I’m not going to try to sugar-coat it, 2022 was an extremely challenging year for investors—particularly conservative investors. Don’t get me wrong, aggressive investors and speculators (those “investing” in crypto, for example) took it on the chin, too. But that comes with the territory.

So, let’s review the investment year that was and see what worked and what didn’t. I’ll use Vanguard as my lens. And of course, I’ll check in on our Portfolios—which, spoiler alert, ended the year in the red but held up relatively well.

(Note: You can find my outlook for 2023 here. And here is a month-by-month look at the events that caught our attention.)

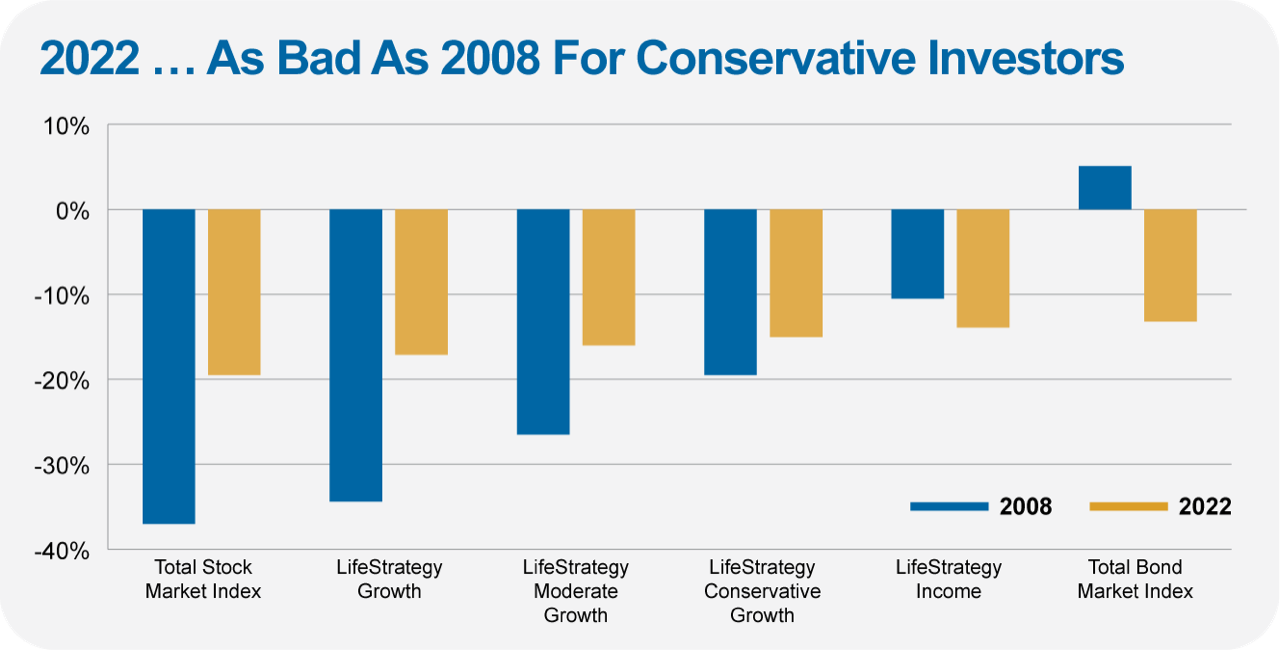

As Bad As 2008

Many investors consider 2008—when Total Stock Market Index (VTSAX) fell 37%—as the worst calendar year in their investment careers. Well, for conservative investors who thought they were keeping risk as low as possible by allocating heavily to bonds, 2022 was worse because of the rapid increase in interest rates and concomitant drop in bond prices.

The chart below—which is probably my “chart of the year”—plots the 2022 returns for Total Stock Market Index, Total Bond Market Index (VBTLX) and the four LifeStrategy funds alongside each fund's 2008 return. As you move from left to right on the chart you move down in stock exposure and risk.

The most conservative balanced fund, LifeStrategy Income (VASIX), fell 13.9% in 2022—steeper than its 10.5% drop in 2008.