Six months into the year, my 2024 Outlook looks both right and wrong.

On the one hand, I said that the stock market was neither at a peak nor a trough and that, therefore, you should expect it to gain ground in the year ahead. Total Stock Market Index (VTSAX) is up 13.6% this year—so far, so good.

However, I also told you that I thought we were at a turning point in the market. In particular, I warned that,

2023’s winners—think technology and growth stocks and the Super Seven—could be 2024’s laggards.

That’s been dead wrong so far. S&P 500 Growth ETF (VOOG) has been Vanguard’s best-performing fund this year, boasting a 23.4% gain. Information Technology ETF (VGT) has been the best-performing sector ETF, up 19.6%. Both funds’ returns have been driven by the same enormous technology companies.

The Super Seven—Apple, Amazon, Facebook (Meta), Google (Alphabet), Microsoft, NVIDIA and Tesla—haven’t all been quite as “super” this year, but they’ve still posted some solid gains. As you can see in the table below, which includes 500 Index’s (VFIAX) returns, the Super Seven were all big winners in 2023—all beat the index fund, with gains ranging from 49% to 239%.

Super Seven Trimmed to Five

| 2023 Return | 2024 Return Through June | |

| NVIDIA | 239% | 149% |

| Facebook (Meta) | 194% | 43% |

| Google (Alphabet) | 59% | 30% |

| Amazon | 81% | 27% |

| Microsoft | 58% | 19% |

| 500 Index | 26% | 15% |

| Apple Inc | 49% | 10% |

| Tesla | 102% | -20% |

| Note: Sorted by 2024 returns. Souce: Ycharts and The IVA. | ||

This year, Tesla has fallen back to earth, down 20%. (In mid-May, the electric vehicle maker was off more than 40% on the year.) Also, Apple has trailed the market…a little.

The other five have delivered market-beating returns—particularly NVIDIA, which is up an astonishing 746% over the past 18 months. (See here for more on NVIDIA.)

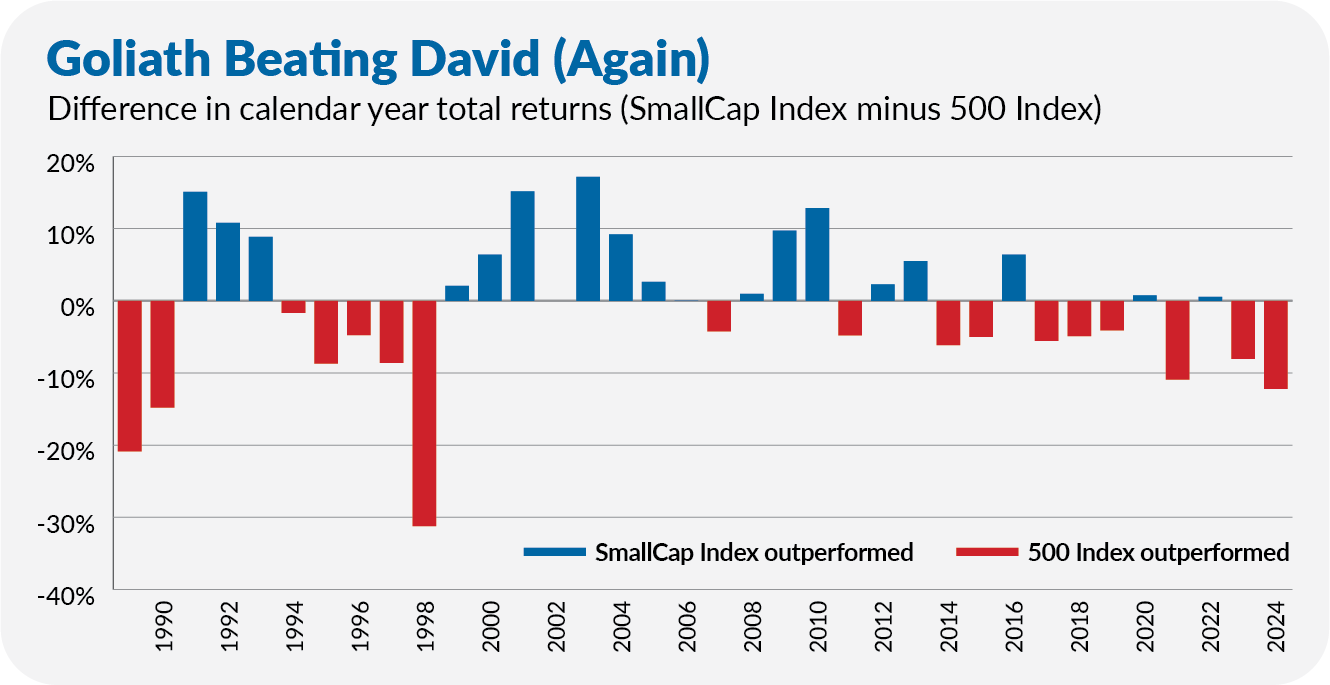

So, despite all the media talk about whether it's the Super Seven, the Fabulous Five or the Miracle One (or whatever), the bottom line is that large caps continue to trounce small caps. 500 Index’s 15.3% gain is 12 percentage points ahead of SmallCap Index’s (VSMAX) 3.1% return.

The chart below shows the difference in annual returns between 500 Index and SmallCap Index. (When the bars are above zero, SmallCap Index beat 500 Index. Bars below zero are years when 500 Index won.) As you can see, if the year had ended on Friday (June 28), then 2024 would clock in as the biggest win for large caps compared to small caps since 1998.

At some point, this trend will reverse. Clearly, predicting when is not my forte—granted, there are still six months left in the year. As the economist (and investor) John Maynard Keynes reportedly said, “Markets can remain irrational longer than you can remain solvent.”

Which is just a clever way of saying that trends can continue (and markets can go to extremes) for longer than you might think. So, if you’re predicting a turn in the market, you either need to get lucky with your timing or need patience to see your forecast through.

The takeaway for most investors—and this is how I invest my own money—is to be diversified. Don’t bet the farm on one outcome. Instead, hold a portfolio that can do reasonably well in multiple scenarios.

Speaking of patience, the bond market continues to test investors’ mettle. Total Bond Market Index (VBTLX) dropped 0.6% in the first six months of the year, and Federal Money Market (VFMXX) returned 2.7%. Thus, the familiar refrain of “Why bother with bonds?” is cropping up again.