By many measures, 2023 was a bang-up year for Vanguard. The firm pulled in $116 billion in assets—double 2022’s total. And thanks to a rising stock market, the money Vanguard managed for investors increased 19%, from $6.8 trillion to $8.1 trillion.

However, all this asset growth didn’t translate into a significantly bigger payout to its Partnership Plan shareholders compared to the year before. Vanguard’s dividend payout for 2023 increased by just 3.7%, to $455.56.

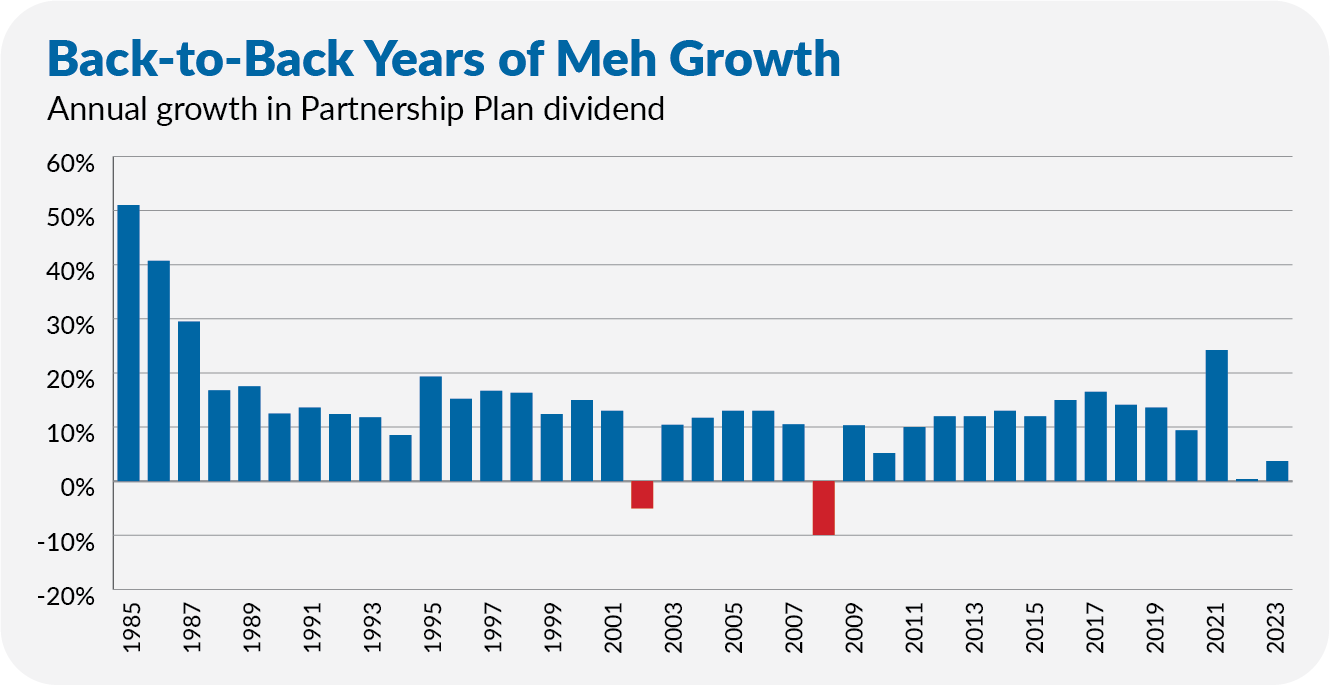

As you can see in the chart below, Vanguard’s Partnership Plan dividend was essentially flat in 2022 (up just 0.4%). So, that’s back-to-back years of little growth in the dividend after a decade of mostly double-digit growth.

What’s going on here?

I can point to two factors.

First, thanks to 2022’s bear market, Vanguard’s assets at the end of 2023 ($8.1 trillion) were only slightly ahead of its 2021 total ($7.9 trillion).

Second, the Partnership Plan’s dividend grew by 24% in 2021—the biggest annual increase in nearly three decades. So, Vanguard may be working off that significant jump.

Over the past three years, the dividend has increased 22%, while Vanguard’s assets have increased 29%. So, if we zoom out a bit, the dividend is growing in line with the assets.

Of course, I’m making my best guess here. Transparency is sorely lacking when it comes to profitability and these Partnership Plan dividends despite the fact that we shareholders of Vanguard’s fund and ETFs are referred to as owners (but in name only).

Profits! What Profits?

Right now, I can hear you asking what I’m talking about. Profits, dividends and a Partnership Plan at Vanguard? Haven’t they often referred to themselves as “non-profit”? Doesn’t Vanguard operate “at cost”?