Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, August 7.

There are no changes recommended for any of our Portfolios.

If you’re feeling queasy, rest assured you are not alone. The stock and bond markets began August like a roller coaster. Let’s start with the facts. And then, I’ll give you my take on what’s happening in the markets and what we, as investors, should (or should not) do about it.

The Facts

On Thursday, August 1, the S&P 500 index fell 1.4%. As stocks sold off, traders bought bonds—pushing bond prices up and bond yields down. The yield on the 10-year Treasury bond fell below 4% for the first time since February.

On Friday, the Bureau of Labor Statistics reported that the unemployment rate rose from 4.1% to 4.3% in July and that fewer new jobs were created. Additionally, several companies reported disappointing earnings. Intel led the way down, tumbling 26%, but it wasn’t the only high-profile tech company in the red on the day—Amazon fell nearly 9% and Tesla declined 4%. Overall, the S&P 500 index dropped 1.8% on the final day of the week.

On Monday, U.S. traders woke up to the news that Japan’s Nikkei index (similar to our Dow Jones Industrial Average) dropped 12.4% on the day—the largest one-day percentage drop since 1987!

The CBOE VIX index (which is often called the “fear gauge” and measures the expected market volatility based on S&P 500 index options) spiked from 23.39 on Friday to 65.73. The index has only reached that level twice before—during the Great Financial Crisis (2008-09) and COVID-19’s emergence (March 2020).

Eventually, cooler heads prevailed in the market. The VIX ended Monday at 38.57—that’s still more than double where the VIX was at the start of the month (16.33), but it’s not 65. The S&P 500 index, which at one point was off 4.3% on Monday, closed the day down 3.0%—a bad day, but nothing we haven’t seen before.

The stock market rebound continued on Tuesday, with the S&P 500 index gaining 1.0%. As I write to you on Wednesday morning, U.S. stocks are starting the day on the right foot.

But here’s what the first four days of August look like when viewed through a Vanguard lens:

500 Index (VFIAX) fell 5.1%, while SmallCap Index (VSMAX) dropped 6.8%. Foreign stocks declined by a similar amount, with Total International Stock Index (VTIAX) down 5.7%. However, the Japan stock-heavy Pacific Index (VPADX) was one of Vanguard’s worst-performing funds in August, with an 8.6% decline. Information Technology ETF’s (VGT) 8.4% decline made it Vanguard’s worst-performing sector fund.

On the other side of the spectrum, long-term Treasury funds once again proved they are the flight-to-safety asset of choice—Extended Duration Treasury ETF (VDE) was Vanguard’s best-performing fund with a 3.1% gain through Tuesday. More broadly, Total Bond Market Index (VBTLX) gained 0.8%. Real Estate Index (VGSLX) is also in the black, up 0.1% so far in August. And Dividend Growth (VDIGX) lived up to its defensive reputation—it was Vanguard’s best-performing diversified stock fund with a decline of just 1.9%.

Yearning for Narrative

Again, that’s just the news and some nifty stats. I’ve purposefully left a market narrative out of my commentary because I don’t find it particularly satisfying or useful.

I get it. We all yearn for a story that explains what is happening in the market. We want someone to tell us that stocks rose because this happened or that bond yields fell in response to something else.

Sure, I could tell you that stocks fell on Friday because the unemployment rate went from 4.1% to 4.3%, and the Nikkei tumbled 12% on Monday because the Japanese central bank raised interest rates. Those things happened, and they certainly played a role in stock prices falling, and it would be a nice, simple, comforting story for me to tell.

But, come on. Central banks raise (and lower) interest rates all the time without sparking panic and global sell-offs. The unemployment rate ticking slightly higher doesn’t typically lead traders to rush for the exit.

On the one hand, I’m trying to say that, yes, I think the market reaction in the first three days of the month was overdone. However, I’m not trying to call a bottom. For all I or anyone else knows, we are in the early stages of a bear market. But for the VIX to go from “zero to sixty” (or specifically 16 to 38) in three days because one central bank raised interest rates and the unemployment rate went up by 0.2%, well, that’s a bit of an overreaction in my book.

