Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, March 1st.

There are no changes recommended for any of our Portfolios.

To investors’ dismay, stocks and bonds fell together in February. While that seems like a repeat of 2022's market, I explained in the Monthly Recap I shared with Premium Members earlier today, that February’s market wasn’t a perfect replica of what we saw last year. For example, though value stocks beat growth stocks last year, that wasn't the case in February. Please see the Monthly Recap for more details—I’ve made some of the commentary available to all readers.

One Year Later

It’s been a little over one year since Russia invaded Ukraine. So, how have the markets fared? I bet you’ll be surprised by some of these numbers. I know I was. (Technically, the anniversary was February 24th, but I’m looking at the 12-month returns ending on February 28th as it allows me to pull in bond fund returns. It doesn’t change the story.)

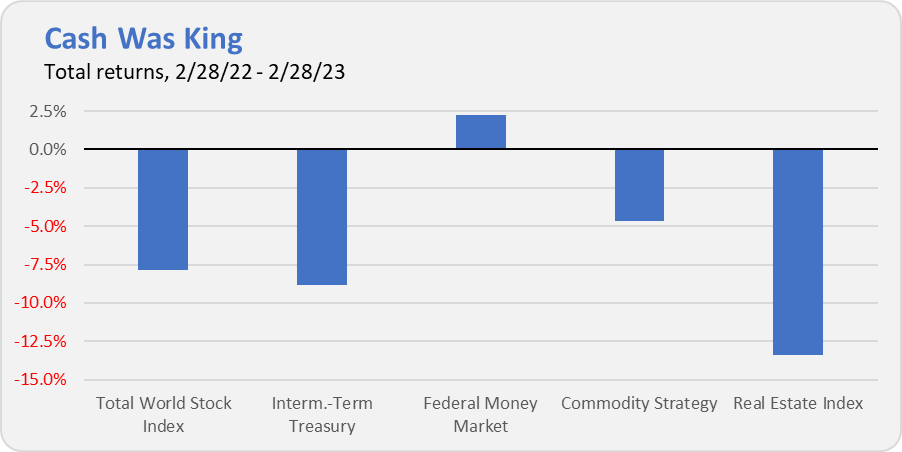

First off, here’s a look at how the major asset classes—stocks, bonds, cash, commodities and real estate—performed over the last year. If you sold and went to cash, well, in hindsight that looks smart. But bonds declining more than stocks … that’s a surprise. Usually in times of uncertainty investors turn to the safety of bonds—particularly, U.S. Treasury bonds. But Intermediate-Term Treasury (VFITX) fell 8.9% over the past year, more than Total World Stock Index’s (VTWAX) 7.8% decline.

I was also surprised to see that Commodity Strategy (VCMDX) fell nearly 5% over the past year. You’d think with inflation running high and Russian commodities effectively being taken out of the market, that commodity prices would soar. Well, they did … until they didn’t.

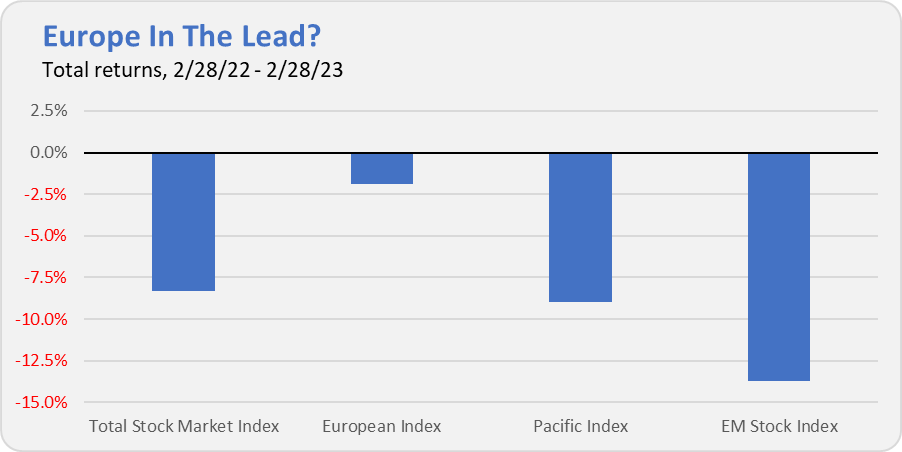

If we look across regions, maybe it’s no surprise to see Emerging Markets Stock Index (VEIEX) down the most over the past year as Russian stocks were removed from the index as worthless ($0.00). But I’d argue that was a small hit to the index fund. The real culprit was China. The iShares MSCI China ETF (MCHI) has fallen about 17% over the past year. I attribute that drop to how China dealt with COVID—not the war in Ukraine.

The best performing region over the past year? Europe! (That’s the one I really didn’t see coming.) You might think that war on the European continent would spell disaster for stock prices there, but European Index (VEURX) is only down 2% over the past 12 months. Go figure.

Out of Malvern

The latest news out of Vanguard is that, in a bid to gather more assets, the firm will be doing a 2-for-1 stock split for six of its S&P-based ETFs in March. Premium Members can read my Quick Take on the situation here.

Our Portfolios

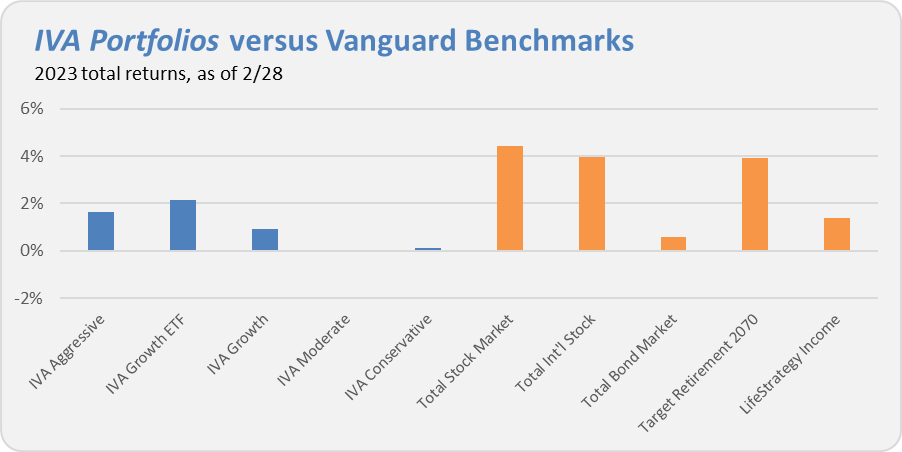

Our Portfolios are showing lagging returns for the year through Tuesday. The Aggressive Portfolio is up 1.7%, the Growth ETF Portfolio is up 2.2%, the Growth Portfolio is up 0.9%, the Moderate Portfolio is down 0.1% and finally the Conservative Portfolio has gained 0.1%.

This compares to a 4.4% return for Total Stock Market Index (VTSAX), a 3.9% gain for Total International Stock Index (VTIAX), and a 0.6% return for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 3.9% for the year and its most conservative, LifeStrategy Income (VASIX), is up 1.4% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.