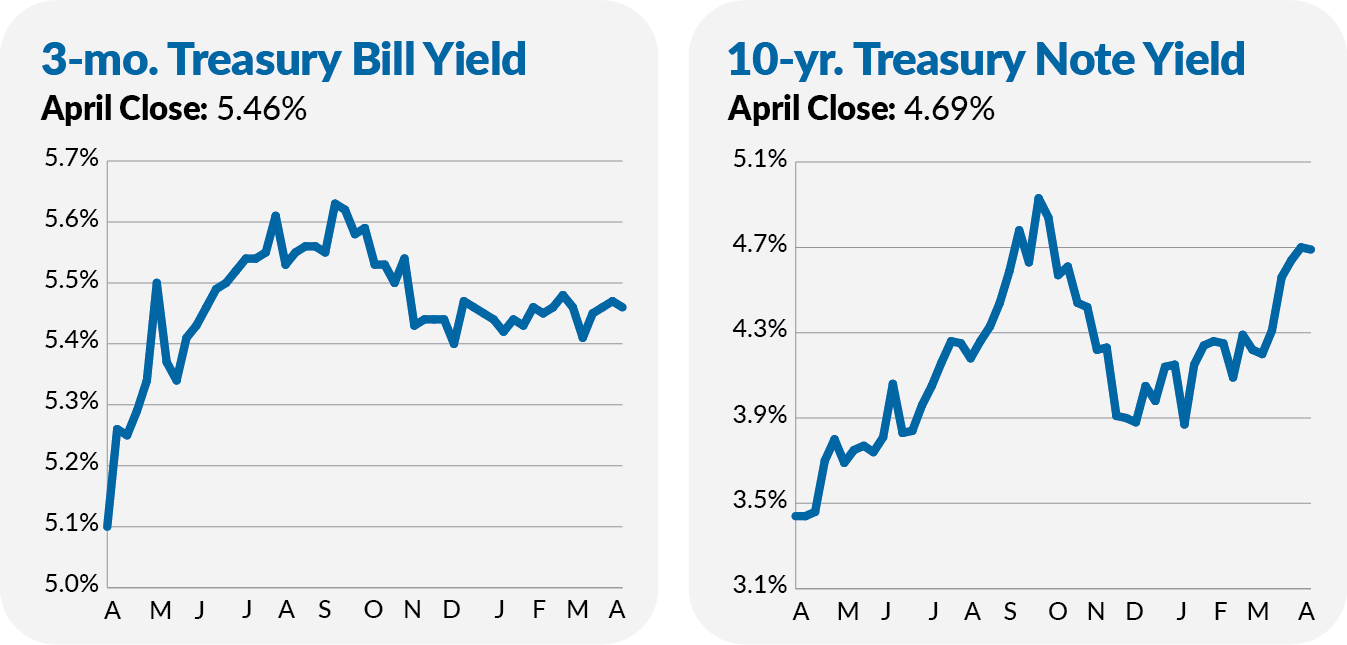

Bonds didn’t offer any refuge for investors with diversified portfolios. As the yield on the 10-year Treasury rose from 4.20% to 4.69%, bonds dropped in price. Total Bond Market Index (VTBLX) slid 2.4%. In fact, Vanguard’s worst-performing fund in April was a bond fund—Extended Duration Treasury ETF (EDV) fell 9.1%.

Only a handful of Vanguard funds gained ground during the month. Commodity Strategy (VCMDX) led the way with a 2.5% gain. Geopolitical tensions and inflation worries led traders to buy commodities, particularly natural gas and metals (like copper and gold). I’m not a fan of owning commodities in the long run—a topic I’ll discuss in more depth in the month ahead.

Utilities, energy and emerging market stocks also advanced in April. But these funds are not broadly owned, and for good reason: They are small sectors in a large market. Given the major stock and bond markets' downturn, it’s no surprise that the average Vanguard investor’s portfolio declined 3.2% in April.

That 70s Show

The economy is growing, but inflation has investors on edge.

The Bureau of Labor Statistics report indicates that U.S. Gross Domestic Product (GDP) reached $22.8 trillion after adjusting for inflation. That means the economy grew 0.4% in the first quarter and is 3.0% bigger than a year ago.

That contrasts with the 1.6% number you see in the headlines for the first quarter. 1.6% is an annualized number—it assumes the economy continues to grow at the 0.4% pace for the rest of the year. Again, all these numbers are after taking inflation into account.

Investors usually cheer economic growth—if the economy is growing, then companies’ earnings should also be growing.