Focusing on after-tax returns is nothing new for The Independent Vanguard Adviser—it’s been a mainstay of our value proposition for subscribers for years. And thanks to some work I’ve been doing over the past several months, I now have an enhanced way to track and calculate after-tax returns, giving me the ability to dive deeper into the topic than before. For instance:

- In Taxing Returns, I defined some key terms and provided a snapshot of Vanguard funds’ after-tax returns.

- In Avoiding Tax Bombs, I dispelled the myth that low turnover funds are more tax efficient, while giving you better tools to identify funds that could saddle you with a large capital gains distribution.

- In Are ETFs More Tax Efficient? No., I showed you how the Admiral share class of Vanguard’s index funds are just as tax friendly as their ETF siblings.

You and I have finally arrived at the “big” question: whether active funds beat low-cost index funds after taxes. I feel I owe you a bit of an apology, because there’s actually a very simple answer to this question: No, the average active fund does not outperform a low-cost index fund after taxes.

If you want to keep it simple and keep capital gains distributions to a minimum, then pick an index fund—there’s nothing wrong with that.

But that’s hardly the end of this story. Remember that we are investing to maximize our after-tax returns, not to minimize our tax bill. Plus, I’ve never given a blanket endorsement to either indexing or active management—I’m very selective in the managers I partner with as well as the index funds (or ETFs) that I think are worthy of my investment dollars and yours.

So, let’s dig a little deeper, look at some specific funds and see if we can come up with a better answer to the active versus passive question.

Key Points

- The average active fund trails a low-cost index fund before and after taxes.

- Vanguard’s index funds are consistently tax friendly, while the tax efficiency of their active funds vary through time.

- Some active funds—think Dividend Growth (VDIGX), Capital Opportunity (VHCOX) and International Growth (VWIGX)—have beaten comparable index funds even after taxes are factored in.

When Average is Below-Average

It’s fairly well established that the average active fund underperforms a low-cost index fund before considering taxes. This is only logical: Since active investors make up the market, if you can match the market at a lower fee (which is what index funds aim to do), you’ll beat the average fund after fees.

Even at Vanguard, where the fee headwind is not as strong, it’s not easy for Vanguard’s chosen active managers to beat the market. The table below shows the 10-year returns through the end of the first quarter for Vanguard’s diversified U.S. stocks funds. Before taxes, six of them outpaced Total Stock Market Index (VTSMX)—three of which were managed by the PRIMECAP Management team—while 10 funds trailed behind the index fund.

However, over the course of a full market cycle, index funds are more tax friendly (they generally pay out less in the way of capital gains) than active funds. So, it follows that if the average active fund trails a low-cost index fund before taxes, then the average fund certainly trails after taxes are accounted for.

It’s no surprise to see the total market fund moves up the ranks after taxes are taken into account. After taxes, only three active funds beat Total Stock Market Index over the prior decade.

| 10-Year Before-Tax Return | 10-Year After-Tax Return | ||

| PRIMECAP | 13.2% | PRIMECAP | 11.7% |

| Capital Opportunity | 13.1% | Capital Opportunity | 11.6% |

| U.S. Growth | 12.7% | U.S. Growth | 11.5% |

| PRIMECAP Core | 12.3% | Total Stock Market Index | 11.3% |

| Growth & Income | 12.1% | PRIMECAP Core | 10.9% |

| Dividend Growth | 11.8% | Dividend Growth | 10.7% |

| Total Stock Market Index | 11.7% | Growth & Income | 10.3% |

| Diversified Equity | 11.6% | Diversified Equity | 9.9% |

| Explorer | 10.9% | Equity Income | 8.9% |

| Windsor | 10.7% | Strategic Equity | 8.9% |

| Strategic Equity | 10.6% | Windsor | 8.9% |

| Windsor II | 10.3% | Explorer | 8.7% |

| Equity Income | 10.3% | Windsor II | 8.5% |

| Strategic SmallCap Equity | 9.5% | Strategic SmallCap Equity | 8.1% |

| Selected Value | 9.3% | Selected Value | 7.6% |

| MidCap Growth | 8.9% | Explorer Value | 6.9% |

| Explorer Value | 8.0% | MidCap Growth | 6.7% |

| Note: Total returns 3/2013 through 3/2023. Source: Vanguard and The IVA. | |||

Of course, this is just one 10-year period. Changing the timeframe can change the story … to a degree. And this particular decade saw large cap U.S. stocks dominate the markets.

