Though markets didn’t end the year on a high note, 2024 was still an incredibly profitable year for investors.

500 Index (VFIAX) very nearly returned more than 25% for the second year in a row. (I don’t usually take returns out to two decimal places, but the flagship index fund returned 24.97% in 2024—just shy of the 25% mark.) Plus, all the major asset classes gained ground last year.

The gains weren’t limited to traditional assets, either; so-called alternatives joined the party this year. Gold gained 27% and hit a record high of $2,789 in October. “Digital gold” Bitcoin closed above $100,000 in December, and the cryptocurrency has gained nearly 100% since spot bitcoin ETFs hit the market in early January.

Despite the rising tide, not all boats were lifted equally—large U.S. stocks once again led the charge. So, let’s review the investment year that was and see what worked and what didn’t, using Vanguard as our lens.

Of course, I’ll check in briefly on my Portfolios—though you can find a full rundown on their ups and downs here. (Note: You can find my Outlook for 2025 here. And here is a month-by-month look at the events that caught Vanguard investors’ attention in 2024.)

U.S. Stocks … And Everything Else

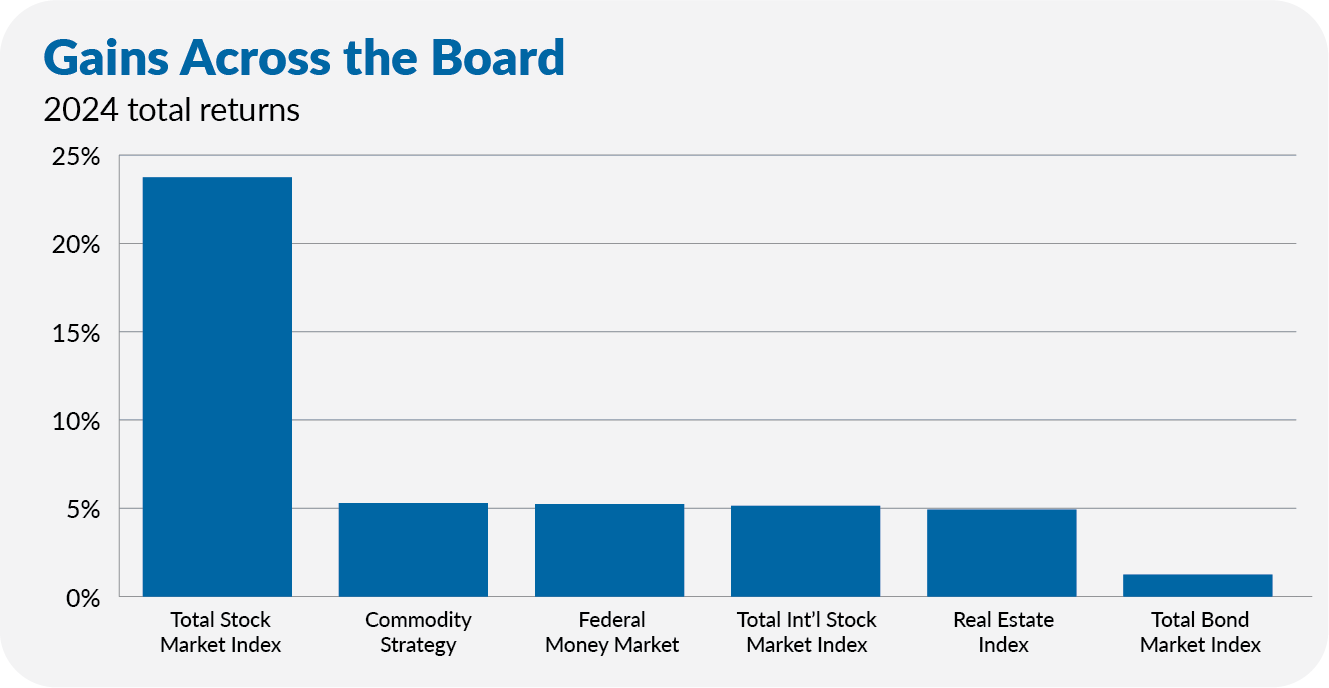

As I said, 2024 was a profitable year for investors. The chart below shows returns for the major asset classes—U.S. and foreign stocks, bonds, cash, real estate and commodities.

As is evident, returns for U.S. stocks stood well apart from the rest.

While Total Stock Market Index (VTSAX) gained 23.7%, the other major asset classes disappointed. Total International Stock Index (VTIAX), Real Estate Index (VGSLX) and Total Bond Market Index (VBTLX) all fell short of Federal Money Market’s (VMFXX) 5.2% gain. Commodity Strategy (VCMDX) only did slightly better, returning 5.3%.

More of The Same

This time last year, I told you that in 2023, the so-called Super Seven—Microsoft, Apple, Amazon, NVIDIA, Alphabet (Google), Meta (Facebook) and Tesla—had driven a wedge between the returns earned by large and small stocks as well as growth and value stocks.

Well, it happened again in 2024.

The chart below shows the difference in returns between large and small stocks in 2023 and 2024. I’ve also shown the discrepancy between Growth Index (VIGAX) and Value Index (VVIAX) each year.