Executive Summary: I analyze Vanguard’s family of large-stock growth funds in this article. I give you my top picks and explain why I’m changing my rating on three of Vanguard’s four large-stock growth index funds. I also examine the three PRIMECAP-run funds and U.S. Growth.

The investment world debates whether growth stocks beat value stocks to no end. I shared my take on the question a few weeks ago—see here.

The bottom line is that the entire growth versus value investment conversation is a distraction. Most investors would be better served owning a diversified portfolio with stocks exhibiting what you and I would consider growth and value characteristics.

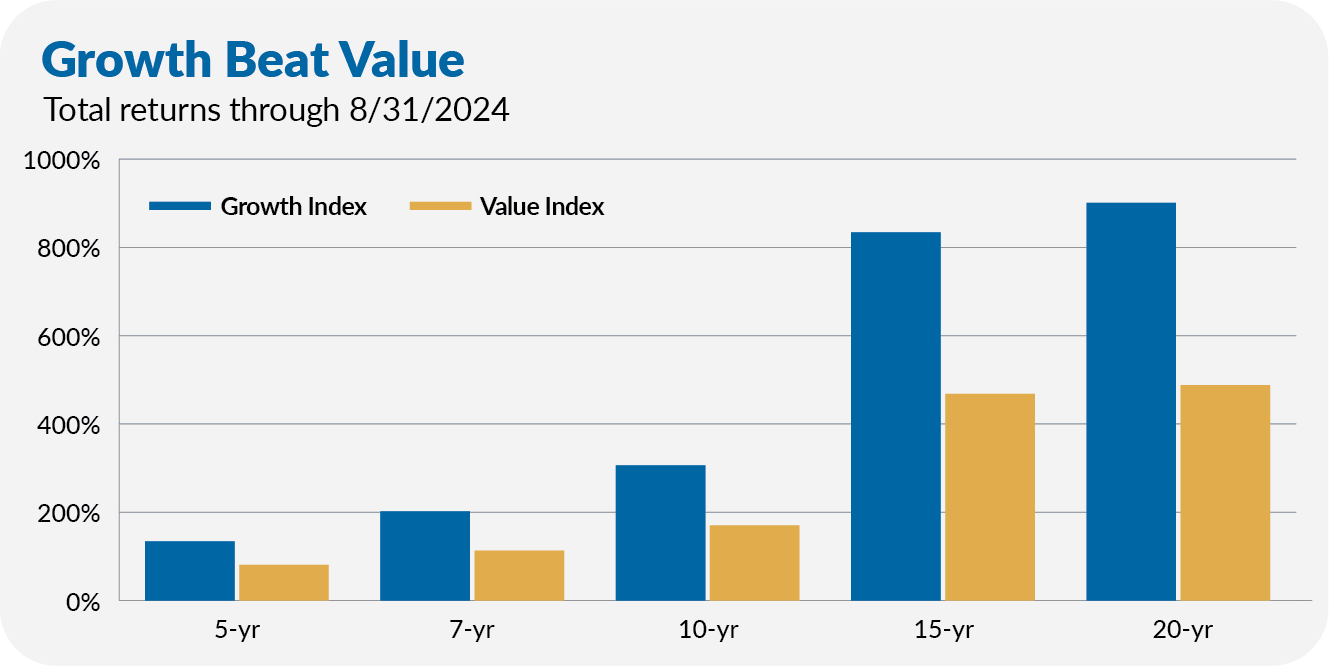

That said, recent history (even going back 20 years) suggests that growth stocks (defined as those with better-than-market earnings growth rates) are vastly superior to value stocks (which typically sport higher dividend yields and sell at smaller multiples to their per-share earnings or book value).

To wit, Growth Index (VIGAX) has outpaced its sibling, Value Index (VVIAX), over the past five, seven, 10, 15 and 20 years. It’s not even close. For example, over the last two decades, the growth fund’s 901% total return is nearly double the value fund’s 488% gain.

However, let me offer a word of caution: Markets are cyclical, and growth stocks’ run of dominant performance will end. Timing the turn of the cycle is impossible.

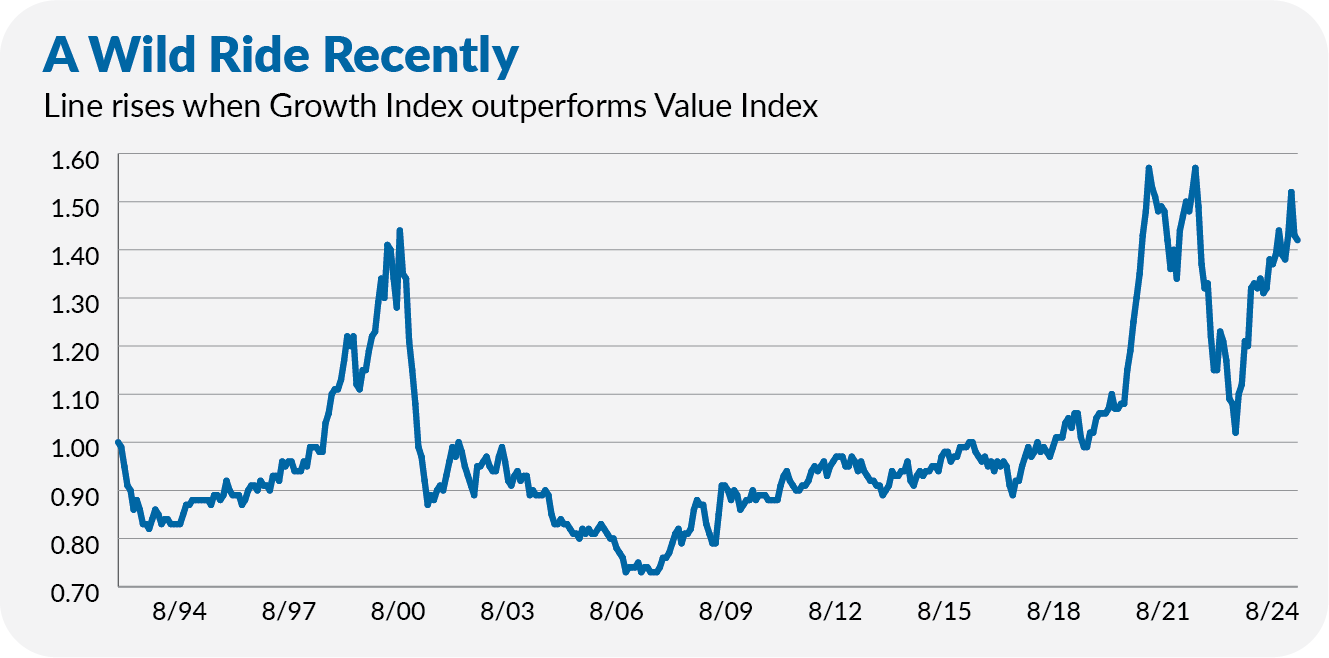

The chart below shows the relative performance of Growth Index and Value Index since their 1992 inception. The line rises when growth stocks are leading. When the cycle turns from growth to value, it can turn fast.

For example, in the first nine months after the bursting of the tech bubble (the sharply declining line between June 2000 and March 2001), Value Index gained 5% while Growth Index fell by nearly a third. Value stocks then carried on outperforming for another six years or so.

Or again, from November 2021 through 2022, the value index produced a 3% return, while growth stocks fell 37%. Granted, that last shift from growth to value dominance was short-lived, as artificial intelligence (AI) helped spark another growth stock boom.

As the chart above makes clear, growth stocks are leading value stocks by a margin we’ve only seen at the peak of the tech bubble and the post-pandemic rebound.

This suggests that the growth portion of many investors’ portfolios may be overheating, or if you’re still looking at the chart, it’s setting us up for a change in dominance. This doesn’t mean you should dump all your growth funds—again, I own a mix of growth and value funds—but if you are a die-hard growth investor, keep your expectations in check.

At this point, I’ll leave the question of whether you should be rebalancing your growth and value holdings and turn to an evaluation of Vanguard’s large-stock growth options.