Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, January 31.

There are no changes recommended for any of our Portfolios.

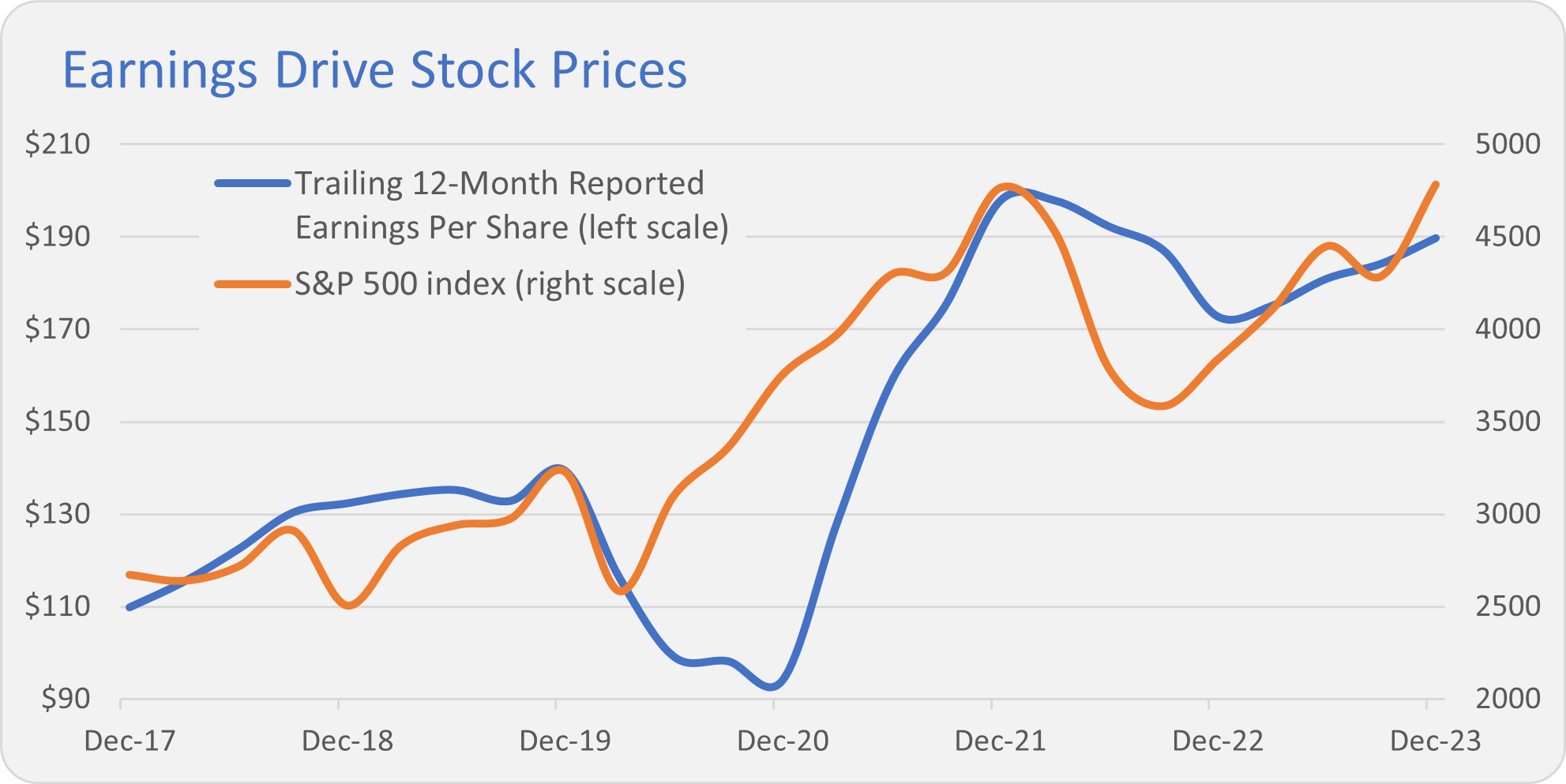

Earnings reporting season is in full swing. So far, according to Lipper/Refinitiv, S&P 500 companies are on track to grow their earnings by 6.1% over the past year. As I say, earnings drive stock prices; earnings on the rise are good for stocks.

Interest rates are another key factor influencing returns. Fed Chair Powell and his colleagues finished their two-day meeting today and left their policy unchanged. While they opened the door to lowering the feds fund rate in the months ahead, for now, they’ll continue to target a range of 5.25% to 5.50% for the benchmark rate as they watch to see how the economy progresses.

