Hello, and welcome to the IVA Weekly Brief for Wednesday, October 2.

There are no changes recommended for any of our Portfolios.

Don’t Play Politics with Your Portfolio

Vice-Presidential hopefuls Waltz and Vance duked it out on the debate stage last night. I’ll leave the political commentary to others. But, as we are in the home stretch of the Presidential election, let me warn you (once again) against mixing politics and your portfolio.

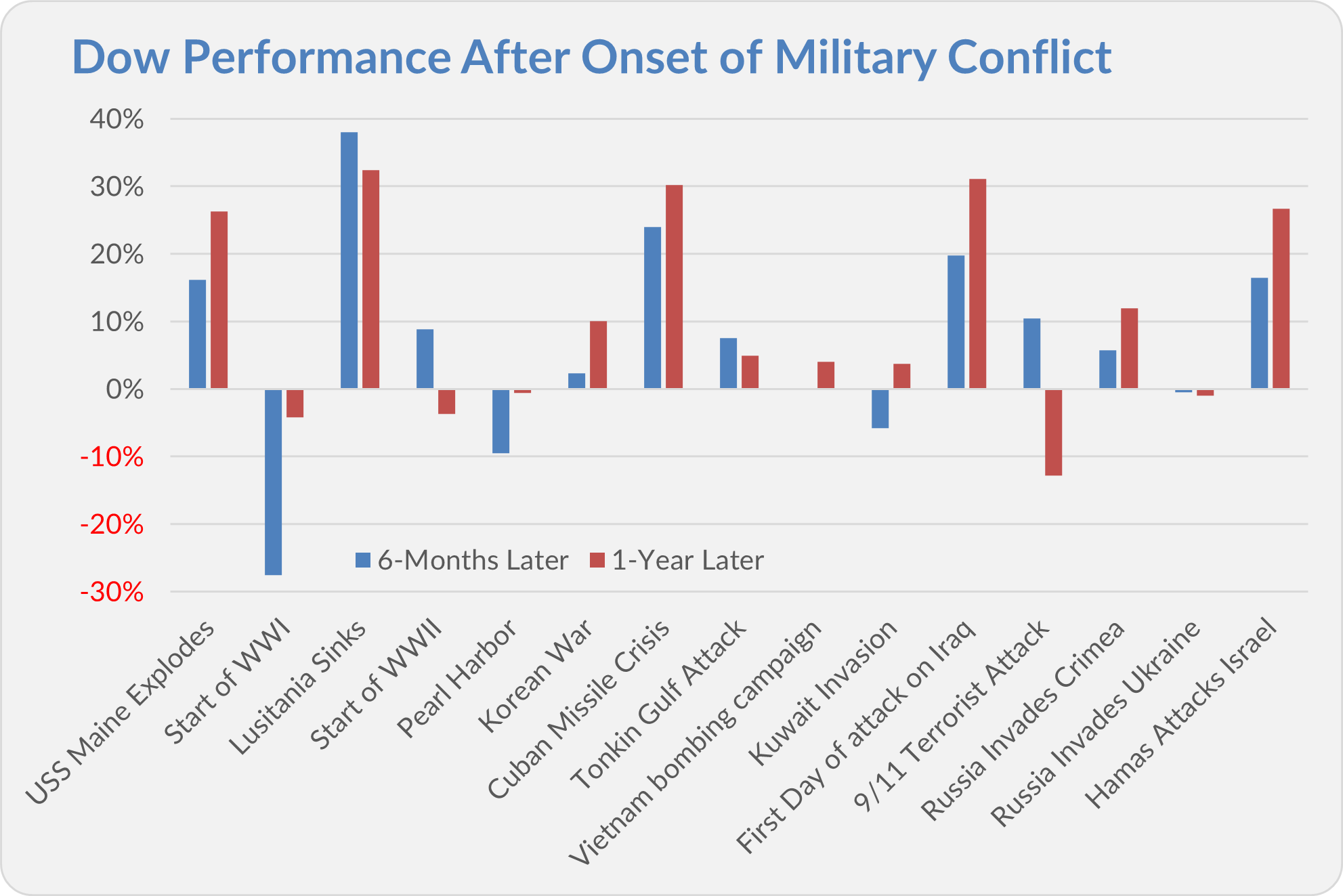

Also, remember to keep geopolitics out of your portfolio. Yes, I know that stocks sold off yesterday—500 Index (VFIAX) slid 0.9%—as hostilities between Iran and Israel escalated. However, in the (roughly) 12 months since Hamas attacked Israel (on October 7, 2023) 500 Index has returned 34%.

For more perspective, the chart below shows how the Dow Jones Industrial Average (Dow) fared following the onset of military conflicts over the past 125 years. On average, the Dow gained 7% in the first six months, on its way to advancing 11% in the first year. I don’t mean to downplay the human toll of these conflicts, but war shouldn’t deter investors from spending time in the market.

Of more immediate consequence for the U.S. economy (and hence, company earnings) is the dockworker's strike at dozens of ports (primarily) on the East Coast. A temporary shutdown shouldn’t be that big of an issue, but a protracted disruption in supply would be problematic—think higher prices.

These issues notwithstanding, I’m not looking to make any changes to the IVA Portfolios. We’ve invested through snarled supply chains before. Even if I knew how this strike would resolve (and when), it’s hard to say exactly where you’d want to place your bets in the market. Speaking of which …

Are You a Trading Wizard?

In Back to the Future Part II, Biff uses a sports almanac (remember those!?) from the future to make a fortune. Surely, if we had tomorrow’s news, we could make a fortune in the stock market, too. Right?

