Hello, this is Jeff DeMaso with the IVA Weekly Brief for Wednesday, July 10.

There are no changes recommended for any of our Portfolios.

And have no fear; if there’s any breaking Vanguard news, I’ll do my best to share it and provide my Quick Take on what it means for you and me and our money as promptly as possible. (I may take a vacation, but I never sleep when it comes to helping you make the most of your Vanguard investments.)

Now, back to our regularly scheduled update …

Are We in a Recession?

I’m sure the recession question is not one you expected this week, given that the stock market continues making new highs and most economic indicators suggest we’re still growing.

However, a little-known recession indicator—the Sahm Rule—is dangerously close to signaling a recession. To be clear, the Sahm Rule does not signal a recession today.

But let us back up to the beginning.

Answering the “Are we in a recession?” question in real-time is challenging. Heck, the National Bureau of Economic Research (NBER), the official arbiter of when recessions started and ended in the U.S., typically determines those start and end dates months (if not quarters) after the fact.

While working as an economist at the Federal Reserve, Claudia Sahm set out to find a metric that policymakers could use to identify the start of a recession in real-time. Here’s what she came up with:

You start by tracking the average unemployment rate over rolling three-month periods. If that average is at least 0.5 percentage points higher than its low over the prior 12 months, then we are in a recession.

This metric is now known as the “Sahm Rule.” As you can see in the chart below, Sahm’s recession indicator would’ve been reliable if you were tracking it in real-time. (Sahm first published her work on this in 2019.) When the line crossed above 0.5, the economy was entering or had recently entered a recession.

The spike in unemployment when COVID struck distorts the chart, so let’s zoom in on the past two-and-a-half years.

On Friday, Sahm’s recession indicator climbed to 0.43. And if the unemployment rate rises from 4.1% to 4.3% in July, then, according to the Sahm Rule, we’ll be in a recession.

Any single metric needs to be taken with a grain of salt. Heck, even Sahm herself has cautioned that her indicator might not be reliable this time around.

Let me repeat what I said earlier: The Sahm Rule does not signal a recession today.

And I agree. I don’t think we are in a recession. But I’m open to the idea that one isn’t far off.

I’ve been keeping an eye on the Sahm Rule because the stock and bond markets are priced as if a recession is a distant thought. The stock market is at an all-time high—though many smaller stocks are not. But let’s look at the bond market.

Consider high-yield spreads—industry jargon for the additional income you earn by lending to risky companies compared to the U.S. government. High-Yield Corporate (VWEHX) is currently yielding 6.48%, while Intermediate-Term Treasury (VFITX) is yielding 4.19%. This means you are only picking up an additional 2.29% in yield with High-Yield Corporate.

That’s not the lowest spread in the past three decades, but it's not far off!

I haven’t recommended High-Yield Corporate in the IVA Portfolios for some time. I think it is a solid fund (and I have owned it in the past), but the risk-reward trade-off hasn’t been appealing—and it’s really unappealing when the spreads are this thin.

I’m constantly assessing the IVA Portfolios and their positioning, but today’s near-record tight spreads have me taking an extra-hard look at our bond funds. Stay tuned.

Ramji’s Welcome Message

Monday was Salim Ramji’s first day as Vanguard’s first outsider CEO. If you were looking for a message from the new chief, you can find it here. As you can tell from the transcript below, Ramji’s remarks were short but hit the relevant points, particularly emphasizing his role as a steward of the company’s culture.

Hello. I’m Salim Ramji, Vanguard’s new CEO. It’s my first week here, but already Vanguard feels like home. It’s our unique structure and our client-focused mission that make Vanguard like nowhere else. And I’m excited for where we are headed. As the world continues to change and our clients are faced with new challenges, our work serving you is more important than ever.

To ensure we are ready to meet this moment, I have three areas of focus: First, continue delivering for our clients, earning your trust every single day. Second, stewarding the company’s culture. We will never deviate from Jack Bogle’s original focus on taking a stand for investors and giving our clients the best chance of investment success. And finally, ensuring we anticipate your needs and continue to evolve our capabilities to serve you well. Thank you for your trust in Vanguard. I look forward to our work together.

