Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 8.

There are no changes recommended for any of our Portfolios.

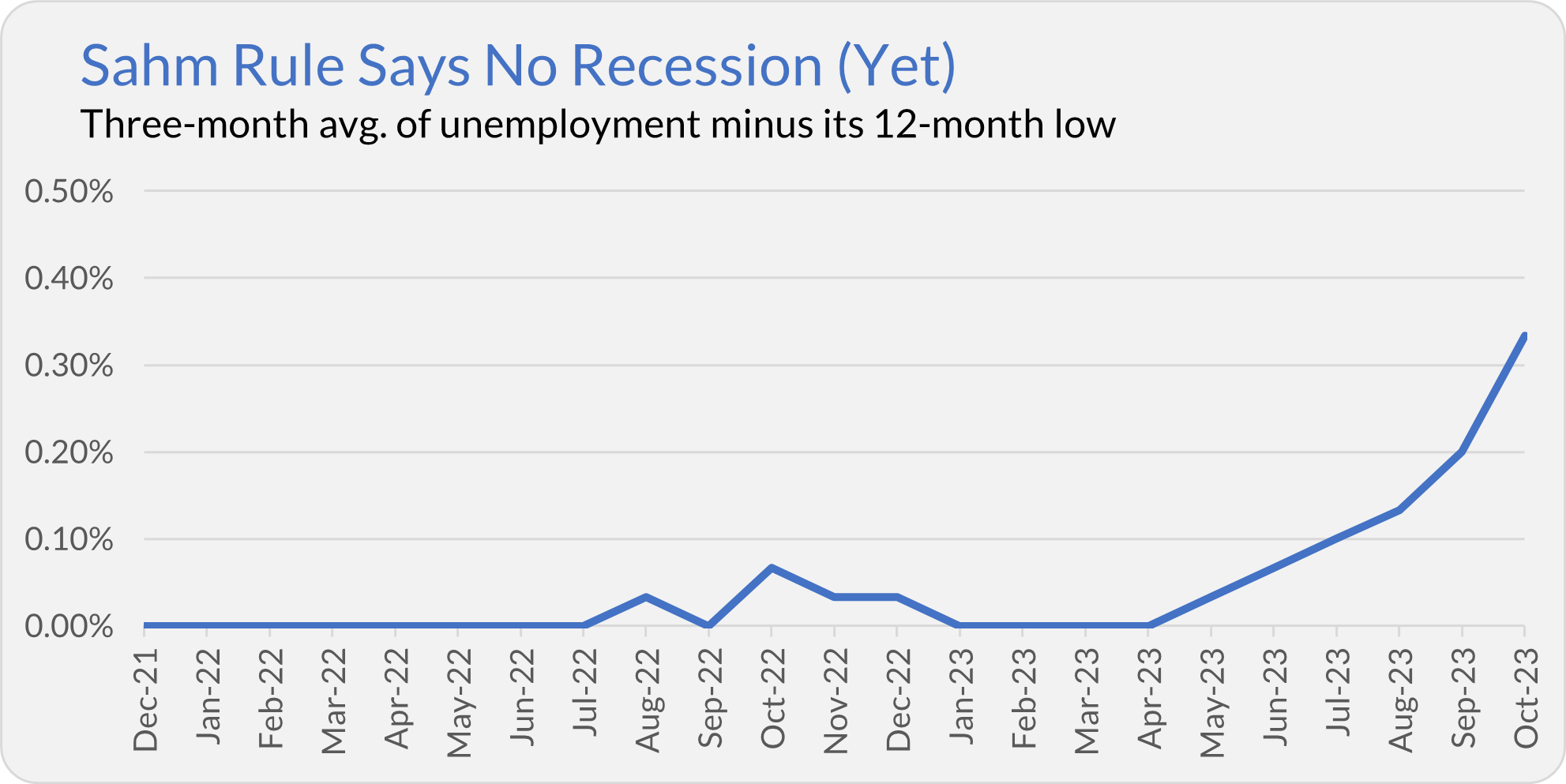

Some pundits have been ringing recession alarm bells over the unemployment rate, which has been creeping higher over the past several months and hit 3.9% in October. A little-known recession indicator—the Sahm rule—is growing in popularity and has been making the rounds.