With unemployment at 3.7% and inflation clocking in around 2.5% to 4.0% (depending on your preferred metric), policymakers can afford to take a wait-and-see approach.

In short, earnings are growing, and interest rates are relatively stable. That’s typically a recipe for market gains.

More Muni Bond Choice

On Tuesday, Vanguard launched two new tax-exempt bond ETFs: Intermediate-Term Tax-Exempt Bond ETF (VTEI) and California Tax-Exempt Bond ETF (VTEC). The index funds have been rolled out with some fanfare. For example, on Tuesday morning, I received an email from Vanguard inviting me to “Enjoy today’s high yields without the IRS taking a bite.”

However, as I told Premium Members when the two ETFs were first filed with the SEC in October, they don’t offer Vanguard investors anything new—we already have low-cost options.

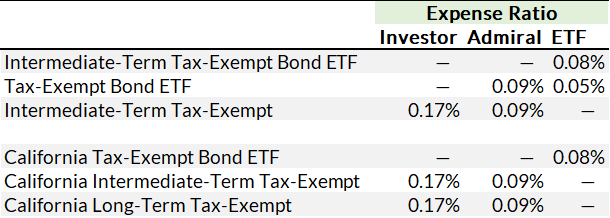

In the table below, you can compare the expense ratios of the new ETFs and the existing Vanguard funds they’ll compete against.

While the new ETFs are cheaper than the Investor shares of Vanguard’s active tax-exempt bond funds, nine out of 10 investors own the Admiral shares of those funds. This means that most investors are, in effect, paying just one basis point for active management—not a bad deal!

In the case of Tax-Exempt Bond ETF (VTEB), it is cheaper—charging just 0.05%—than the new Intermediate-Term Tax-Exempt Bond ETF.

Call me old-school, but I always liked Vanguard’s narrow, straightforward tax-exempt bond lineup. I believe Vanguard had the balance right between choice and simplicity in its municipal bond lineup. That balance is slipping away now.

For example, before 2015, you had one Vanguard-run intermediate-term tax-exempt bond fund. For the past eight years, you had to pick between two funds. Today, you have to choose between three funds.

Having more options hasn’t led to better outcomes. From its 2015 inception through the end of December, Tax-Exempt Bond ETF returned 21.5%. Intermediate-Term Tax-Exempt (VWITX) gained a nearly identical 20.8% over that period. I expect the new Intermediate-Term Tax-Exempt Bond ETF will roughly match its two sibling funds over time.

I get it from Vanguard’s perspective. Money is flowing toward ETFs, and the fund giant didn’t have much to offer in the municipal bond space. Now they do.

And Vanguard may not be done. I wouldn’t be surprised to see a long-term tax-exempt bond ETF roll off Vanguard’s production line sooner than later.