Well, the team at Elm Wealth built a fun Crystal Ball Trading game to test this idea. They took 15 front pages from The Wall Street Journal (one page from each of the past 15 years) and blacked out anything specifically about how stocks or bonds fared. But you get all the other information—unemployment reports, Fed announcements, etc.

Then, with that knowledge in hand, the game allows you to trade the S&P 500 and a 30-year Treasury bond future—you can go long or short and use up to 50x leverage based on what you think these securities will do.

As I often say, trading on economic news is not easy. Not only must you predict the data correctly, you’ve got to anticipate how all the market’s other traders will respond to it. This game removes step one—you know the data! So, can you profitably predict traders’ reactions?

I’ll let you test your trading ability here. I think you can learn a good lesson by playing along.

In full disclosure, I was only right 55% of the time on my way to making a 16% profit. Given my “perfect” knowledge, I don’t think anyone should be too impressed by those results. Let’s just say that I won’t start day trading any time soon, and I hope you don’t either. If you're willing to say so, let me know how you make out.

Our Portfolios

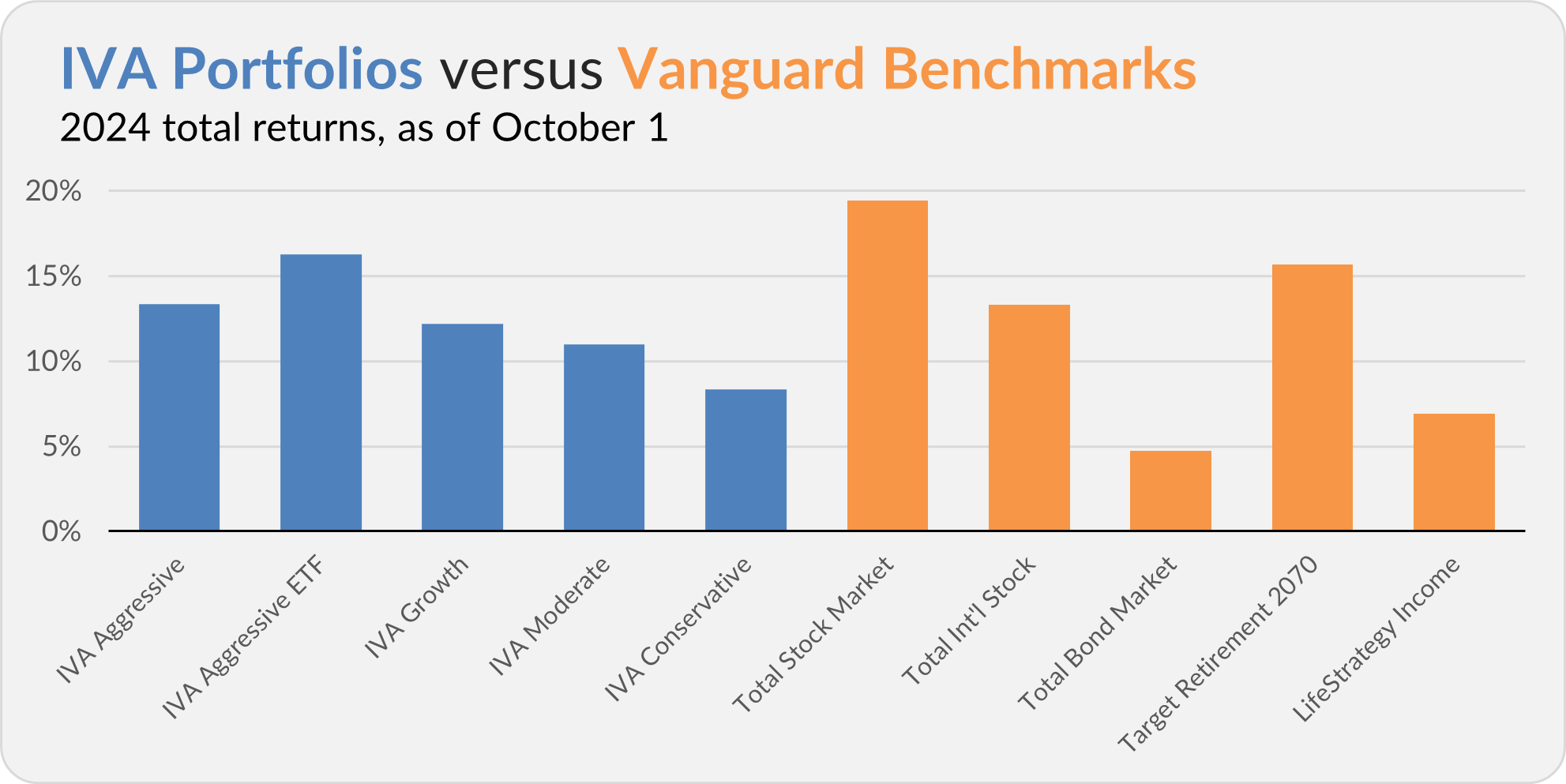

Our Portfolios are showing solid absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 13.4%, the Aggressive ETF Portfolio is up 16.3%, the Growth Portfolio is up 12.2%, the Moderate Portfolio is up 11.0% and the Conservative Portfolio is up 8.3%.

This compares to a 19.4% gain for Total Stock Market Index (VTSAX), a 13.3% return for Total International Stock Index (VTIAX), and a 4.7% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 15.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 6.9%.

IVA Research

Premium Members received two IVA articles yesterday.

In the Monthly Recap, Gains Can Lead to More Gains, I analyzed the IVA Portfolio’s performance in the third quarter. Also, with 500 Index up 35% over the past 12 months, I looked at what strong past returns tell us about the road ahead.

In Spending Your Way Through Retirement, I weighed the pros and cons of various retirement spending strategies.

Until my next IVA Weekly Brief, have a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.