Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 17.

There are no changes recommended for any of our Portfolios.

Earnings Recession?

As of Friday, just over 90% of companies in the S&P 500 index had reported first quarter earnings and nearly 8 out of 10 companies beat expectations. That’s pretty good—though analysts had lowered their estimates heading into earnings season, lowering the bar a bit.

According to the researchers at FactSet, when all the data is in, despite beating expectations for the first three months of the year, S&P 500 companies will collectively have reported a decline in earnings for the second straight quarter. That’s not great. But my take is that we are still working through some of the noise from the COVID pandemic and the boom that followed, so swings in quarterly data are to be expected.

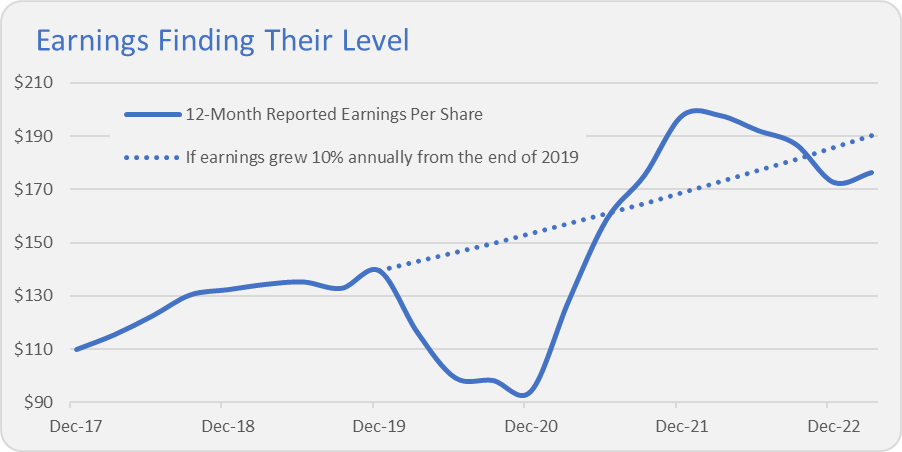

And you can see that in the chart below, which shows rolling 12-month earnings per share for S&P 500 companies (as reported by Standard & Poor’s) as well as my projection of where earnings would be if we had avoided a pandemic in 2020. To make that estimate, I simply assumed earnings grew at a 10% annual pace over the past three years (slightly below the 12% pace earnings grew by in 2018 and 2019).

In 2019, S&P 500 companies reported earning nearly $140 per share. Then the pandemic struck, and earnings dropped to around $95 per share in 2020—well below the $150 or so we might have otherwise expected. Earnings bounced back in a big way in 2021, arguably overshooting the mark to nearly $200 a share.

As the economy has adjusted to changes in consumer behavior, supply chain problems, inflation, higher interest rates and a host of other variables, earnings have come down over the past year to approximately $175 per share. That’s not too far off where earnings would be under my 10% per year growth assumption.

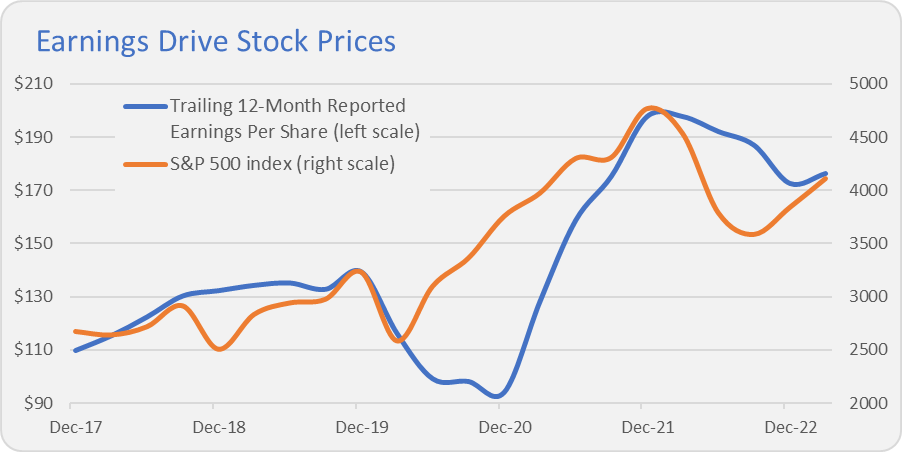

Remember that earnings drive stock prices over time. You can see this in the chart below, where I’ve overlaid the S&P 500 index against rolling 12-month earnings for companies in the index. Given that earnings have stalled out, it’s no surprise that stocks are pretty much in the same place they were a year ago, too.

