Executive Summary: In this article, I analyze Dividend Growth and Dividend Appreciation Index (and ETF). The dividend funds’ recent underperformance reflects a market cycle favoring tech giants—not a flaw in strategy. Focusing on dividend growers offers resilience in bear markets. Investors should remain patient; when cycles shift, Dividend Growth is poised to deliver solid, risk-aware returns.

Should you stick with an underperforming fund (manager) or cut and run?

Investors in actively managed funds will undoubtedly face this question at some point in their investment lifetimes. After all, no manager outperforms all the time. And don’t kid yourself into thinking you’ll own funds only when they are outperforming.

Frankly, the only way to never find yourself in a market-trailing position is to own the market via something like 500 Index (VFIAX) or Total Stock Market Index (VTSAX). Buying a market tracker is a viable path for investors, but I’ve always taken a different (more active) path with my IVA Portfolios and my personal portfolio.

While I took action in the Portfolios to manage risk and pursue some opportunities in July, my trades did not involve the two largest stock funds in the Portfolios—Dividend Growth (VDIGX) and Capital Opportunity (VHCOX)—even though neither of these engines has been firing on all cylinders for some time.

I wrote (in-depth) about the PRIMECAP Management team a year ago and will do so again in December when their original Vanguard fund, PRIMECAP (VPMCX), celebrates its 40th anniversary.

So, today, I’m turning my attention to Dividend Growth. I’ll also discuss Dividend Appreciation ETF (VIG), which I recommend in the Aggressive ETF Portfolio. (Note: In this analysis I use the mutual fund shares (VDADX) of the dividend index fund. As I’ve explained, the mutual fund and ETF shares are virtually identical.)

Key Points

- Dividend Growth has delivered market-like returns with less risk over the full market cycle.

- Participating in bull markets and holding up better in bear markets is a good combination for a core holding.

- Don’t blame Peter Fisher for Dividend Growth’s lagging returns this year.

- A challenging run the last two years obscures Dividend Growth’s potential for outperformance.

Consecutive Off Years

Why are we talking about Dividend Growth?

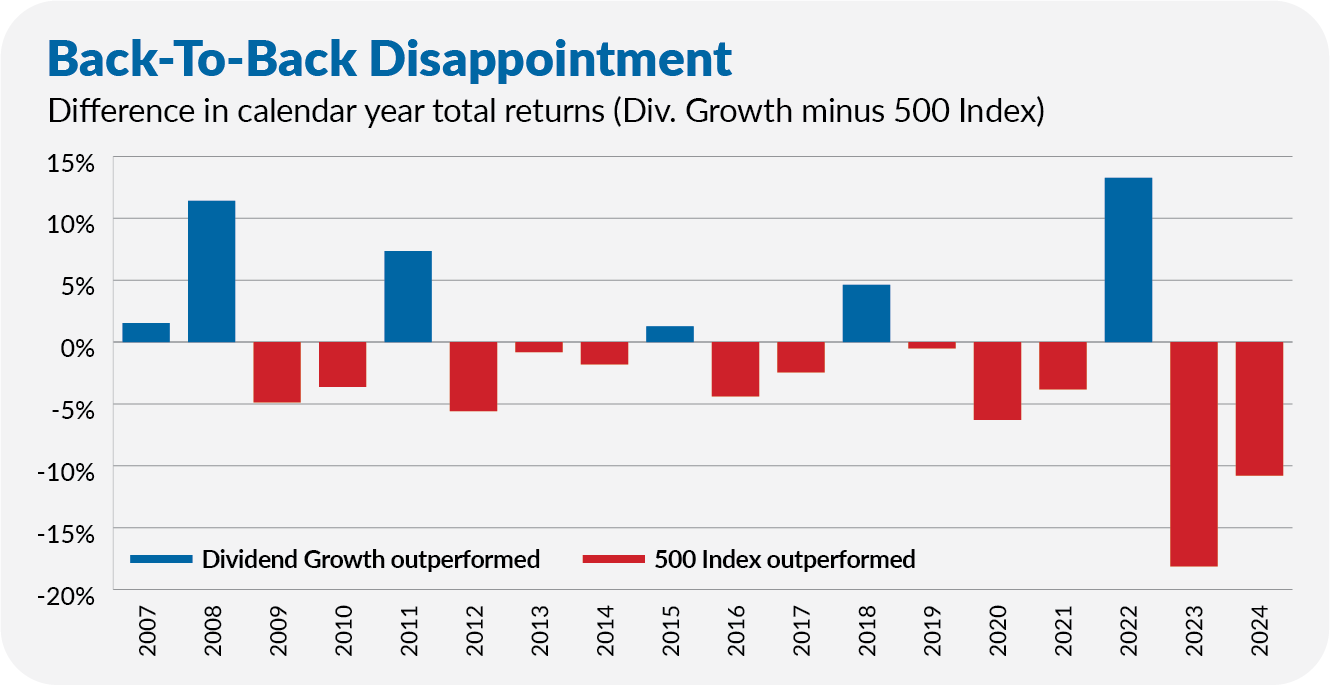

The short answer is that the fund had its worst year relative to 500 Index in 2023, gaining just 8.1% while the index fund returned 26.2%. And it has continued to lag in 2024, up just 10.1% through October, nearly eleven percentage points behind 500 Index’s 20.9% return.

For a historical perspective, the chart below plots the difference in annual returns between Dividend Growth and 500 Index. When the bars are above zero, the actively managed fund outperformed. While 2022 was Dividend Growth’s best year relative to the flagship index fund, the last two years have been its worst.

So, what the heck is going on here?

Don’t Blame Fisher

Let me state clearly: Dividend Growth’s poor (relative) performance in 2024 has nothing to do with long-time manager Don Kilbride handing the reins to his successor, Peter Fisher, at the start of the year.

Why am I so confident saying that?