It was surprisingly hard for me to find Ramji’s video. For the past three days, when I’ve gone to Vanguard’s personal investors home page (https://investor.vanguard.com/home) using my default browser (Microsoft Edge), there’s been no mention of Ramji at all. I could find Ramji’s video on Vanguard’s advisor and institutional sites, but not the personal site.

However, if I switch to a different browser (Google Chrome), Ramji’s smiling face greets me.

I’m guessing that I need to clear cookies or something like that. But should I really have to do that each time Vanguard updates the “hero page” on its website? (No, I shouldn’t.) As I’ve said, fixing Vanguard’s technology and service should be Ramji’s top priority.

As a reminder, Vanguard’s President and CIO, Greg Davis, joined the firm’s board on Monday. Longtime board member Mark Loughridge became Vanguard’s first non-executive chairman. I’ll have more on the folks who steward our money in a coming report.

Ascensus is coming

Speaking of reminders, as I’ve told you—here and here and here—Vanguard sold its small business retirement unit to Ascensus. If you have an Individual 401(k), SIMPLE IRA or multi-participant SEP-IRA, your account will move to Ascensus soon. Here are the important dates to know:

Friday, July 12, is the last day to move your plan (or account) from Vanguard to a different provider. If you don’t want your account to move to Ascensus, you must have a $0 balance at the end of this week.

July 17 is the last day to make any transactions within your account—make contributions, change investments, withdraw money, etc.—before they move to Ascensus.

July 19, after 4 pm, the transfer to Ascensus will begin, and your account will enter a blackout period. You’ll be able to access your account at Ascensus sometime during the “week of July 22.” You should have read-only access to your account history at Vanguard for one year.

The week of July 22, Ascensus will provide information on how to log into your account and get up and running.

If you have questions, here are some contact numbers Vanguard provided in a general email:

- Before the transfer, contact Vanguard at 877-662-7447 Monday through Friday from 8 a.m. to 8 p.m., Eastern time.

- After the transfer, contact Ascensus Monday through Friday from 9 a.m. to 7 p.m., Eastern time, at:

- Individual(k) plan sponsors: 833-688-0086

- SEP and SIMPLE IRA plan sponsors: 833-889-4554

- SEP and SIMPLE IRA participants: 833-889-9878

Also, here is Ascensus’s welcome page.

My advice?

As I told you in June, I’m moving my individual 401(k) to E*TRADE. That’s what works for my situation—it isn’t for everyone, though.

Whether you’ve already moved your accounts or will be transferring to Ascensus, I recommend keeping a close eye on your money while it is in motion. Confirm that the number of shares you own after the transfer matches the shares you held before the move for each fund.

While you should have access to your account statements and documents at Vanguard for the next 12 months, I’d suggest downloading any statements you want now. And take a screenshot of any important pages showing your account while it’s still live on Vanguard’s site.

As just one cautionary tale concerning Vanguard’s accuracy in moving money around: On Monday, I heard from one IVA reader moving his account from Vanguard to Fidelity. Only four of his five Vanguard funds moved over on his first transfer attempt. It took several phone calls, but eventually, a separate transfer request had to be made to move the final fund over.

While Vanguard, Fidelity, Schwab, and E*TRADE all talk a good game, no one cares about your money as much as you do.