Off to the Dustbin

If you are one of the few remaining shareholders of Managed Allocation (VPGDX), I just want to give you a reminder that your shares will be merged into LifeStrategy Moderate Growth (VMSGX) on Friday.

Vanguard has been busy preparing Managed Allocation’s portfolio for the transition. At the end of April, the managers had worked down their holdings in Market Neutral(VMNFX), Commodity Strategy (VCMDX) and Global Minimum Volatility (VMVFX) to nearly zero. Plus, they received cash when Alternative Strategies was liquidated a month ago.

That said, there was still some work to do coming into May as funds like Value Index (VIVAX), High Dividend Yield Index (VHYAX) and Dividend Appreciation Index (VDADX) were in Managed Allocation’s portfolio but are not in the LifeStrategy portfolio. Plus, the active fund had a 10% position in Ultra-Short-Term Bond (VUBFX) to sell down.

Also, Managed Allocation is paying out a fairly large distribution (around 7% of NAV) to shareholders today. This effectively wipes the slate clean from a capital gain perspective so that shareholders of LifeStrategy Moderate Growth aren’t negatively impacted when the two funds merge.

Premium Members can read more about Managed Allocation’s demise here. I’m a little disappointed to see it get shuffled off to the dustbin of history, as the fund provided a litmus test for whether adding complexity to a portfolio leads to better results … or not.

About Time

If Vanguard manages your 401(k) or 403(b), expect the mutual fund giant to start sending you a “nudge” or two in the weeks and months to come. In English, that means you can expect to get emails and other “digital notifications” encouraging you to contribute to retirement accounts early and to invest that money in the market rather than parking it in cash.

I fully support efforts that promote spending time in the market—Dan and I have been doing that for over three decades. To give just one example, in Upping the Limit, I not only told you that the contribution limits for retirement savings were increasing but also showed you the power of investing early and often.

Welcome to the dance, Vanguard. We saved you a seat.

Note, the Upping the Limit article originally went out to Premium Members, but I’ve now made it available to everyone. If you find the content useful, consider starting a free 30-day trial.

Archive Under Construction

I’m excited to say that we’ve begun building out The IVA archive. In the archive, Premium Members can now find downloadable PDFS of all the monthly Portfolios and Performance Review updates since the launch of this new service.

Additionally, we are working to add past issues of our prior publication, The Independent Adviser for Vanguard Investors, to the archive. Please be patient as we work to catalogue more than 30 years of our history.

The archive is only available to Premium Members and can be found here.

Our Portfolios

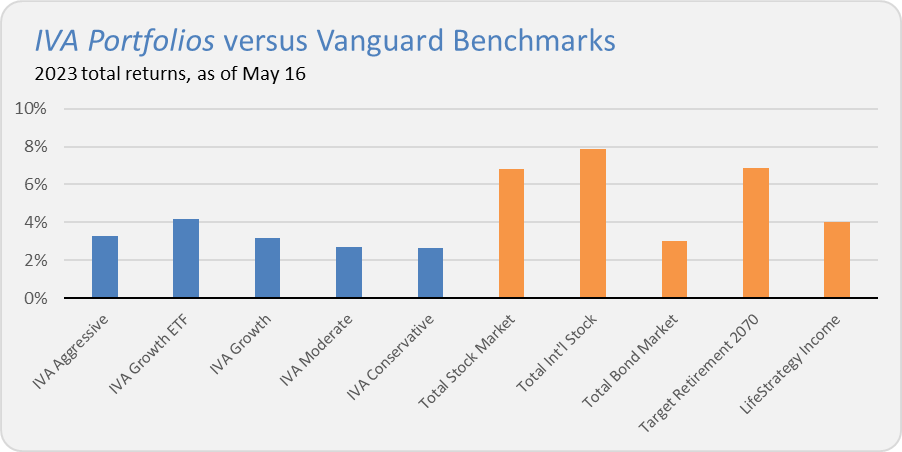

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 3.3%, the Growth ETF Portfolio is up 4.2%, the Growth Portfolio has gained 3.2%, the Moderate Portfolio has returned 2.7% and finally the Conservative Portfolio is up 2.6%.

This compares to a 6.8% return for Total Stock Market Index (VTSAX), a 7.9% gain for Total International Stock Index (VTIAX), and a 3.0% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.0% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.