If you ask me, the noise around the upcoming Presidential election is already deafening, and it’s slated to get even louder as November approaches. With President Joe Biden and former President Donald Trump set to square off in the first of two debates on June 27, the noise will only ratchet up from here. The thing is, turning down the volume might be the best advice I can give when it comes to your portfolio.

That’s easier said than done, but I’ll try to provide some perspective (and reassurance to investors who want to spend time in the market) by answering two questions I am asked every election year:

- Should I sell my stocks and watch the election fallout from the sidelines?

- If [insert name of candidate] is elected, should I get out of the market?

I’m somewhat sympathetic to the concerns behind both questions. While most elections are uncertain, 2024’s feels especially tense—the polls suggest it’s a close race, and the integrity of our elections is being questioned yet again. Both parties will tell you that the future of our country hangs in the balance.

Sitting on the sidelines (in cash) certainly feels like a safe, if not downright prudent, thing to do. But it’s not.

So, let’s first evaluate the merits of moving to cash in the months around the election itself.

I collected the price return of the S&P 500 since its 1957 inception over the five months of September through January—two months before, the month of and two months after the election.

The chart below shows the average stock market (price) return for each of those five months in non-election years versus election years. The final bars show the average returns for the full five months.

I’ve also included the data excluding 2008 from the election year count because it was such an outlier. The S&P’s 16.9% decline in October 2008 was its second-worst month on record, but the market’s tumble wasn’t related to the upcoming election. It was about the shocking failure of Wall Street stalwart Lehman Bros. and concerns that the financial system was collapsing.

I prefer to look at the election data without 2008, but I’ve included it both ways so you can make up your own mind.

The months leading up to November aren’t particularly robust in terms of gains. But markets made up for those lackluster returns in November and the months following the election. Taken as a whole, over the five months, stocks gained ground on average despite the election. In fact, if we exclude 2008, stocks did better on average during election years than non-election years!

Are you really going to make a big asset allocation change (and incur a tax bill, if you are trading in your taxable accounts) on the slim possibility that stocks will drop during the two pre-election months? I wouldn’t.

But what if you’re thinking longer-term? What if you’re thinking of avoiding stocks for the next four years based on the election’s outcome?

I took a look at that as well.