According to Claudia Sahm, who created the rule, a rise in unemployment can tell us in real-time when a recession has started—no need to wait months for the official recession declaration. Specifically, the Sahm rule tracks the average unemployment over three-month periods. If the average unemployment rate over the past three months is at least 0.5 percentage points higher than its low over the prior 12 months, then we are in a recession.

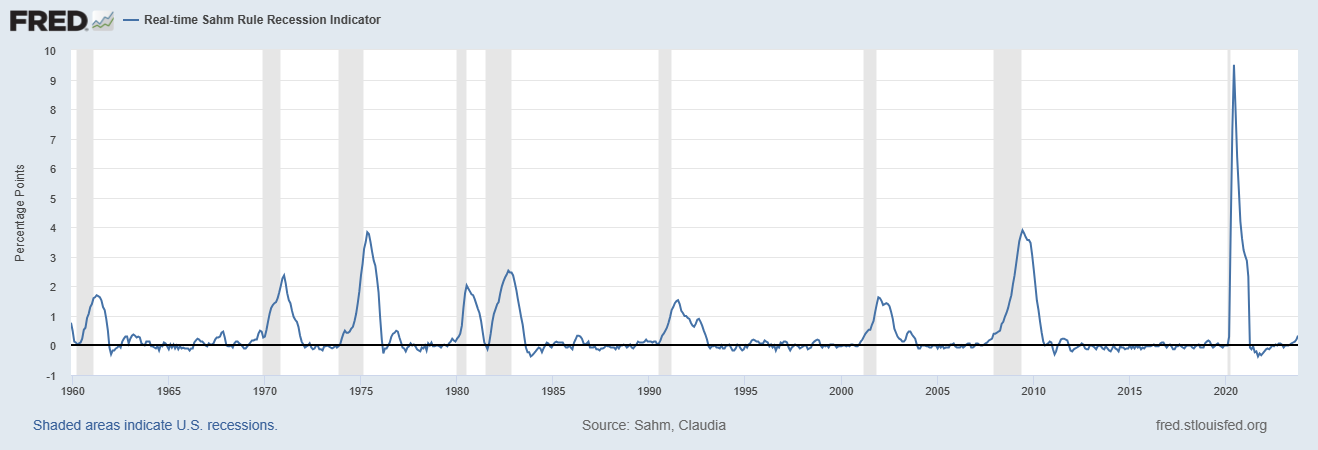

Here's a look at Sahm’s recession indicator over the past six decades.

As you can see, it has been a reliable recession indicator. When the line has been on the rise and above 0.5, the economy has been in a recession.

A few observations:

First, according to the Sahm rule, we are not in a recession today. It’s only at 0.33—below the 0.50 recession threshold.

Second, the rule was only “discovered” a few years ago by Claudia Sahm when she was working as an economist for the Federal Reserve. We shouldn’t be surprised that the “rule” looks good in the past because it was built to fit that history. The question is, will it be accurate moving forward?

Claudia Sahm wrote an opinion piece in Bloomberg warning us that her indicator might not be reliable this time around. In her own words:

But again, a recession is not inevitable. Indicators of economic downturns like the Sahm rule are empirical regularities from the past, not laws of nature. The pandemic was extremely disruptive, and the rebalancing of the economy has been messy and slow. That’s as true for inflation and supply chains as it is for the labor market. [Emphasis added]

Sahm is warning us that the economic data is still “messy” thanks to the pandemic. But there is more to her warning than just noisy data. While I love her phrase “empirical regularities,” what Sahm is telling us (in plain English) is to take any model or single metric with a large grain of salt. That’s good advice.

Nickled and Dimed

Turning to Malvern, Vanguard is increasingly adding fees to nudge customers in certain directions.

For example, earlier this year, Vanguard increased the service fee on its brokerage accounts to push people to go paperless. Vanguard also has fees to push people out of their legacy mutual fund accounts and into brokerage accounts.

As Ignites recently reported, Vanguard is adding a platform fee to its Personal Advisor Select offering. Before getting to the fee, let me quickly walk you through Vanguard’s personal advice options as the platform was restructured this year:

- Digital Advisor: Vanguard’s traditional “robo-advisor.” It has low minimums ($3,000) and low cost (0.20%), but you don’t get any human interaction.

