Our Purpose

To help serious Vanguard investors make meaningful investments by providing independent, honest, unbiased coverage of all things Vanguard and investment advice and education you can use in a language you can understand.

Our weekly publication provides thoughtful, contextualized insights and advice, alongside Model Portfolios and fund recommendations, to help you achieve investment success—however you define it.

Much of what passes for investment advice and information is actually entertainment. Here today, gone tomorrow. With no accountability.

If you're looking for scrolling ticker-tapes, flashing headlines, act-before-it's-too-late stock tips, and weekly 10-best lists, we're not for you.

The Independent Vanguard Adviser is the go-to resource for the serious Vanguard investor who doesn't want to make moves every minute, while making every move count.

Not all Vanguard funds are created equal and low fees will never turn a lousy fund into a winner—even the cheapest Vanguard fund could be too expensive.

As an unbiased observer, we'll tell you what's what at Vanguard—the good and the bad.

And we'll tell you how to succeed as a Vanguard investor; like us.

If more information and faster updates made us better investors, we'd all be super investors thanks to Google and CNBC.

But more than content is needed; context is everything.

You want to make meaningful investments, but if your investment decisions are based solely on the content of the daily media machine, without intention and context, those decisions won't do you or your portfolio much good.

The Independent Vanguard Adviser has offered thoughtful, contextualized insights and investment advice concerning Vanguard and the markets for over 30 years.

The Independent Vanguard Adviser provides the information, updates, insights, context and advice we'd want our friends and family to have. And it's all in a language that's accessible and understandable.

No get-rich-quick schemes. No baffling with bulls%!#. No snake oil promises. Not here.

And we aren't just sharing information; we are invested alongside you. That's a promise.

Time in the market...it's simple, not easy.

“You are my lighthouse when it comes to Vanguard.”

“I want to thank you for your clarity and honesty. There is a lot of snake oil for sale; and lots of drama. You have a steady, thoughtful hand which is appreciated.”

“Enjoying your financial letter and process—made us financially secure!”

Hi, I'm Jeff DeMaso.

Welcome to The Independent Vanguard Adviser.

I've been a Vanguard investor for over a decade. Prior to launching this service, I co-wrote the award-winning Independent Adviser for Vanguard Investors newsletter alongside my mentor, Dan Wiener.

Together, we covered all things Vanguard as independent and sometimes critical observers. We provided practical investment advice while demystifying the investment markets and economic mumbo-jumbo—in a readable, understandable way.

While Dan has (semi-)retired, I continue to carry the mantle. And I'm not just an armchair pundit shouting into the void. Over two decades while working at a multi-billion-dollar investment firm, I held titles that ranged from intern to CIO (and everything in between). I've walked the talk … and continue to do so.

A simple promise: My family and I will continue investing in the same funds and ETFs I recommend to you. Full stop.

Our Investment Results

As I said, there is no snake oil here. I don't sell dramatic performance claims—past results do not guarantee future performance. I firmly believe I can help you achieve investment success even if you don't follow one of my Portfolios.

But I know that for many of you, the performance of my recommendations is where the rubber meets the road. Also, frankly, I'm proud of our decades-long portfolio returns.

