A simple way to build a portfolio holding 50% in stocks and 50% in bonds is to own equal measures of Wellington (VWELX) and Wellesley Income (VWINX). In doing so, you combine two of the best balanced funds while avoiding the pitfalls of “collecting” funds. Your allocation to stock and bonds will be fairly fixed, around 50/50, and costs remain extremely low—about 0.24%.

Oh, and on top of that, historical performance has been strong.

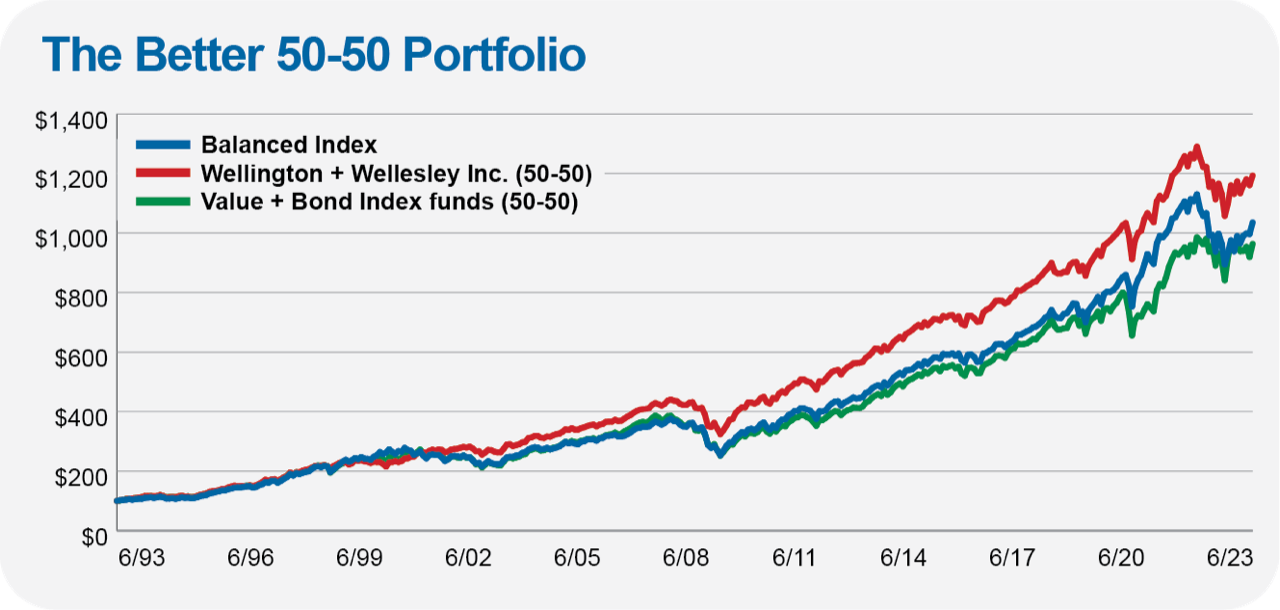

In the chart below, I’ve plotted the returns of Balanced Index (VBINX), which keeps 60% of assets in Total Stock Market Index (VTSMX) and 40% in Total Bond Market Index (VBMFX), against two 50-50 mixes. One mix combines Wellesley Income and Wellington. The other mixes Value Index(VIVAX) and Total Bond Market Index. I started the analysis on Value Index’s 1992 inception with a 50-50 split. I reinvested distributions but never made any trades to rebalance the portfolios.

Why did I use Value Index and not, say, 500 Index (VFINX)? Since both of the actively managed balanced funds tend to invest in large-cap value stocks, it seems only appropriate that an investor in index funds might seek to do the same. Plus, in Balanced Index I’ve already got a portfolio of market-cap-weighted indexes which, with 60% in stocks, should have a built-in advantage over time.

As you can see, the 50/50 mix of the active funds completely overwhelms both Balanced Index, with its higher stock allocation, and the mix of value and bond index funds.

Surprisingly, after nearly three decades, the Wellington-Wellesley Income combination would still have a nearly 50/50 mix, even though I never rebalanced—technically, you would have 53% in stocks and 47% in bonds as of June 2023.

By comparison, the investor in the Value Index-Total Bond Market Index portfolio would now have about 80% invested in stocks—making the Wellington-Wellesley Income combo all the more impressive as a hands-off approach to domestic diversification.

I can only attribute this to the excellent portfolio managers running these sibling funds.