Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 8.

There are no changes recommended for any of our Portfolios.

Higher Rates = Lower Stock Prices

Fed Chair Jerome Powell has been on Capitol Hill the past two days. Here’s what he had to say:

The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes.

In English, Powell is saying that the Fed is still worried about inflation. They want to see the economy slow down and are prepared to keep raising interest rates until they see that happen.

For traders, the simple equation seems to be that higher interest rates equal lower stock prices. Accordingly, 500 Index (VFIAX) fell 1.5% on Tuesday.

The Fed next meets on March 21 and 22. While Powell says they will look at the “totality of the data,” Friday’s unemployment report and next week’s inflation report will be key inputs.

Slow Housing Market

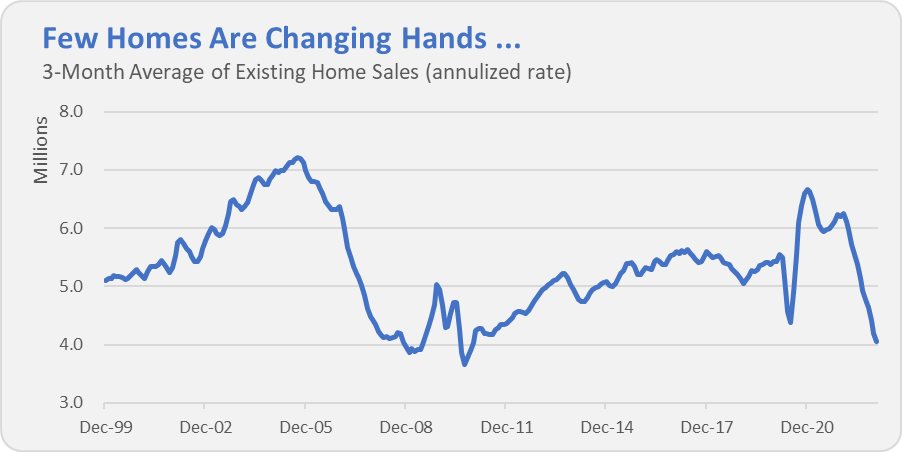

If Powell and company are looking for evidence that they are having an impact, they could look to the housing market. Existing home sales are clocking at levels last seen during the COVID panic and the depths of the Global Financial Crisis.

The drop-off in home sales in the Global Financial Crisis comes as no surprise, since housing was at the epicenter of that calamity. And of course, sales stalled during COVID—it’s hard to buy (or sell) a new house when you don’t leave your own.

In the chart above, you can see that home sales peaked around the end of 2020. While that peak may have been inflated by COVID distorting all of the economic data, the drop-off in home sales since then is dramatic. The recent fall-off in home sales is all about higher costs for potential buyers—both in terms of prices and mortgage rates.

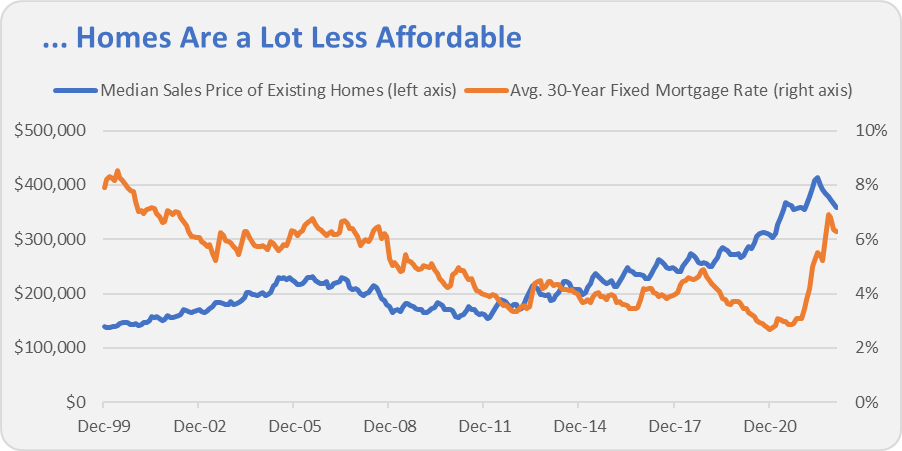

Consider the next chart, showing the median price paid for an existing home and the average interest rate for a 30-year fixed-rate mortgage. While I’m showing the data since the turn of the century to match the first chart, focus on the past two years.

Since the end of 2020, mortgage rates have doubled from a low of 3% or so to over 6% and the median home price went from around $300,000 to over $400,000. Okay, home prices have declined over the past seven months. Still, in the space of two years, mortgage rates doubled and home prices increased 15% to 20%. You don’t need me to tell you, but higher prices combined with higher mortgage rates make buying a home a lot more challenging.

Employment may still be strong, and inflation may still be above the Fed’s target, but the Fed’s actions have cooled what was once a red-hot housing market.

Short-Term Muni Pile-Up

Yesterday (March 7), Vanguard launched Short-Term Tax-Exempt Bond ETF (VTES). This was on the heels of renaming Short-Term Tax-Exempt Ultra-Short-Term Tax-Exempt (VWSTX). I covered these changes back in December when Vanguard announced these plans.

The quick story is that renaming the active fund to Ultra-Short-Term Tax-Exempt was overdue. This tax-exempt fund typically has an average maturity of one to two years and is most similar to Ultra-Short-Term Bond (VUBFX). The new name is appropriate and in line with the industry standard.

While that helps clear up one potential confusion, Vanguard now has Short-Term Tax-Exempt Bond ETF and Limited-Term Tax-Exempt (VMLTX) going head-to-head. We’ll just have to remember that the ETF is an index fund, and the limited fund is actively managed.

The Other Side of the (ESG) Coin

As I told you in December, Vanguard gave into political pressure and backed out of the Net Zero Asset Managers (NZAM) alliance. Well, the other side of that coin has landed.

According to an article in the UK version of InvestmentWeek, over 1,400 Vanguard shareholders have banned together to accuse the company of violating its fiduciary duty to limit the financial risks of climate change. Their letter alleges that backing out of the NZAM violates Vanguard’s “duty of loyalty” to investors.

Is Vanguard violating its fiduciary or loyal duty here? I’m not a legal expert, but if it is found to have broken its fiduciary duty, that could lead to a class action lawsuit.

What is clear is that Vanguard, which is responsible for over 20% of all mutual fund and ETF assets in America, is now the elephant in the room. With 30 million customers, what Vanguard says and does matters.

Distributions Ahead

Mutual fund investors typically think of capital gain distribution season as coming in December. That’s true, but some Vanguard funds also pay out “supplemental” distributions in March.

Supplemental distributions are gains or income that were earned last year but not accounted for or distributed in December 2022. They must be paid out before the end of the first quarter. Vanguard says it will publish a list of payers on March 10. Stay tuned.

But March isn’t just for supplemental distributions—it’s also when quarterly income-payers are set to distribute their first payout of the year. Below is a list the Vanguard funds (and ETFs) that are scheduled to pay out income in March.

500 Index, Balanced Index, Communication Services Index, Consumer Discretionary Index, Consumer Staples Index, Developed Markets Index, Dividend Appreciation Index, Emerging Markets Stock Index, Energy Index, Equity Income, ESG International Stock ETF, ESG U.S. Stock ETF, European Stock Index, Extended Duration Treasury ETF, Extended Market Index, Financials Index, Global Credit Bond, Global ex-U.S. Real Estate Index, Global Wellesley Income, Global Wellington, Growth Index, Health Care Index, High Dividend Yield Index, Industrials Index, Inflation-Protected Securities, Information Technology Index, International Dividend Appreciation Index, International High Dividend Yield Index, LargeCap Index, LifeStrategy Conservative Growth, LifeStrategy Income, Managed Allocation, Materials Index, Mega Cap Growth ETF, Mega Cap ETF, Mega Cap Value ETF, MidCap Growth Index, MidCap Index, MidCap Value Index, Pacific Stock Index, Real Estate Index, Russell 1000 Growth ETF, Russell 1000 ETF, Russell 1000 Value ETF, Russell 2000 ETF, Russell 2000 Growth ETF, Russell 2000 Value ETF, Russell 3000 ETF, S&P 500 Growth ETF, S&P 500 Value ETF, S&P MidCap 400 ETF, S&P SmallCap 600 Growth ETF, S&P SmallCap 600 Value ETF, Short-Term Inflation-Protected Securities Index, SmallCap Growth Index, SmallCap Index, SmallCap Value Index, Social Index, Target Retirement Income, Tax-Managed Balanced, Tax-Managed Capital Appreciation, Tax-Managed SmallCap, Total International Stock Index, Total Stock Market Index, Total World Stock Index, U.S. Liquidity Factor ETF, U.S. Minimum Volatility ETF, U.S. Momentum Factor ETF, U.S. Multifactor, U.S. Quality Factor ETF, U.S. Value Factor ETF, Utilities Index, Value Index, Wellesley Income, Wellington, World ex-U.S. Index, World ex-U.S. SmallCap Index.

And, if it helps your planning, below is a PDF of Vanguard’s dividend distribution schedule for 2023.

Our Portfolios

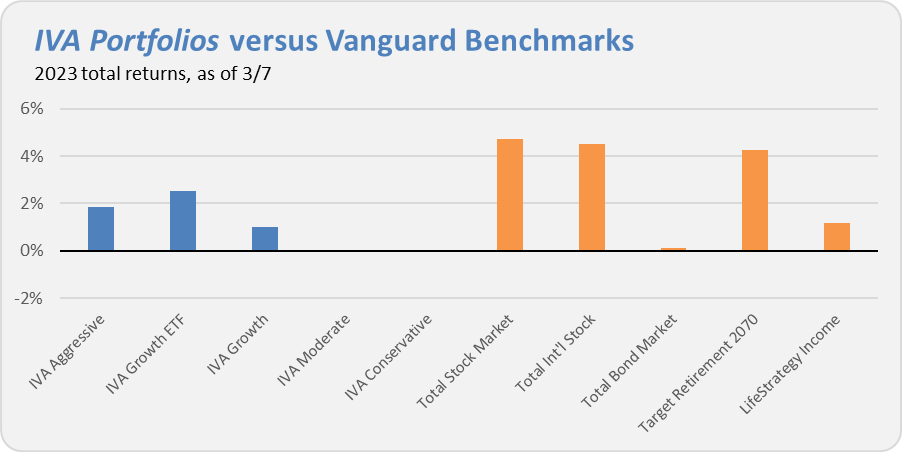

Our Portfolios are trailing the indexes for the year through Tuesday, with returns ranging from up 2.5% for the Growth ETF Portfolio to down 0.1% for the Conservative Portfolio. Dividend Growth (VDIGX) and Health Care ETF (VHT) continue to be the detractors, as both are down so far this year while the broad indexes are up.

This compares to a 4.7% gain for Total Stock Market Index (VTSAX), a 4.5% return for Total International Stock Index (VTIAX), and a 1.0% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 4.2% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 1.2% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.