Vanguard provides a straightforward, cost-effective way to make tax-deductible gifts to nonprofit organizations through its Charitable Endowment Program. For those who wish to make significant and continuing charitable donations, this program is, with minor exceptions, marvelous.

The Vanguard Charitable Endowment Program (VCEP) is easy to use. You can donate various assets to the program, including stocks, bonds, cash, fund shares and other marketable securities. The assets will be sold, with the proceeds going into one of the 35 investment portfolios (called “pools”) you choose. These assets become part of your personal charitable account, titled (nearly) any way you like.

The beauty of the program is that it allows you to donate your assets to the Endowment and take the tax deduction now. (Plus, if you contribute securities that have appreciated in value, you avoid paying taxes on those gains.) Then, you have years to decide where the money should go. When you make donations out of your charitable account, you can make them anonymously or with recognition.

As for the logistics of the program, it’s pretty simple.

Technically, once you’ve donated to the Endowment, you have no legal control over where or how your donation is distributed. However, VCEP operates on a “donor-advised” basis. This means that Vanguard Charitable takes the donor’s (your) “recommendation” on how to invest the donated assets and the donor’s “advice” on which organizations should receive grants.

Practically speaking, VCEP does what you want it to do with your money. While the law says they don’t have to do it this way, VCEP wouldn’t exist if it didn't—it wouldn’t attract money from donors if it didn’t give you essentially complete control over where your donations go.

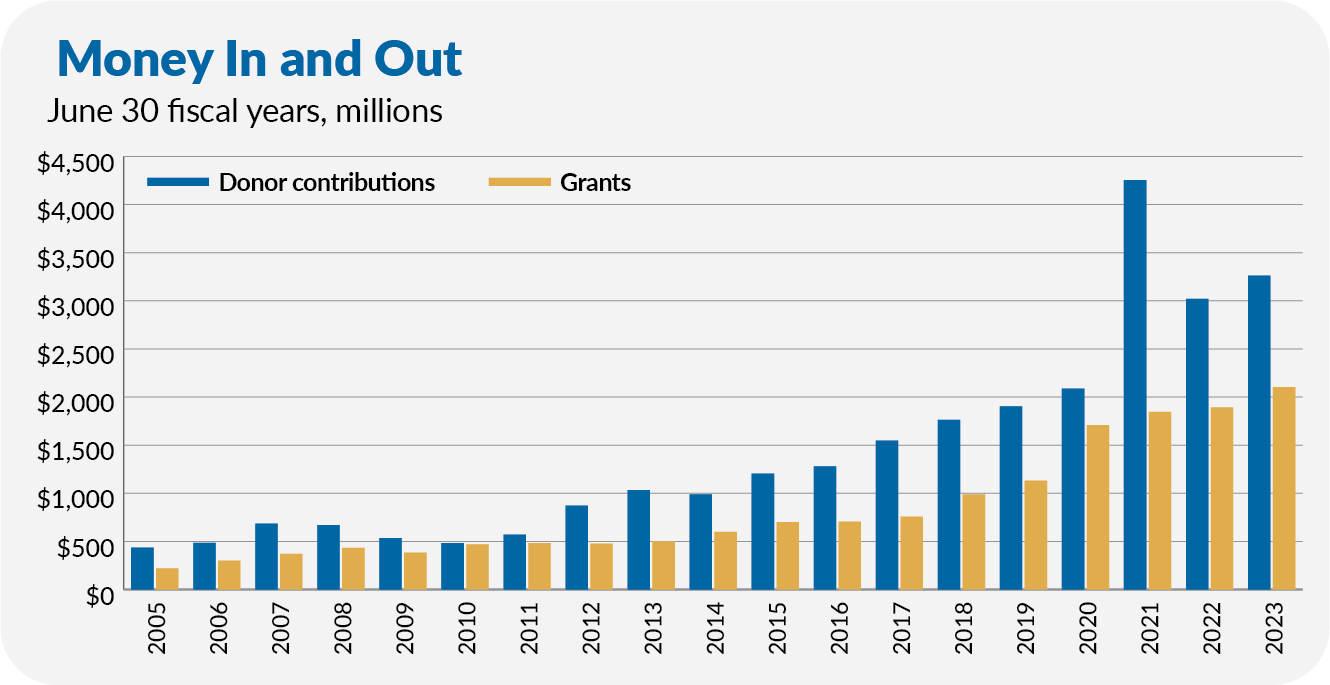

And attract money it has! Since registering with the Internal Revenue Service in December 1997, VCEP has grown dramatically. Donors have contributed more than $3 billion in each of the last three years. In the fiscal year ending in June 2023, VCEP held nearly $17 billion—up from about $15 billion at the end of June 2022.

For the first time, grants from the program topped $2 billion in the 12 months ending June 2023.

If you are interested in having the near-equivalent of your own charitable foundation, here’s what else you need to know.

How It Works

To start, you need to give the program a minimum of $25,000. (Subsequent gifts must be $5,000 or more.) You can also get a group of family, friends or associates together and each donate $5,000 (totaling $25,000 or more) to open a joint account.

Depending on how much money you donate, you’ll qualify for either “Standard” or “Premier” (previously called Select) status. The Standard designation is for accounts with up to $1 million.

Premier status is typically for those with balances greater than $1 million for at least three months—though Vanguard Charitable says it is subject to approval. It features reduced administrative fees and the additional benefit of a dedicated service team, which Vanguard Charitable calls its Premier Services. (In the past, Premier status gave you access to lower-cost funds, but that’s no longer the case.)

When opening your account, you’ll need to give it a name. As long as it starts with “The,” ends with “Fund,” and doesn’t include “trust,” “foundation,” or “endowment,” you can name it as you want. However, keep in mind that the name will appear in communication and grants (unless you give anonymously). Also, Vanguard Charitable reserves the right to deny account names.

When you’re getting started is also, counterintuitively, a time when you need to think about the end of the plan—or at least the end of your time with the plan. You’ll want to set up (or recommend) a succession plan for Vanguard Charitable to follow after your passing.

You have a few options to choose from—you can pick one option or mix and match: