Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 1.

There are no changes recommended for any of our Portfolios.

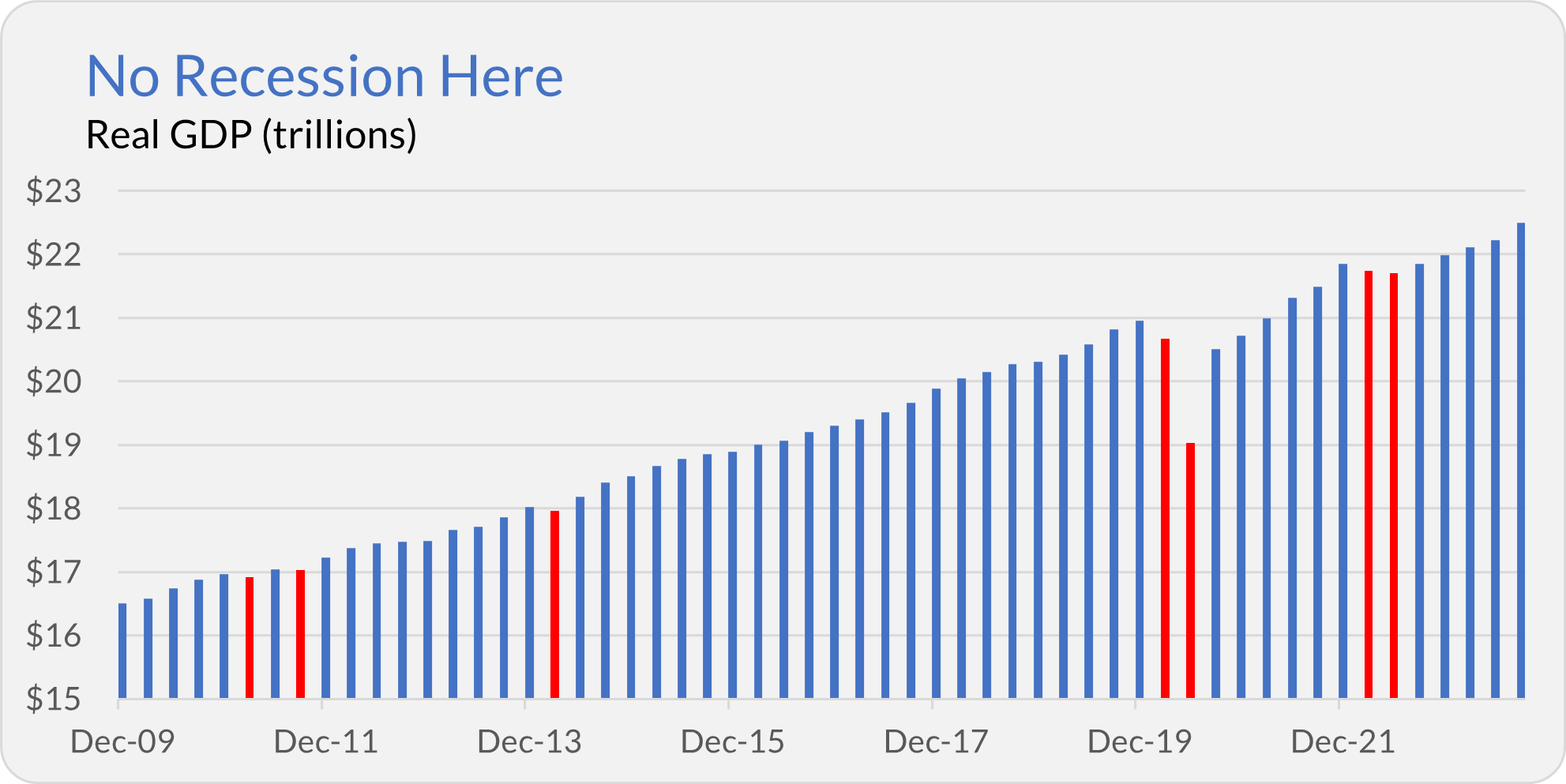

The recession has not started yet.

The U.S. economy grew by 1.2% after inflation in the third quarter. (The 4.9% number in the headlines is an annual growth rate.) Over the past nine months, gross domestic product (or GDP), the most common measure of the size of the U.S. economy, grew by 2.3%. To put some dollar figures on it—GDP has increased by more than $500 billion this year. And, again, that’s after adjusting for inflation.

As you can see in the chart below, since the end of 2009, real GDP (“real” means “after inflation”) has increased from $16.5 trillion to $22.5 trillion. The red bars in the chart indicate quarters when GDP declined. With the exception of the COVID shock, GDP grew steadily. Yes, a few months saw GDP contract marginally, but economies don't move in straight lines.

The recession warnings at the start of the year have proven wrong … or at least early.

With the economy expanding, Fed Chair Powell and colleagues took a wait-and-see approach today—holding the fed funds target range steady at 5.25%-5.50%. While Powell is keeping his options open, most traders expect the Fed will keep the fed funds rate at the current level into 2024.

Preparing to Set Sail

Vanguard launched International Dividend Growth (VIDGX) last night.

Peter Fisher, who is taking over the reins at Dividend Growth (VDIGX) from Don Kilbride at the end of the year, runs this active fund. He’ll be using the same approach—searching for quality companies with the ability and willingness to grow their dividends—but applying it to foreign markets.

The fund is currently in a “subscription period” until November 14. This means the fund will hold cash as Vanguard tries to raise money. Then, beginning on November 15, Fisher will start buying stocks and building out the portfolio.

Premium Members can look forward to an article next week where I’ll have more to say about International Dividend Growth and how it compares to Vanguard’s other foreign stock funds. But the short story is that given Dividend Growth’s success over the long run, this new fund deserves some consideration.

In the meantime, Premium Members can read my exclusive interview with Kilbride and Fisher here and find my deep dive into Fisher’s track record here.

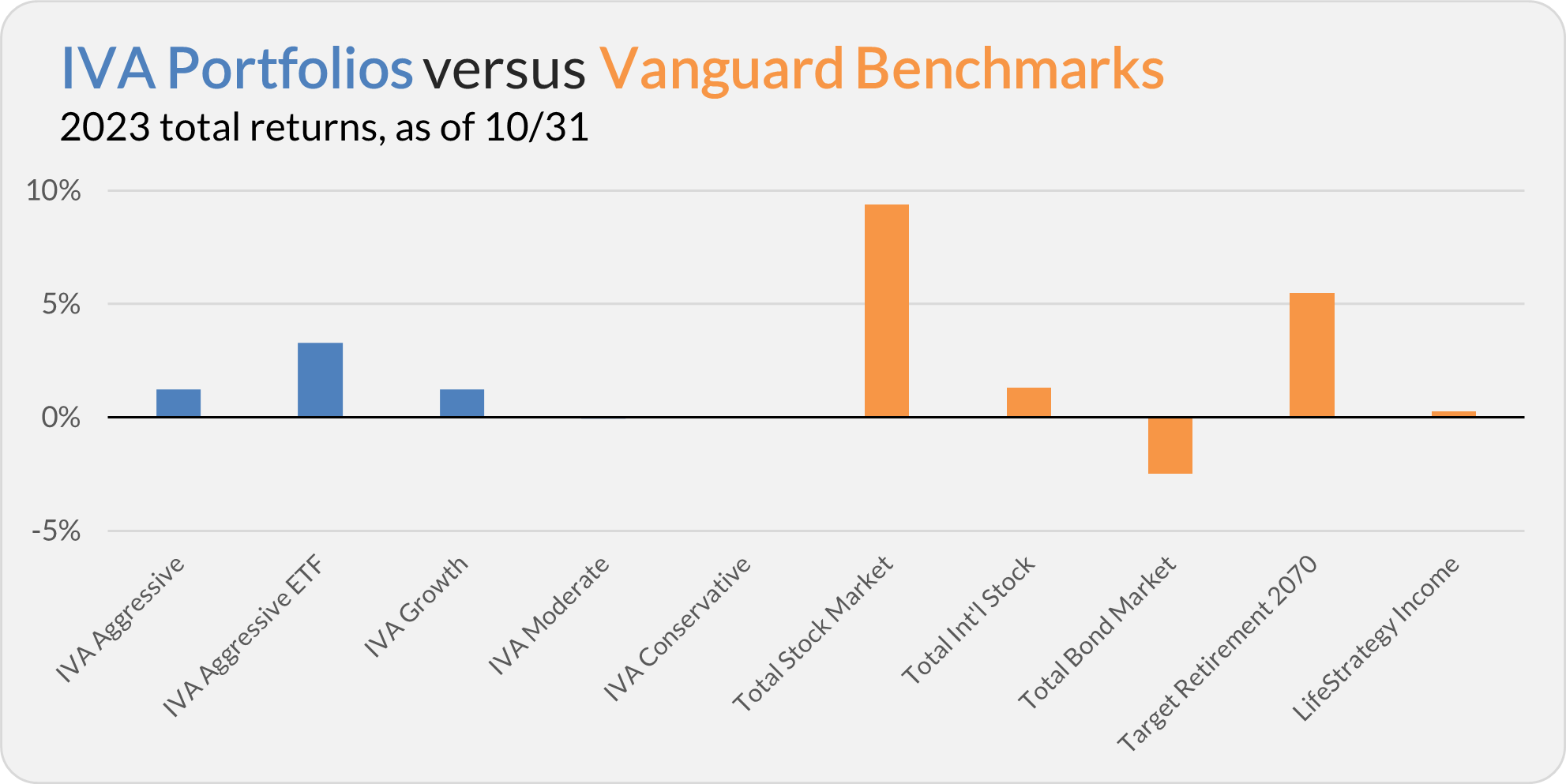

Our Portfolios

Our Portfolios are fighting to hold onto gains this year. The Aggressive Portfolio is up 1.2%, the Aggressive ETF Portfolio is up 3.3%, the Growth Portfolio is up 1.1% and the Moderate and Conservative Portfolios are flat.

This compares to a 9.4% gain for Total Stock Market Index (VTSAX), a 1.3% return for Total International Stock Index (VTIAX), and a 2.5% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 5.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.3%.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.