- Personal Advisor: Vanguard’s low-minimum hybrid option. The minimum ($50,000) and costs (0.35%-0.40%) are a little higher, but you can talk to a human—it won’t necessarily be the same human every time, though.

- Personal Advisor Select: Same as Personal Advisor, but once you hit a higher asset level ($500,000), you get a dedicated human advisor.

- Wealth Management: If you have over $5 million, you get more hands-on and sophisticated advice.

The new $75 fee will be applied to Advisor Select clients whose assets drop below $450,000. You can read about the “Advice platform fee” on page 9 of this brochure. But to save you the trouble, here are the two key paragraphs:

Advice platform fee

On January 1, 2024, an advice platform fee (“Advice Platform Fee”) will be made effective. This $75 quarterly fee will be assessed on enrolled Vanguard Personal Advisor Select Portfolios with assets less than $450,000. Your level of Portfolio assets will be measured and any Exceptions (see below) will be determined on the day that your quarterly advisory fee is calculated. If your Portfolio is subject to the Advice Platform Fee, it will be added to your advisory fee and be assessed in the same manner as your advisory fee. See the “Type of Clients” Section for further information on service minimums. Personal Advisor Select will begin assessing the Advice Platform Fee on those clients who are subject to the fee beginning in April 2024.

Exceptions from the Advice Platform Fee

Clients who are in retirement and taking distributions from the Portfolio such that Portfolio assets are less than $450,000 will not be assessed the Advice Platform Fee, provided that the Portfolio initially qualified for a dedicated advisor at the time of enrollment in the service. Clients who maintain Inherited IRAs, SEP IRAs, Simple IRAs, Trusts, and accounts under an Agent Certification for Incapacitated Person (ACIP) as part of their Portfolio will be excluded from the Advice Platform Fee. Additionally, Clients with i) automatic withdrawal plans established on Portfolio accounts, ii) individual accounts of a Secondary Advice Client (such as a spouse or domestic partner) that are part of the advised Portfolio, iii) no retirement goal, or iv) other goals in addition to a retirement goal (i.e. financial plans with multiple investing goals) will also be exempt from the Advice Platform Fee.

Let me translate the legalese for you.

The first paragraph isn’t too complicated. If you initially qualified for Advice Select, but your account has fallen below $450,000, you'll get hit with this additional fee of $75 per quarter (or $300 per year). That's Vanguard's way of ensuring they are getting paid "enough" for providing a dedicated advisor.

The second paragraph lists the exemptions and makes me wonder who Vanguard is trying to target or capture with this fee.

Vanguard isn’t looking to ding retirees drawing down their portfolio; they are exempt. If you have goals other than retirement, you are exempt, too. So, who is impacted by this fee?

Vanguard says they are “working with a small cohort of personal advisor select clients who have less than the required minimum in advised assets to shift to our Vanguard personal advisor offer.” In other words, pay up or lose your dedicated advisor!

But consider this: Let’s say I sign up with $500,000 and list retirement as my goal. All it would take is a correction (a 10% decline) for my account balance to fall below $450,000. So, if I stay the course and follow Vanguard's advice and principles, I might have to pay this platform fee by no fault of my own—it was the market!

That's not someone you'd expect Vanguard to hit with additional fees. It also means I might lose my advisor when I need them most—a bear market!

To me, this is a fee consultants would love. It sounds good on paper … for the business—you’re not getting “bogged down” by small accounts, and it helps maintain revenue during bear markets.

But it feels short-sighted to me. Clients will hate it, and it adds an asterisk to that 0.30% fee for Advisor Select. Plus, it contradicts Vanguard’s low-cost brand and history of “looking out” for the “little guy.”