Yields Rising

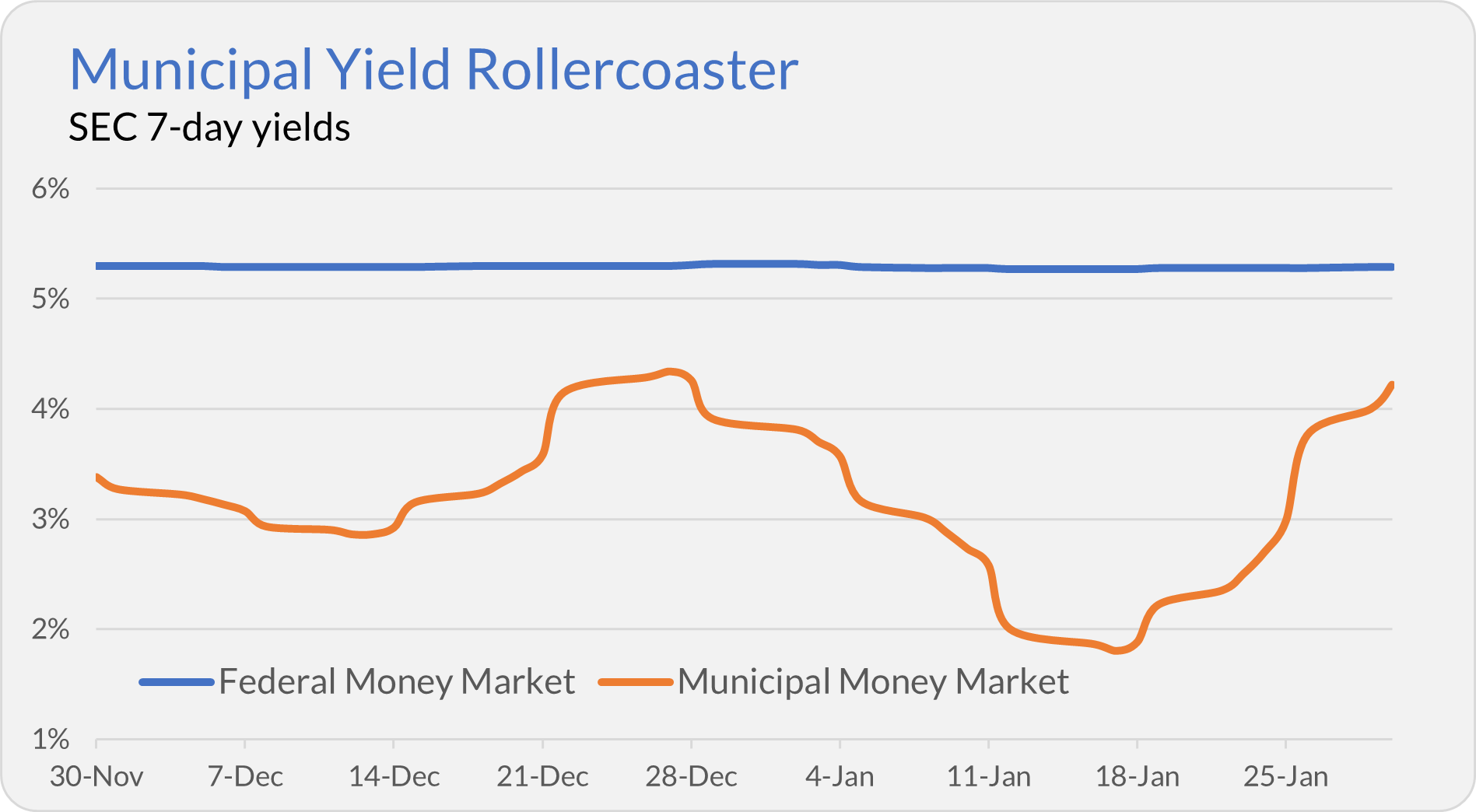

Speaking of municipal bonds, let me provide a quick update on Municipal Money Market’s (VMSXX) yield. Last week, I described the fund’s yield as a rollercoaster—rising in December, falling in January, and ascending again.

Well, since I wrote to you, Municipal Money Market’s yield has gone from 2.50% to 4.22% as of Tuesday’s close. I suspect the tax-exempt fund’s yield has overshot the market and will come down in the weeks ahead. But I’m not expecting it to hit the sub-2% lows it reached a few weeks ago.

Yes, there was a brief opportunity for a tax-sensitive investor to ditch Municipal Money Market and earn a higher (after-tax) yield with Federal Money Market (VMFXX). But as I said, it was a brief opportunity. It’s not worth most investors' time and effort to chase these yields.

Uncovering Tech Issues

I have heard from several readers reporting issues trying to sell noncovered shares of their mutual funds online.

Noncovered shares are shares bought before Jan. 1, 2012. They are called “noncovered” because while Vanguard reports the cost basis of those shares to you, you are responsible for reporting sales (and gains or losses) to the IRS.

With covered shares—those you’ve purchased in the last decade or so—Vanguard reports the required info to you and the IRS. (You can find more about covered versus noncovered shares here.)

In plain English, some of you are having trouble selling long-held shares of your mutual funds at Vanguard. Here’s the latest response one reader received from Vanguard:

I am writing to inform you that Vanguard's Technical Support group reviewed the issues related to the issues you are experiencing with selling some noncovered shares in your account. Upon reviewing your issue, the Technical Support representative found that the system was not working as designed and needed [to] be fixed by the Information Technology team. At this time there is no estimated resolution date, but this team is working to identify the fix.

I apologize for the inconvenience this has caused and appreciate your patience in the meantime. As you know you can always call Vanguard and have a representative complete the trades over the phone for you.

At a minimum, you’d expect Vanguard’s system to handle purchases and sales of mutual funds. But, well, if you are trying to sell shares of a mutual fund that you bought a long time ago (before 2012), you may need to pick up the phone and call Vanguard to place the trade.

Our Portfolios

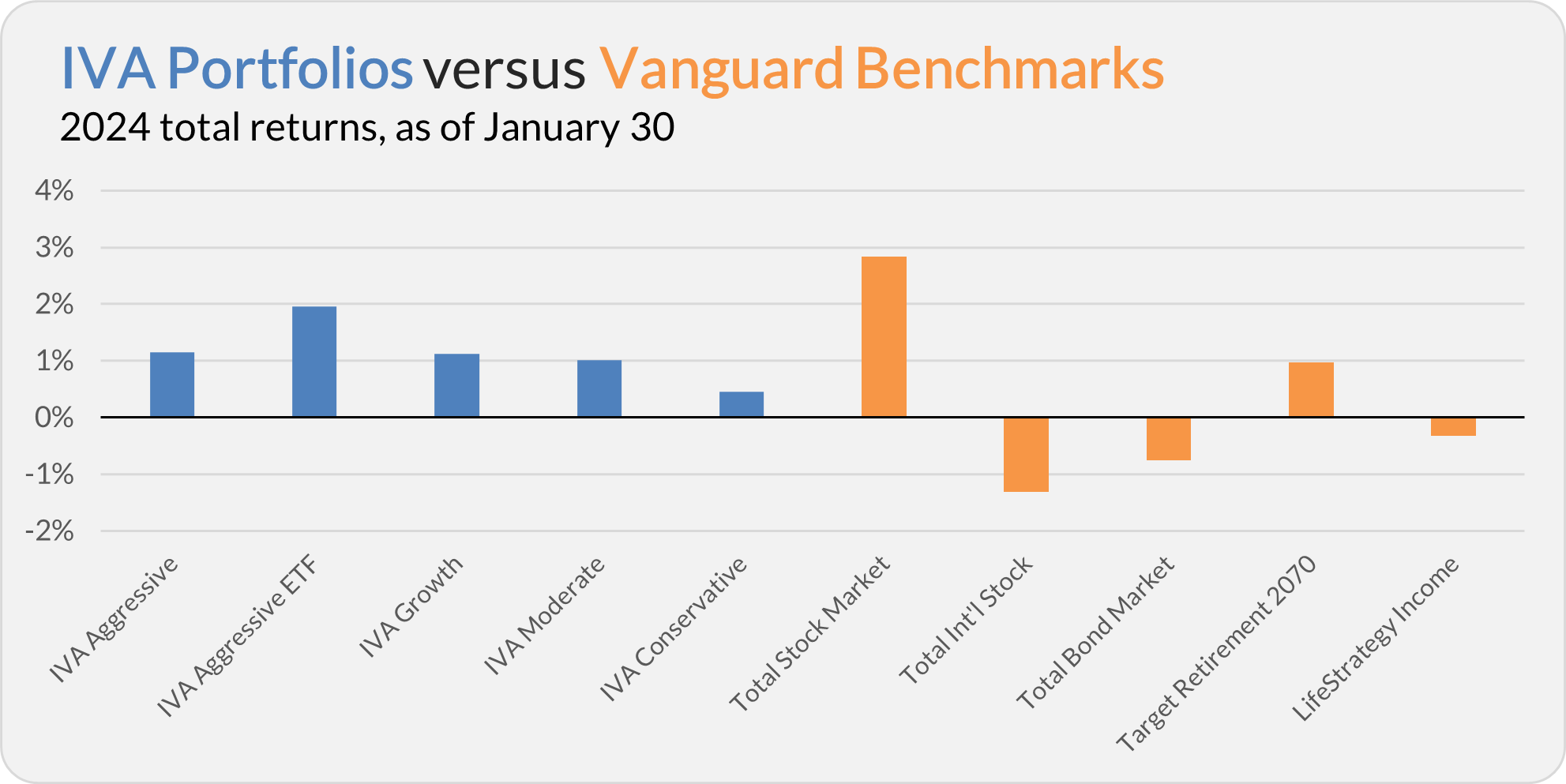

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 1.2%, the Aggressive ETF Portfolio is up 2.0%, the Growth Portfolio is up 1.1%, the Moderate Portfolio is up 1.0% and the Conservative Portfolio is up 0.5%.

This compares to a 2.8% gain for Total Stock Market Index (VTSAX), a 1.3% decline for Total International Stock Index (VTIAX), and a 0.8% drop for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 1.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is down 0.3%.

IVA Research

Yesterday, in Where Did the Recession Go?, I discussed the factors that led forecasters astray with Premium Members. And earlier this morning, I shared a Quick Take with Premium Members on the prospects of Vanguard reopening its three PRIMECAP-run funds.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.