Our Portfolios

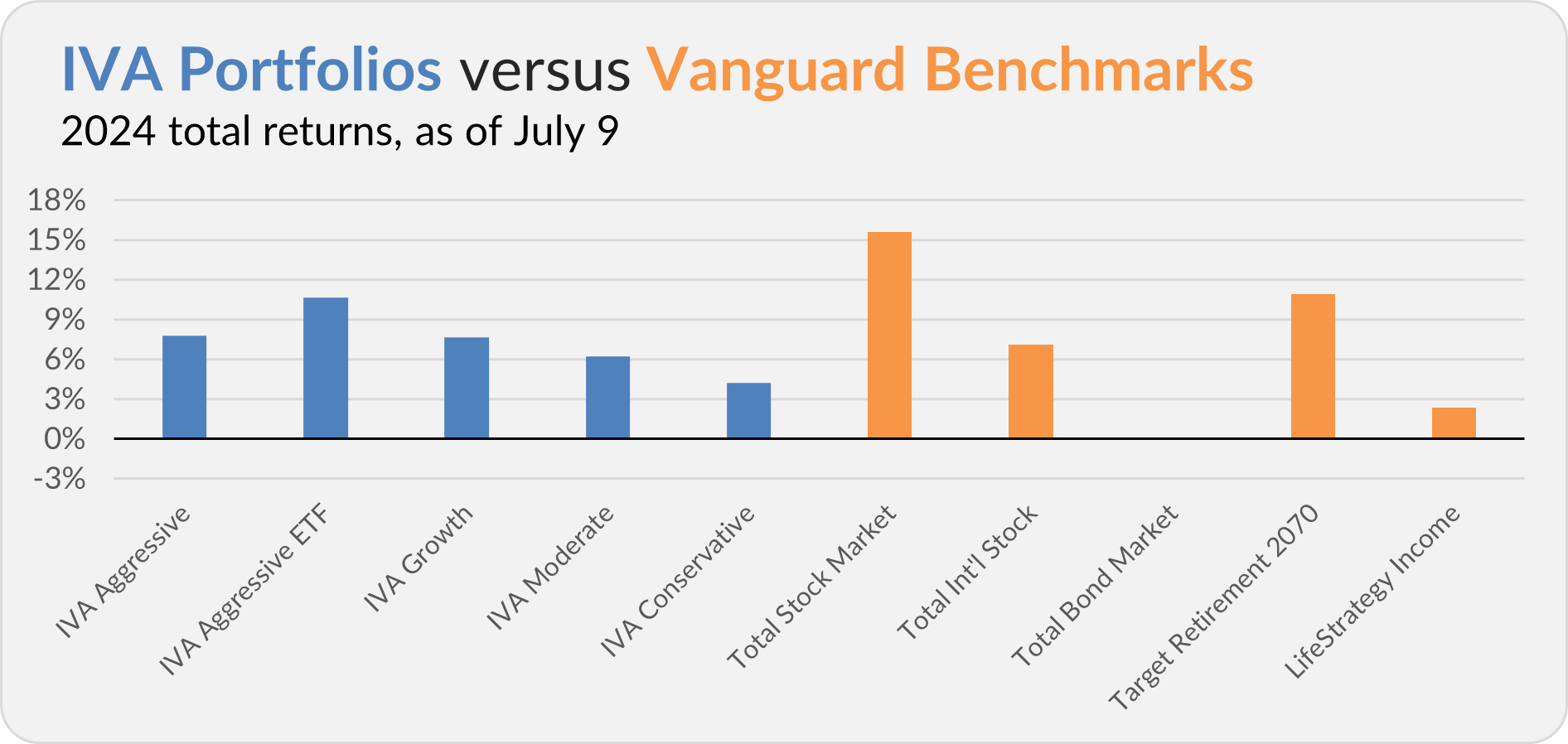

Our Portfolios are showing decent absolute but lagging relative returns for the year through Tuesday. The Aggressive Portfolio is up 7.8%, the Aggressive ETF Portfolio is up 10.7%, the Growth Portfolio is up 7.6%, the Moderate Portfolio is up 6.2% and the Conservative Portfolio is up 4.2%.

This compares to a 15.6% gain for Total Stock Market Index (VTSAX) and a 7.1% return for Total International Stock Index (VTIAX). Total Bond Market Index (VBTLX) is flat (0.0%) this year. Vanguard’s most aggressive multi-index fund, Target Retirement 2070 (VSNVX), is up 10.9% for the year, and its most conservative, LifeStrategy Income (VASIX), is up 2.3%.

IVA Research

Yesterday, in Giving Today and Tomorrow, I popped the hood on Vanguard’s Charitable Endowment Program, which enables you to take the tax benefit of donating today while giving your money over time.

Until my next IVA Weekly Brief, this is Jeff DeMaso wishing you a safe, sound and prosperous investment future.

Still waiting to become a Premium Member? Want to hear from us more often, go deeper into Vanguard, get our take on individual Vanguard funds, access our Portfolios and Trade Alerts, and more? Start a free 30-day trial now.