Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 29.

There are no changes recommended for any of our Portfolios.

As I reflect on the first quarter, I’m reminded that the risks that trip up the markets tend to be the ones investors (and traders) aren’t paying attention to.

At the start of the year the “big question” on everyone’s mind was if the Federal Reserve (Fed) would raise interest rates too high and tip the economy into a recession. Nobody was worried about bank runs and failures. And yet, we’ve seen two of the biggest bank failures on record this month, plus the takeover of Credit Suisse, and investors are now asking if their cash is safe.

That said, even bank failures and concerns about contagion haven’t exactly thrown the markets for a loop. As of Tuesday’s close, 500 Index (VFIAX) was up 0.2% in March. Foreign stocks and bonds are also showing positive returns this month. Of course, dig a little deeper and you can find pockets of weakness. For example, Financials ETF (VFH) is off 12.3% and SmallCap Value Index (VSIAX) is down 8.3% in March.

Step back slightly, and on the year, there are gains to be found across the board. Every single one of Vanguard’s foreign and global stock funds are positive so far this year. Same with all of Vanguard’s bond funds. U.S. stocks are broadly up, though some sectors are down.

What’s consistently in the red this year are Vanguard’s “alternative” funds. Market Neutral (VMNFX) is off 1.4%, Real Estate Index (VGSLX) is down 3.8%, and Commodity Strategies (VCMDX) has declined 4.5%. Alternative Strategies (VASFX) is also underwater, but this fund is being liquidated in April, and judging by its recent performance, it holds mostly cash at this point.

Poor Marks

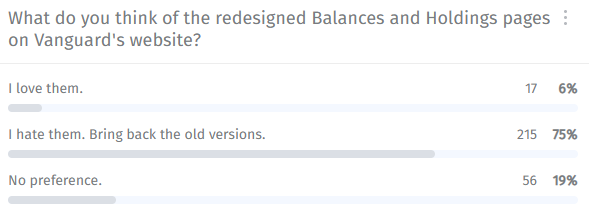

Last week, I asked what you thought of Vanguard’s recently redesigned webpages. The results from the poll are below, and, clearly, the new look is not popular. Three out of four of you want the old versions back!

I’m skeptical that Vanguard will revert to the old design, but maybe these results will spur some improvements to the new pages.

A New Factor

It took several months, but we now know who replaced Antonio Picca as the head of Vanguard’s factor strategies. Today, Vanguard named Scott Rodemer as the co-manager, alongside John Ameriks, on Global Minimum Volatility (VMVFX) and the five factor ETFs.

Ameriks, the global head of Vanguard’s Quantitative Equity Group, stepped in as the portfolio manager on the factor strategies when Picca abruptly left the firm in July 2022. To his credit, Ameriks has invested in some of the factor funds he manages. As of June 2022, Ameriks had between $100,001 and $500,000 invested in U.S. Liquidity Factor ETF (which has shut down since then) and U.S. Minimum Volatility ETF (VFMV) as well as another $500,000 to $1 million invested in U.S. Value Factor ETF (VFVA).

Rodemer, who is the Head of Equity Factor Investments within the broader equity group, is co-managing the fund alongside his boss. While Rodemer has been at Vanguard since 2004, a Google search for more information comes up more or less blank—I’m not even seeing a LinkedIn page or a bio on Vanguard’s website. On top of that, as of November 2022, Rodemer did not own shares of any of the factor ETFs, nor Global Minimum Volatility. That doesn’t exactly inspire confidence.

For more on Vanguard’s factor ETFs, Premium Members can read the deep-dive report I wrote on their five-year anniversary—see here.

Our Portfolios

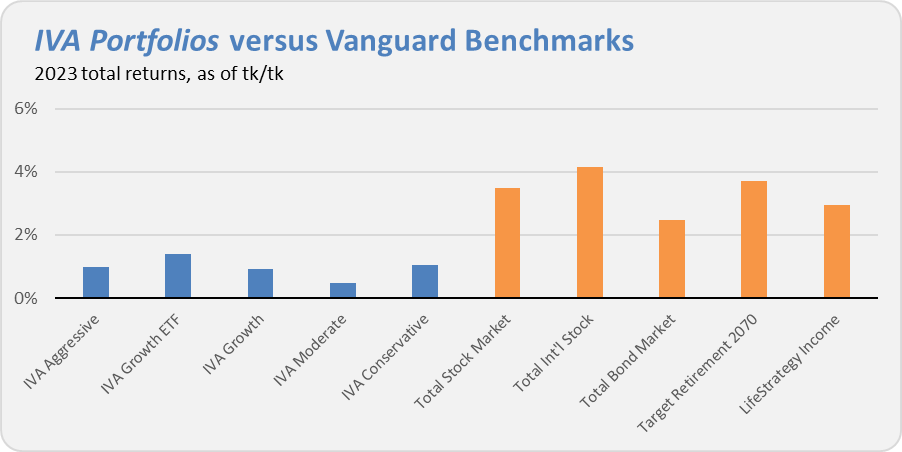

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 1.0%, the Growth ETF Portfolio is up 1.4%, the Growth Portfolio is up 0.9%, the Moderate Portfolio has gained 0.5% and finally the Conservative Portfolio is up 1.1%.

This compares to a 3.5% return for Total Stock Market Index (VTSAX), a 4.1% gain for Total International Stock Index (VTIAX), and a 2.5% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.7% for the year and its most conservative, LifeStrategy Income (VASIX), is up 2.9% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.