Our Portfolios

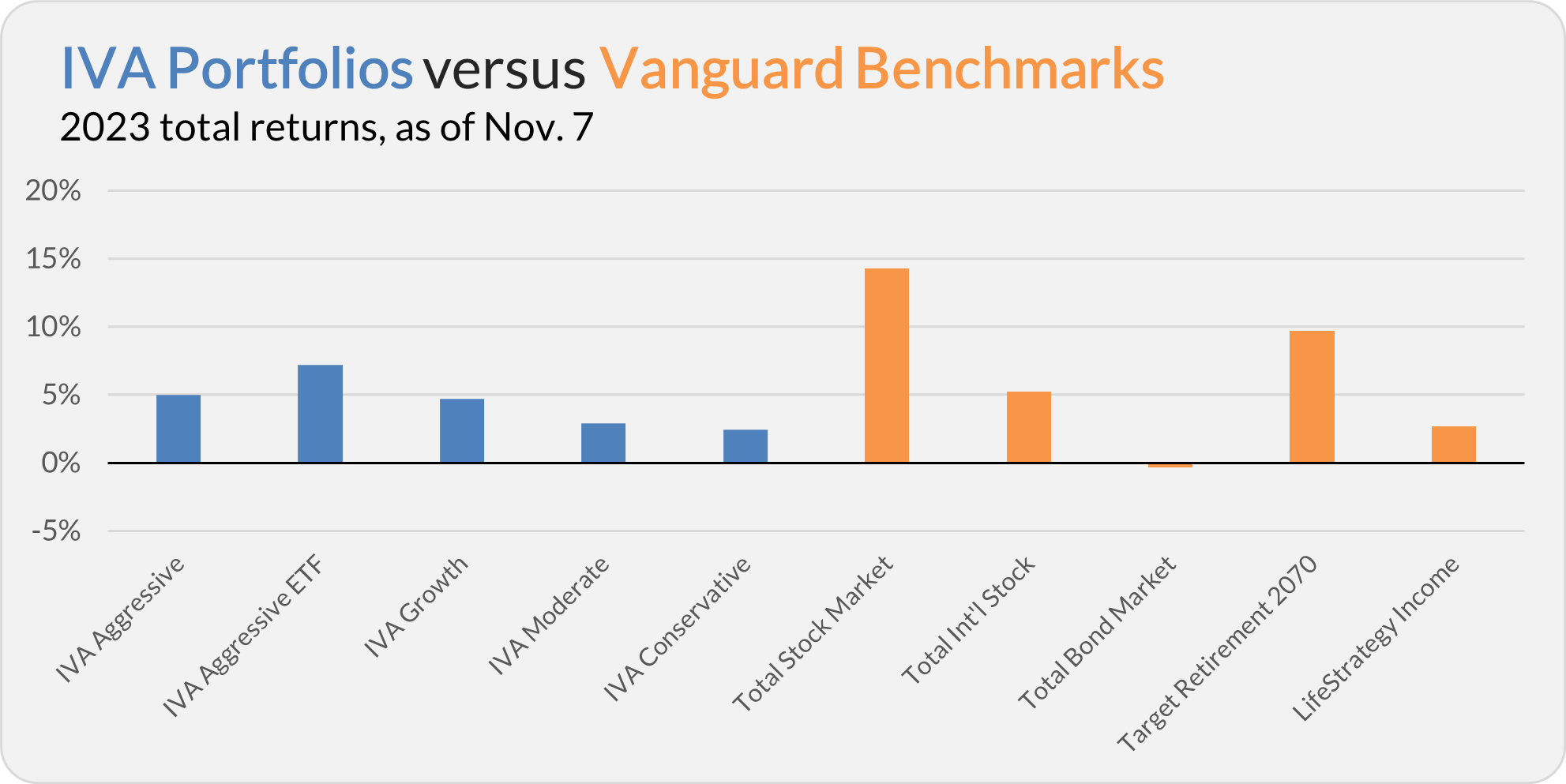

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.0%, the Aggressive ETF Portfolio is up 7.2%, the Growth Portfolio is up 4.7%, the Moderate Portfolio is up 2.9% and the Conservative Portfolio is up 2.4%.

This compares to a 14.3% gain for Total Stock Market Index (VTSAX), a 5.2% return for Total International Stock Index (VTIAX), and a 0.3% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 9.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.7%.

A week ago, I showed Premium Members how diversification has disappointed investors this year. Today, let me remind you not to get too caught up in year-to-date numbers.

Take Dividend Growth (VDIGX). Through the end of October, the fund’s -2.1% return lags way (way) behind 500 Index’s (VFIAX) 10.7% gain. However, if we look at the 22 months since the end of 2021, Dividend Growth has lost less than 500 Index, -6.8% to -9.4%.

I’m not saying I’m happy to see Dividend Growth in the red when 500 Index is up double digits. (I’m not.) But no fund should be judged over a single 10-month period. Zoom out, and you can get a better signal of a fund’s worth.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.