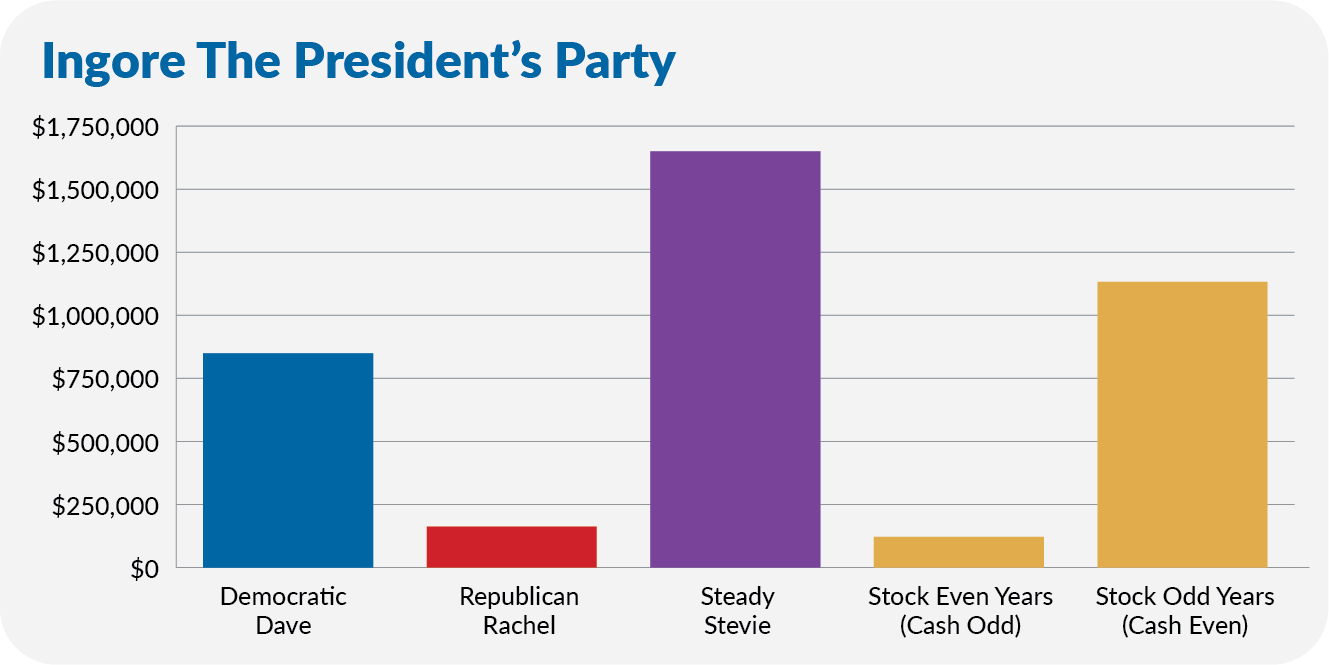

Consider three hypothetical investors starting with $10,000 at the end of 1976. Democratic Dave decides he will only hold stocks—I’ll use 500 Index (VFIAX) as my proxy—when a Democrat is in the White House. If a Republican is President, Dave will get out of the market and hold Cash Reserves Federal Money Market (VMRXX). Republican Rachel sets out with the opposite plan—investing in stocks only when a Republican resides at 1600 Pennsylvania Ave. Meanwhile, Steady Stevie decides to put politics aside and hold 500 Index throughout.

Before turning to the numbers, here are a couple of notes.

First, to keep things simple, I ran my calculations off the calendar year—not from election or inauguration dates. So, for the 1976 election, my four years ran from 1977 through 1980.

Second, I’m starting this analysis at the end of 1976, as it conveniently lines up the new Presidential term with 500 Index’s first full calendar year. Plus, over the past 48 years, the two parties have evenly split time in the Oval Office, so I’m not taking a partisan period approach.

And just so you know, I’ve run this analysis over longer periods using S&P 500 and Dow data… The story is the same.

Now, take a look at the numbers. The chart below shows how our three investors fared through the end of May 2024. Democratic Dave’s $10,000 portfolio has grown to $849,016—five times Republican Rachel’s $162,578 portfolio.

Again, as I said, the two parties have split time in the Oval Office, so you can’t explain Democratic Dave’s outperformance to spending more time in the market—Dave and Republican Rachel were invested for the same amount of time.

While I find it surprising that investing under a Democratic president has yielded better results, given the Republican party’s reputation as being more business-friendly, I wouldn’t necessarily read too much into that.

Why? Well, for one thing, it’s easy to play with numbers to find winning or losing “strategies.”

For instance, an investor who held stocks in even years (1978, 1980, and so on) and cash in odd years would’ve turned $10,000 into $121,877. An investor who did the opposite, holding stocks in odd years (1977, 1979…), would now have $1,132,548—outperforming Democratic Dave!

Is there something inherently superior about investing in odd years or in Democratic versus Republic administrations? No.

The real lesson can be learned from Steady Stevie’s portfolio, which has grown from $10,000 to more than $1.6 million over the past 12 Presidential terms.

The bottom line is that partisans on both sides of the aisle have had ample opportunity to make the mistake of saying, “I won’t invest in the market as long as so-and-so is in the White House.” Compounding your wealth takes time and patience, which can be richly rewarded. If you are going to sit out of the market half the time based on who the president is, well, let’s just say that’s not a sound investment strategy.

Elections are emotional times for everyone—as voters, citizens and investors. If you need to sell some stocks so you can sleep at night, do that. But give the investor in you control of the remote and turn down the volume on your TV and social media streams.

You can stay informed without hanging on every headline and sending your heart rate racing. Your portfolio will be better off if you keep politics out of the investment process.