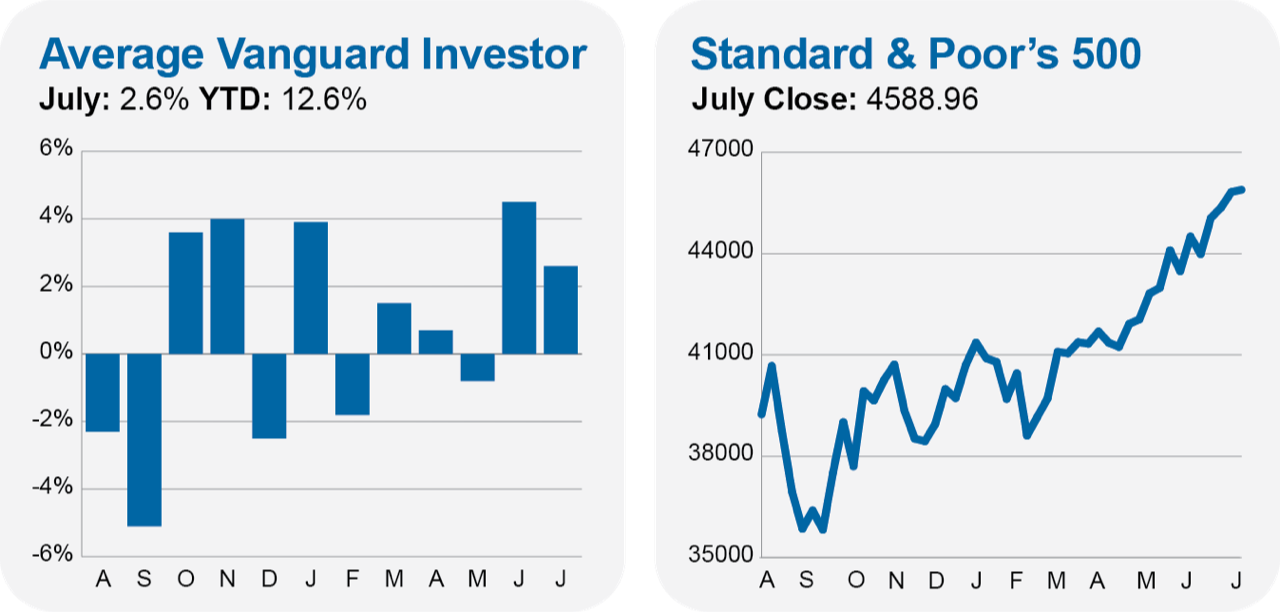

Investors have had plenty of reasons to smile this year.

500 Index (VFIAX) is up 20.6% on the year and just 1.9% below its all-time high (when you count dividends). SmallCap Index (VSMAX) hasn’t matched that pace, but it has returned 14.7% in 2023. Foreign stocks are trailing their U.S. counterparts, with Total International Stock Index (VTIAX) advancing 13.7%.

Last year was painful for bond investors, but Total Bond Market Index (VBTLX) has gained 2.2% in 2023. That’s nothing to get excited about, but it’s a first step toward making up for last year’s declines.

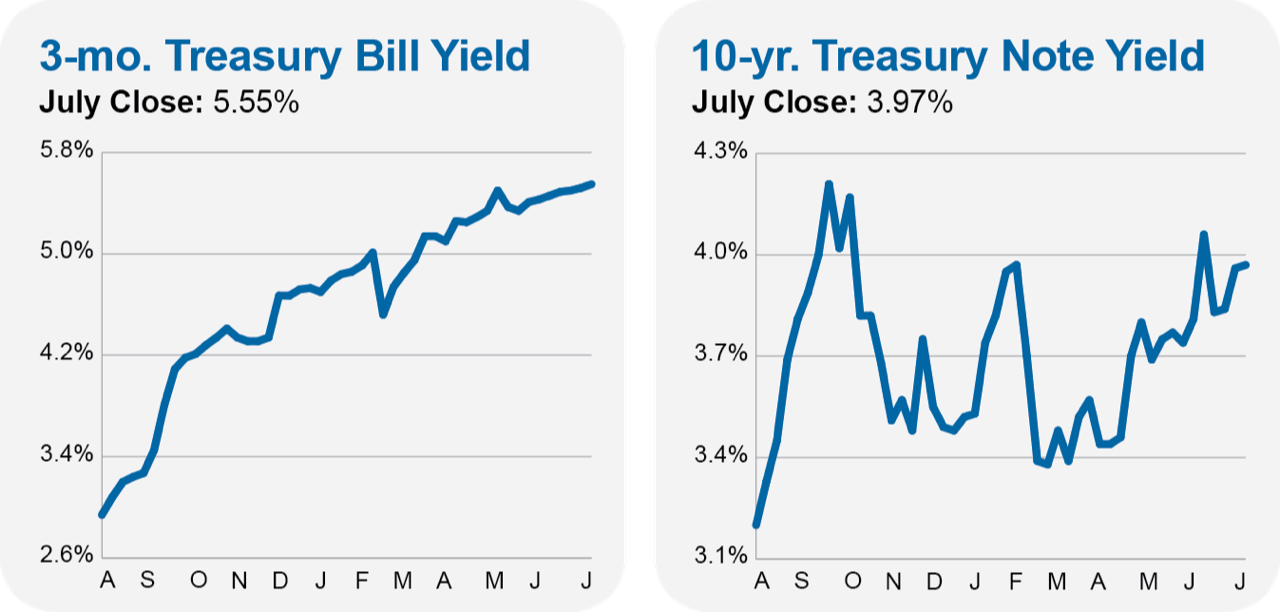

On top of that, savers are finally earning some income from their savings. Holders of Cash Reserves Federal Money Market (VMRXX) are on pace to make a nearly 5% return this year. It’s been a long time since cash delivered that much income.

Only two Vanguard funds are in the red this year; Commodity Strategy (VCMDX) and Utilities ETF (VPU) are down 2.6% and 3.6%, respectively. That's hardly anything to fret over.

Put it all together, and the average Vanguard investor has gained 12.6% over the past seven months.

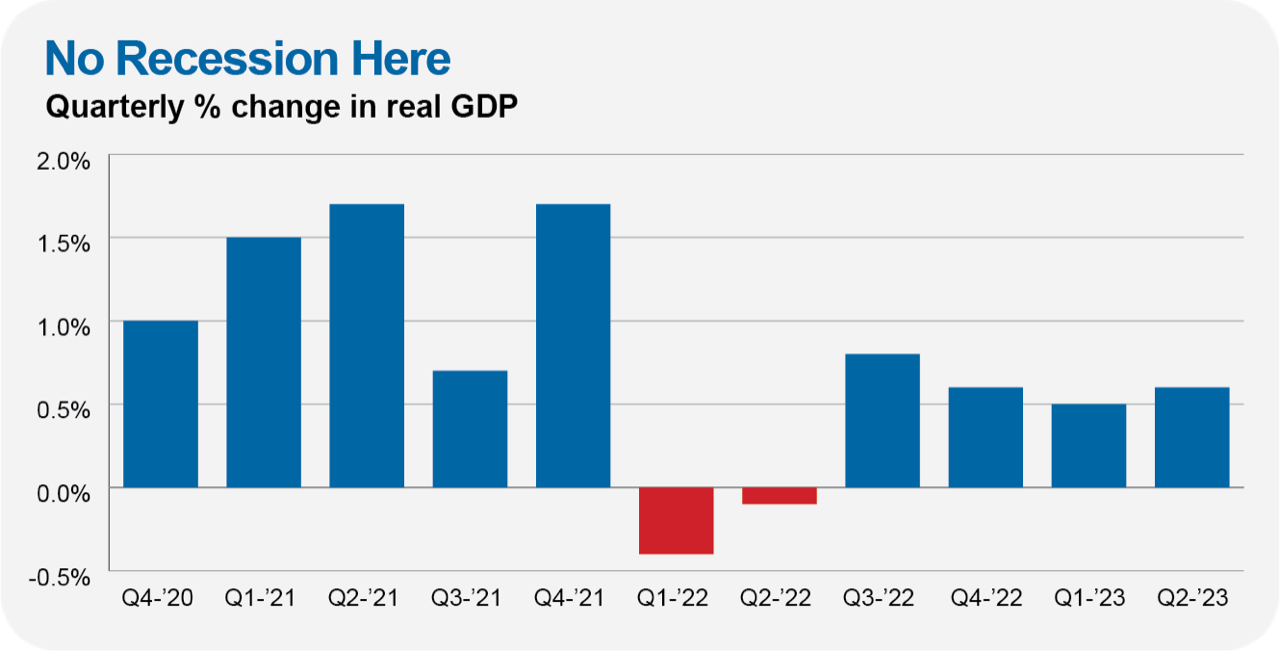

On top of that, the prospects of a “soft landing” are rising. A soft landing refers to the Federal Reserve’s (Fed) ability to bring inflation down without pushing the economy into a crushing recession. Over the past 12 months, inflation has dropped from 9% to 3%, and there’s no recession in sight.

The first estimate indicates that the economy (measured by GDP) increased by 0.6% in the second quarter after inflation. The number you see in the headlines—2.4%—is the annualized growth rate (which assumes the economy expands by 0.6% in the following three quarters). Based on that first estimate, the economy grew 1.1%—or over $220 billion—in the year's first six months.

Stocks and bonds are up. The economy expanded and unemployment held steady, while inflation came way down. The U.S. did not default on its debt. Sure, a few banks went under, but we didn’t see industry-wide bank failures, as some feared. Is it any wonder that most investors are bullish?

Is this as good as it gets?