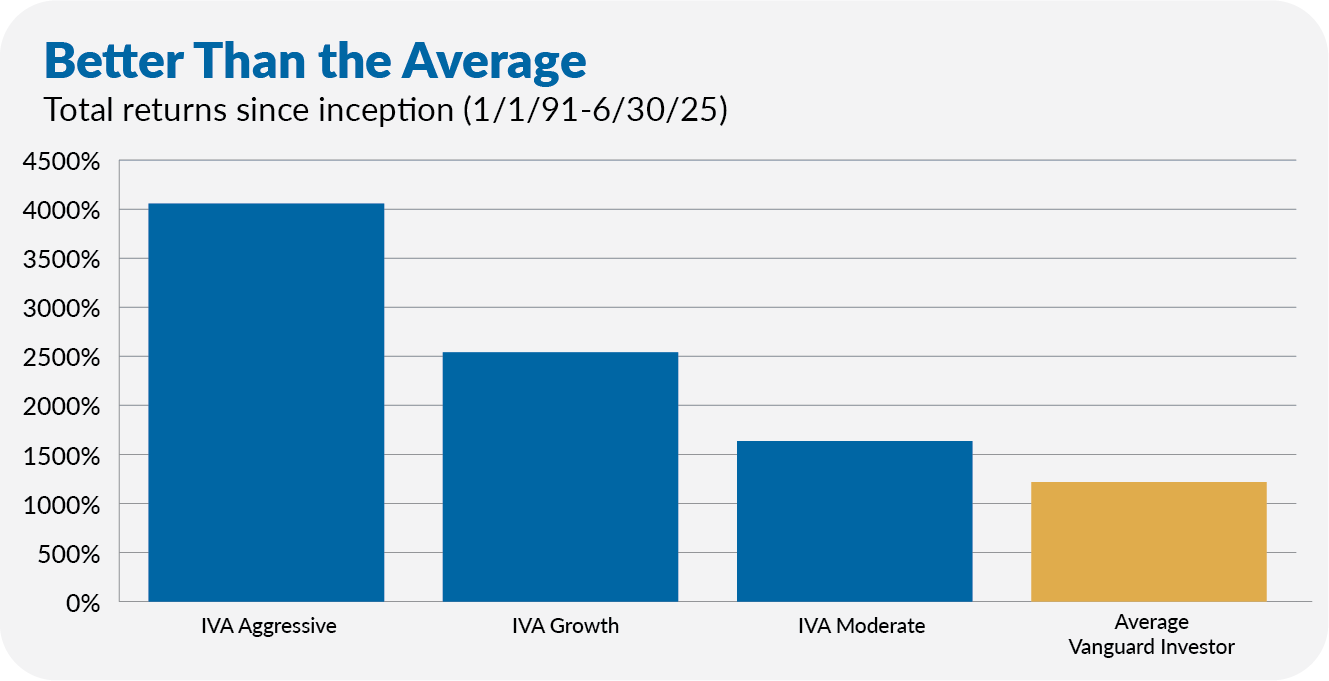

The bottom line is that first Dan, then Dan and me, and now I have been helping subscribers earn better returns than the average Vanguard investor for decades.

How We Invest

We have always followed a few well-articulated principles.

The investment world is riddled with claims of profitable market timing. They're all hogwash.

If you and I could successfully time the market, we would. But we can't—no one can, at least not consistently.

Successfully timing the market requires selling before markets fall and buying back in before they rise. Or the reverse. You need to make two correct calls to succeed with market timing.

Many investors have tried; some have gotten one trade right but not the second. The evidence, however, clearly shows that most trading harms rather than enhances returns.

As long-term investors, we know there will be corrections, bear markets and crashes. Rather than fear them, we see stock market declines as the price for participating in the compounding that stocks offer those with patience and fortitude.

We view downturns as opportunities to buy when others are selling.

It's a great time to be an investor.

You can access the stock and bond markets in a diversified, tax-efficient way at virtually no cost. I love index funds and ETFs for this.

But partnering with active managers can lead to index-beating returns. The thing is, you have to be very selective in choosing managers. Most active managers don't outperform their benchmark indexes or index funds over time.

I'm a realist. And I'm flexible. I partner with the best managers in Vanguard's stable where I can.

I'm also delighted to own an index fund (or ETF) where I lack confidence or conviction that a fund manager can give us the outperformance we want.

Diversification is essential because we can't predict the future. In short, you should diversify because not all your investment decisions will be profitable!

I see two sides to the diversification coin—risk reduction on one and exposure to opportunity on the other.

Owning a concentrated portfolio is a great way to make a fortune but also a great way to go broke. Being diversified reduces the risk that any one investment will derail your portfolio.

The hidden cost of a highly concentrated portfolio is missed opportunities, the things you don't own that could be the winningest investment you ever make. Being diversified gives you a better chance of owning assets that compound your wealth.

That said, you don't have to go overboard with diversification. The textbooks (and Vanguard) often take things too far. I promise you that I won't. And neither will you.

You'll never hear me say that investing is easy—it isn't. But keeping it simple can be highly effective. Adding complexity to your portfolio doesn't guarantee better outcomes.

Case in point, most college endowments—the epitome of complex portfolios—fail to beat a simple 60/40 portfolio of stocks and bonds like Balanced Index.

“I just finished reading your latest email and wanted to note the regard and respect I have for the knowledge, depth, clarity and wry humor encompassed in your writings … I started subscribing at least 10 years ago to help guide my kids, both of whom have had investments at Vanguard. Enough said…thanks!”

“I wanted to take a quick moment to offer a special thank you for today’s article, “Just Keep Going.” It was quite a long read, and I’m sure it took a ton of time to pull together, but it was one of the best financial articles I’ve EVER read—and I’ve been reading financial info for over four decades.”

“I have followed your portfolio guidance for three decades. I have to say that the power of compounding and regular contributions to our traditional IRAs has provided us with a very comfortable “nest egg” in retirement. You may not hear it from many readers, but you have made our future bright with no worries about finances. ”

How We Help You

We eat and breathe Vanguard, and our research is ongoing. Here's how we help Premium Members.

Model Portfolios

Prescriptive portfolios for all...whether you are aggressive or conservative, experienced or just starting.

Performance Review

Buy, hold and sell ratings on over 100 Vanguard funds and ETFs...Plus, all the data you need to make your own decisions

Weekly Brief

A weekly update on the markets and the economy...and the latest news from Malvern, PA (where Vanguard's HQ is located).

IVA Research

Weekly deep-dive research and education to make you a better informed and more confident investor.

Quick Take

When there's Vanguard news that deserves a faster response, we'll get the information you need in your hands as quickly as possible.

Trade Alerts

We don't trade often, but when we do, you'll receive an alert (via email) detailing what we recommend...and why.

| Free Members | Premium Members | |

|---|---|---|

| Weekly Brief | ||

| Model Portfolios | ||

| Trade Alerts | ||

| Performance Review Table | ||

| Weekly IVA Research Article | ||

| Quick Takes | ||

| Access to the archive of over 176 IVA Research articles and past issues of our prior publication |

If you're even a little curious (and if you've read this far, you probably are), you can sign up to receive the free Weekly Brief in your email inbox or start your free 30-day trial below: