Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, June 7.

There are no changes recommended for any of our Portfolios.

Bull Market?

Are we in a new bull market? We won’t be able to answer that question until more time has passed. But also, frankly, it’s not all that important.

I have seen multiple definitions of bull and bear markets—each as arbitrary as the next. A bear market is traditionally defined as a 20% decline from a high. But what should we call a 19% decline?

Some people measure the start of a bull market when stocks have rallied 20%. Others start the stopwatch when stocks have recouped all their bear market losses. Who is right? Who cares?

All these definitions don’t really matter in the long run. Stocks stumble from time-to-time (call it a bear market if you want, or if it’s a small decline call it a teddy bear), but that’s the price we pay to participate in the compounding machine that is the stock market.

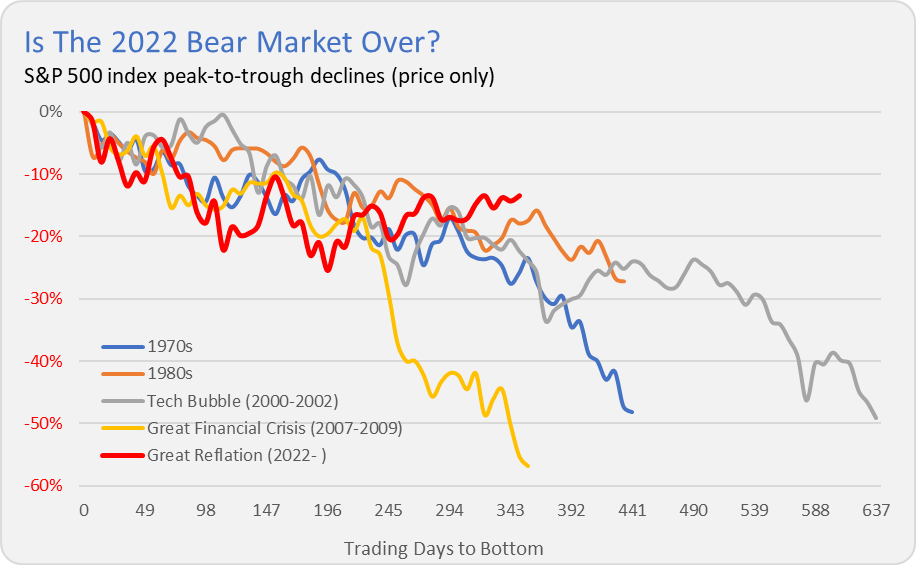

So, rather than squabble over whether this is a bull or bear market, let me try to put the recent decline and rebound into some context. The chart below compares the past 15 months or so of market action to the major bear markets of the past five decades. The chart shows the depths the market fell to before beginning to recover (so, peak to trough) as measured by the S&P 500 index (not counting dividends). (I’m also using weekly data as opposed to daily data to take some of the noise out of the chart.)

No two bear markets are alike. The 1970s bear market dropped 48% while the Great Financial Crisis bear dropped 57%. It took over 600 trading days for the tech bubble to burst. That bold red line is the market since peaking in January 2022.

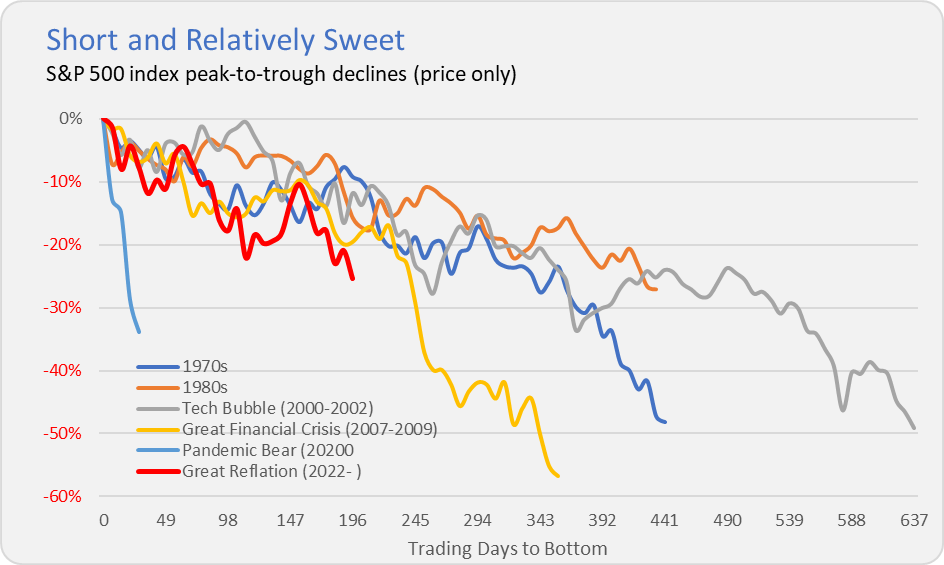

If the low for this bear market was reached in October (when the index was 25% below its January high), then this is what the chart would look like. (I added the COVID-bear market for some additional context.)