Additionally, while I’ve narrowed this list down to just “diversified U.S. stock funds,” I’m still not necessarily comparing apples to apples. For example, Explorer (VEXPX) trailed the broad index fund after taxes, but that had more to do with being a small-cap growth fund than being an active small-cap growth fund. The active fund actually outpaced SmallCap Growth Index (VISGX) over the 10 years in question after taxes, though we’re talking about compounding at 8.7% versus 8.6%—not exactly a big win for the multimanaged Explorer.

I’m not trying to dispel the notion that the average active fund trails the indexes, but we have to use care when drawing conclusions from point-in-time returns. So, as I’ve done throughout this series of articles, I’m going to dive a bit deeper into the data on tax efficiency through time.

Tax-Efficiency’s Time Dependence

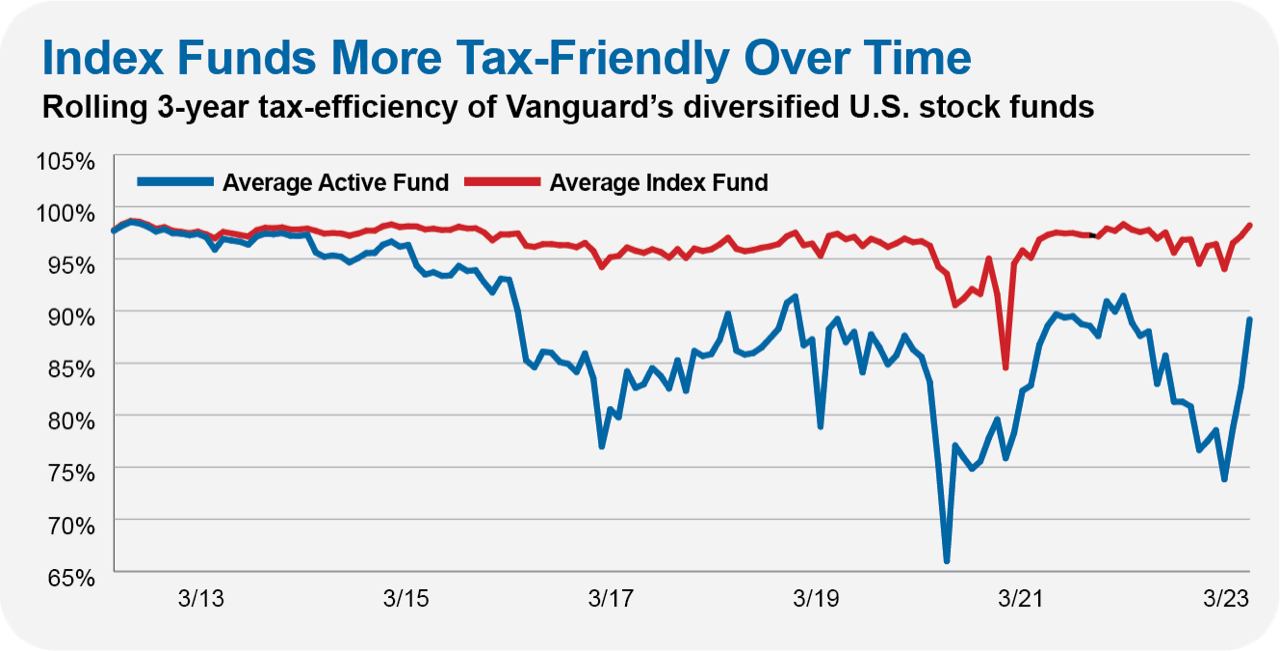

Let’s examine a claim I’ve made several times: Index funds are more tax friendly than active funds over time. The chart below shows the rolling three-year tax efficiency for Vanguard’s average active diversified U.S. stock fund compared to the firm’s average diversified U.S. stock index fund.1

While the active and index funds were on level footing for tax efficiency in the early 2010s, that changed over time—the active funds became less tax efficient while the index funds were more consistent.

Two questions jump out from the chart. First, why were active funds as tax friendly as index funds in the early 2010s? Second, how have index funds maintained their tax efficiency while active funds have lost some of theirs?