Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, November 16.

There are no changes recommended for any of our Portfolios.

Let's start off this week with a few Vanguard-related updates:

First, capital gain distribution season is fast approaching, and Vanguard reported estimates for fund distributions on Monday. Premium Members can find my coverage of year-end distribution season here and here.

Second, Global Environment Opportunities (VEOIX), Vanguard’s newest ESG fund, exited its subscription period today. That means the fund is no longer only collecting cash but is investing that cash in a portfolio of companies. I’ll have more to say on the fund as it gets up and running but if you’re thinking of investing here, I took a quick look at the strategy’s track record a few weeks ago.

Finally, Antonio Picca, the former lead manager of Vanguard’s factor ETFs who departed the firm in September after five years, has emerged. Picca, according to LinkedIn, is now at Goldman Sachs leading their single-stock Systematic Trading Strategies (STS) group. I take that to mean he’ll still be developing computer-driven strategies for picking stocks—but at Goldman, not Vanguard.

Turning to the markets ... Dan and I often talk about the amount of noise and the lack of news in the headlines and media. That noise can distract investors and make it hard to find the important signals.

This past week there has been a lot of noise out of the “cryptosphere” as the second-largest crypto exchange, FTX, blew up in spectacular fashion. Unless you are loaded up on bitcoin or other cryptocurrencies—and if you are, you probably don’t want to keep reading—this is more noise than signal. Cryptocurrencies are hardly systemic; heck, the point of them is to be outside the system.

I don’t own and haven’t owned any cryptocurrencies, and I view them as a speculation—not an investment. As with any speculation putting money into crypto could work spectacularly well or blow you up. Which means don’t put more money in than you’re willing to lose.

With Donald Trump announcing that he’ll be running for office again in 2024 it is not going to get any easier for investors to tune out the noise. Love him or hate him, Trump makes headlines and stirs emotions. That’s generally not a good mix for investors.

Stocks and bonds had a darned good day on Thursday last week, showing once again that attempting to time the markets could mean missing out on spectacular, one-day wonders. 500 Index (VFIAX) gained 5.5% and Total Bond Market Index (VBTLX) rallied 2.0%—a big move for bonds. The catalyst for the move was an inflation-read that came in lower than expected. The Consumer Price Index (CPI) was “only” up 7.7% over the year ending in October. That’s down from 8.2% in September and the June high of 9.1%.

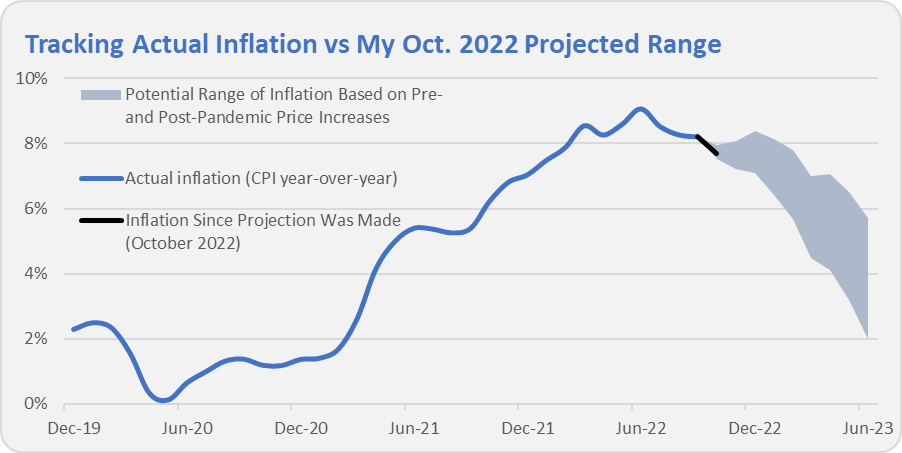

Frankly, I don’t think anyone should’ve been surprised that inflation ticked lower. A month ago, I shared a chart showing actual inflation and some potential future paths for the pace of price increases. My assumptions were pretty simple: I looked at what would happen if prices continued to rise at the post-pandemic average of 0.6% per month or if the pace of increases slowed down and prices only rose at the pre-pandemic average of 0.2% a month. I figured that would give us a reasonable range of expectations over the next six to nine months.

I’ve updated that chart and added in the most recent inflation reading below. I’ll revisit this chart in the months ahead to see if the inflation-range I laid out in October had any merit. I might as well try to keep myself honest, even if that’s not the norm in this industry—pretty much every talking head you see on TV is able to make wild predictions without being held accountable. (That’s something to keep in mind as we approach year-end and “outlook” season.)

After a good October, stocks and bonds are continuing to gain ground in November and a number of our Portfolio holdings have had a nice couple of weeks. Topping the charts is International Growth (VWIGX) with a gain of 15.0%—again, a short-term performance jump you wouldn’t want to have missed. Foreign stocks are having a good month and the falling dollar has helped, but the fund’s China holdings in (Tencent and Meituan) and semiconductors (Taiwan Semi and ASML) are driving returns with gains between 23% and 40%.

The three PRIMECAP-run funds are up between 5.1% and 5.6% this month which puts them in the top four diversified U.S. stock funds in Vanguard’s stable—MidCap Growth Index (VMGMX) has also snuck in with a gain of 5.2%.

Those strong returns are helping to offset lagging returns from Dividend Growth (VDIGX) and Health Care ETF (VHT). But that’s part and parcel of building a diversified portfolio—some funds lead when others lag, and vice versa. If every fund is lagging or leading at the same time, well, you’re not diversified.

Plus, we’re talking two weeks here, so let’s not get too excited by International Growth’s rally, nor too put-off by Dividend Growth’s trailing numbers.

Drawing the performance lens back a bit further than two weeks, one thing that jumps out to me is the handful of U.S. stock funds that are now showing positive returns for the year. Value Factor ETF (VFVA), Equity Income (VEIPX) and High Dividend Yield Index (VHYAX) are in the black. The gains may be less than 1% but a gain is a gain—especially during a bear market—and on a relative basis the outperformance is huge.

Our Portfolios are not showing positive returns for the year through Tuesday, but performance continues to trend in the right direction. The Aggressive Portfolio is down 13.7%, the Growth ETF Portfolio is off 16.5%, the Growth Portfolio is down 12.9% and finally the Moderate Portfolio is off 10.4%. This compares to a 16.1% decline for Total Stock Market Index (VTSAX), a 16.4% drop for Total International Stock Index (VTIAX), and a 13.7% decline for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2065 (VLXVX), is down 15.7% for the year and its most conservative, LifeStrategy Income (VASIX), is down 12.1% for the year. Vanguard’s poster child for diversified portfolios, representing the firm’s best thinking, Managed Allocation (VPGDX) is down 8.6%.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.