Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, May 15.

There are no changes recommended for any of our Portfolios.

Let's start with this week's news out of Malvern (Vanguard's HQ).

Coming In …

Last night, Vanguard announced that it had found Tim Buckley's successor as chief executive. Buckley's last day as Vanguard's CEO and chairman will be July 8. Salim Ramji will succeed Buckley as CEO, while longtime board member Mark Loughridge will become chairman. In July, Ramji and Greg Davis, Vanguard's CIO and President, will join the board.

Vanguard also announced that John Murphy, President and CFO of Coca-Cola, will join the board of directors on June 1. I suspect Murphy is replacing Deanna Mulligan, who resigned from Vanguard's board last week—more on that in a moment.

So, what should we, as Vanguard owners, make of our new CEO—Vanguard's first "outside" head honcho?

For the past five years, until he stepped down in January, Ramji oversaw iShares (BlackRock's ETF arm). So, he's one of a few people with experience running an asset manager as large as Vanguard that has seen such dramatic growth. I tipped him as a potential candidate in my interview with ETF.com in March.

Much noise will be made about Ramji being Vanguard's first CEO without a connection to the firm's founder, Jack Bogle. But it was bound to happen someday. Frankly, it may be a positive, as past CEOs have operated under Bogle's shadow. Bogle deserves his cult following, but today's Vanguard is more of a sprawling organization than an upstart investment firm. Being able to operate with a freer hand could have its benefits.

Plus, it's not like Ramji (or anyone not living under a rock) is unaware of Vanguard's culture and history. As a former consultant, I'm sure Ramji appreciates the power of a brand like Vanguard. Greg Davis, who was named President when Buckley announced his retirement, can serve as a "guardian" of the firm's culture.

Though, it certainly feels like Vanguard's culture has been changing already. Vanguard adding fees and selling off non-core businesses—like its small-biz retirement accounts—lends a sense that the bottom line has taken priority from the shareholder (owner) experience. Heck, as I'll tell you in a moment, the word "product" has reentered Vanguard's lexicon.

Ramji will have to prove himself at Vanguard, but I'm optimistic about the appointment. Of course, time will tell how much impact (good, bad or otherwise) Ramji can have on the firm; Vanguard isn't exactly a nimble little ship that can turn on a dime.

Resolving Vanguard's technology and service issues would be an excellent first step. Doing so would at least earn Ramji some goodwill among us shareholders.

… Going Out

Deanna Mulligan resigned from Vanguard's board of trustees after just six years at the table—she joined at the start of 2018. Her resignation was effective May 3, though the supplements to the funds' Statement of Additional Information (SAI) were updated a week later on May 10.

At my last count, Mulligan was reasonably well invested alongside the shareholders she represented. She had at least $1 million in Vanguard's funds and ETFs, with over $100,000 invested in each of the following funds:

- Total Stock Market Index

- Extended Market Index

- PRIMECAP Core

- Dividend Growth

- Global Wellington

- Federal Money Market

- Ultra-Short-Term Bond

- Limited-Term Tax-Exempt

- Intermediate-Term Tax-Exempt

- NY Long-Term Tax-Exempt

Of course, over the past six years, Vanguard has paid Mulligan around $1.5 million for her troubles.

Vanguard didn't offer any explanation for Mulligan's sudden departure. Given the other high-profile and high-level departures announced this year—CEO and chairman Tim Buckley and general counsel Anne Robinson—it's hard not to wonder what's happening at Vanguard.

And yes, I'll be looking to see how much Vanguard's new board members—Salim Ramji, Greg Davis and John Murphy—have invested alongside shareholders. Unfortunately, that data won't be disclosed for months and months.

Products?!

Over the weekend, I received an email from Vanguard promoting its five new funds: International Dividend Growth (VIDGX), Core Bond ETF (VCRB), Core-Plus Bond ETF (VPLS), Intermediate-Term Tax-Exempt Bond ETF (VTEI) and California Tax-Exempt Bond ETF (VTEC). (Click any ticker to see my take on those new funds.)

What caught my eye about the email wasn't so much that Vanguard was trying to drum up assets for the new funds but that Vanguard called the new funds "products."

The email's subject line was "We've expanded our product lineup." Then, in bold lettering, Vanguard invited me to "Get to know our new products."

When Vanguard's founder Jack Bogle was running the ship (and much of the messaging), using the word "product" was a big no-no. Heck, as Bogle told Institutional Investor in a 2015 interview, he banned the word.

But the fruit-and-nutcake fringe of ETFs is just poison for investors. Investors in these are subject to abuse, subject to opportunism, subject to overzealous marketing. They are unsound investment products. I don’t like investment products anyway. I banned the use of the word “product” all those years ago at Vanguard, but it’s come back even here.

I'm not implying that any of the five new funds are poison, but the context helps to understand Bogle's point. I know. It may just be semantics, but it's also about mindset. Is it a product or a solution? As Bogle said, times have changed at Vanguard.

Inflation Check-In

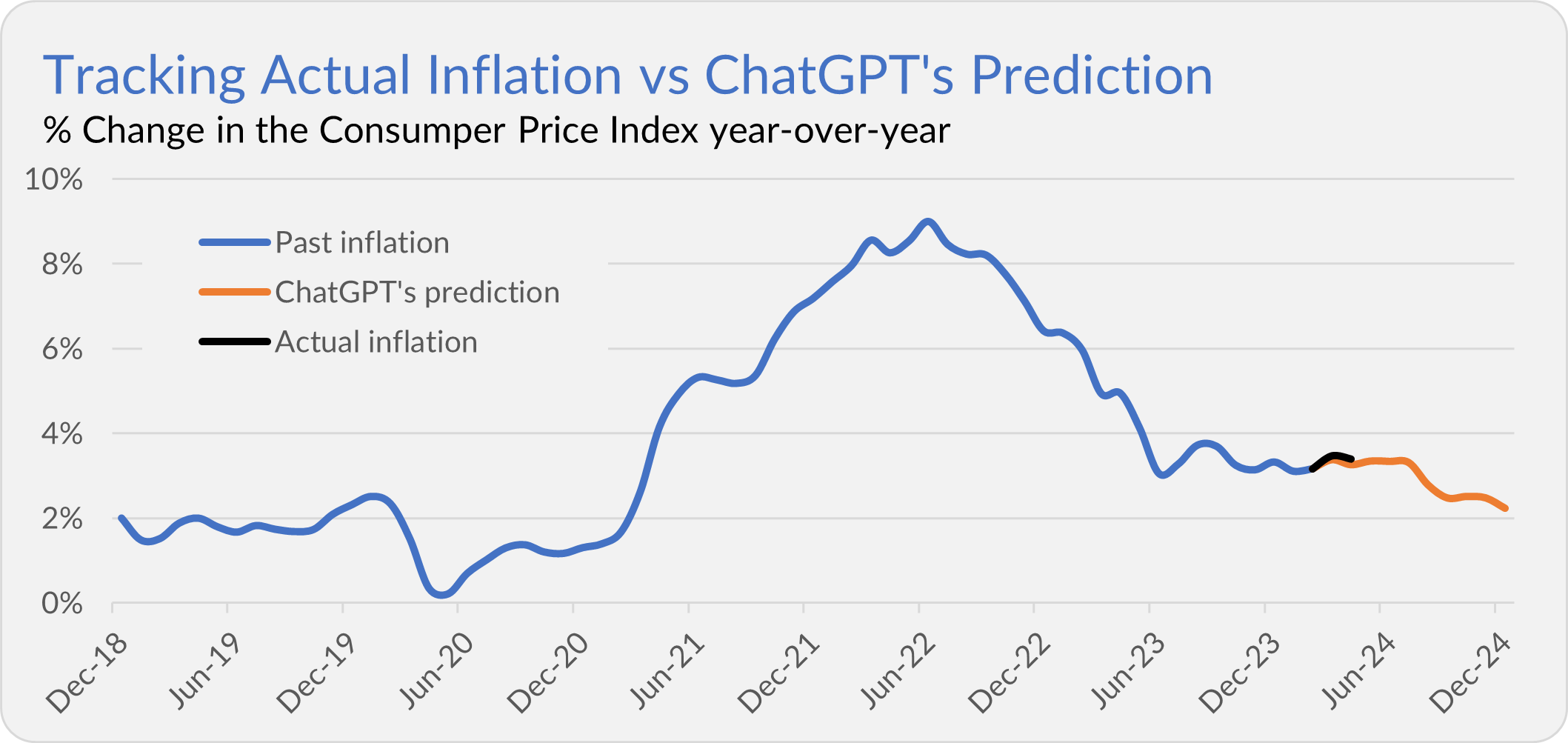

A month ago, I asked OpenAI's ChatGPT to predict inflation for the rest of the year. Today, the Bureau of Labor Statistics (BLS) reported that the Consumer Price Index (CPI) rose 0.3% in April and is up 3.4% over the past 12 months.

ChatGPT expected inflation to clock in at 3.3% in April—not far off.

In a moderated discussion yesterday, Fed Chair Powell said that he expects inflation to fall from here, but he is admittedly less confident in that view than he was a few months ago. As he put it, "we're just going to have to see where the inflation data fall out."

As I've been saying for months, Federal Reserve policymakers will continue to sit on their hands as long as inflation runs around 3% and unemployment stays near 4%.

Our Portfolios

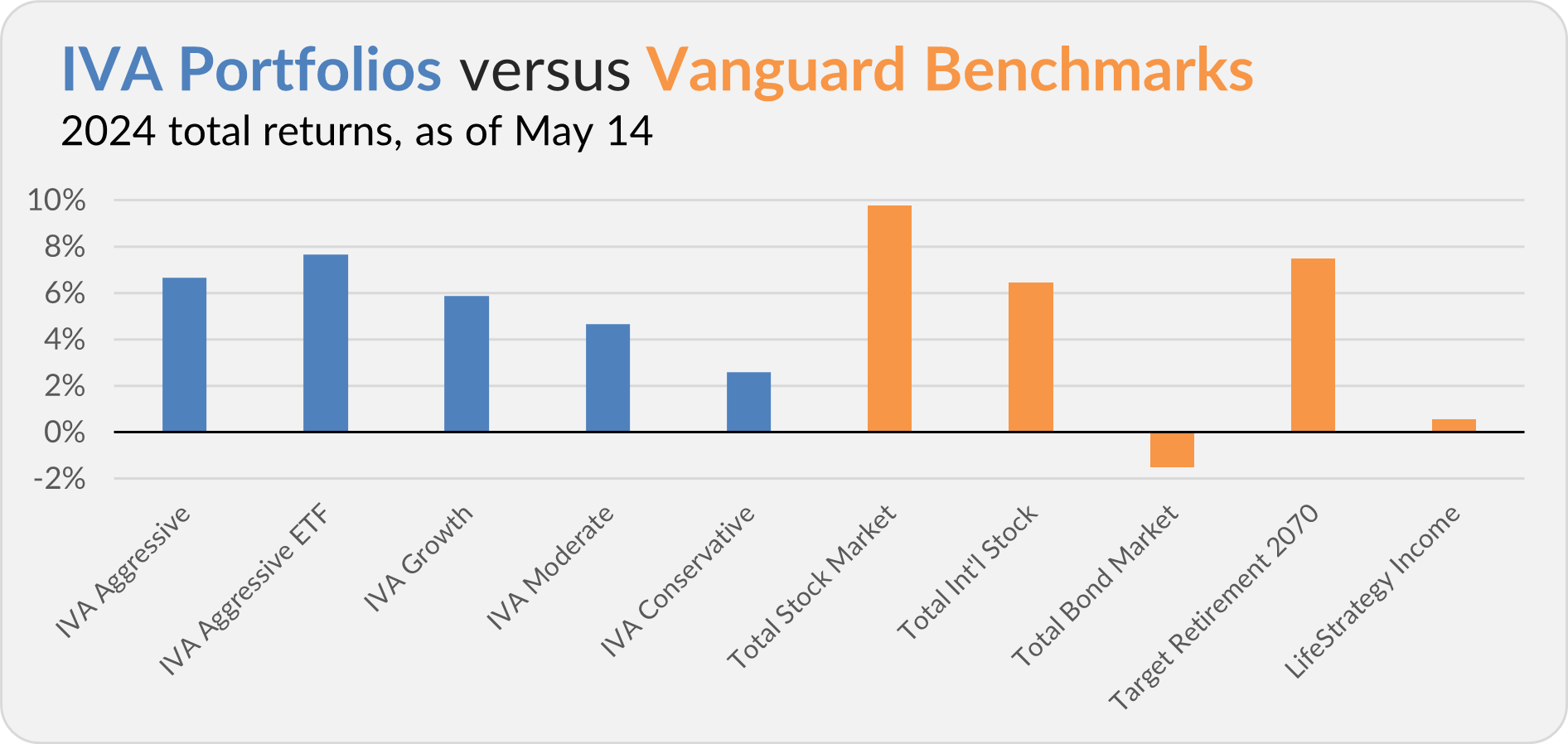

Our Portfolios are showing decent absolute returns for the year through Tuesday. The Aggressive Portfolio is up 6.7%, the Aggressive ETF Portfolio is up 7.7%, the Growth Portfolio is up 5.9%, the Moderate Portfolio is up 4.7% and the Conservative Portfolio is up 2.6%.

This compares to a 9.8% gain for Total Stock Market Index (VTSAX), a 6.5% return for Total International Stock Index (VTIAX), and a 1.5% decline for Total Bond Market Index (VBTLX). Vanguard's most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 7.5% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 0.5%.

IVA Research

Yesterday, in Don't Forget Munis, I compared Vanguard's tax-exempt bond funds to their taxable fund siblings. I also shared my thoughts on asset location with Premium Members.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.