However, I’m also telling you that while few are willing to admit it, no one really knows why stocks sold off as hard as they did on Monday.

What’s an Investor To Do?

So, as one IVA reader asked me on Monday, “What do you suggest investors do today?”

I don’t mean to be flippant, but as a long-term investor, you should avoid doing anything most of the time.

Days like Thursday, Friday and (most importantly) Monday are not a sign that the market is broken. I see them as the price of admission to the stock market’s long-term compounding ride.

Remember, 500 Index (VFINX) has compounded at an 11.3% annual rate since its inception (a total return of 16,797%) despite bear markets, wars, pandemics, elections, high and low inflation, recessions, financial crises and on and on.

If it helps, consider that despite the recent market action, 500 Index is up 18.6% over the past 12 months. Over the past five, seven and ten years, the flagship index fund has grown at better-than-double-digit rates—14.4%, 13.1% and 12.5%, respectively.

Spending time in the market isn’t easy, but it is effective. So, take a moment and assess yourself and your portfolio.

If you were shaken on Monday, that may be a sign you need to reduce your portfolio's risk. (For example, you may need to sell some stocks.) If you were one of the IVA readers lamenting that Vanguard’s web outage was keeping you from buying more stocks, congratulations on your stalwartness. But go ahead and pat yourself on the back if you were content to sit on your hands and stick to the plan—that’s hard enough and a victory in itself.

It was only three tough days in the stock market, and the S&P 500 index didn’t even enter correction territory—a decline of more than 10% from its prior high. I don’t mean to be the bearer of bad news, but at some point, our patience and fortitude as investors will be tested more than they were these past few days. But I’m also confident that patience and fortitude will be rewarded with time.

To paraphrase a friend of mine, stay diversified, disciplined and invested.

Has The Recession Started?

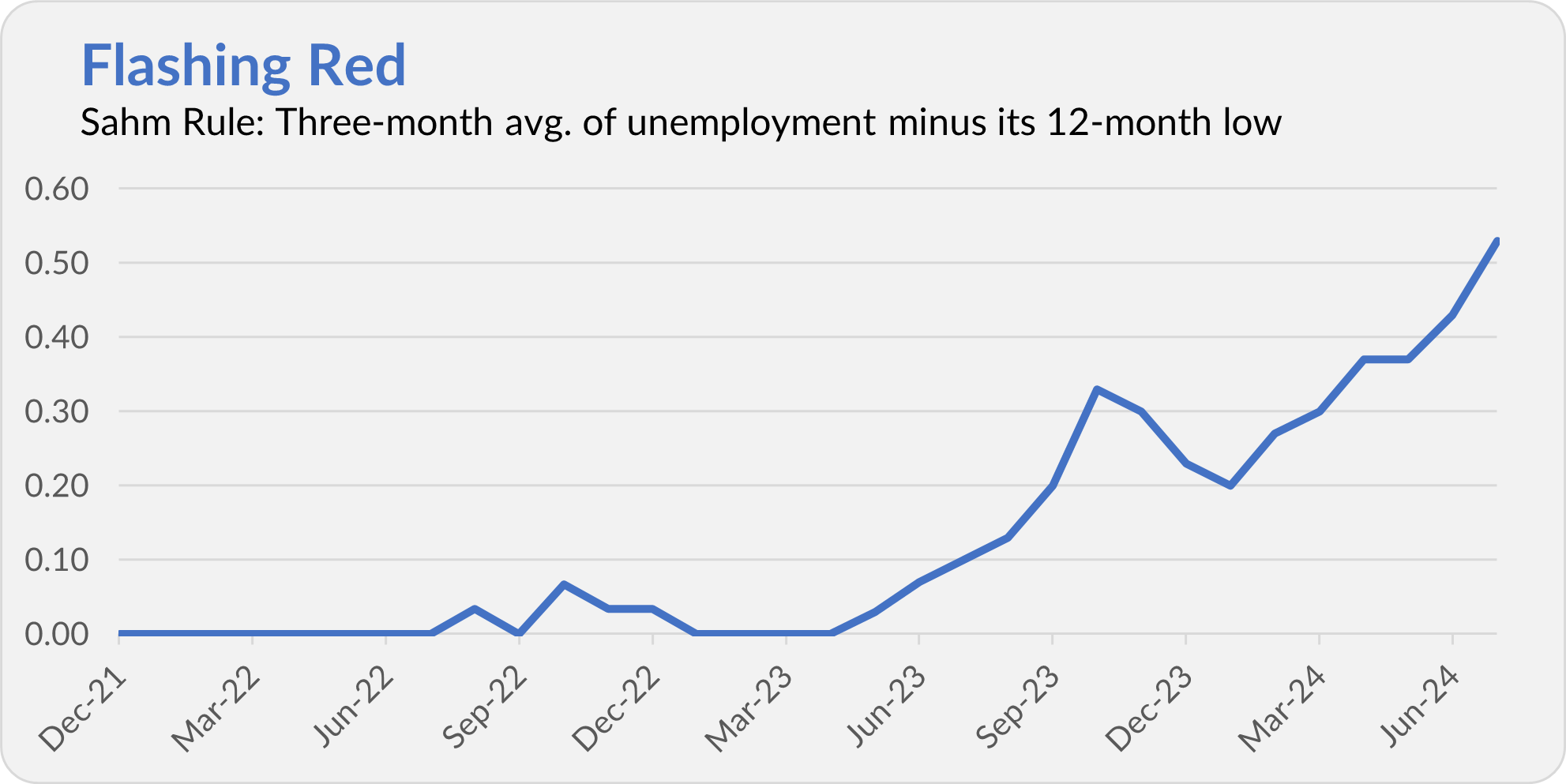

A few weeks ago, I warned that the Sahm Rule was dangerously close to signaling a recession.

Claudia Sahm developed the Sahm Rule while working at the Federal Reserve as a metric that policymakers could use to identify the start of a recession in real-time. The indicator involves tracking the average unemployment rate over rolling three-month periods. If the average unemployment rate over the past three months is 0.5 percentage points higher than its low over the prior 12 months, then we are in a recession.

With the unemployment rate rising to 4.3% in July, we crossed above the Sahm Rule’s 0.5 recession threshold.

Before you hit the panic button, consider that plenty of other economic factors—like industrial production and incomes—suggest we are not in a recession. Heck, even Claudia Sahm doesn’t think we are in a recession—though she says the risk of a recession in the next several months is “elevated.”

So, take it for what it is: one suggestion that we may be in a recession today. That doesn’t mean you need to upend your portfolio.

Remember, the last two recessions were doozies (to use a technical term). In 2020, we effectively turned off the economy with the flip of a switch in response to COVID-19—something that’s never happened before. And the 2008 recession is called the “Great Recession” because it was the worst economic decline since the Great Depression.

In no way am I trying to say that recessions are good—they aren’t. But not all recessions are created equal. The next recession—whether it has started already or is still ahead of us—will likely be much milder than the last two.

Vanguard’s Website … Does It Load?

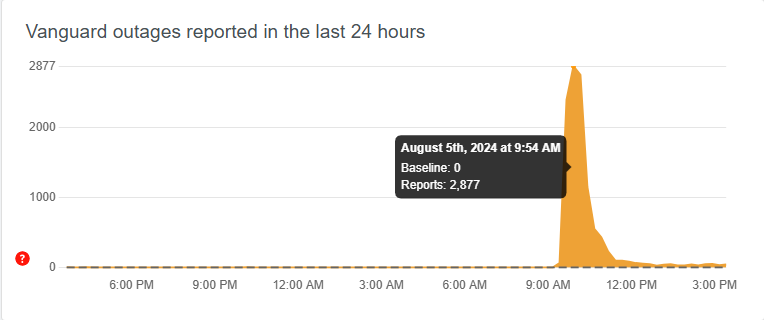

Turning to Malvern, it wasn’t just the markets that tripped up on Monday morning; Vanguard’s website failed to load for many investors.

On Monday, when sellers (and maybe some buyers) tried to check and trade their accounts, the largest brokerage platforms—Vanguard, Fidelity and Schwab—struggled to keep up with the surge. Many IVA readers told me they could not access their accounts—some were looking to buy! And Downdetector confirmed the outages.

This isn’t the first time Vanguard’s website has gone down on a volatile market day. While Vanguard wasn’t alone in having tech issues on Monday, this is the latest example of the fund giant’s need to improve its technology. We (owners) deserve better.

Private Markets … Do They Load?

On Monday, Vanguard’s new CEO, Salim Ramji, continued his media tour. This time, during an interview with Bloomberg, Ramji discussed expanding Vanguard's presence in private markets. He told listeners that,

… Vanguard sometimes is thought of as index versus active—I don’t think that’s the truth. What we’re really about is low-cost investing. And low-cost investing applies in index [investing] and it applies in active [investing]. And I would like it over time to also apply to private assets.

Vanguard already has a foot in private markets via a series of private equity funds launched in partnership with HarbourVest. My sense is that they haven’t exactly caught on. Ramji seemed to confirm this when he said, “It seems like there is some demand there.”

That doesn’t sound like investors have been banging down the door to invest in the HarbourVest funds. But it’s hard to know for sure since there is very little disclosure or information available about these funds.

And therein lies part of the problem. How do you exert fee pressure in private markets when no one knows what fees you are charging?

I also couldn’t help but chuckle at the irony of Ramji discussing a phrase he’s learned since joining Vanguard: “Does it load?”

At Vanguard, the question refers to whether new investment strategies (think bitcoin or private markets) have a role to play in investors’ portfolios. Frankly, I’m skeptical that private markets “load” for most investors. But, given many Vanguard investors were asking the same question about Vanguard’s website on the same day Ramji was being interviewed on national television … well, as I said, the new CEO should prioritize fixing the firm’s tech before he looks to expand into private assets.

IVA Research

Yesterday, in David, Goliath or …?, I answered the question of whether large stocks are superior to small stocks.

Our Portfolios

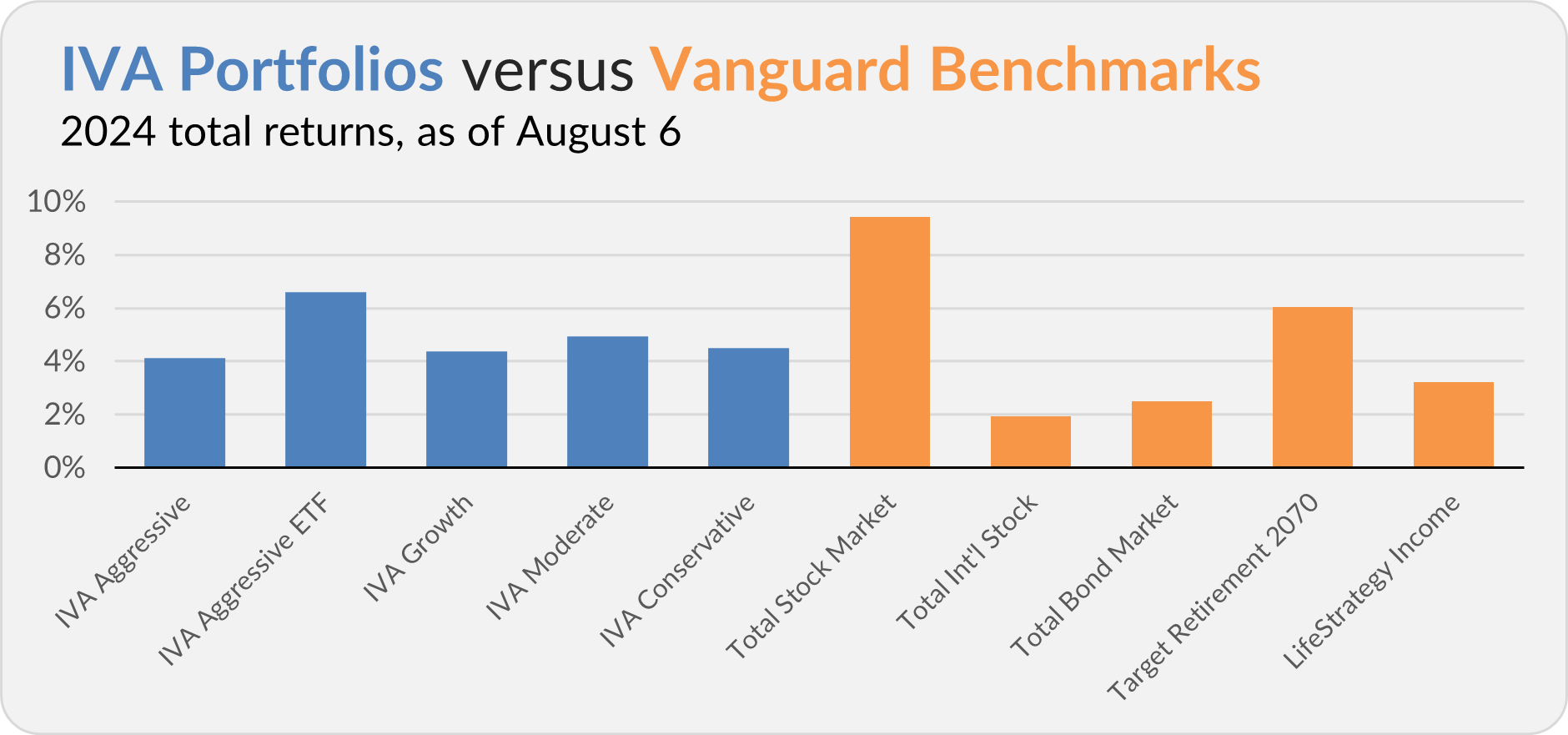

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 4.1%, the Aggressive ETF Portfolio is up 6.6%, the Growth Portfolio is up 4.4%, the Moderate Portfolio is up 4.9% and the Conservative Portfolio is up 4.5%.

This compares to a 9.4% gain for Total Stock Market Index (VTSAX), a 1.9% return for Total International Stock Index (VTIAX), and a 2.5% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 6.0% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 3.2%.

I don’t provide fund-level commentary on the Portfolios every week. However, given the number of questions I received the past few days, I’ve provided additional analysis for Premium Members below the paywall.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Additional Portfolio Notes

If you’re reading this, you are a Premium Member. Thank you.

I don’t comment on each fund every week because that would be very noisy. However, given the dramatic moves in the market, I thought it would be helpful to see how the funds in the IVA Portfolios were behaving. In the following analysis, we’re only looking at four trading days, so take it all with a large grain of salt.

The first point to make is that rebalancing the Portfolios a few weeks ago was a good call, at least in the short run. No, I didn’t see the recent sell-off coming.

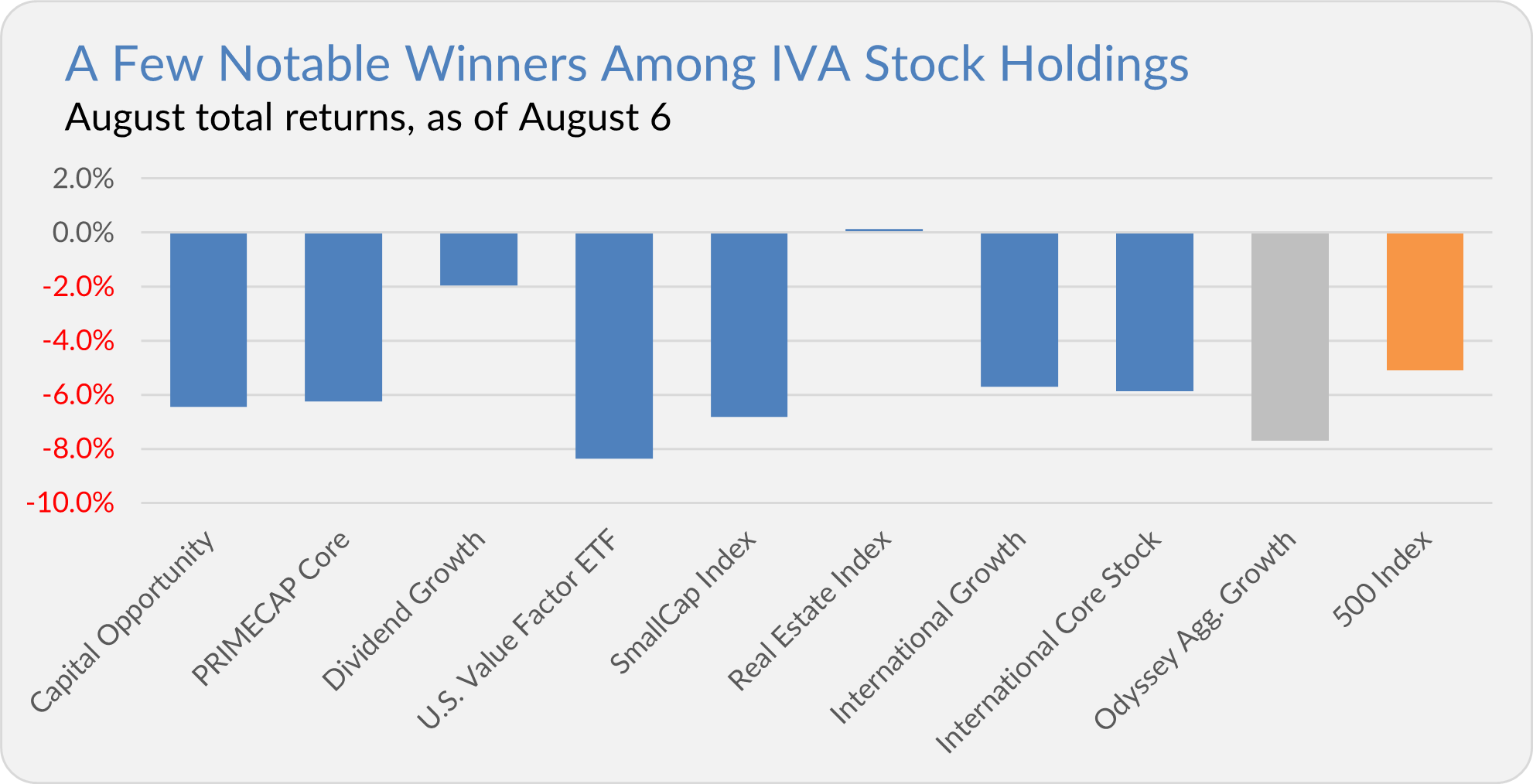

Looking under the hood of the Portfolios, the first chart shows how the stock funds have performed in August. I’ve included PRIMECAP Odyssey Aggressive Growth (POAGX) because many of you (like me) own the fund.

Dividend Growth (VDIGX), which has been a drag on performance this year, delivered solid downside protection over the past few days. That’s encouraging.

The recently purchased Real Estate Index (VGSLX) has started well in the Aggressive and Aggressive ETF Portfolios, with a 0.1% gain in August.

Admittedly, I’m a little disappointed that SmallCap Index (VSMAX) and U.S. Value Factor ETF (VFVA) didn’t provide more downside protection this month, but, as I said, it’s four days in the market.

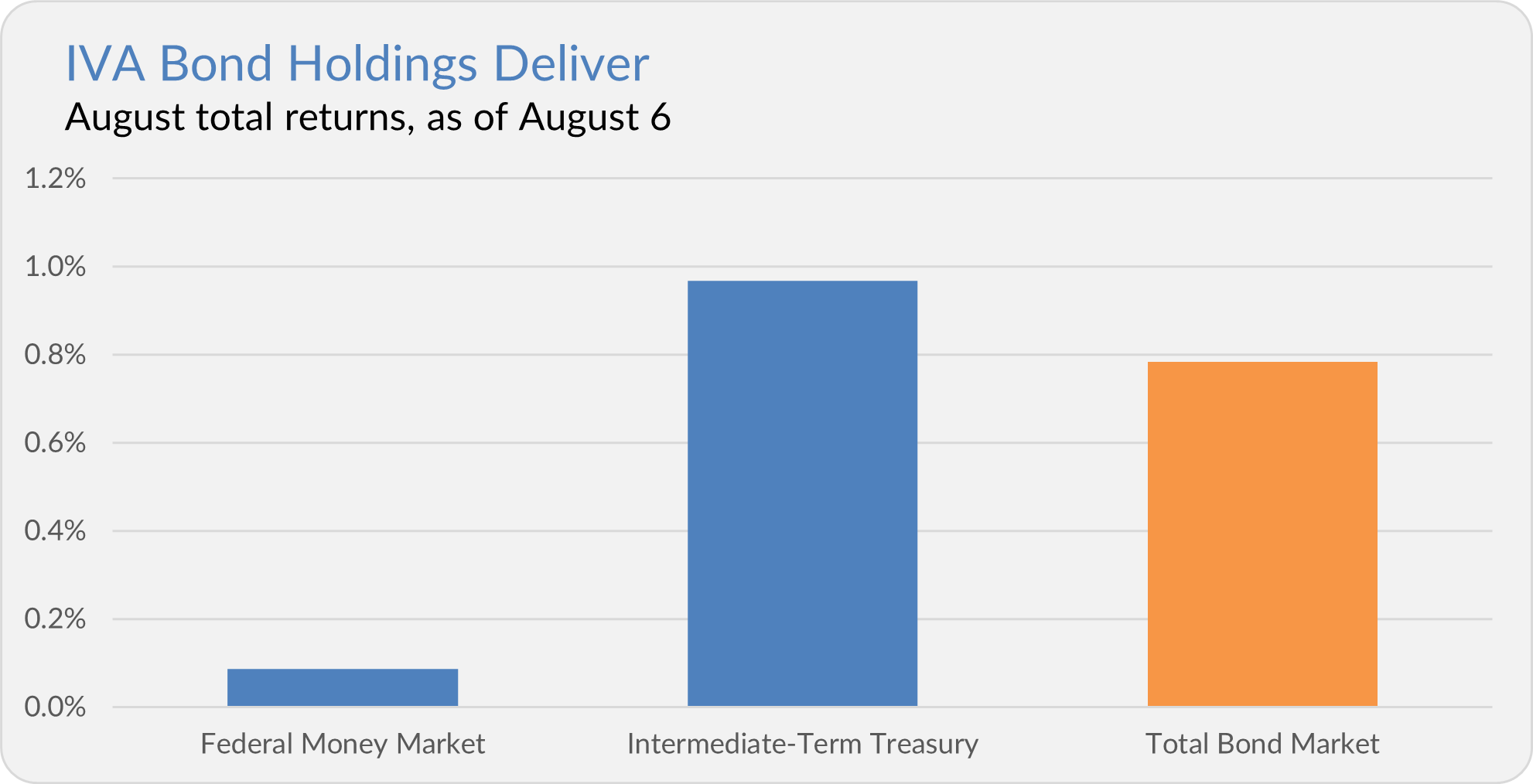

On the bond side of the portfolio, Intermediate-Term Treasury (VFITX) is up 1.0% in August, which is what I would’ve hoped to see when stocks were selling off. For the record, that’s better than Intermediate-Term Investment-Grade’s (VFICX) 0.4% return.

To be fair, Short-Term Investment-Grade (VFSTX) has outperformed Federal Money Market (VMFXX) 0.4% to 0.1% in August. But I won’t complain about having cash on hand when stock markets are falling and volatility is spiking.

Onwards.