The bottom line is that if we’re truly in the early days of a bullish recovery we are doing so from one of the shortest and least painful bear markets of the past 50 years.

Bull for Vanguard, Bear for us

Prices are going up at Vanguard. The company just increased the annual service fee per Vanguard Brokerage Account to $25. Multiply that by millions of accounts and, well …

However, there are a few ways to avoid paying this fee: Probably the most common and easiest method is to sign up for e-delivery of statements, confirmations, reports, prospectuses, proxy materials, etc. (That’s what I do.)

If you want those paper statements, you’ll need over $5 million in “qualifying” Vanguard assets to avoid paying the $25 fee—which means that even many Flagship clients will be dinged!

Vanguard also won’t charge clients in their advisor programs—think Digital Advisor or Personal Advisor. Nor will the fee apply to business or trust accounts (registered under an employee identification number).

Oh. And if you still have the legacy mutual fund accounts that Vanguard’s been trying to get rid of for years, Vanguard will charge $25 for each mutual fund, regardless of whether you go paperless or not. To my reading of the rules, the only way to avoid the fee on the legacy system is by having at least $5 million invested at Vanguard. If that $25 per fund fee doesn’t raise your ire and finally motivate you to switch to the brokerage system, well …

You can find Vanguard’s updated commission and fee schedule here.

By charging $25 per mutual fund, Vanguard is trying to move people off the old legacy mutual fund platform. The $25 account fee on brokerage accounts, well, that’s really a “paper statement fee” (as one subscriber put it to me).

You’d think having more than a million dollars at Vanguard would immunize you from being nickeled-and-dimed but being a Flagship client doesn’t mean as much these days as it used to.

Our Portfolios

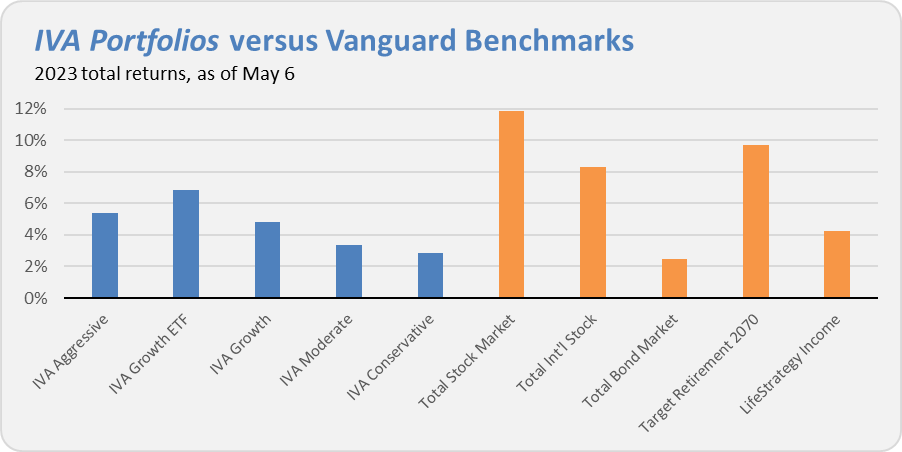

Our Portfolios are showing positive returns for the year through Tuesday. The Aggressive Portfolio is up 5.4%, the Growth ETF Portfolio has gained 6.8%, the Growth Portfolio is up 4.8%, the Moderate Portfolio has returned 3.4% and finally the Conservative Portfolio is up 2.8%.

This compares to an 11.9% gain for Total Stock Market Index (VTSAX), an 8.3% return for Total International Stock Index (VTIAX), and a 2.4% gain for Total Bond Market Index (VBTLX). Vanguard’s most aggressive multi-index fund, Target Retirement 2070(VSNVX), is up 9.7% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 4.3% for the year.

Until my next Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.