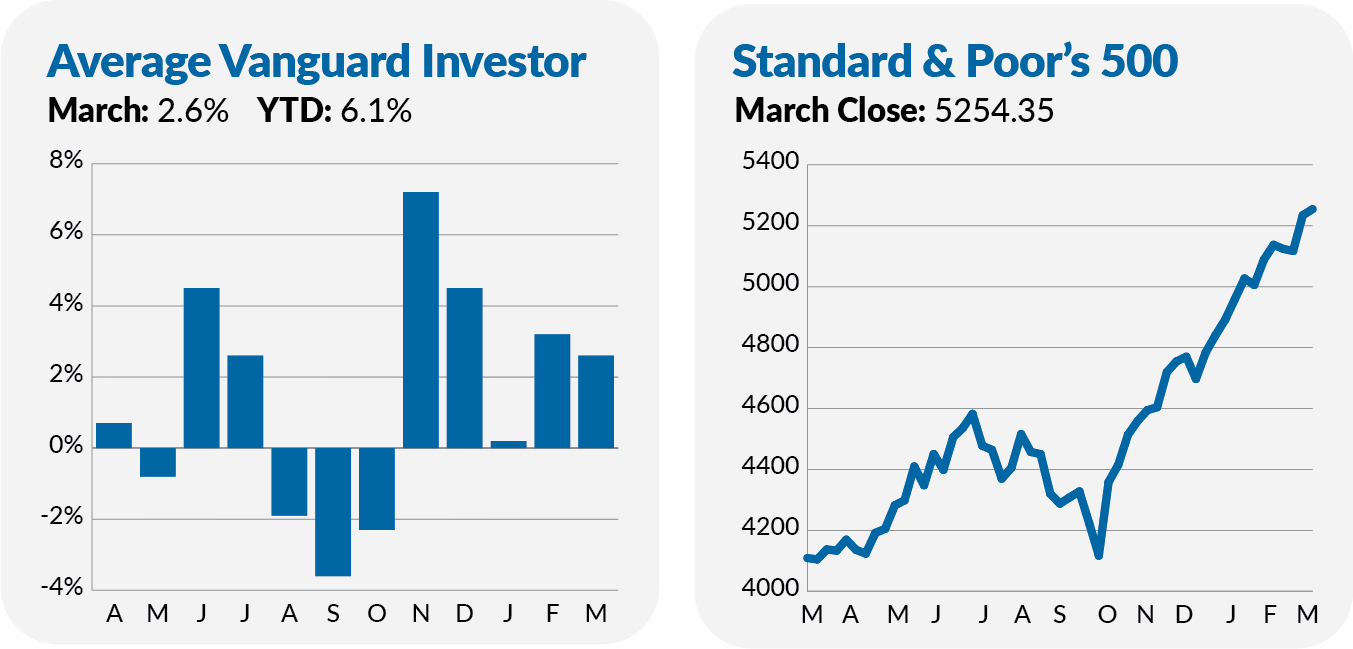

We are in a bull market. And during bull markets, asset prices reach record heights.

Here’s a quick rundown of all the “stuff” that set records in March: The S&P 500 index, the S&P 400 index (midcap stocks), Germany’s local market, Japan’s local market, the Stoxx 600 (like Europe’s S&P 500), India’s local market, bitcoin, gold.

Or, if you prefer to view it through a Vanguard lens, 50 of the firm’s U.S. and foreign stock funds set record (total return) highs in March. Everything from Total Stock Market Index (VTSAX) to Dividend Growth (VDIGX) to Capital Opportunity (VHCOX) to U.S. Value Factor ETF (VFVA) to European Index (VEUSX) to Global Minimum Volatility (VMVFX) set new highs.

While there is plenty of debate about whether the stock market is in a bubble, and I find the concentration of a handful of stocks at the top of the market worrisome, new highs alone don’t raise my alarm bells. As I said, this is what happens during bull markets.

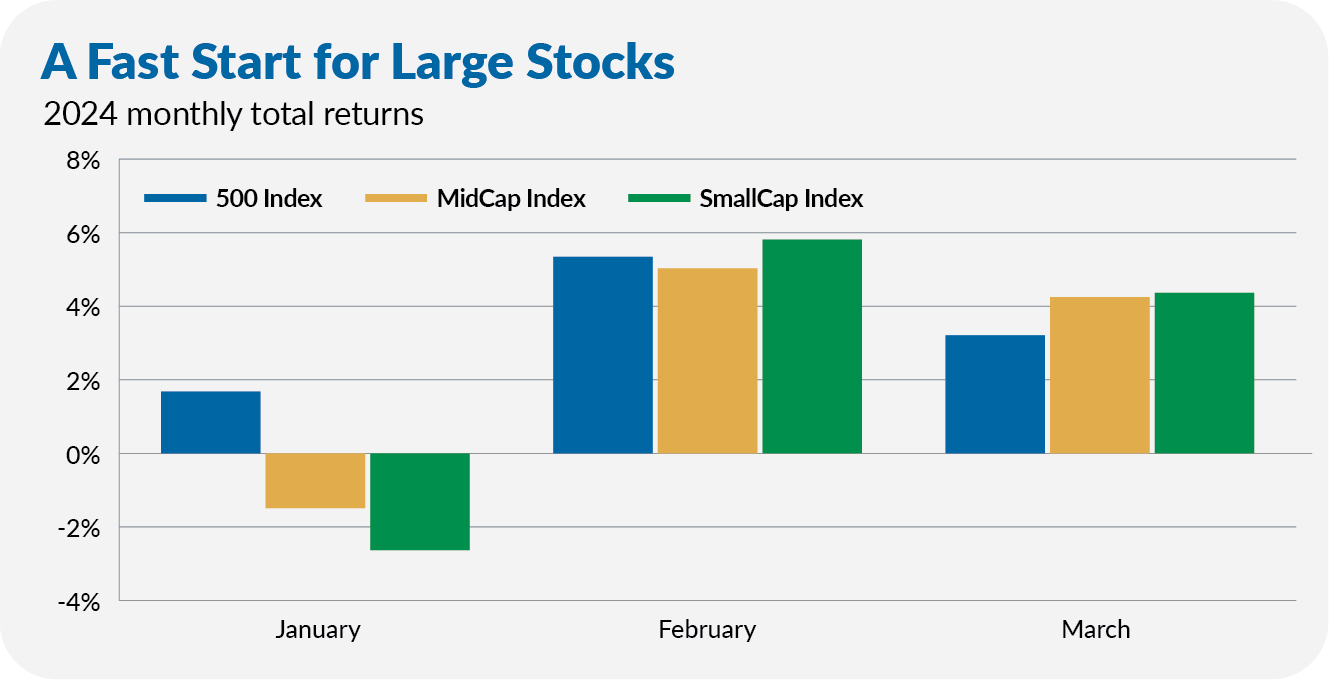

Notably absent from the list of Vanguard funds setting new highs are MidCap Index (VIMAX) and SmallCap Index (VSMAX). But, as of the end of March, both index funds needed gains of less than 1% to reach new peaks.

Yes, 500 Index (VFIAX) is still leading the pack for the year. The flagship index fund’s 10.5% return is ahead of MidCap Index’s 7.9% gain and SmallCap Index’s 7.5% advance. But, as you can see in the chart below showing the monthly returns of each index fund this year, 500 Index’s edge was gained in January. In other words, the bull market is broadening out a bit.

If you’re a contrarian and looking for pockets of the market that are still priced below prior highs, here are a few Vanguard funds that have some ground to make up: